10% and Beyond – How to Earn a Double-Digit Dividend Yield From Your Investments

For our Morning Stocks Analysis, the Seedly team worked closely with The Fifth Person who are experts in the field to curate unbiased, non-sponsored content to add value back to our readers.

Disclaimer: This is not a sponsored post. Opinions expressed in the article should not be taken as investment advice. Please do your own due diligence.

If you have any questions on the mentioned stocks, feel free to discuss them with Seedly Community here.

Whenever you mention income investing (or dividend investing) to certain investors, they may reply with one of many possible responses:

- “Dividends? I’m only earning 2-3% a year. That’s too low.”

- “If I’m earning a 3% dividend yield, I’ll need a large investment for my dividends to be worthwhile.”

- “I can make higher returns investing in growth stocks.”

Do these sound familiar to you? Income investing is often viewed as a ‘slow and steady’ way to invest. If you look at the Straits Times Index, a basket of the 30 largest companies in Singapore, its dividend yield is only 3.60% (as at 28 February 2019). It’s a similar story in Malaysia and the U.S. – the FTSE Bursa Malaysia KLCI currently yields 3.18% and the S&P 500 yields 1.99%. All of that sounds a little unsexy considering that the FAANG Stocks have gone on to dominate the stock market over the last 5-10 years.

But is it true that income investing means you’re always stuck with a 2-3% dividend yield? And do you really need a large sum of money for income investing to be feasible?

Let’s find out.

Why high-yield stocks are a no-go

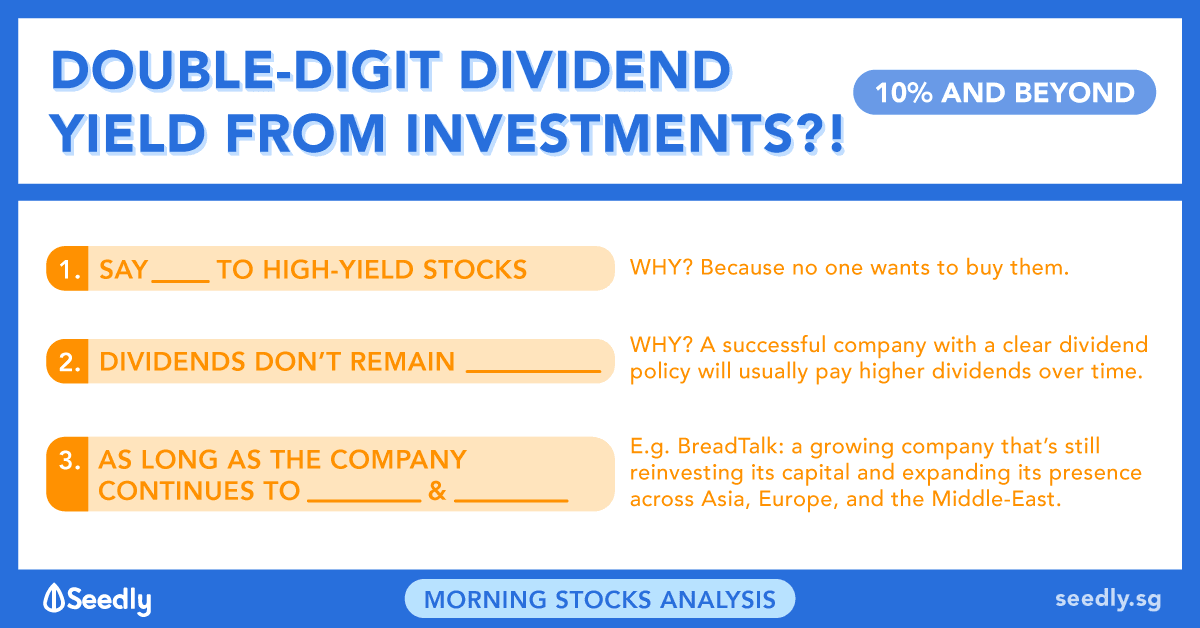

First things first, if you plan on investing for dividends, then high-yield stocks are a no-go. But why is that so? If we’re looking for yield, shouldn’t we invest in a stock that’s already paying a 10% yield versus one that’s only paying 3%?

The simple explanation is because high-yield stocks are unusually high for a reason – no one wants to buy them. A company that’s facing serious financial difficulties would lead to investors avoiding and selling their shares. This causes the share price to fall. And a lower share price gives you a higher yield. The problem is that the company is unlikely to maintain its dividend due to its financial difficulties. So even if the high dividend yield looks really enticing right now, it may drop very soon.

