At the start of the year, Galaxy Digital, Coinbase (NASDAQ: COIN) Ventures, Pantera Capital and other companies participated in a US$25M (S$33.7M funding round) for Terraform Labs the company behind the Terra blockchain.

The Terra blockchain is best known for its algorithmic stablecoins like TerraUSD (UST) which is currently the fifth-largest stablecoin in the world by market cap.

In addition, Terraform Labs is behind Chai, a South Korean payment platform with a little over two million active users as well as the Mirror Protocol, a decentralised exchange that allows you to trade synthetic shares in certain publicly traded companies.

On 17 March 2021, Terraform Labs launched their newest project, the Anchor decentralised finance (DeFi) protocol; an accessible savings and lending platform built on the Terra blockchain.

The protocol was also well received by investors as Anchor managed to raise a total of US$20 million (S$26.9 million) from an initial coin offering (ICO) token sale (ended 20 March 2021) with the participation of the following cryptocurrency venture capital firms:

Fun fact, Alameda Research is co-founded by Sam Bankman Fried, the 29-year-old cryptocurrency billionaire worth S$20.3 billion.

Although you can benefit from Anchor Protocol in other ways, Anchor’s main product so to speak is its savings protocol that gives you a 19.47% annual percentage yield (APY) on your UST deposits at the time of writing.

FYI: APY refers to the effective rate of return on an investment over one year after taking into account the effect of compound interest.

Is this for real?

Here is what you need to know!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment product. The writer may have a vested interest in the investments products mentioned.

What is the Anchor Protocol?

I’m glad you asked.

The Anchor Protocol is a decentralised money market savings and lending platform.

Put simply, you can liken Anchor Protocol to a bank that facilitates deposits and loans with one key difference. Unlike traditional banks, there is no intermediary.

Instead, the deposits and loans are automatically processed by the protocol’s smart contract.

According to Terraform, these are the key features of the Anchor Protocol:

- Principal protection: Anchor implements a liquidation protocol that liquidates borrower collateral when any loans exceed the 60% loan to value (LTV) threshold, thus protecting the principal of depositors.

Here’s how it works. Let’s say John borrows $1,000 and put up $4,000 worth of collateral in cryptocurrencies (LTV of 25%). In the event that the value of his collateral falls below $1,666, that means that his LTV ratio has exceeded the 60% LTV threshold. As a result, his collateral will be partially liquidated to pay off his loan. - Frictionless: There are no minimum deposits, account freezes or sign-up requirements.

- Instant withdrawals: Terra deposits are instantly withdrawable — no lockup required.

- Stable interest rate: Anchor stabilizes the deposit interest rate by passing on a variable fraction of block rewards from collateral assets to the depositor.

The protocol actually has a native governance crypto token: ANC which can also be used for staking.

FYI: Governance tokens are tokens that grant holders voting rights on a blockchain project. Holders can vote to influence decisions like the adding and removing of features or a revamp of the governance system and more.

At the time of writing, the APY for Anchor’s savings protocol or Anchor Rate as it is known stands at 19.47% APY.

FYI: The Anchor Rate benchmark interest rate for Anchor’s savings protocol and is derived and shaped by the collateralised assets staked on Acnhor. This rate can also be changed by governance proposals.

Here is the money market portion.

The attractive 19.47% APY entices lenders to deposit their stablecoins (e.g. UST) into the Anchor Protocol.

On the borrower’s side, they obtain UST loans by staking assets from the biggest proof-of-stake (PoS) blockchains as collateral.

In return, the borrowers will get what Anchor calls bAsssets, tokens that represent a right to the staked assets.

At the start, Anchor only offered yields for UST deposits. But subsequently, it partnered with Orion Money to launch its EthAnchor

Now, you can deposit Ethereum-based stablecoins like BUSD, DAI, USDC, USDT and evens wrapped UST onto EthAnchor.

Not to mention that Anchor Protocol has plans to offer non-USD pegged stablecoins, such as EUT, KRT and THT somewhere in the near future..

How Can You Benefit From The Anchor Protocol?

So here are some of the ways you can earn from the Anchor Protocol:

- Borrow

- Stake ANC

- Provide liquidity

- Earn.

