3 Small Cap Stocks With Consistent Dividends Over Last 5 Years

For our Morning Stocks Analysis, the Seedly team worked closely with SmallCapAsia, who is an expert in the field, to curate unbiased, non-sponsored content to add value back to our readers.

Disclaimer: This is not a sponsored post. Opinions expressed in the article should not be taken as investment advice. Please do your own due diligence.

If you have any questions on the mentioned stocks, feel free to discuss them with Seedly Community here.

From my findings, I’ve learnt that it is not easy to find Small Caps which have paid out consistent dividends to its shareholders over the long-term. This is because Small Caps, typically:

- Do not have a solid balance sheet with healthy cash balances

- Keep cash to fund working capital or to expand

Hence, if you’ve found Small Caps stocks that have a track record of consistent dividend payouts, they would stand out in the market as they are considered rare jewels.

I’ll share 3 of such “rare jewels” in the sections below.

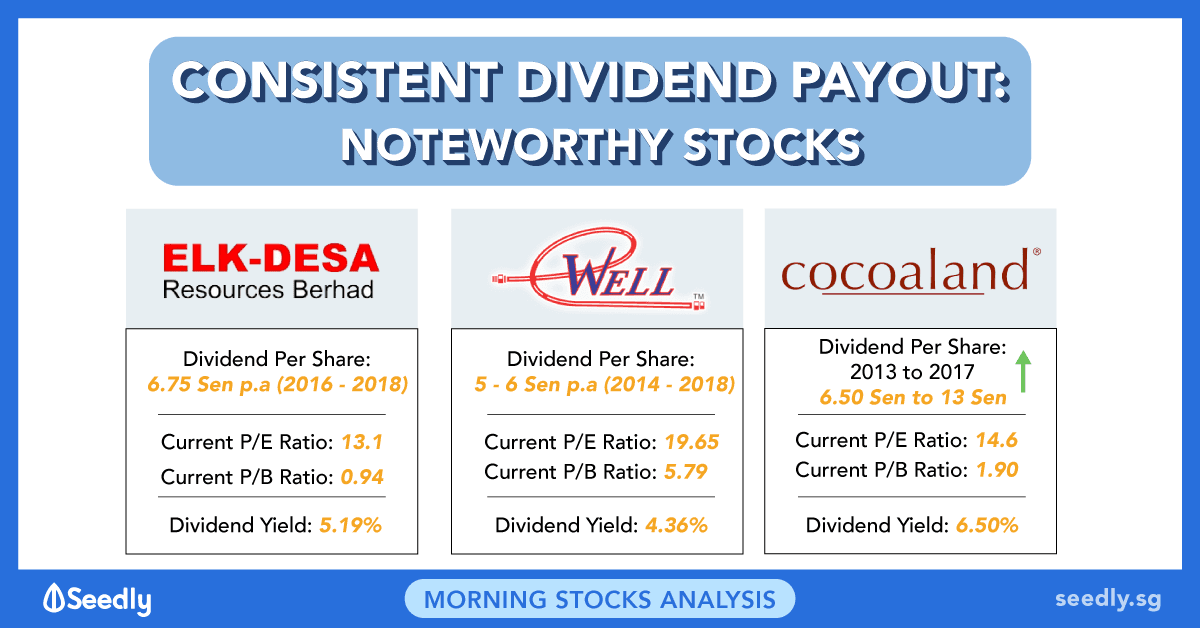

1. Elk-Desa Resources Bhd (Bursa: 5228)

Elk-Desa Resources Bhd (Elk-Desa) have been offering hire purchase financing to purchasers of second-hand vehicles in Malaysia since 2004. Additionally, Elk-Desa had also begun to furniture trading in mid-2015.

Over the past 4 years, Elk-Desa has achieved a CAGR of 12% in its hire purchase loan portfolio. Its net hire purchase receivables increased steadily from RM 252.7 million in 2014 to RM 400.4 million in 2018. Further, its non-performing loan ratio remained low at 1.0% in 2018, contributing to Elk-Desa’s increase in both sales and profits.

Moreover, revenue had grown from RM 48.4 million in 2014 to RM 104.1 million in 2018. Meanwhile, shareholders’ earnings also increased from RM 16.4 million in 2014 to a total of RM 25.9 million in 2018.

It has maintained a dividends per share (after a rights issue in 2016) at 6.75 sen per annum for the past 3 years.

As of date of writing, Elk-Desa is trading at RM 1.30 a share. Hence, its current P/E Ratio of 13.1 is based on its EPS (2018) of 9.91 sen.

Its current P/B Ratio of 0.94 is based on its net assets per share of RM 1.39 in 2018.

Its dividend yield of 5.19% a year is based on its latest DPS of 6.75 sen in 2018.

