Benefits For New Parents (2023 & Beyond): Baby Bonus, CDA Grants, 4 Weeks Paternity Leave & More

Everyone in Singapore is impacted by the announcements made during the Singapore Budget 2023!

This year’s Budget theme is ‘Moving Forward in A New Era’ and the Government seemed to have heard the cries of young couples who want to grow their families.

Let’s check out the changes!

TL;DR: Budget 2023 Measures to Support Singaporeans on Parenthood

Jump here:

- Baby Bonus and Baby Support Grant

- Child Development Account

- Tax incentive for parents

- Parenthood and Childcare Leaves

- Housing schemes for those with a baby or babies

- MediSave grants for newborns

- Free Passports

Disclaimer: This is not a sponsored post, all opinions are our own. We just want you to do well in life. Do note that the perks mentioned are for Singapore Citizens and/or Singapore Permanent Residents only. For more information about our editorial guidelines, please refer to the Seedly Code of Ethics.

Baby Bonus Cash Gift, Payout, Bonus Payout Schedule

This should be very familiar to all Singaporean couples.

I think you would already know, raising a child in Singapore is expensive AF.

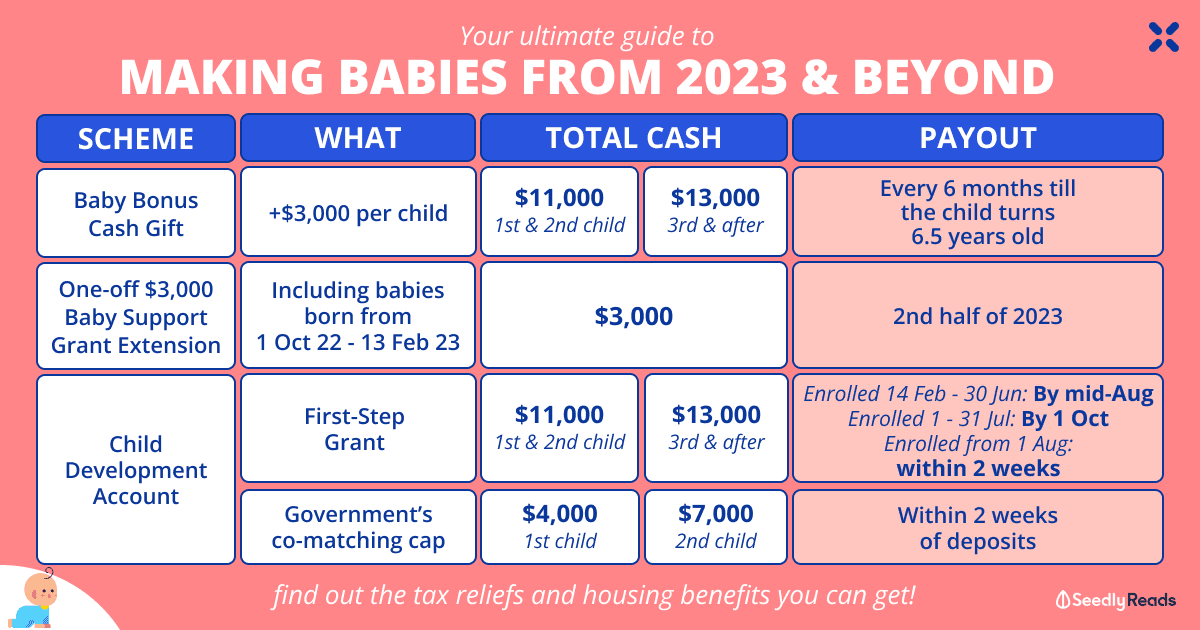

Luckily for couples who are starting to conceive, this year’s Budget took into account the rising cost of living and inflation, and has raised the Baby Bonus cash gift by $3,000!

With the adjustments, parents of babies born on 14 Feb 2023 and after will receive $11,000 each for their first and second child and $13,000 for their third child and beyond.

