5 Key Takeaways from Head of POSB, Nelson Neo - Seedly Personal Finance Festival 2024

Did you know that POSB was established by the British government back in 1877 to encourage savings?

Since then, POSB has grown with Singapore through many crises such as the Asian Financial Crisis in 1997, SARS in 2003 and the Global Financial Crisis in 2008. But thanks to great planning and foresight by our forefathers, Singapore has managed to work through those tough times.

Likewise, it is important for us as individuals to plan for our future!

Luckily for us, we had the privilege of having Nelson Neo give us an overview of financial planning at the Seedly Personal Finance Festival 2024. For those who don’t know, Nelson is the perfect man for the job as he is the Head of Financial Planning Advisory & Head of POSB!

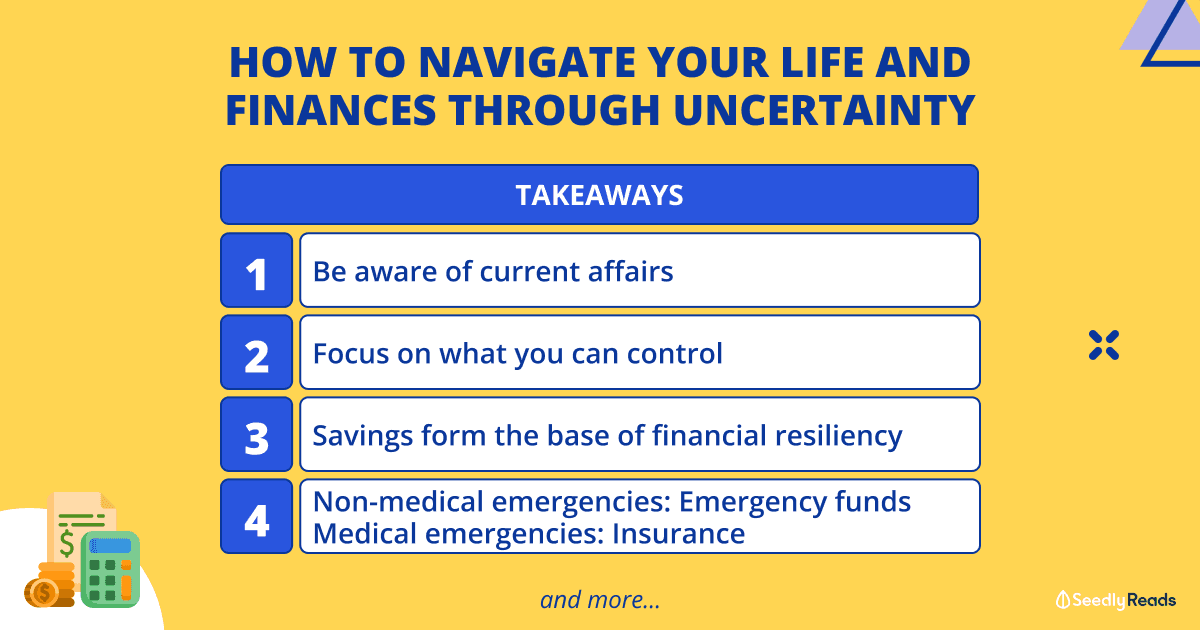

So without further ado, here are the key takeaways from Nelson’s sharing on Navigating Your Life and Finances Through Uncertainty.

TL;DR: 5 Key Takeaways from Head of POSB, Nelson Neo – Seedly PFF 2024

Key Takeaways

- Be Aware of Current Affairs as They Will Affect Us

- Focus on what you can control

Disclaimer: POSB Bank is the Main Title sponsor of the Seedly Personal Finance Festival 2024. All opinions mentioned in this content are solely those of the author and do not reflect the views or opinions of POSB Bank. The information provided is for informational purposes only and should not be considered financial advice. Please conduct your own research or consult a professional financial advisor before making any investment decisions.

Be Aware of Current Affairs as They Will Affect Us

When faced with uncertainty, it’s best to focus on what you already know! In other words, being equipped with the knowledge of what is going on now to prepare for the future.

According to Nelson, one should be aware of current affairs such as economic crises, trade tensions, rate hikes and inflation that will directly or indirectly impact our personal finances.

For example, those who have a home loan could be paying a lot more on their monthly instalments as interest rates went up a couple of years ago. For homeowners, knowing about what was going on globally would have easily saved them thousands of dollars by refinancing their home loans.

Personally, my dad is paying thousands more on his home loan as he couldn’t see the need to refinance, even after I told him that inflation would drive interest rates up. So it definitely pays to be aware!

Additionally, it is important to be aware of current trends such as the fact that Singapore will become a “super-aged” nation by 2026. This is when the proportion of the population aged 65 and above reaches the 21% mark. And by 2030, it is estimated that one in four Singaporeans will be 65 years old and above. We will thus need to plan for longer life expectancies, not only for ourselves but also for us to be able to support our aged parents who may not have sufficient medical coverage and/or savings.

Lastly, make an effort to understand the changes in schemes such as CPF, which will directly impact our retirement planning and passive income flow.

Focus On What You Can Control

When it comes to facing an uncertain (financial) future, we all know that it is impossible to predict what exactly will happen. Therefore, a better perspective is to focus on what you can control. According to Nelson, there are four key aspects of financial planning that everyone should know.

Savings

The first would be savings, which form the base of financial resiliency. Nelson recommends at least three to six months of emergency funds to cover rainy days such as a sudden loss of income and replacing important appliances.

Nelson has set aside at least 12 months’ worth of emergency funds, which is also in line with what we share here on Seedly:

Insurance

The second aspect of financial planning is insurance and a top priority is covering healthcare-related risks. While insurance forms a good financial safety net for medical emergencies, Nelson reminds us that there are times when we need to pay in cash before tapping into medical insurance claims.

While Nelson did not go too in-depth about insurance, I was reminded of when I first started considering it and found out about what sort of protection I needed, thanks to the Seedly community. So if you haven’t got down to planning insurance yet, here’s a great guide for you!

Budgeting and Financial Planning

The third aspect is to have a proper budget and a comprehensive financial plan for yourself and your family. While having an excel spreadsheet is great, there are plenty of helpful tools these days that can help you budget and stay on track with your financial goals.

Since most Singaporeans have a DBS or POSB account and most likely have the digibank app installed, you can easily start budgeting and planning your finances under the “Plan” tab. The app has many features and tools to guide you through your personal finance journey.

Debt Management

Lastly, it is critical to have good debt management. Nelson emphasises managing spending, and avoiding excessive borrowing and high-interest debt to improve cash flow. In other words, you should aim to have more money coming in than money going out so you can pay your debts and still have some spare to save, protect and grow your money!

Bonus tip

Before ending his talk, Nelson offered a tip on navigating financials and life choices. He urged the audience to make a Lasting Power of Attorney (LPA), which is a legal document that we could file to safeguard our interests if we are unable to make decisions due to mental incapacity. This could help prevent family disputes over money and legal issues later on in life.

Key Takeaways from POSB

All in all, Nelson Neo has given us a great framework for navigating an uncertain financial future. If you want to find out more about financial planning, DBS has a financial planning framework that you can read about.

Related articles

- Here’s What I Learnt From Seedly’s Personal Finance Festival 2023 (Main Stage) + Sweet Deals to Level Up Your Personal Finance Game!

- Here’s What I Learnt From Seedly’s Personal Finance Festival 2023 (Side Stage): Money & Life Lessons You Can’t Buy

- Seedly Money Framework: Win Your Finances in 2024 & Beyond

Advertisement