What I Expect the Stock Market to Do in 2020 and How I Plan to Position My Portfolio

Sudhan P

Sudhan P●

As cliché as it sounds, 2019 has come and gone in the blink of an eye.

As I look ahead into 2020, I wanted to pen my thoughts on what I expect the stock market to do in the new year and what I’m doing to position my portfolio. It will serve as a reminder for myself as I journey through 2020 as well.

It’s timely that just moments before I planned to write this piece, I came across a question asking for opinions on the stock market in 2020 on our Seedly Community page.

But before I look ahead, let’s have a throwback to 2019.

How 2019 Panned Out

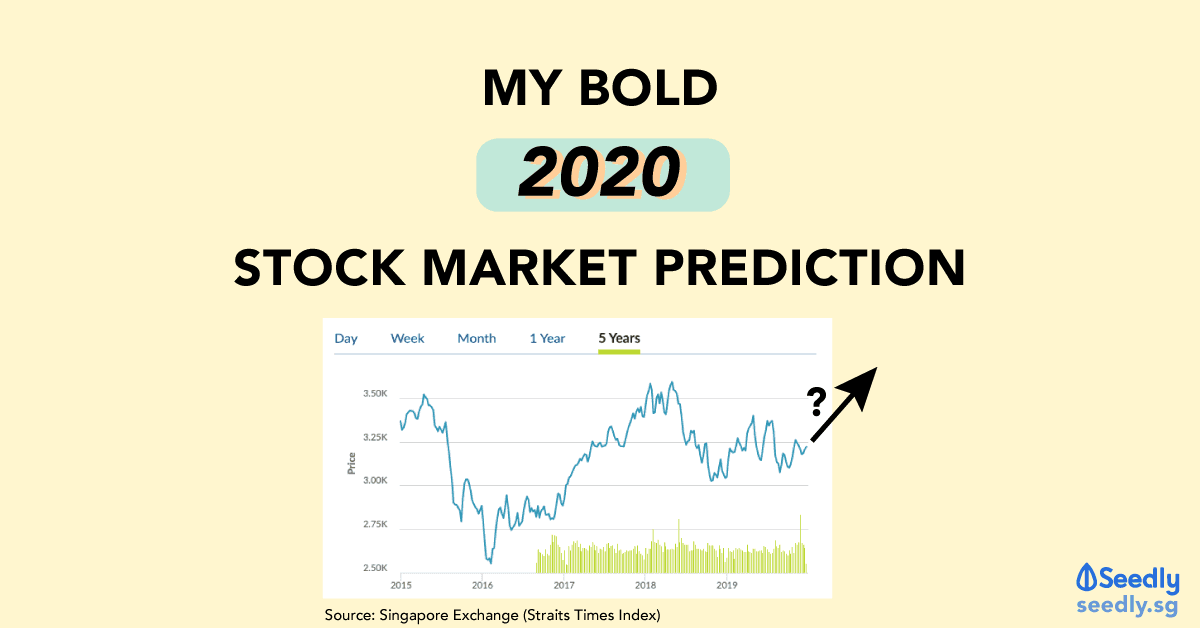

For 2019, the Straits Times Index (STI) rose 5%.

In Hong Kong, despite the widespread protests that plagued the territory this year, the Hang Seng Index (HSI) put on some 9%.

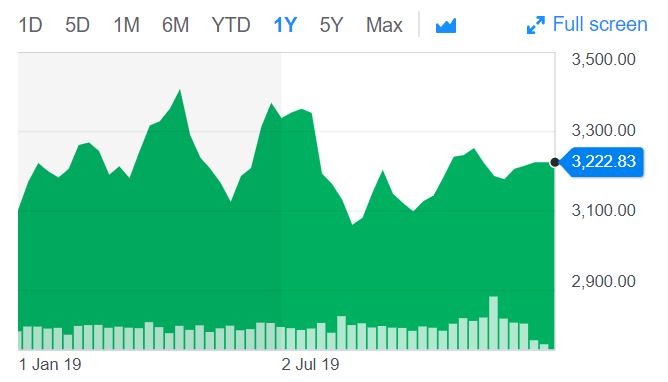

Elsewhere, the S&P 500 index, a stock benchmark in the US, has trounced both the STI’s and HSI’s returns by a considerable margin.

For the year that just ended, the index — containing 500 large corporations of the US — added around 29%, amassing the best gain since 2013. The index hit numerous new highs in 2019.

In terms of valuation, as of 31 December 2019 close, the Straits Times Index is going at around 12 times its historical earnings while the S&P 500 trades at a price-to-earnings (PE) ratio that is almost double that of the Singapore stock market benchmark. HSI is selling at a PE ratio of around 11.

The US stock market has surprised many, as talks were rife that US shares are not poised to perform well on the back of political tensions.

What I Expect the Stock Market to Do in 2020

I don’t like to make predictions, but for the fun of it, I would expect the stock market in the US to take a breather as it has hit many new records in 2019.

I believe investors might pull out of the US and funds would flow into Asia, namely, Hong Kong, Singapore and Malaysia.

Why is that so, you may ask.

With valuations pulling away from the mean, investors in the US market may feel that stocks are getting more and more expensive and that the investment return in the country’s stock market is limited, for now. That could cause investors to sell US stocks, and consequently, the stock market could fall.

The money now has to flow somewhere, and the cash could find its way to Asian stock markets, especially those that still look undervalued, like Singapore’s Straits Times Index.

In the grand scheme of things, though, a breather is healthy for the US market and is not something to be feared.

If you roll time back to the end of 2018, the S&P 500 hit a low of 2,147 points in December that year due to widespread panic about the US-China trade war. Fast forward one year later, the index has surprised many investors.

That one recent episode shows that a correction is excellent for the market for its next leg up.

However, having said all of that, don’t take my word for it as my predictions are just that — predictions.

The US stock market may continue rising in 2020, and the Singapore stock market could continue its lacklustre performance.

How I Plan to Position My Portfolio

It’s good to have an idea of what the market may do or where it is at. However, as investors, we shouldn’t focus on market or economic predictions but instead, focus our attention on the fundamentals of the business we are investing in.

Warren Buffett, the man behind the famed conglomerate Berkshire Hathaway, once said in his 1994 shareholder letter:

“We will continue to ignore political and economic forecasts, which are an expensive distraction for many investors and businessmen.

Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%.

But, surprise – none of these blockbuster events made the slightest dent in Ben Graham’s investment principles. Nor did they render unsound the negotiated purchases of fine businesses at sensible prices. Imagine the cost to us, then, if we had let a fear of unknowns cause us to defer or alter the deployment of capital. Indeed, we have usually made our best purchases when apprehensions about some macro event were at a peak. Fear is the foe of the faddist, but the friend of the fundamentalist.”

Buffett does not care about economic and political forecasts as they do not mean a thing to him. What matters is that the business he is invested in is fundamentally sound.

Therefore, in 2020, I’ll continue to do what I’ve been doing in the past years.

I’ll carry on positioning my Singapore portfolio for income and my US portfolio for growth. As I receive dividends from my Singapore stocks, I’ll channel them to buy more US growth stocks.

In terms of what specifically I’ll concentrate on, I’ll continue investing in companies that possess durable competitive advantages, produce copious amounts of free cash flow, and have a strong balance sheet with more cash than debt.

One thing I would expect, though: Such companies, if chosen at the right valuations, would continue doing well over the long-term no matter what the stock market does.

Have Burning Questions Surrounding The Stock Market?

Why not check out Seedly’s QnA and participate in the lively discussion regarding stocks!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.