The Ultimate Guide to Baby Support Grant and Baby Bonus in Singapore (How to Apply + Payout Schedule + CDA)

15 Oct 2020 Update

The cutoff date of the grant has been extended.

Parents of Singaporean babies born before 1 Oct 2020 with an estimated delivery date between 1 Oct 2020 to 30 Sept 2022 will now be eligible for the grant.

I think you would already know, raising a child in Singapore is expensive AF.

But for a more specific number, we estimate that it will cost you about $285,468 to provide for the average child in Singapore, from childbirth to university.

Of course, there are a thousand other considerations you will need to consider before having a child. For example, here’s a piece on how much income you’ll need before having your child.

But, if you have made the monumental decision to have a child in Singapore, you’ll have a bit of help along the way.

In an attempt to boost Singapore’s birth rates, the Singapore Government launched the Baby Bonus Scheme to encourage more Singaporeans to have babies.

But, no one could have anticipated the COVID-19 pandemic, which has battered Singapore’s economy and has resulted in increased unemployment in Singapore.

Naturally, couples who aspire to become parent might be warier because of this economic uncertainty.

To help address these concerns, the Government has announced a one-off $3,000 Baby Support Grant on Friday (1 Oct) which will be will be given to all parents of Singaporean children born from 1 Oct 2020 to 30 Sept 2022.

Also, parents of Singaporean babies born before 1 Oct 2020 with an estimated delivery date between 1 Oct 2020 to 30 Sept 2022 will now be eligible for the grant.

This will supplement the current Baby Bonus Scheme and the grant will be sent to the same bank account that parents have appointed for receiving the cash gift.

Here’s the lowdown on the Baby Bonus Scheme and the Baby Support Grant, including a guide on how to apply for both!

Information accurate as of 15 October 2020.

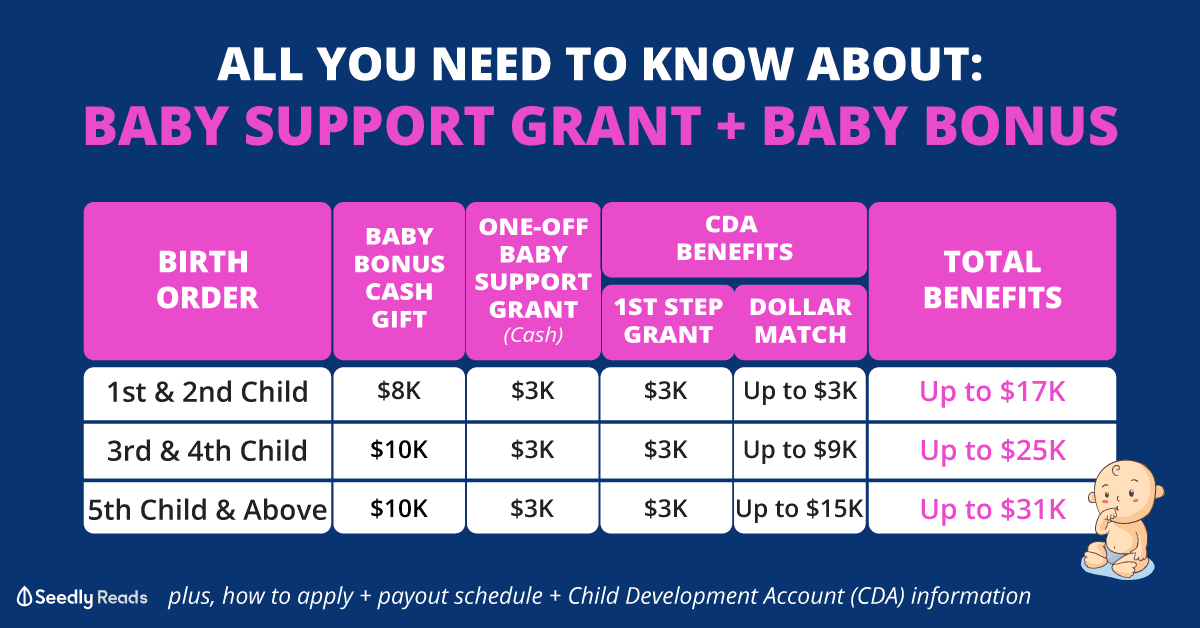

TL;DR: Make More Babies Get More Baby Bonus Benefits!

