One dollar a day? Is it THAT easy to become a Millionaire? Where do I begin? Can I start today? Sign me up! Wait, hold on… This sounds pretty dubious, is that even possible?

Purely Saving One Dollar

Assuming there are 360 days a year, saving one dollar a day would take you 231 years to make your first million on pure savings. I don’t know about you but I definitely do not have 231 years to live, even Abraham died at age 175. If he had saved a dollar a day, he would have only saved $766,500, a little short of a million.

Sorry to burst your bubble, folks! But let’s see how we can work around our situation, shall we?

Invest One Dollar – Power of Compounding

Same as above, but you invest it and manage to earn 6% in return annually. That would take you 88 years to reach $1 million, in fact, $1,081,252 to be exact. That’s almost 2.6 times faster than just purely saving, that’s the power of compounding. Yes, I did use a bit of trial and error and my trusty financial calculator to get this result.

Double that Dollar, Make that $2

What happens if you double it? Instead of putting a dollar in your investment a day, try $2. You would reach your first million 11 years earlier, taking 77 years.

TRIPLE, QUADRUPLE, QUINTUPLE THAT DOLLAR

| How much to save a day? | How long to reach S$1 million? |

|---|---|

| $10 | 50 years |

| $20 | 39 years |

| $30 | 33 years |

| $40 | 29 years |

| $50 | 26 years |

| $60 | 23 years |

Now, you are probably calling me mad. Saying how are you going to save $60 a day if you don’t even have that. But let’s look at the numbers in a month.

| How much to save a day? | In a Month |

|---|---|

| $10 | $300 |

| $20 | $600 |

| $30 | $900 |

| $40 | $1,200 |

| $50 | $1,500 |

| $60 | $1,800 |

Still not convinced it is possible? Let’s show you that it is possible.