The amount will be disbursed in tranches of $400 every six months until the child becomes six and a half years old.

Without sounding too much like a governmental campaign, we’ve summarised the critical information you should know when your baby has arrived:

| New Disbursement Timeline | Amount of cash gift given out | |

|---|---|---|

| 1st and 2nd Child | 3rd Child onwards | |

| Within 7 to 10 working days from birth registration or joining the scheme, whichever is later | $3,000 | $4,000 |

| When child turns 6 months old | $1,500 | $2,000 |

| When child turns 1 year old | $1,500 | $2,000 |

| When child turns 15 months old | - | - |

| When child turns 18 months old | $1,000 | $1,000 |

| 2 years until 6.5 years (New) | $400 every 6 months ($4,000) | $400 every 6 months ($4,000) |

| Total | $11,000 (+$3,000) | $13,000 (+$3,000) |

Source: Made For Families

Baby Support Grant & Eligibility

In addition, the Government announced a one-off $3,000 Baby Support Grant in 2020 to help parents get through the economic uncertainty due to COVID-19.

This grant is originally for all parents of Singaporean children born from 1 Oct 2020 to 30 Sept 2022 and will supplement the current Baby Bonus scheme.

During Budget 2023, the grant has been extended to include parents of babies born from Oct 1, 2022, to Feb 13, 2023, who will be given the one-off Baby Support Grant of $3,000.

It will be disbursed via the same bank account that the parents have appointed for receiving the Baby Bonus cash gift.

Total Amount From Baby Bonus and Baby Support Grant

- The first and second babies can receive up to $11,000

- The third onwards will receive up to $13,000

Read more:

- Ultimate Guide To Childcare: Your Options & How Much

- CPF Hacks to Give Your Child a Headstart

- Your Ultimate Guide To Raising A Child In Singapore

Child Development Account, Dollar-for-dollar Matching & Account Interest

With the Baby Bonus, parents will need a Child Development Account (CDA) to receive grants and cash rewards from the government.

The CDA is a special savings account for children that can be opened with either POSB/DBS, OCBC, or UOB to help build up the savings that can be spent on approved uses.

The CDA account comes under the Baby Bonus scheme, which is part of the Marriage and Parenthood Package.

Under this scheme, there’s a Baby Bonus Cash Gift component and a Baby Bonus CDA component.

The child’s CDA will be opened within 3 to 5 working days upon their birth registration and completing the online form.

- One can choose to open a CDA with DBS, OCBC, or UOB.

- One will then have up to 12 years to save for their child in their child’s CDA

CDA First Step Grant: Up to $5,000

Parents of children born from 14 Feb 2023, you will be getting $5,000 (up from $3,000) that will be deposited into your child’s CDA under the government’s CDA First-Step Grant.

Regardless of the order of the child, you will be getting this amount for each child.

The good thing about this grant is that there is no initial deposit from parents required.

For now, you will continue to receive the amount you’ll be getting in 2023 and be notified when the enhanced amounts are disbursed in 2024.

For the additional $2,000 payout eligible parents can get, this is the rough timeline you can expect to receive it:

- For children enrolled between 14 Feb and 30 Jun 2023: By mid-Aug

- For children enrolled between 1 Jul – 31 Jul: By 1 Oct

- For children enrolled from 1 Aug: Within two weeks of account opening

CDA Dollar-for-Dollar Matching of Savings:

For those who didn’t know, the government also matches every dollar you save into your child’s CDA account.

Meaning if you deposit $3,000 into your child’s CDA account, the government will deposit $3,000 into the same account as well!

From 14 Feb 2023, the cap in which the Government matches the savings of parents’ under the CDA for a family’s first and second child will be increased.

The co-matching cap for the first child, which is currently $3,000, will go up to $4,000.

The co-matching cap for the second child will go up from $6,000 to $7,000.