Summarised Financial Results:

| Year | Revenue (RM '000) | Shareholder's Earnings (RM '000) | Dividend Per Share (Sen) |

|---|---|---|---|

| 2014 | 48,391 | 16,400 | 7.5 |

| 2015 | 57,615 | 18,796 | 7.5 |

| 2016 | 64,167 | 18,788 | 6.75* (RI) |

| 2017 | 94,489 | 23,001 | 6.75 |

| 2018 | 104,127 | 25,924 | 6.75 |

Source: Annual Reports of Elk-Desa Resources Bhd

2. Wellcall Holdings Bhd (Bursa: 7231)

Wellcall Holdings Bhd (Wellcall) manufactures a wide range of industrial rubber hoses and exports them to 200+ clients over 70+ countries worldwide. Its main markets are the United States, Canada, Europe, Australia & New Zealand.

For the last 5 years, Wellcall increased its revenue from RM 146.4 million in 2014 to RM 171.1 million in 2018. This was due to higher export sales to the major markets listed above. Since 2015, Wellcall had maintained its shareholders’ earnings at RM 30 – 40 million per annum and thus, sustained its dividends per share (DPS) at 5 – 6 sen per annum.

As of date of writing, Wellcall is trading at RM 1.25 a share. Hence, its current P/E Ratio of 19.65 is based on its EPS (2018) of 6.36 sen.

Its current P/B Ratio of 5.79 is calculated based on its net assets per share of 21.6 sen in 2018.

Its dividend yield of 4.36% a year based on its latest DPS of 5.45 sen in 2018.

Summarised Financial Results:

| Year | Revenue (RM '000) | Shareholder's Earnings (RM '000) | Dividend Per Share (Sen) |

|---|---|---|---|

| 2014 | 146,363 | 29,466 | 5.13 |

| 2015 | 158,112 | 41,325 | 6.13 |

| 2016 | 134,470 | 31,291 | 6.13 |

| 2017 | 159,133 | 36,454 | 6.17 |

| 2018 | 171,124 | 31,649 | 5.45 |

Source: Annual Reports of Wellcall Holdings Bhd

3. Cocoaland Holdings Bhd (Bursa: 7205)

Cocoaland Holdings Bhd (Cocoaland) is a manufacturer of a wide range of food & beverage (F&B) products mainly hard candies, gummies, wafer and snacks in Malaysia under well-known brands such as Lot 100 & Cocopie.

Frasers & Neave Holdings Ltd (F&N) is presently the second largest shareholder of Cocoaland with 27.2% shareholdings. To that end, F&N Ltd & Thai Beverage are indirect shareholders of Cocoaland.

For the last 5 years, Cocoaland has increased its sales from RM 254.5 million in 2013 to RM 267.2 million in 2017. It contributed to the growth in shareholders’ earnings from RM 22.1 million in 2013 to RM 33.5 million in 2017. It has grown its dividends per share (DPS) from 6.50 sen in 2013 to 13.00 sen in 2017.

As of date of writing, Cocoaland is trading at RM 2.00 a share. Thus, its current P/E Ratio of 14.60 is based on its EPS for the latest 12-month of 13.7 sen.

Its current P/B Ratio is 1.90 based on net assets per share of RM 1.05 as at 30 September 2018.

At RM 2.00 a share, it boasts a dividend yield of 6.50% per annum if it is able to keep its DPS at 13.0 sen a share.

Summarised Financial Results:

| Year | Revenue (RM '000) | Shareholder's Earnings (RM '000) | Dividend Per Share (Sen) |

|---|---|---|---|

| 2013 | 254,450 | 22,050 | 6.5 |

| 2014 | 260,760 | 21,918 | 7.5 |

| 2015 | 261,645 | 32,721 | 8 |

| 2016 | 272,637 | 43,800 | 10 |

| 2017 | 267,153 | 33,526 | 13 |

Source: Annual Reports of Cocoaland Holdings Bhd

Seedly Contributor: SmallCapAsia

SmallCapAsia is a website focused primarily on undervalued gems that can generate Big, Fat Returns for investors. Their Slogan is simple: Start Small, Win Big!

Read other articles by SmallCapAsia:

- Stocks to Benefit from Singapore Government Redevelopment Plans

- Exciting Stocks to Research This Week

- Interesting Stocks You Might Have Missed Out

- Cheap Companies With Attractive Dividend Yield

- Here Are 3 Interesting Stocks You Can’t-Miss!

- 8 Companies I Chanced Upon My Baby’s Arrival

- 3 Really Cheap Shares You Can Buy Today

- 3 Amazing Growth Stocks Flying Under The Radar

- 3 Cheap Stocks Trading Below Their Book Value

- 3 Companies With Insiders Buying Shares Recently

- 3 Top Dividend Stocks on Sale

- Why You Should Consider These 3 Unheard Stocks – Meghmani Organics, Jackspeed Corporation, Samurai 2K Aerosol

- 3 Stocks That Are Ridiculously Cheap

- 3 Companies With Insiders Buying Shares Recently

Advertisement