Without sounding too much like a governmental campaign, here are the details that Singaporeans need to know with regards to the baby bonus:

| Birth Order | Baby Bonus Cash Gift | One-off Baby Support Grant (Cash) | CDA Benefits | Total Benefits | |

| CDA First Step Grant (Initial Deposit) | Dollar-for-Dollar Matching Cap | ||||

| 1st & 2nd Child | S$8,000 | S$3,000 | S$3,000 | Up to S$3,000 | Up to S$17,000 |

| 3rd & 4th Child | S$10,000 | Up to S$9,000 | Up to S$25,000 | ||

| 5th Child & Above | S$10,000 | Up to S$15,000 | Up to S$31,000 | ||

Source: Ministry of Social and Family Development

Baby Support Grant

In addition, the Government has announced a one-off $3,000 Baby Support Grant on Friday (1 Oct).

This will supplement the current Baby Bonus scheme and the grant will be sent to the same bank account that parents have appointed for receiving the cash gift.

Total Amount From Baby Bonus and Baby Support Grant

- The first and second baby can receive up to S$17,000.

- The third and fourth will can receive up to S$25,000.

- The fifth baby onwards can receive up to S$31,000.

Disclaimer: This is not a sponsored post, all opinions are our own. We just want you to do well in life. For more information about our editorial guidelines, please refer to the Seedly Code of Ethics.

What Is Wrong With Singapore’s Birth Rate?

To understand why the Government is giving out the baby bonus, let’s take a look at Singapore’s birth rate.

The total fertility rate for Singapore is low, at about 1.14 children per woman in the year 2019.

FYI: The fertility rate is defined as the average number of live-births each female would have during her reproductive years.

Over the last few decades, Singapore’s total fertility rate has been declining steadily; similar to what is happening in many developed countries.

This will be problematic for Singapore, as according to the UN Population Division, this is nowhere near the Replacement-level of fertility.

FYI: The Replacement-level of fertility is defined as the rate at which a population exactly replaces itself from one generation to the next, without migration.

This rate is roughly 2.1 children per woman for most countries, although it may differ slightly when accounting for mortality rates.

Any number below 2.1 will mean a decrease in population size.

Since it takes “two hands to clap”, a total fertility rate of 1.14 for each couple will mean that the Singaporean born population will decline drastically by about 50% with each passing generation.

To address this problem, the Singapore Government has implemented the Baby Bonus scheme as well as the Baby Support Grant to help parents with raising a child during the COVID-19 pandemic.

Baby Support Grant Eligibility And Restrictions

This one-off grant is available for all parents of Singaporean children born from 1 Oct 2020 to 30 Sept 2022.

Also, parents of Singaporean babies born before 1 Oct 2020 with an estimated delivery date between 1 Oct 2020 to 30 Sept 2022 will now be eligible for the grant.

Each couple will get $3,000 for each child born during this time period.

You’ll be happy to know that there are no restrictions on the use of the Baby Support Grant.

To save more money, you might want to check our article on how a couple managed to save close to $8,000 in the first year as parents.

Step-By-Step Guide To Applying For Baby Bonus and Baby Support Grant

To be eligible, the parents of the baby will have to be lawfully married.

Your child will also have to be a Singapore Citizen at birth.

Here are some tools to help you with your Baby Bonus and Baby Support Grant Application:

- You can submit an online form to join the Baby Bonus scheme as early as 2 months before the estimated delivery date.

- To check if the child is eligible for Baby Bonus cash gift, Baby Support Grant and/or CDA benefits, you can use this Eligibility Checker Tool.