This is to most straightforward and relatively less risky strategy. All you have to do is to deposit your UST onto Anchor Protocol to earn that 19.47% APY return.

As this guide is for beginners, we will dive deeper into the less risky and complex Earn strategy.

This is to most straightforward and relatively less risky strategy. In terms of execution, all you have to do is to deposit your UST onto Anchor Protocol to earn that 19.47% APY return.

How Does Anchor Protocol Work?

To explain this, I would be referring to Loop Finance writer FrictionFabrizio’s explanation:

There are four main parties that make up the Anchor Protocol money market:

1. Lenny The Lender

The first party is Lenny.

Sick and tired of the low-interest rates he is getting from his savings accounts, Lenny buys some UST on an exchange like KuCoin.

He then sends the UST to his Terra Station wallet (digital ‘savings’ account), links it to the Anchor Protocol and clicks on the Earn tab.

The next step he takes would be to deposit $1,000 UST (1 UST = US$1 at the time of writing) and pay a one-off terra fee that increases with the amount you deposit. But, this fee is currently capped at ~$1.42 UST.

Once the money is in, Lenny is now earning interest on his UST deposit which is paid out proportionally every eight seconds per block transaction.

The best part? There is no lock-in. But, you will need to pay a terraTax fee of up to ~$1.42 UST two times per transaction if you want to withdraw.

At the time of writing (30 August 2021), Lennys around the world have deposited a massive $1.3 billion UST (~$1.75 billion) into Anchor Protocol.

But you might be wondering where is this yield coming from? If not, the Anchor Protocol would be just one huge Ponzi scheme.

Here is where Bob comes in.

2. Bob The Borrower

Here is where Bob comes in.

Bob is bullish about Ethereum and its native cryptocurrency Ether (ETH) and expects it to go to the moon in the near future despite the volatility.

So Bob bonds three ETH on Anchor Protocol and receives three bonded ETH (bETH) in return.

By putting up the bETH as collateral on Anchor, he can take a loan of up to 60% of the value of bETH in UST.

Assuming that three bETH = $10,000 UST Bob is able to loan $4,500 UST with an LTV of 45% from Anchor as his collateral is worth $10,000 UST when he took the loan out.

Borrowers are also incentivised to borrow, as they will be rewarded with Anchor tokens (ANC) when they borrow UST from Anchor.

This is done to encourage borrowing and participation in the Anchor Protocol ecosystem.

At the time of writing, the borrow annual percentage rate (APR) is 26.21% and the distribution APR is 35.86%.

Thus, borrowers will be getting ANC tokens at a 9.65% APR.

But Bob is taking a risk. If the value of his bETH exceeds the 60% LTV ratio, his collateral will be liquidated.

The good thing about Anchor is that Bob can repay the loan at any time as there is no lock-in. But, Bob will have to take note that it takes 21 days to un-bond his bETH back to bETH.

At the time of writing, Bobs around the world has put up US$2.3 billion UST (S$3.10 billion) in collateral on the Anchor Protocol.

3. The Anchor Protocol

Now we have the Anchor Protocol.

The Anchor Protocol only has one job: maintain borrower revenue at a rate that will cover the cost of paying the lenders interest on their deposits.

This is achieved through the Anchor Protocol’s smart contracts which programmatically imposes a variable interest rate on Bob’s loans AND uses the bETH that Bob has put up in collateral to earn staking rewards.

PoS requires that participants ‘stake’ their cryptocurrency by risking or locking it in to guarantee the integrity/security of the blockchain. The cryptocurrency that is staked and locked in is randomly assigned the right to validate the next block of transactions by the cryptocurrency network.

This chance of your cryptocurrency being selected is generally proportional to the number of coins you stake. Generally, the more coins you have, the higher your chance of your cryptocurrency getting chosen.

In return, you will be rewarded with more coins in staking rewards for the contribution to the network.

With the revenue collected from staking and the interest on Bob’s and other borrowers loans, Anchor pays Lenny and other lenders the interest based on the current Anchor Rate of 19.47%.

The Anchor Protocol smart contracts are constantly working overtime to ensure that the Anchor Rate payout is sustainable.