Savings made after 1 Oct 2023 will be co-matched within two weeks of the deposit, excluding public holidays.

Do note that there are caps on the dollar-to-dollar matching scheme depending on how many children you have:

| Child Order | Child Develop Account (for approved uses, such as healthcare and preschool fees) | Total CDA Benefits | |

|---|---|---|---|

| CDA First Step (No initial deposit required) | Govt's Dollar-for-Dollar Matching | ||

| 1st child | $5,000 (+$2,000) | Up to $4,000 (+$1,000) | Up to $6,000 |

| 2nd child | $5,000 (+$2,000) | Up to $7,000 (+$1,000) | Up to $9,000 |

| 3rd | $5,000 (+$2,000) | Up to $9,000 | Up to $14,000 |

| 4th child | $5,000 (+$2,000) | Up to $9,000 | Up to $14,000 |

| 5th child onwards | $5,000 (+$2,000) | Up to $15,000 | Up to $20,000 |

Tax Reliefs

When you become a parent, you can receive income tax incentives for your taxes.

To be specific, I’m referring to the Parenthood Tax Rebate (PTR), Working Mother’s Child Relief (WMCR) & Qualifying Child Relief (QCR)/Handicapped Child Relief (HCR).

To qualify for any of the rebates, you must be a Singapore tax resident who is married, divorced, or widowed in the relevant year.

But before we move on, it’s important to note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each Year of Assessment.

Parenthood Tax Rebate (PTR)

The PTR is given to Singapore tax residents to encourage them to have more children. For each child, this is the amount of rebate you can get:

- 1st child: $5,000

- 2nd child: $10,000

- 3rd child onwards: $20,000

For any reason, if you wish to transfer the unutilised PTR to your spouse, you may do so too. If not, you can also discuss with your spouse how both of you would like to share the PTR.

Note: Any unutilised PTR will automatically be carried forward to offset your future income tax payable, and any remaining balance is not refundable.

Working Mother’s Child Relief

The PTR is not all. The Working Mother Child’s Relief (WMCR) is a tax relief to encourage mothers to continue working after having a child.

The WMCR takes a percentage off your earned income – 15% for your 1st child, 20% for the 2nd, and 25% per child thereafter, subject to a maximum of 100%.

WMCR percentages are added together if you claim for more than one child and the total is capped at 100% of the mother’s earned income.

However, from 2024 onwards, the tax relief system will move from a percentage of the mother’s earned income to a fixed dollar relief system.

Mothers who are eligible to claim the benefit can receive an annual relief of $8,000 for their first child, $10,000 for their second child, and $12,000 for each subsequent child beyond the second.

Qualifying Child Relief (QCR)/Handicapped Child Relief (HCR)

Lastly, if you are a parent with an unmarried child who fulfills all conditions, you will be able to claim Qualifying Child Relief (QCR) or Handicapped Child Relief (HCR).

| Qualifying Child Relief (QCR) | Handicapped Child Relief (HCR) | |

|---|---|---|

| Your child: - was born to you and your spouse/ex-spouse; or - is a step-child; or - is legally adopted | Yes | Yes |

| Your child was: - below 16 years old; or - studying full-time at any university, college, or other educational institution at any time in the year | Yes | N.A. |

| Your child did not have an annual income exceeding $4,000 Note: Annual income includes allowances and salaries from National Service, internship, school attachment and part-time employment. It does not include scholarships, bursaries and similar allowances | Yes | N.A. |

| Your child is mentally or physically handicapped | N.A. | Yes |

| Relief | $4,000 per child | $7,500 per child |

The QCR is $4,000 per child while the HCR is $7,500 per child. Do note that regardless of whether the QCR/HCR is claimed by the father or mother, it will be applied first. The WMCR will be limited to the remaining balance.

And, the total cap (i.e. QCR/HCR + WMCR) is $50,000 per child.

Let’s use an example to illustrate!