On the other hand, a successful, financially-healthy company would lead to more investors buying their shares. This causes its share price to rise. And a higher share price equals a lower dividend yield. This is why you hardly see blue-chip stocks like CapitaLand or Public Bank pay you a yield higher than 4%.

How to earn a double-digit dividend yield

So now we know that we need to avoid high-yield stocks and that high-quality stocks tend to pay a lower yield, how then do we generate a double-digit dividend yield?

Right now, Mapletree Commercial Trust (MCT) – a REIT that owns a portfolio of retail and office properties in Singapore – trades at S$1.77 a unit (as at 1 March 2019):

Chart: Google Finance

MCT’s last annual distribution (dividend) was 9.04 cents a unit. So assuming you buy MCT at $S1.77 a unit and it maintains its distribution, your effective yield is 5.1%. Decent, but still halfway from making a double-digit yield.

However, what you need to remember is that dividends don’t have to remain stagnant. Just like how an underperforming company may have to reduce its dividend, a high-performing company can choose to increase its dividend. In fact, a successful company with a clear dividend policy will usually pay its shareholders a higher dividend over the years.

In the case of MCT — which is a real estate investment trust (REIT) — it has a policy of distributing 90% of its income to unitholders in order to qualify for the tax transparency benefits that Singapore REITs currently enjoy.

So let’s have a look at MCT’s distribution history since it listed:

The above is a chart of MCT’s distribution per unit (DPU) over the last seven years. As you can see, MCT has grown its DPU by 170% since its listing — from 5.27 cents in 2012 to 9.04 cents in 2018.

So what does this mean?

This means if you purchased MCT during its IPO at 88 cents and simply held onto the units, your distribution yield would now be hitting 10.3%. (And MCT looks likely to post a higher DPU in 2019, increasing your annual yield once more.)

You could argue that it’s impossible to know how a stock would turn out when it first lists, and I’d agree with you – we can be unsure of IPO stocks as we don’t have enough historical data at hand. But, even then, there are still opportunities to get in once you have enough information to identify that a company shows significant quality.

For example, we invested in MCT in 2015 during the oil crisis (four years after its IPO) at S$1.28 — which currently gives us a distribution yield of 7.1% and growing, and not to mention some sizable capital gains as well. Assuming all goes well, we hope to see our investment in MCT reach a double-digit yield in time to come.

How we earned a 14.3% dividend yield

There is one stock where we’ve already hit a double-digit yield — albeit with special dividends included – BreadTalk. A multinational food and beverage corporation, BreadTalk listed in 2003 and first started paying a dividend in 2006.

Here’s BreadTalk’s dividend history from 2006 to 2018:

As you can see, BreadTalk’s dividend has remained rather steady and increased little by little over the years. To be exact, we didn’t invest in BreadTalk for its dividend; it’s a growing company that’s still reinvesting its capital and expanding its presence across Asia, Europe, and the Middle East.

However, the company really started to raise its dividends in the past three years. In 2017, the company declared a record dividend of 7 cents per share. We purchased BreadTalk in 2012 during the euro-debt crisis at 49 cents a share – thereby giving us a dividend yield of 14.3%! Granted, we don’t expect these kinds of yields from BreadTalk every year. But as long as the company continues to expand and do well, we expect to see its regular dividend to grow in lockstep.

(*Do note that BreadTalk’s 2018 dividend per share is 1.5 cents after the company did a 2-for-1 share split that year. Essentially, the pre-split dividend in 2018 is 3 cents per share for parity with the rest of the data on the chart.)

BreadTalk is trading at 86 cents (post-split; as at 1 March 2019), so we’re also sitting on 251% in capital gains after adjusting for the share split. In fact, a 1972-2017 study done by Ned Davis Research shows that stocks that pay a growing dividend gave the best returns compared to the rest of the S&P 500:

So investing for income doesn’t necessarily mean you have to forgo capital gains. In fact, you get to enjoy the best of both worlds if you’re able to pick the right dividend stocks.

Seedly Contributor: The Fifth Person

The Fifth Person believes in spreading a message – that sound investment knowledge, financial literacy and intelligent money habits can help millions of people around the world achieve financial security, freedom, and lead better lives for themselves and their loved ones.

Their company and the knowledge shared was born from that vision and they hope to foster smarter, more profitable investment decisions for people and the world at large.

Advertisement