Monthly Household Income vs Housing Type in Singapore: Where Do You Stand?

●

In Singapore, there are many ways that are commonly used to gauge one’s lifestyle.

And one of the most common ways for us is to look at the type of housing as one of the indicators.

I mean, we can even take a look at how much our neighbours earn…

We previously saw how much the median monthly household income is. (Spoiler alert: It’s $7,744 in 2020)

Ever wondered how your household income compares to those that are staying in a similar housing type as you?

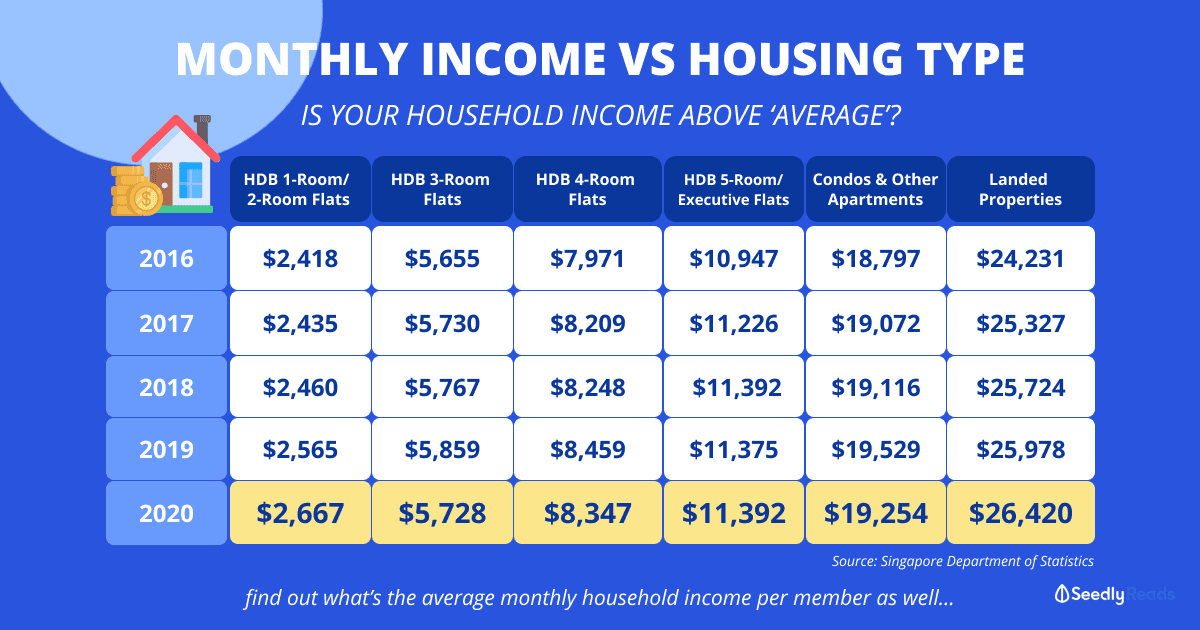

TL;DR: Average Monthly Household Income From Work vs Type of Housing

| Year | HDB 1- & 2- Room Flats | HDB 3-Room Flats | HDB 4-Room Flats | HDB 5-Room & Executive Flats | Condominiums & Other Apartments | Landed Properties |

|---|---|---|---|---|---|---|

| 2020 | $2,667 | $5,728 | $8,347 | $11,392 | $19,254 | $26,420 |

| 2019 | $2,565 | $5,859 | $8,459 | $11,375 | $19,529 | $25,978 |

| 2018 | $2,460 | $5,767 | $8,248 | $11,392 | $19,116 | $25,724 |

| 2017 | $2,435 | $5,730 | $8,209 | $11,226 | $19,072 | $25,327 |

| 2016 | $2,418 | $5,655 | $7,971 | $10,947 | $18,797 | $24,231 |

Source: Singapore Department of Statistics

Note: Monthly household income from work refers to income received by the working members of the household from employment and business.

It includes one-twelfth of the annual bonus, excludes employer CPF contributions and the income of maids.

A few key pointers:

- Average household income for individuals staying in a 3-room flat is $5,728 in 2020, a 2.24% decrease as compared to 2019

- Average household income for individuals staying in a 4-room flat is $8,347 in 2020, a 1.32% decrease as compared to 2019

- Average household income per household member is twice as much for members living in a condo (& other apartments) as compared to members living in a 5-room flat ($6,733 vs $3,332)

- Average household income per household member is consistently higher for members living in a condo than those living in landed properties

Average Monthly Household Income Per Member

It could be inaccurate if we were to look at the average household monthly income alone since there is a different number of members in a household.

As such, another method is to look at the average household income per person.

Here’s a breakdown of the monthly household income from work per household member, excluding employer CPF contributions:

| Year | HDB 1- & 2- Room Flats1/ | HDB 3-Room Flats | HDB 4-Room Flats | HDB 5-Room & Executive Flats | Condominiums & Other Apartments | Landed Properties |

|---|---|---|---|---|---|---|

| 2020 | $1,424 | $2,500 | $2,812 | $3,332 | $6,733 | $6,115 |

| 2019 | $1,394 | $2,552 | $2,842 | $3,397 | $6,938 | $6,210 |

| 2018 | $1,266 | $2,393 | $2,722 | $3,294 | $6,909 | $5,999 |

| 2017 | $1,173 | $2,337 | $2,587 | $3,211 | $6,694 | $5,994 |

| 2016 | $1,156 | $2,311 | $2,502 | $3,057 | $6,683 | $5,883 |

Source: Singapore Department of Statistics

It is interesting to note that the monthly household income is higher for members living in condominiums (& other apartments) as compared to those living in landed properties.

