Savings Account Alternatives: Here's Where To Put Your Savings Now

So you’ve got some money squirrelled away.

Maybe it’s an emergency fund (aka rainy day fund).

Maybe it’s money that you’ve earmarked for a wedding or the downpayment of an HDB BTO flat.

Or maybe it’s money that you want to invest, but you haven’t quite figured that sh*t out yet.

How now brown cow?

Well, there’re tonnes of financial instruments out there…

So… which one should you go with?

Let’s take a closer look.

TL;DR: What Kind of Low Risk, High Interest, Capital Guaranteed Options Are There?

Based on the criteria I set out:

- Capital is protected (low risk)

- Fuss-free (no multiple conditions like credit card spend, salary crediting, insurance or investment purchases)

- High liquidity (no withdrawal fees, no early withdrawal penalties and no restrictions)

- High interest (definitely higher than the 0.05% base interest given by banks; naturally as high as possible)

- High account limit (no cap or limits preferable).

These are the best options for now:

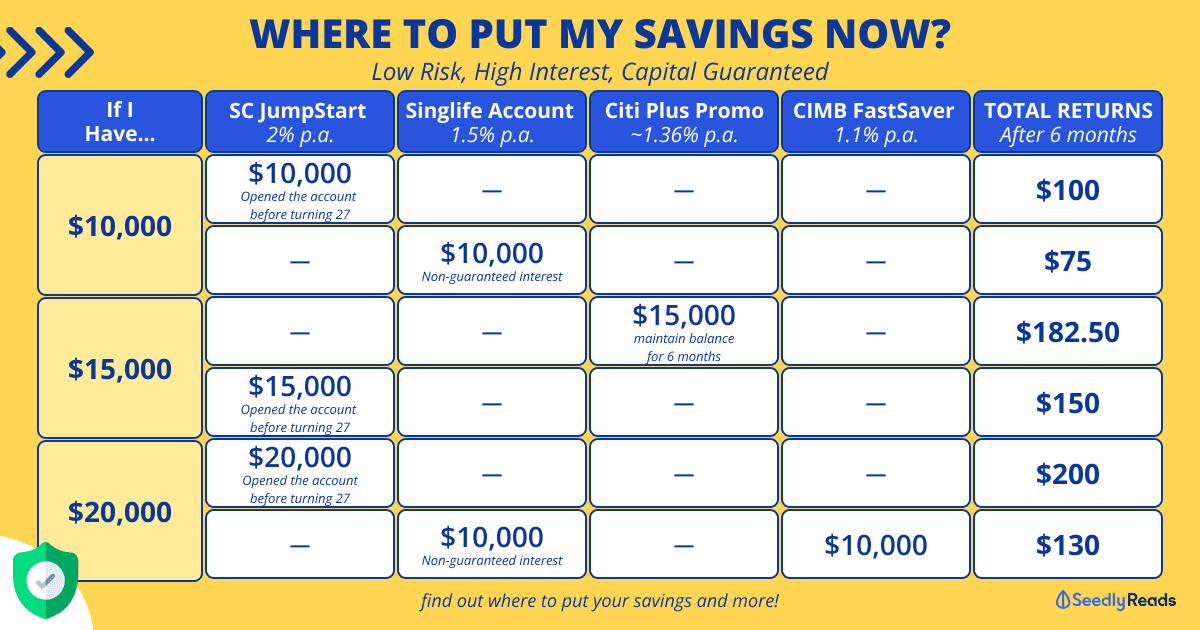

| If I Have... | Standard Chartered JumpStart (2% p.a.) | Singlife Account (1.5% p.a.) | Citi Plus: Citi Interest Booster Account (6 Month Promo Returns ~1.36% p.a.) | CIMB FastSaver (1.1% p.a.) | Total Rate of Return After 6 Months | Best For |

|---|---|---|---|---|---|---|

| $10,000 | $10,000 | — | — | — | $100 | Only have $10,000, and have an SC Jumpstart account (you must be under 26 years old to open) |

| — | $10,000 | — | — | $75 | Only have $10,000, above 26 years old without an SC Jumpstart account | |

| $15,000 | — | — | $15,000 | — | $182.50 | Those without an SC Jumpstart account T&Cs apply* |

| $15,000 | — | — | — | $150 | Those with an SC Jumpstart account | |

| $20,000 | $20,000 | — | — | — | $200 | Those who have opened an SC Jumpstart account |

| — | $10,000 | — | $10,000 | $130 ($75 + $55) | Those without an SC Jumpstart account |

*Must be ‘New-to-Bank’ to Citibank & a Seedly member and deposit a minimum sum of $15,000 in fresh funds within 2 months of account opening and maintain this sum as a Citi Plus customer for six months from account opening.