Scenario: Mr. and Mrs. Chen have one child who was 12 years old in 2021, and Mrs. Chen’s earned income in 2021 was $80,000. The couple decided that Mrs. Ng would claim the full amount of QCR of $4,000, and they are also entitled to PTR of $5,000 for their only child. They have both agreed to split the PTR equally too (i.e. $2,500 each).

This will be Mrs. Chen’s tax computation after the change in WMCR:

- Earned income of Mrs Ng: $80,000

- Personal Income Tax Reliefs:

- Earned income: $1,000

- QCR: $4,000

- WMCR: $8,000

- CPF Relief (20% of earned income): $16,000

- Chargeable Income: $51,000 ($80,000 – $29,000)

- Tax payable for Mrs Chen’s Year of Assessment:

- $550 (first $40,000) + $2,800 (next $11,000 at 7%) = $3,350

- Less PTR: $1,040 (her PTR is $2,500 since she’s splitting equally with Mr Chen, and any unutilised amount will roll over to the following year)

- Therefore, her net tax payable is $2,310.

Read more:

- Top 5 Tips to Reduce Income Tax in Singapore

- A Singaporean’s Guide: How to Claim Income tax Deduction for Work-Related Expenses

Maternity Leave, Paternity Leave & Childcare Leave

All mothers with newborns are entitled to 16 weeks of Government Paid Maternity Leave and now as working fathers, from 1 Jan 2023, you will be entitled to two more weeks of Government Paid Paternity Leave.

This brings us to a total of four weeks of paternity leave!

Although the additional leave is a cause for celebration, employers are not obliged to provide it, for now. This implies that employers who opt to offer additional leave will be reimbursed by the government.

While you’re not allowed to encash these leaves, you are allowed to take them within 12 months of your baby’s birth.

For the uninitiated, the government currently reimburses up to $5,000 for two weeks of paternity leave taken by employees.

The cap for paternity leave is $2,500 including CPF contributions while there are variations for maternity leave (including CPF contributions):

- 1st & 2nd child: $10,000 per four weeks or a total of $20,000 per child order

- 3rd and subsequent child: $10,000 per four weeks or a total of $40,000 per child order

Do check with your employers beforehand and plan your leaves in advance to reduce any possibility of work conflict!

Shared Parental Leave

Fathers who are lawfully married to the child’s mother can apply for four weeks of paternity leave from the wife’s 16 weeks, subject to her approval.

Unpaid Infant Care Leave

Bonding and being present in a child’s early development is extremely important and from 2024, Unpaid Infant Care Leave will be increased from six to 12 days a year for each parent.

That said, this policy is only applicable to working parents with kids aged under two.

Childcare Leave (For Children Under Seven Years Old)

You are eligible for Government Paid Childcare Leave if your child is a Singapore Citizen and is below seven years old, and you’ve been employed continuously for at least three months.

Both you and your spouse would each get six days per year until the year your child turns seven years old, and this is capped at 42 days for each parent.

Adoption Leave

Similar to regular birth, adoptive fathers who meet the following requirements are also entitled to paternity leave for all births:

- Your child is a Singapore Citizen.

- For employees: Completed at least 3 months of work before the birth of your child.

- For self-employed: Engaged in your work for a continuous period of at least 3 months before the birth of your child, and would be subject to a loss in income during the paternity leave period.

BTO Balloting: Increase Your Chances at Balloting

From 14 Feb 2023, there will be additional ballot chances for families with children and young married couples aged 40 years old and below.

Parenthood Priority Scheme

Building a nest when your little one has arrived is something that’s very meaningful.

As with all Singaporean couples, you can apply for a Build-to-Order (BTO) and Sales of Balance (SBF) flat.

What you would need to do is to apply for a flat under the Parenthood Priority Scheme (PPS) to increase your chances of balloting.

Under this scheme, up to 30% of the BTOs and 50% of the SBF flats are allocated to applicants.

