Ascendas REIT Vs Mapletree Industrial Trust: Which Is The Better Buy?

With real estate investment trusts (REITs) forming a large part of the stock market in Singapore, it’s worth comparing the attributes of some of the larger REITs in the market. So I thought I’d look at two of the largest industrial REITs in Singapore; Ascendas Real Estate Investment Trust (SGX: A17U) and Mapletree Industrial Trust (SGX: ME8U).

Both have market capitalisations of over S$3 billion, although Ascendas is the only one of the two that’s a Straits Times Index constituent stock.

Let’s take a look in further detail at which one offers investors the better prospects.

Disclaimer: This is not a sponsored post. Opinions expressed in the article by the author should not be taken as investment advice. Please do your own research and due diligence.

DPU Growth And Yield

Ascendas and Mapletree Industrial both have strong track records in growing their distribution per unit (DPU) over the years.

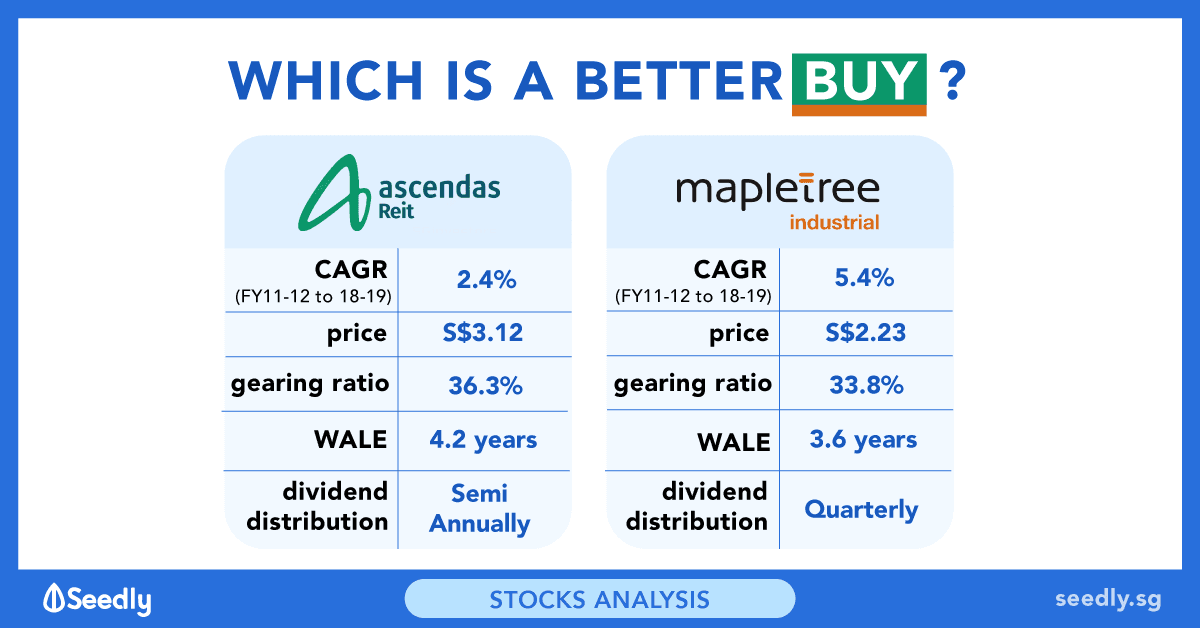

Let’s start with Ascendas. It has grown its full-year DPU from 13.56 cents in FY11/12 to 16.04 cents in FY18/19 – giving it a compound annual growth rate (CAGR) during the period of 2.4%.

Meanwhile, Mapletree Industrial grew its DPU from 8.41 cents in FY11/12 to 12.16 cents in FY18/19, delivering a CAGR in its DPU of 5.4% over the same period.

In terms of yield, on a trailing 12-month basis Ascendas is yielding 5.2% at its current unit price of S$3.12 while Mapletree Industrial’s distribution yield is 5.5% based on its latest unit price of $2.23.