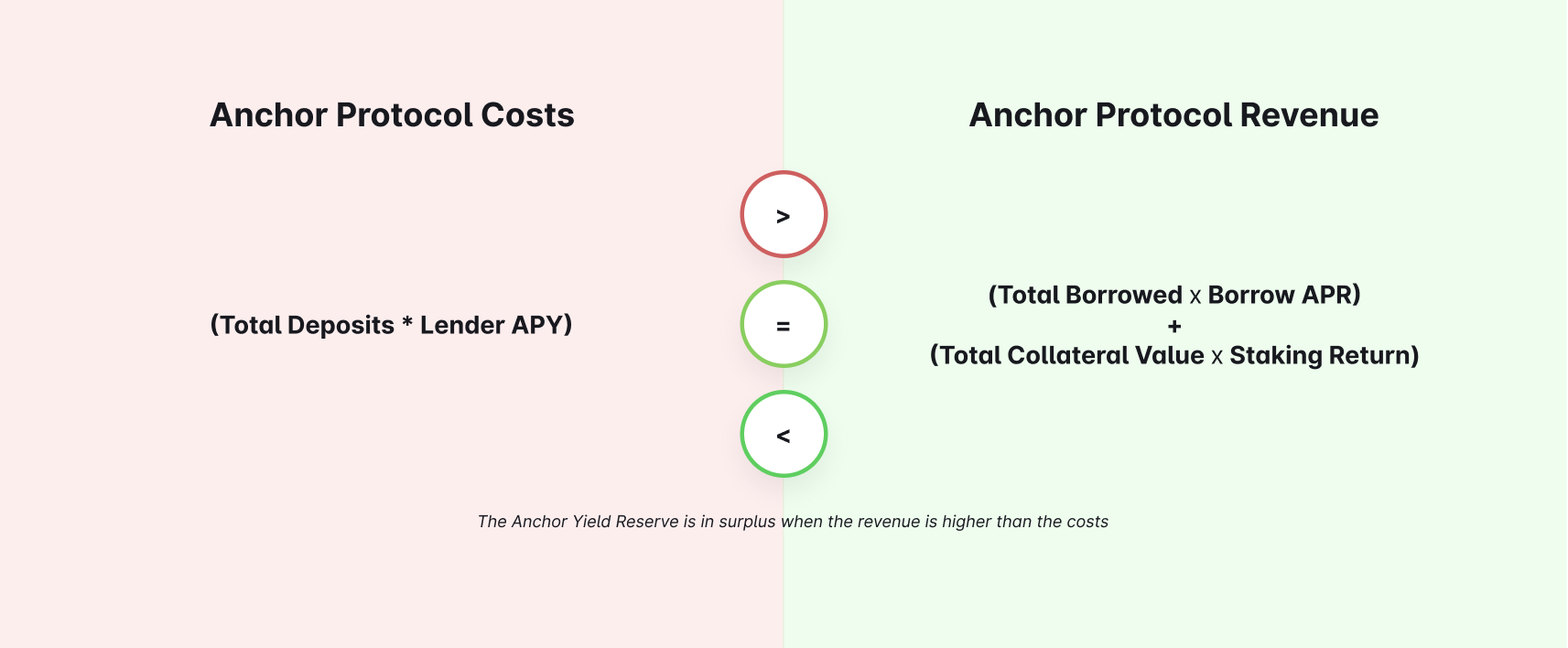

When the amount of interest collected from borrowers exceeds the cost to support lenders, this excess amount will be added to the Anchor Yield Reserve.

Whereas when the cost of paying lenders interest exceeds the amount of interest collected from borrowers, the yield reserve is tapped to pay the lenders interest.

4. The Anchor Yield Reserve

As the name suggests the Anchor Yield Reserve functions as a reserve to cover the Anchor Protocol when the cost of paying lenders interest exceeds the amount of interest collected from borrowers.

Here is how to calculate the yield reserves:

You can try calculating it yourself using the data provided by Anchor here.

Sounds good so far?

Risks of Anchor Protocol

So what are the risks of using Anchor Protocol?

Here is a couple you need to be aware of:

1. Anchor Protocol Hacking Risk

As the Anchor Protocol is a DeFi protocol, you can never rule out the risk of a hack. Think Poly Network and the many DeFi hacks that happened this year.