These are the requirements:

- Partners must be first-time buyers

- You have a citizen child (i.e. natural offspring from a legal marriage or legally adopted) who is aged 18 years or below. For adoptive parents, you must have the Adoption Order of your child when you apply for a flat

- If you or your spouse is expecting, and have a doctor’s certification of the pregnancy, you may also apply for the PPS.

Third Child Priority Scheme

For those who already have two children and your third little one has just arrived, don’t miss out on applying under the Third Child Priority Scheme (TCPS) too.

The flat allocation under this scheme is up to 5% of BTO or SBF flats.

To qualify for this scheme, these are the requirements:

- You and/or your spouse is a Singapore Citizen

- If you are divorced or widowed, you must be a Singapore Citizen to qualify

- Your family must consist of at least three children (i.e. natural offspring from a legal marriage or legally adopted). For divorced parents, you must have legal custody, care, and control of your children. For adoptive parents, you must have the Adoption Order of your children when you apply for a flat

- Your third child must be a Singapore Citizen born on or after 1 January 1987

- Your other children must be either SCs or Singapore Permanent Residents

- You have not previously bought a flat under the TCPS

MediSave Grant for Newborns

So, as part of the Marriage and Parenthood Schemes, every eligible Singaporean baby can receive a $4,000 MediSave Grant.

This includes children who are adopted, as well as children who are born to divorce or unwed mothers.

The grant is meant to support your newborn’s healthcare expenses, such as MediShield Life premiums, recommended childhood vaccinations, hospitalisation and approved outpatient treatments.

This is a seamless process whereby you don’t need to apply for the grant and it will automatically be disbursed to your child’s Central Provident Fund (CPF) account after birth registration.

If you have your information ready, it’s going to take you less than 10 minutes to set up your child’s CPF account!

- Go to CPF’s e-Cashier page and input your child’s NRIC number under the Payer’s CPF Account Number/NRIC

- Choose the type of top-up you are making

- Indicate the amount you wish to top-up

- Make payment through the various modes of payment available

Adding on, if you’re already starting on managing your child’s CPF, why not take a step further to maximise his or her CPF account?

MediShield Life For Babies

All Singapore Citizen babies, regardless of health conditions, are automatically covered by MediShield Life (MSHL), for life.

You can tap on the Medisave Grant for Newborns (i.e. $4,000) to pay for your baby’s MediShield Life premiums.

Read more:

- MediSave Care: Withdraw up To $200 a Month for Your Long-Term Care Needs

- Singaporean’s Ultimate Guide: What You Need To Know About Medisave?

- Ultimate Guide to MediSave: What Can I Use It for & How Much Can I Withdraw?

Free Passports

For the travel wanderlust parents, before you start travelling with your newborn, your child should have a passport ready.

As a small token to celebrate the birth of a new citizen, the Immigration & Checkpoint Authority (ICA) will waive the application fee for passports of Singapore Citizens born on or after 1 January 2020.

The key here is to apply for a passport before their first birthday.

To do so, you can take these simple steps:

- Download the MyICA app, log in and click on the notification about the waiver

- You can directly access the passport application process via the notification without having to pay the application fee

Alternatively, you can also log on directly to ICA’s passport e-Service to apply for your child’s first passport.

You will receive the same electronic notification about the waiver upon entering your child’s birth certificate number.

Read more:

- Travel Insurance Claim Guide: From Baggage Loss, Trip Cancellations to COVID-19

- Best Travel Insurance with COVID-19 Coverage For Your Holiday Plans

- 8 Best Travel Credit Cards to Book Flight Tickets and Hotels With

Parenthood Tips & Tricks

Navigating parenthood can be confusing and tricky for first-timers.

But, you are not alone.

If you need a second opinion on how to manage your child’s finances, join the Seedly Community’s Parenting Group!

Related Articles:

Advertisement