This is perhaps due to the larger family sizes for members staying in landed properties, as compared to those staying in condominiums.

Breakdown of Monthly Household Income vs Type of Housing

Curious to find out what’s the most ‘popular’ type of housing for households with similar monthly household income as yours?

Here’s the breakdown according to average monthly household income from work:

| Monthly Household Income from Work | 1- & 2- Room Flats | 3-Room Flats | 4-Room Flats | 5-Room & Executive Flats | Condominiums & Other Apartments | Landed Properties | Others |

|---|---|---|---|---|---|---|---|

| No Employed Person | 18.23% | 26.36% | 23.72% | 15.13% | 10.88% | 5.42% | 0.26% |

| Below $1,000 | 24.22% | 27.57% | 26.23% | 12.42% | 7.06% | 2.16% | 0.34% |

| $1,000 - $1,999 | 23.75% | 31.82% | 27.26% | 11.20% | 3.98% | 1.60% | 0.39% |

| $2,000 - $2,999 | 16.61% | 30.95% | 31.82% | 12.61% | 5.40% | 2.15% | 0.47% |

| $3,000 - $3,999 | 10.22% | 30.37% | 35.44% | 15.53% | 5.64% | 1.97% | 0.84% |

| $4,000 - $4,999 | 6.80% | 26.71% | 39.52% | 18.07% | 6.55% | 1.91% | 0.45% |

| $5,000 - $5,999 | 4.08% | 24.67% | 39.78% | 20.98% | 8.00% | 2.14% | 0.35% |

| $6,000 - $6,999 | 2.88% | 21.72% | 42.79% | 22.02% | 8.02% | 2.24% | 0.34% |

| $7,000 - $7,999 | 1.56% | 19.54% | 44.06% | 23.72% | 9.02% | 1.85% | 0.23% |

| $8,000 - $8,999 | 1.39% | 17.54% | 44.22% | 24.30% | 9.50% | 2.64% | 0.41% |

| $9,000 - $9,999 | 0.90% | 14.58% | 42.90% | 27.94% | 10.83% | 2.64% | 0.21% |

| $10,000 - $10,999 | 0.60% | 12.70% | 40.50% | 30.12% | 12.71% | 3.12% | 0.25% |

| $11,000 - $11,999 | 0.28% | 12.06% | 37.86% | 32.42% | 14.32% | 2.93% | 0.14% |

| $12,000 - $12,999 | 0.29% | 9.97% | 37.34% | 33.00% | 15.87% | 3.42% | 0.11% |

| $13,000 - $13,999 | 0.11% | 9.40% | 34.67% | 34.06% | 18.41% | 3.27% | 0.09% |

| $14,000 - $14,999 | 0.20% | 7.38% | 33.18% | 35.05% | 20.38% | 3.51% | 0.30% |

| $15,000 - $17,499 | 0.17% | 6.68% | 32.13% | 34.38% | 22.17% | 4.38% | 0.08% |

| $17,500 - $19,999 | 0.09% | 4.73% | 26.36% | 34.84% | 28.21% | 5.57% | 0.20% |

| $20,000 & Over | 0.03% | 2.25% | 12.89% | 23.81% | 44.50% | 16.41% | 0.13% |

Source: Singapore Department of Statistics, data interpreted by writer

- The majority of households in Singapore stay in 4-room HDB flats – more than 30% of households with a monthly household income of $2,000 to $17,499

- Almost half of those with a household income between $7,000 to $8,999 stay in 4-room HDB flats

- More than 30% with household income between $10,000 to $19,999 stay in 5-room HDB flats

- Almost half of condominium residents (44.5%) have a monthly household income of more than $20,000

Breakdown of Resident Households by Type of Housing

What’s the proportion of households living in the different types of residence?

Here’s the breakdown in 2020:

| Type of Housing | Proportion of Resident Households |

|---|---|

| HDB 1- & 2-Room Flats | 6.5% |

| HDB 3-Room Flats | 17.7% |

| HDB 4-Room Flats | 31.6% |

| HDB 5-Room & Executive Flats | 22.9% |

| Condominiums & Other Apartments | 16% |

| Landed Properties | 5% |

Source: Singapore Department of Statistics

More than half of Singapore and Permanent Resident households live in 4-room or 5-room HDB flats.

What Type of Property Can I Really Afford?

So…

Should you buy the largest property that catches your eye?

Definitely not.

Given that purchasing a property’s one of the biggest financial commitments in life, you should choose a home that is within your means.

This means buying a home that you can comfortably afford in the long run.

If you’re wondering what type of HDB flat you can REALLY afford…

Or if you wish to purchase a freehold condo instead, this is how much you need to earn before even thinking about one…

And if you’ve got any burning questions on property purchases or just about anything else, you know where to go!

Advertisement