Allocating Your Salary Properly

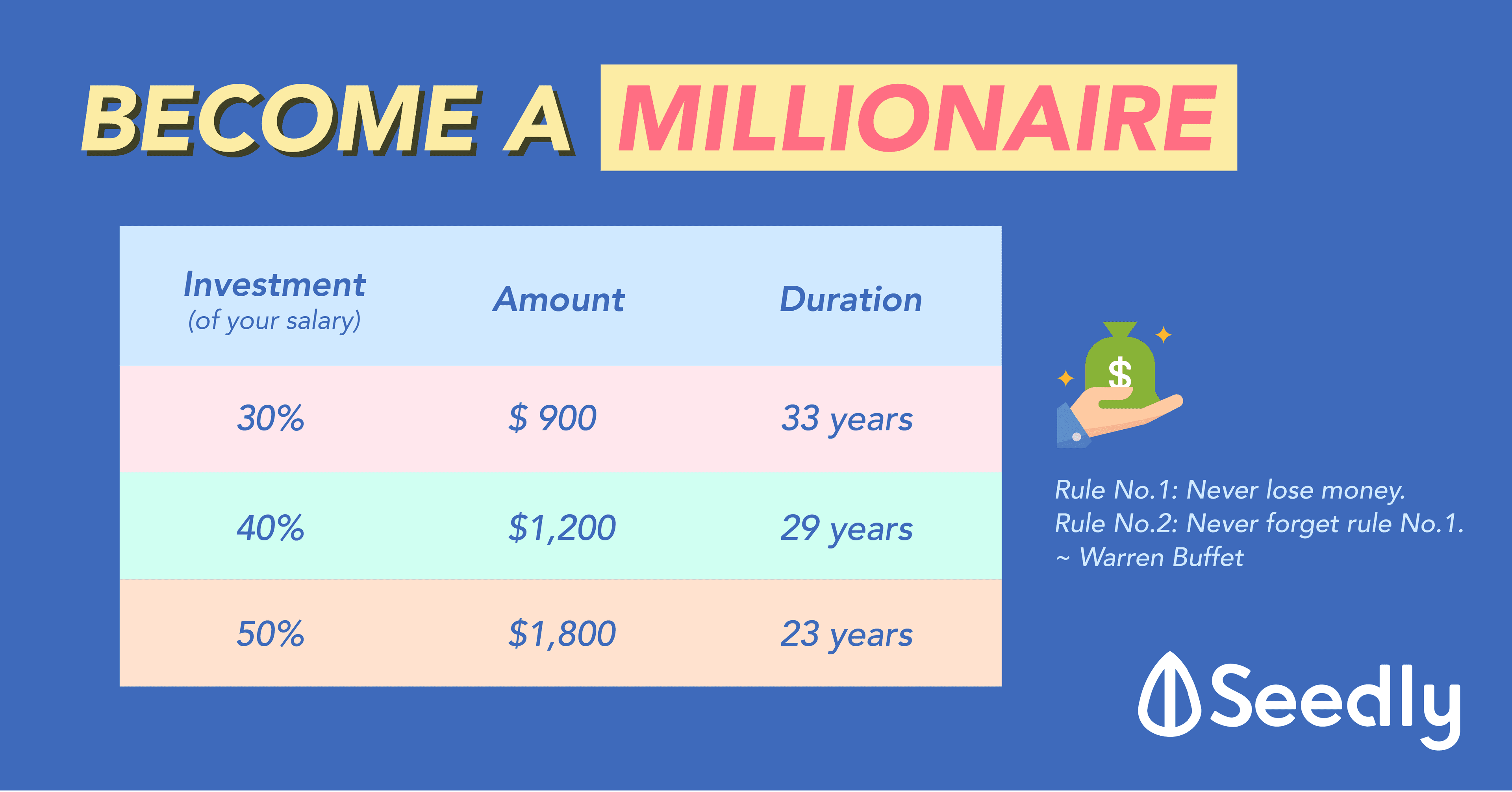

We are a huge advocate on allocating our salary proper. There are many variations as to how you could do it, for us, we follow our “golden rule” of 20/50/30, where you save 20% of your salary, spend 50%, and 30% of your salary goes into your investments.

An Average Chap

- Monthly Salary: $3,000

- Allocates his salary according to the “golden rule”

Savings/Expenses/Investments – 20/50/30

| Savings (20%) | Expenses (50%) | Investments (30%) |

|---|---|---|

| 600 | 1,500 | 900 |

Placing 30% of your salary, $900, is the same as investing $30 a day. Now, does that sound more achievable?

Reduce Savings, Increase Investment – 10/50/40

If you are more adventurous especially once you have your emergency funds ready, you can try moving the 10% allocation to your savings into your investments instead.

Another way to increase the allocation of your investment is to reduce your expenses, meaning the salary allocation ratio could be 20/40/40 (savings/expenses/investments) instead.

| Savings (10%) | Expenses (50%) | Investments (40%) |

|---|---|---|

| 300 | 1,500 | 1,200 |

Increase Investment, Reduce Everything Else! – 10/30/50

In our previous article, we showed you how it is possible to reduce your expenses to 30% of your salary, so if that works for you, you can try reducing your expenses and increasing your investment too!

To help you reduce your spending, you should start tracking your expenses as you are more aware of what you are spending on. You can download the Seedly App, any other apps available or if you are very meticulous, you can even track it on your own excel!

| Savings (10%) | Expenses (30%) | Investments (60%) |

|---|---|---|

| 300 | 900 | 1,800 |

By reducing your expenses and increasing your investment, you are able to place $1,800 into your investment in a month. With that, in 23 years you could be A MILLIONAIRE!

I should have titled this as “Earn your first million in just 23 years!” or something more click bait-y. Meh…

Don’t worry if you are not adventurous enough to do park 50% of your salary into investments.

Let’s look back at the numbers.

| How much to save a day? | In a Month | How long to reach S$1 million? |

|---|---|---|

| $10 | $300 | 50 years |

| $20 | $600 | 39 years |

| $30 | $900 | 33 years |

| $40 | $1,200 | 29 years |

| $50 | $1,500 | 26 years |

| $60 | $1,800 | 23 years |

- Using the Golden Rule of 20/50/30: 33 years

- Increasing your investment allocation by 10%: 29 years

It is not daunting after all, you will still be able to achieve your $1 million even by allocating your salary the golden rule way.

Yes, there are some years where you would outperform 6% annually in returns, and sometimes we will underperform but on average a rough gauge would safely be around 6%.

Here are some helpful articles for you to check out if you would like to start getting into investments:

- Read Me First! Your Personal Finance Journey Guide

- When Should I Begin Investing?

- Easiest Ways To Invest A Monthly Sum For Beginners

- Cheat Sheet: What Are The Common Investment Products In Singapore?

What would you do with your first million dollars? Share with us in the comments section below!

Advertisement