Annual Value of Property in Singapore Guide: The Magic Number for Government Support and Property Tax

●

When it comes to property tax and government support in Singapore, there is one common magic number that the Singapore Government looks at.

The Annual Value (AV) of the residential property you are living in.

Generally, the Singapore Government views AV and Assessable Income (AI) as the main indicators to ‘measure’ how well off you are financially.

AV is used instead of flat types as it is a more accurate representation of how much the property is worth and serves as a proxy for the individual or household’s wealth.

These numbers and other eligibility criteria determine how much government support you’ll get and how much property tax you need to pay.

In principle, these indicators are a form of means-testing that the Singapore Government uses to ensure that the aid is going to those who need it most.

Government support schemes like the GST Voucher scheme and Assurance Package use AV and assessable income as indicators.

Your annual property tax is calculated using the AV as well.

This is why it’s important that everyone knows the AV of the residential property that you are either living in, renting or owning.

This is to ensure that you know what government support schemes you are eligible for and get a handle on the property tax you need to pay.

TL;DR: All You Need to Know About Annual Value (AV) of Property in Singapore

From 1 January 2025, the annual value bands for owner-occupied residential properties will be raised. Some households will thus enjoy lower property tax rates!

In This Article

- What is the Annual Value (AV) of property in Singapore?

- How to calculate the Annual Value (AV) of property in Singapore?

- How to appeal against the Annual Value (AV) of property valuation

- How does the Annual Value (AV) affect government support?

- How does the Annual Value (AV) affect the property tax rate?

- How to calculate the residential property tax rate?

What is the Annual Value (AV) of Property in Singapore?

Well, I’m glad you asked.

Contrary to popular belief, the Annual Value of residential property in Singapore is not based on the actual rental income you personally receive from renting out your home.

Instead, the Inland Revenue Authority of Singapore (IRAS) defines the AV of buildings (inclusive of residential properties) as the ‘estimated gross annual rent of the property if it were to be rented out.’

This amount excludes furniture, furnishings and maintenance fees.

It is determined based on estimated market rentals of similar or comparable properties.

To determine the AV, IRAS evaluates market rentals of similar or comparable properties within your residential property’s area.

IRAS will usually update AV prices annually and update owners about any changes made to the property’s AV.

IRAS will also review the property’s AV if there are any physical changes to the property that will affect the property’s rental value.

An important thing to note is that the way AV is determined is the same, regardless of whether the property is occupied by the owner, vacant or rented out.

How to Calculate the Annual Value (AV) of Property in Singapore?

The first way for property owners is to refer to your property tax bill.

The property AV can be found in the top left-hand corner.

Property owners can also check the AV of their own residential property for free by logging in to myTax Portal.

Look under Messages > Correspondence & Notices > Property Tax > Letters/Notices.

For non-property owners, you can find the AV of any property registered in Singapore using the Check Annual Value of Property tool.

Median Annual Value of Homes in Singapore

Otherwise, you can refer to this table with data provided from Data.gov.sg about the Median Annual Value of residential properties for FY2022.

Even though this data is from 2 years ago, it still provides a good indication, as my family home’s annual value was quite close to the numbers found here. Your mileage may vary.

| Type of Property | Number of Houses | Median Annual Value (SGD) |

|---|---|---|

| 1 or 2 Room | 43,492 | $6,540 |

| 3 Room | 244,102 | $9,900 |

| 4 Room | 439,429 | $12,480 |

| 5 Room | 250,163 | $13,500 |

| Executive & Others | 65,077 | $14,220 |

| Non-landed (includes Executive Condominiums) | 343,487 | $27,000 |

| Landed | 75,051 | $39,600 |

How to Appeal Against the Annual Value (AV) Property Valuation From IRAS?

The AV is not set in stone.

If you think that IRAS’s valuation of your property’s AV is too damn high, you can file an objection with IRAS.

This can be done anytime if you want to object to your property’s AV in IRAS’ property valuation list.

Otherwise, when your AV is updated, and IRAS sends you a Valuation Notice about the AV of your property, you will have to file for an objection within 30 days.

Details about how to file an objection can be found in the link above.

However, if you are still unhappy with IRAS’ judgement after you filed an objection, you can still appeal to the Ministry of Finance.

How does the Annual Value (AV) affect Government Support?

Generally, government support schemes are based on the Annual Value of your residential property or assessable income.

For those schemes that have AV as one of the assessment criteria, your AV will be based on the place of residence registered to your NRIC.

This means that it applies to you whether you are renting or living with your parents.

For those looking to rent a place, you can take this factor into consideration, as the smaller places of residence enjoy the most government support.

How does the Annual Value (AV) Affect the Property Tax Rate?

The AV of your residential property is a huge factor in determining your property tax rate

This is the case as the property tax you need to pay is based on this simple formula:

Your Property’s Annual Value x Property Tax Rate = Property Tax Payable

How to Calculate the Residential Property Tax Rate?

There are three types of residential property tax rates in Singapore.