Jump to:

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment product.

What Kind of Low Risk, High Interest, Capital Guaranteed Options Are There?

Whatever I’m about to discuss here aren’t necessarily the best financial products to use if you’re looking to grow your income or increase your wealth.

Instead, the options listed here are the best if you:

- have emergency savings which you want to have on standby but want to at least try and beat inflation

- have savings for an upcoming short-term goal or life event (eg. wedding, downpayment for a property)

- have excess funds, which you haven’t deployed in your investments (eg. waiting for the right opportunity or still learning).

And you don’t want to leave it in your regular bank savings account which gives you a base 0.05% interest rate.

Option 1: High-Interest Savings Account

Your best bet is still a high-interest savings account.

The downside is that many of these accounts have multiple hoops to jump through in order to qualify for a higher interest tier.

Thankfully, Standard Chartered’s JumpStart account and CIMB FastSaver Accounts offer great interest rates just for depositing money into them!

1) Standard Chartered JumpStart Account

| Standard Chartered JumpStart Account | Criteria |

|---|---|

| Interest | 2% p.a. (First $20,000) 0.1% p.a. (Above $20,000) |

| Initial Deposit | No minimum |

| Fall Below Fee | None |

| Minimum Balance | None |

| Age Requirement | 18 to 26 years old |

| SDIC Protection | Insured up to $75,000 by SDIC |

If you’re 26 years old or younger, then this is a solid option as you get 2% p.a. for the first $20,000.

Do note that if you opened this account when you were younger than 26, you still can enjoy the sweet 2% p.a. interest rate even if you are older than 26 now!

2) CIMB FastSaver Account

| CIMB FastSaver | Criteria |

|---|---|

| Interest | 1.1% p.a. (First $10,000) 1.1% p.a. (Next $15,000) 1.5% p.a. (Next $25,000) 2% p.a. (Next $25,000) 0.8% p.a. (Above $75,000) |

| Initial Deposit | $1,000 |

| Fall Below Fee | None |

| Minimum Balance | None |

| Age Requirement | 16 years old and up |

| SDIC Protection | Insured up to $75,000 by SDIC |

If you’re older than 26 years old and missed out on the SC JumpStart Account, CIMB FastSaver is an alternative, fuss-free option which gives you up to 2% p.a. for balances under $75,000.

Option 2: Insurance Savings Plans

Based on the criteria I set out, your best bet would be:

1) Singlife Account

| Singlife Account | Criteria |

|---|---|

| Rate of Return | Up to 2.5% p.a. (First $10,000) Up to 1.1% p.a. (Next $90,000) 0% p.a. (Above $100,000) |

| Initial Deposit | $500 |

| Fall Below Fee | None |

| Minimum Balance | $100 (to enjoy the rate of return) |

| Age Requirement | 18 to 65 years old |

| SDIC Protection | Protected under Policy Owners' Protection Scheme (PPF) |

Do note that with insurance savings plans, your returns are non-guaranteed. So, if you don’t mind a lower interest rate (0.4% lower), you could opt for the CIMB FastSaver Account for a guaranteed 1.1% p.a.

Option 3: Citi Plus Citi Interest Booster Account

Alternatively, you could look at something like the Citi Plus account.

More than just your usual savings account, Citi Plus is a holistic digital-only wealth management account that lets you save, invest and insure yourself all within the Citi Mobile App.

