A Guide To Buying Your First Property In Singapore - BTO, EC and Resale Flats

This article was written by Yeo Jun Wei, an avid contributor in the Seedly Personal Finance Community Group

A big financial commitment

When it comes towards buying a house, it is probably the biggest purchase in one’s lifetime. However, there is more than meets the eye when it comes towards choosing a house based on its location or sun-facing. In fact, the most important thing would be to properly understand the financial aspect of things. It would be the couple’s first foray into debt unless they have student loan obligations to pay.

An Example: Johnny and wife (JW)

- A typical couple planning for their first home.

- We will use an income of $3,500 per individual, for a total household income of $7,000

- This is in line with an average graduate to estimate.

This article will not focus on non-monetary factors, such as location – future development plans around the area can greatly affect the resale price; floor level – higher floors are windier but gets dustier faster; facing – flats with North South facing tend to be windier, avoiding the noon sun etc. These factors are important to your decision but it is very hard to quantify a value to factors. Rationalize as a couple on the amount that you are willing to pay for these added benefits.

How much can one afford?

Here are the top 4 considerations for any couple to think about before buying any property.

Consideration 1: Income

The amount of debt obligation one can take up is based on the servicing ratio, this is the TDSR (total debt servicing ratio) for bank loans and MSR (mortgage servicing ratio) for HDB loans. This would equate to a $4,200 repayment for bank loans and half that at $2,100 for HDB Loans. This would result in a home loan of estimated about $460,000 for HDB, and higher at $900,000 for private property.

Consideration 2: Upfront payments

The down payment needed is proportional to the purchase price of the flat after deducting subsidies. Different loans would require different down payment percentages, HDB loan at 5% and Bank Loan at 10%. (Based on staggered down-payment scheme) Also, a larger flat size will exponentially increase the total upfront payment as some fees have different rates. Things like Legal fees and Stamp duties are based on your property cost and can add from 1% more up to over 3% depending on the cost of your house. Depending on the house type as well as the loan type, you will need to have different amounts saved up.

Consideration 3: Living Expenses

Personally, I am not a fan of people who purchase expensive wallets but have no money to put inside them. Likewise, the cost of your house may have a significant impact on your spending power and the lifestyle you want to live. There is no point to purchase a house too far out of your means and force yourself to scrimp and save to fund the house. Things such as buying a car or not should be factored in your household expenses planning before buying a house. Additionally, prepare an amortization table of your housing monthly repayments and see if your expenses would fit into your wages.

Consideration 4: Retirement

No, your retirement nest egg is not your house and never should be your only fall-back. If all your income is going to living expenses and housing and there is none leftover, you are doing it wrong. Build a model or do some calculations for extra cash you would save per month if you have gotten a different home. The amount of cash saved per month should be invested in various channels such as stocks, bonds, REITS, fixed deposits, CPF and hopefully a projected return on capital of your investments of about 4%.

Will it be worth more in the future?

“But hey my house is my asset! Even if I can barely afford it now it will be worth more in the future.”

Yes, I do agree that in general property prices would generally rise in the future. However, do consider the following things.

You still need a house to live in

Selling the house at elevated prices in the future would also mean that you will need to purchase a new house at those elevated prices. Unless you would be downgrading, then you would be able to hopefully have a large profit on the purchase of your house. Truth be told, upgrading is more common than downgrading.

Rental yield is an opportunity cost

Even though the house purchase is a lease from the government, by staying in your apartment you would lose the opportunity cost of renting it out and earning extra income. Do note that this is income forgone and the larger the house you stay in, the greater the opportunity cost.

Houses with only long lease tenures are likely to keep its value

If you are purchasing resale flats, do note that 20-30-year-old flats out there have a large amount of its lease tenure used up already. For a young couple that is still in their early twenties, they would be able to outlive the lease tenure of the flat, and the HDB flat is stated to have no longer have an asset value.

What home loan should we get?

Pro Tip: Get Approval in Principle (AIP) from both HDB and banks as a safety net to ensure that you would be qualified for the house as a safety net.

Down-payment sum considerations

HDB Loans also allow for flexibility in terms of down-payment, allowing you to only pay up 5% of the house at the start as compared to 10%. Look towards schemes such as the staggered down-payment scheme which is available for all first-time buyers to relieve your load, and start planning and saving early. Also, do remember the additional costs mentioned earlier in the article as well.

Early repayment/ Late repayment fees

In general, HDB loans are more lenient with longer grace periods but both HDB and banks have different late payment costs. HDB has no penalty fee for early repayment while banks charges 1.5% to 1.75% penalty fee if early repayment is within commitment period.

Fixed vs floating rates

I could write an entire article about monetary policy and rates as well as do back testing yet may never be truly certain which would be better. However, I feel that fixed rates by HDB is slightly better due two factors.

- Fixed rates allow for a piece of mind and easy calculations, do not need to keep on refinancing and worry if you are getting the best possible rate out there

- Domestic floating rates are set to rise due to monetary policy

The BTO Timeline

Conclusion

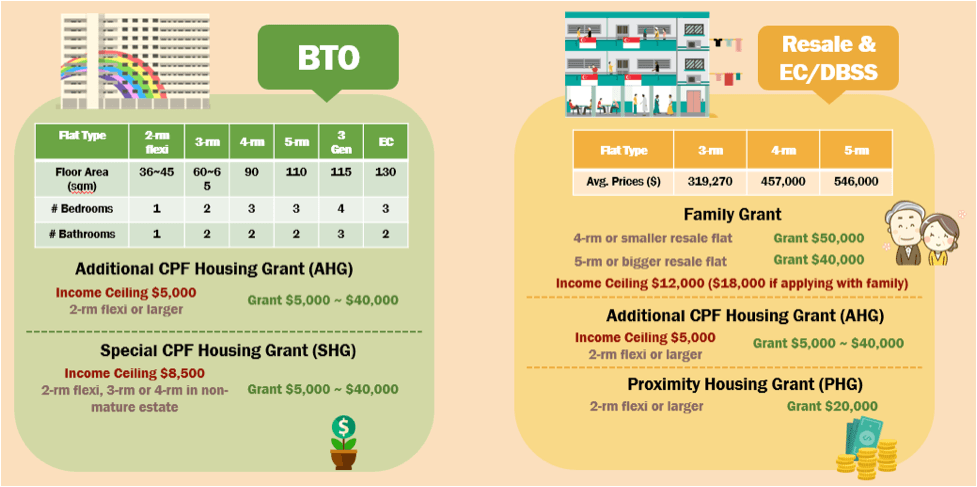

Start saving early and planning for your finances. In doubt, try to live below your means and be able to manage your cash flow. If you would like to see the information as a snapshot, please take a look at our infographic!

Advertisement