I hear you.

With more than 700 stocks listed on the Singapore stock market, it would be difficult to pick out the crème de la crème.

Also, due to the uncertainties brought about by the pandemic, you might still be freaked out to invest in stocks.

To make life simpler for you and less scary, I have filtered out, using a stock screener, three of Singapore-listed stocks that you can consider researching further for your stock portfolio.

Without further ado, let’s dive into those companies.

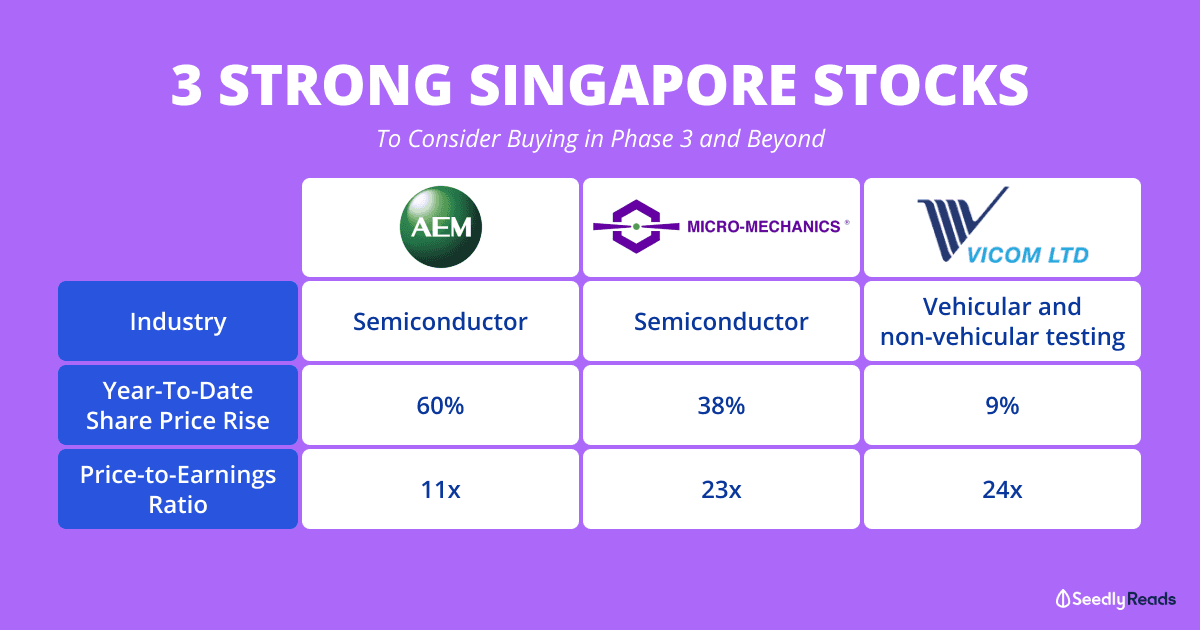

Company #1: AEM

AEM Holdings Ltd (SGX: AWX) is involved in the designing and manufacturing of equipment and precision components.

The company has a strategic partnership with one of the largest semiconductor companies in the world (believed to be Intel). AEM has been developing and manufacturing top-notch test handlers and consumables for this key customer.

In its 2020 third-quarter business update, AEM saw robust growth in both its top-line and bottom-line on a year-on-year basis.

Revenue for the latest quarter surged 93% while earnings soared 77.4%. The strong sales growth came on the back of increased orders for its tools, consumables, and services.

For the nine months ended 30 September 2020, AEM’s revenue and net profit increased by around 86% and 121% respectively.

For the whole of 2020, AEM has a sales guidance of between S$500 million and S$520 million based on its sales order visibility and business outlook. Last year, it raked in a revenue of S$323 million.

A key risk for the company is, as you might have figured out, the high revenue concentration from its main customer.

According to its 2019 annual report, this customer contributed to 94% of total revenue for the year.

If for any reason, the customer pulls out, AEM would be hit badly. Having said that, the probability of this happening is low, in my opinion, as the partnership has been going on for over 18 years.

Year-to-date, AEM’s share price has increased by over 60%. At its current share price of S$3.40, AEM has a price-to-earnings (P/E) ratio of 11x and a dividend yield of 2.4%.

Company #2: Micro-Mechanics

Micro-Mechanics (Holdings) Ltd (SGX: 5DD) is involved in the designing, manufacturing, and marketing of consumables and precision tools that are used in the semiconductor industry.

The company is also featured as one of the three stocks you should consider buying in 2021 and beyond.

Micro-Mechanics has a competitive advantage in that it does not have a single direct competitor providing the full range of services that it currently provides.

This is also evidenced by its high gross profit margin and net profit margin of 53.4% and 22.8%, respectively, for its full-year ended 30 June 2020 (FY2020).

For the first quarter of FY2021, revenue rose 18.3% year-on-year to a record S$18.1 million due to growth in the global semiconductor industry.

Meanwhile, quarterly net profit surged 42.3% to S$4.7 million and free cash flow increased by 81.9% to S$4.9 million.

There’s still plenty of growth ahead for Micro-Mechanics over the long run.

According to VLSI Research, chip sales for the semiconductor sector could double to nearly US$1 trillion by 2030.

Year-to-date, Micro-Mechanics’ share price has gone up 38%.

At its current share price of S$2.70, Micro-Mechanics sports a P/E ratio of 23x and a dividend yield of 4.4%.

Company #3: VICOM

VICOM Limited (SGX: WJP) is a provider of technical testing and inspection services largely in Singapore. VICOM has around 70% market share in the vehicle testing business in our city-state.

For VICOM’s 2020 third-quarter, revenue fell 16% year-on-year while earnings declined by 5%.

The lower profitability was mainly because business volumes were affected by the COVID-19 pandemic. This was partially offset by the government handouts.

However, things are improving.

On a quarterly basis, VICOM’s revenue grew 53% in the latest quarter while it posted operating profit excluding the government reliefs.

In the 2020 second-quarter, the company had an operating loss of S$1.3 million before the COVID-19 government handouts, as seen below.

VICOM also updated the market that its third-quarter performance improved after Singapore exited the circuit breaker on 2 June 2020.

The improvement should allow VICOM to pay a dividend in the final quarter of the year. No interim dividend was declared in the first half of 2020 to “conserve cash during this period of COVID-19 uncertainties”.

With Singapore entering Phase 3 of the re-opening, VICOM’s operations are likely to pick up further, and so is the dividend outlook.

Over the slightly longer term, there’s a high chance that the company will do great, despite Singapore’s push for a car-lite society. Well, you and I know that cars provide convenience and a status symbol for Singaporeans, so it would take many years for cars to become obsolete like horse carriages.

Year-to-date, VICOM’s share price has increased by slightly less than 10%. At its share price of S$2.12, it has a trailing P/E ratio of around 24x.

Bonus Point

All three companies featured above either have no debt or negligible debt.

This, coupled with the large hoard of cash that they hold, will help them weather through any tough economic conditions.

The last I heard, companies with very little debt and loads of moolah rarely go bankrupt.

Want More In-Depth Analysis And Discussion?

Why not check out our community at Seedly and participate in the lively discussion surrounding stocks like AEM Holdings Ltd (SGX: AWX) and many more!

Participate In The Stocks Discussion Now!

The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer owns shares in Micro-Mechanics and VICOM.

Advertisement