One is for the Owner-occupied Property (OOP) tax rate, the Non-owner-occupier Residential tax rates and the residential property tax exclusion tax rate.

Owner-Occupied Property (OOP) Tax Rate (Residential Properties)

Owner-occupied residential properties may be HDB flats, condominiums and other residential properties where the owner lives in (“occupies”) the property.

They enjoy cheaper rates than Non-owner-occupier resident rates.

The following tax rates apply to non-owner occupied properties except for those in the exclusion list.

Owner-occupier tax rates (Effective 1 Jan 2024 to 31 Dec 2024)

| Annual Value ($) | Tax rate effective from 1 Jan 2024 to 31 Dec 2024 | Property Tax Payable |

|---|---|---|

| First $8,000 Next $22,000 | 0% 4% | $0 $880 |

| First $30,000 Next $10,000 | - 6% | $880 $600 |

| First $40,000 Next $15,000 | - 10% | $1,480 $1,500 |

| First $55,000 Next $15,000 | - 14% | $2,980 $2,100 |

| First $70,000 Next $15,000 | - 20% | $5,080 $3,000 |

| First $85,000 Next $15,000 | - 26% | $8,080 $3,900 |

| First $100,000 Above $100,000 | - 32% | $11,980 |

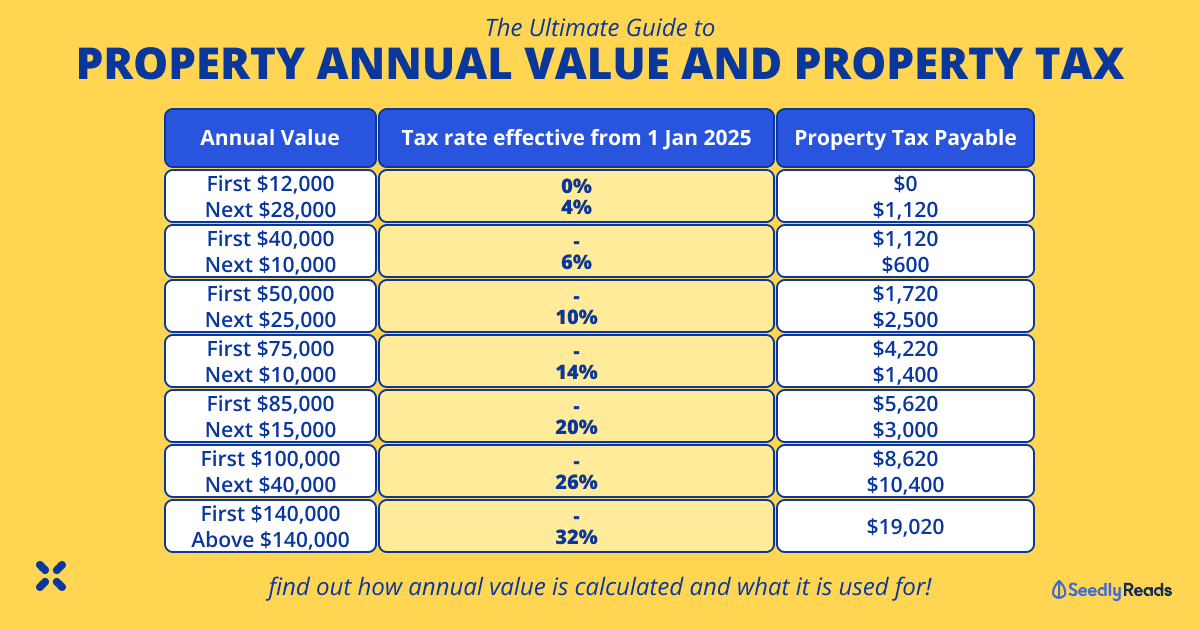

As announced in Budget 2024, the annual value bands for owner-occupied residential properties are raised from Jan 1, 2025:

| Annual Value ($) | Tax rate effective from 1 Jan 2025 | Property tax payable |

|---|---|---|

| First $12,000 Next $28,000 | 0% 4% | $0 $1,120 |

| First $40,000 Next $10,000 | - 6% | $1,120 $600 |

| First $50,000 Next $25,000 | - 10% | $1,720 $2,500 |

| First $75,000 Next $10,000 | - 14% | $4,220 $1,400 |

| First $85,000 Next $15,000 | - 20% | $5,620 $3,000 |

| First $100,000 Next $40,000 | - 26% | $8,620 $10,400 |

| First $140,000 Above $140,000 | - 32% | $19,020 |

This means that some homeowners will pay lower property taxes. Hooray!

Non-owner-occupier Residential Tax Rates (Residential Properties)

Residential Property Tax Rates Exclusion List

Residential properties on this list will be taxed at 10%.

Otherwise, you can use IRAS’s interactive calculator for you to calculate your own property tax.

There you have it. All you need to know about the Annual Value of property in Singapore and how it affects the government support you get and the property tax you pay.

If you have any other questions about property, feel free to raise them with our friendly Seedly Community!

Advertisement