Citi Plus offers interest up to 2.8% p.a. on the first $50,000 of your savings with the Citi Interest Booster Account:

| Citi Plus Citi Interest Booster Account | Criteria |

|---|---|

| Rate of Return | Up to 2.8% p.a. on first $50,000 (~1.36% p.a. for promo) |

| Minimum Initial Deposit | $0 ($15,000 for promo) |

| Monthly Fall Below Fee | $15 [Maintain min, monthly total relationship balance (TRB) of $15,000*] |

| Minimum Balance to Earn Bonus | $15,000 TRB |

| Age Requirement | 18 & above |

| SDIC Protection | Insured up to $75K by SDIC |

*From now till 31 December 2023, Citibank has waived its minimum account service fee. TRB refers to the sum of (i) the average daily balance of your checking, savings and deposit accounts, (ii) the average daily value of your investments, and (iii) all outstanding amount(s) payable on your secured loan accounts as of the date of your last statement.

You start with a base 0.01% p.a. interest rate and earn bonus interest rates by completing different missions. Additionally, you earn an exclusive base Interest at 0.29% p.a. from 17 September 2023 to 31 December 2023, capped at average daily balance of $50,000.

This gives you a base interest rate of 0.30% p.a. in total.

Each mission carries different requirements and a different bonus interest rate. When you fulfill the requirements of all the missions and combine the bonus interest rates, you’ll earn a total interest rate of up to 2.80% p.a. when you increase your balance, investment with Citibank, purchase an insurance plan policy and more:

| Bonus interest (p.a.) | Category | Action required |

|---|---|---|

| 0.10% | Birthday | Keep account open during birthday month Get bonus interest for birthday month |

| 0.20% | Save | Increase your balance by $1,500 or more Get bonus interest on incremental balance from previous month |

| 0.20% | Spend | Spend minimum $500 of eligible spending on Citi Cash Back + Mastercard or Citibank Debit Mastercard Get bonus interest per month |

| 0.60% | Invest | Perform three investments of S$1,000 or more Get bonus interest per month Qualifying transactions include: min $1,000 investment funds purchase min $1,000 forex conversion min $1,000 stocks purchase |

| 0.60% | Insure | Purchase a new regular premium insurance policy with minimum annual premium of $5,000 Get bonus interest for 12 months |

| 0.80% | Mortgage | Take up a minimum home loan of $500,000 Get bonus interest for 12 months |

Based on the interest table above, you can see that in terms of interest rate, Citi Plus doesn’t fare really well if you don’t want to jump through any hoops. Neither having a high bank balance nor crediting your salary will give you bonus interest, unlike other savings accounts.

Citi Plus Promo

That being said we have included Citi Plus as Citi is offering a great deal to Seedly readers.

New-to-bank customers will get $50 + $100 cash via PayNow when they apply for a Citi Plus account and fulfil the requirements.

Promotion Criteria:

- Promotion valid for New-to-Bank customers only

- Receive $50 cash upon starting a Citi Plus relationship and get another $100 cash (total $150) when you fund a min. deposit of $15,000 within two months of account opening and maintaining the funds for 4 months.

- Receive your $50 cash reward for opening a Citi Plus account in two weeks!

- Promotion valid until 31 Aug 2023

- Terms and Conditions apply.

Why not Fixed Deposits?

The tenor for a fixed deposit can range anywhere between 1 month to 3 years. And the deposit required ranges anywhere from as little as $500 to a minimum of $50,000 just to qualify.

But the biggest problem is how illiquid a fixed deposit is.

Technically, you could withdraw it anytime you want, but you’ll probably receive no or very little interest in return. Or in the worse case, might have to pay early withdrawal fees.

Why not Singapore Savings Bonds?

SSBs are damn inflexible.

For the SSB issued in October 2022, you’d have to hold it for the full 10 years in order to get an average annual return of 3.21%. That’s barely enough to even beat inflation.

Even though there’s no penalty if you choose to redeem the bond (in multiples of $500) anytime.

You’ll still need to pay a $2 transaction fee for every redemption request.

Why not Cash Management Accounts?

Since your cash account is invested in various funds in order to grow your capital.

This means that your capital is NOT guaranteed.

I know that there’s a case for keeping your money with the robo advisor or brokerage which you’re already or are planning to invest with.

And accounts like StashAway Simple give up to 2.1% p.a. (note: it’s up to, and this amount is correct as of the time of writing)

But you’ll also have to contend with longer withdrawal times — between one to three business days.

And since your money is being invested in funds, whatever you can take out at that point is subjected to prevailing market conditions.

Related Articles

Advertisement