But on balance, Anchor has not been hacked so far. It has also taken precautions like carrying out audits of its smart contracts:

Not to mention that it has a bug bounty programme where ethical hackers get rewarded if they can discover vulnerabilities within the Anchor Protocol.

Anchor will pay a reward of US$500 to US$150,000 for eligible discoveries according to the terms and conditions.

2. UST Depegging

UST is pegged to US$1 using a mechanism that is algorithmically based.

An important thing to note is that stablecoin is 100% algorithmic and not backed by any collateral.

Here’s how UST’s mechanism works.

It revolves around two cryptocurrency tokens UST and Terra (LUNA).

Terra’s network will always value UST at US$1 and work towards maintaining the US$1 peg algorithmically.

The value of UST is derived from factors like the fluctuating value of the US dollar and the supply and demand forces acting on UST.

When the value of UST is worth more than US$1, LUNA holders are incentivised to sell their tokens for UST. LUNA is then burnt and UST is minted.

On the flip side, when the value of UST falls below US$1, UST holders are incentivised to sell their tokens for LUNA. UST is then burnt and LUNA is minted.

These actions and the algorithm work in tandem to bring the UST price back to the target peg of US$1.

If UST is not able to maintain its peg, it may cause huge losses for users.

Thankfully, this has only happened a few times and the peg was quickly restored.

3. The 19.47% APY is Not Fixed

Currently, the Anchor Protocol has set the Anchor Rate at 20% APY.

But, it can always be adjusted by Anchor’s governance system.

This rate can also fluctuate when the ratio of lenders and borrowers changes. Basically, more borrowers means that it will be easier to maintain the Anchor Rate.

Thankfully, this Anchor Rate has been successful in keeping the yield at around these levels so far.

4. Yield Not Sustainable During a Crash

However, when a market crash suddenly happens the yield will not be sustainable.

Back in the May 2021 cryptocurrency flash crash where about US$1 trillion was wiped off the total cryptocurrency market cap, the LUNA token crashed to a low of US$4.10. (for context LUNA is currently trading at US$33.0).

This caused a few problems:

- It reduced the amount of interest being earned by the protocol to pay depositors as there are fewer borrowers paying interest.

- Borrowers who were burned might not be incentivised to come back.

- It increased the borrower incentive paid in ANC tokens by a ridiculous amount (currently at 164% APY), which means the supply of ANC tokens is super high now, and with demand low during a bearish period, it could cause ANC to dump.

When this happened, the 20% APY fixed yield was still being paid to depositors. But there was not enough capital to make payout the yield.

As a result, the yield reserve was tapped.

This brings me to my next point.

5. Anchor Protocol Yield Reserve Running Out

After the May 2021 crash, the yield reserve almost ran out.

To prevent this from happening Terraform Labs pumped in $70M UST to Anchor Protocol’s yield reserve to stabilise things.

It is unlikely that this will happen again. But, the good news is that Anchor Protocol at the time of writing still has $67M UST in its reserves.

6. Foreign Exchange Risk

According to Investopedia: Foreign exchange risk refers to the losses that an international financial transaction may incur due to currency fluctuations. Also known as currency risk, FX risk and exchange-rate risk, it describes the possibility that an investment’s value may decrease due to changes in the relative value of the involved currencies.

Since the UST stablecoin is pegged to the U.S. dollar, you have to contend with the price fluctuations of the greenback.

Depositors Funds Are Still Safe

But an important thing to note is that there is an assurance from Anchor that your capital will still be preserved.

This is due to Anchor’s liquidation protocol and over-collaterisation requirement.

Even if the Anchor Rate falls, you can always withdraw your money any time and park your money somewhere else.

However, this does not cover risks like smart contract hacks.

Anchor Protocol Insurance

But if you are kiasi like me.

You can actually buy insurance on Anchor Protocol.

The insurance covers you against events like a UST depeg or smart contract hacks.

The cost is also quite low as it tops out at about 2.5 per cent of your insured value a year.

I would recommend buying insurance if you want to deposit your money on the Anchor Protocol.

But do carefully read the terms and conditions of the insurance before committing to anything.

In addition, Terraform Labs is actually building a native insurance project called Ozone which will be providing insurance on the Anchor Protocol so keep a look out for that!

Related Articles

Advertisement