Clearly, Mapletree Industrial comes out on top here.

Winner: Mapletree Industrial Trust

Gearing Ratio

Given REITs rely partly on taking on debt to fund growth, it’s important that we ask how leveraged a REIT is before we decide to invest. Although the MAS sets a regulatory ceiling of 45% on gearing, it’s preferable to find a REIT that is comfortably below that.

In terms of leverage, Ascendas had a gearing ratio of 36.3% as of 31 March 2019. This was higher, though, when compared to Mapletree Industrial which had a gearing ratio of 33.8% as of 31 March 2019.

Winner: Mapletree Industrial Trust

Portfolio Strength

Gauging the strength of a REIT’s portfolio can also be helpful in deciding how robust its assets are.

Here, we can take a look at the weighted average lease to expiry (WALE) – in short, the longer it is, the better.

On this front, Ascendas’s portfolio WALE of 4.2 years is superior to Mapletree Industrial’s portfolio WALE of 3.6 years.

Winner: Ascendas REIT

Foolish Takeaway

Overall, I think Mapletree Industrial is the stronger of the two industrial heavyweight REITs.

Another aspect I like about Mapletree Industrial is that it pays distributions every quarter (so four times a year) whereas Ascendas pays semi-annually (twice a year).

However, investors should fully research a REIT’s overall operating business before making any decision to invest.

Want More In-Depth Analysis And Discussion?

Why not check out Seedly’s QnA and participate in the lively discussion surrounding stocks like Ascendas REIT, Mapletree Industrial and many more!

Stock Discussion on Ascendas REIT

Stocks Discussion: Mapletree Industrial Trust

Seedly Guest Contributor: The Motley Fool

For our Stocks Analysis, the Seedly team worked closely with The Motley Fool, who is an expert in the field, to curate unbiased, non-sponsored content to add value back to our readers.

The Motley Fool offers stock market and investing information, offering people suggestions on how to take control of their money and make better financial decisions.

The Motley Fool Singapore primarily covers the Singapore market, though we also bring investing news from around the world. We also host a range of educational content, written for everyday people. We feel that the best person to make your financial decisions is you, and we want to help you take control of your own money. The Motley Fool also champions shareholder values and advocates tirelessly for the individual investor.

If you have any questions on the mentioned stocks, feel free to discuss them with the Seedly Community here.

Read other articles by The Motley Fool:

- Singtel Vs Starhub: Which Stock Is The Better Buy?

- 2 Billion-Dollar REITs Yielding Above 6%

- StarHub Shares Have Fallen 64% In 5 Years: Is It A Bargain Now?

- 3 Blue-Chip Stocks Yielding More Than Your CPF Ordinary Account

- 3 Singapore Blue-Chip Stocks That Have More Than Doubled Their Profits In The Last Decade

- Singapore’s Top 10 Dividend Shares Among the World’s Best

- The Better Dividend Share: SIA Engineering Company Ltd or Singapore Technologies Engineering Ltd?

- Big Week For Earnings With DBS, OCBC, UOB And Two Property Giants

- 2 Singapore Blue-Chip Companies That Announced Weaker Results Recently

- How Singapore-Listed Banks Performed in 2018

- 5 Blue-Chip Shares That Have Raised Their Dividends In 2018

- 5 Singapore REITs That Have Grown DPU in 2018

- 3 Singapore Companies That Have Paid Dividends For More Than 20 Years

- 2 REITs To Watch This Week – Mapletree Commercial Trust And Mapletree Industrial Trust

- 2 REITs That Have Performed Well Recently – Mapletree Industrial Trust and Fraser Centrepoint Trust

- 2 Companies That Have Recently Announced Growth – DBS and Sheng Siong

- Keppel KBS US And Sasseur REIT Delivered 20%+ Return To Investors In 2019

Advertisement