- Should you have any other questions, you can always ask the friendly Seedly Community or call the Baby Bonus Hotline at

1800-253-7707

Baby Bonus Cash Gift Schedule And Payout

Upon the birth registration of your baby or the completion of the baby bonus form online, you can expect to receive the cash gift portion of the baby bonus within 7 to 10 working days.

| Baby Bonus Cash Gift | |||||

|---|---|---|---|---|---|

| Birth Order | Within 10 Working Days | Around 6 Months | Around 12 Months | Around 15 Months | Around 18 Months |

| 1st & 2nd | $3,000 | $1,500 | $1,500 | $1,000 | $1,000 |

| 3rd & Above | $4,000 | $2,000 | $2,000 | $1,000 | $1,000 |

Source: Ministry of Social and Family Development

Baby Support Grant Schedule And Payout

The Baby Support Grant will be deposited from 1 Apr 2021, or within one month after enrolment into the Baby Bonus scheme, whichever is later.

Parents will receive the grant in the same bank account they have appointed for receiving the Baby Bonus cash gift.

At the moment, you cannot apply for the grant.

But, we will update this article when the National Population and Talent Division (NPTD) releases information on how to do so.

Child Development Account (CDA)

On top of the more direct cash gift payout, all eligible Singaporean children will get a special savings account called the Child Development Account (CDA).

This account will be opened automatically when your child joins the Baby Bonus Scheme.

You will also be able to choose between DBS, OCBC or UOB for your child’s CDA account.

CDA First Step

All Singaporean children born after 24th March 2016, will receive an initial $3,000 grant in their CDA from the Government without parents having to save in the CDA first.

Government Dollar-for-Dollar Matching Contributions

Subsequently. the Government will match any amount parents deposit into their children’s CDA (up to $15,000).

For example, if you deposit $1,000 into your child’s CDA, the government will match it and deposit an additional $1,000 in your child’s CDA the next month.

This matching is capped based on the number of children you have.

Here’s how much you can get out of the CDA from the Government:

| Child Order | CDA Benefits | Total CDA Benefits | |

|---|---|---|---|

| CDA First Step | Dollar-for-Dollar Matching Cap | ||

| 1st & 2nd Child | $3,000 | Up to $3,000 | Up to $6,000 |

| 3rd & 4th Child | Up to $9,000 | Up to $12,000 | |

| 5th Child & Above | Up to $15,000 | Up to $18,000 | |

The CDA account can be kept open until your child is 12 years old; so do plan accordingly, and save up the amount necessary to help you bag the entire bonus.

Parenthood Tax Rebate (PTR)

One other benefit is the Parenthood Tax Rebate (PTR) which is available to Single parents and parents who adopted a child.

To qualify for PTR, you need to be a Singapore tax-paying resident, who is either married, divorced or widowed in the relevant year.

Here’s the amount of tax rebate you can enjoy:

| Order Of Child (Born/ Adopted) | PTR (Child born in the years from 2004 to 2007) | PTR (Child born from the year 2008 onwards) |

|---|---|---|

| 1st Child | $0 | $5,000 |

| 2nd Child | $10,000 | $10,000 |

| 3rd Child & Above | $20,000 (per child) | $20,000 (per child) |

Do Single Parents Qualify For The Baby Bonus?

In Singapore, single parents (eg. unwed moms) do not get to enjoy the maximum Baby Bonus.

This is extremely worrying, given that single parents are usually the ones that require more assistance.

Unfortunately, single parents in Singapore are disqualified from the Baby Bonus Cash Gift Component as a whole.

However, they still qualify for the PTR and CDA Bonus package:

Child Order CDA Benefits Total CDA Benefits

CDA First Step Dollar-for-Dollar Matching Cap

1st & 2nd Child $3,000 Up to $3,000 Up to $6,000

3rd & 4th Child Up to $9,000 Up to $12,000

5th Child & Above Up to $15,000 Up to $18,000

Side note: Mad respect for single parents out there! It is definitely not an easy task! Hustle on!

Advertisement