New to Investing? Here Are The Best Investing Strategies You Need to Learn Before Investing

●

“If you fail to plan, you are planning to fail!” ~Benjamin Franklin

Planning is important; if you don’t plan, paradoxically, you are actually planning – but to fail.

Planning is a part of our everyday life. People do in-depth planning for their workday, a holiday, university education and buying a house; what more something as important as investing.

I would liken investing without an investment strategy, like dieting without a plan. Sure, you can lose weight through sheer will and effort but engaging a dietician will help.

Although they are not absolutely necessary, they greatly increase your success rate.

However, like dieting, there is no one size fit all investment strategy.

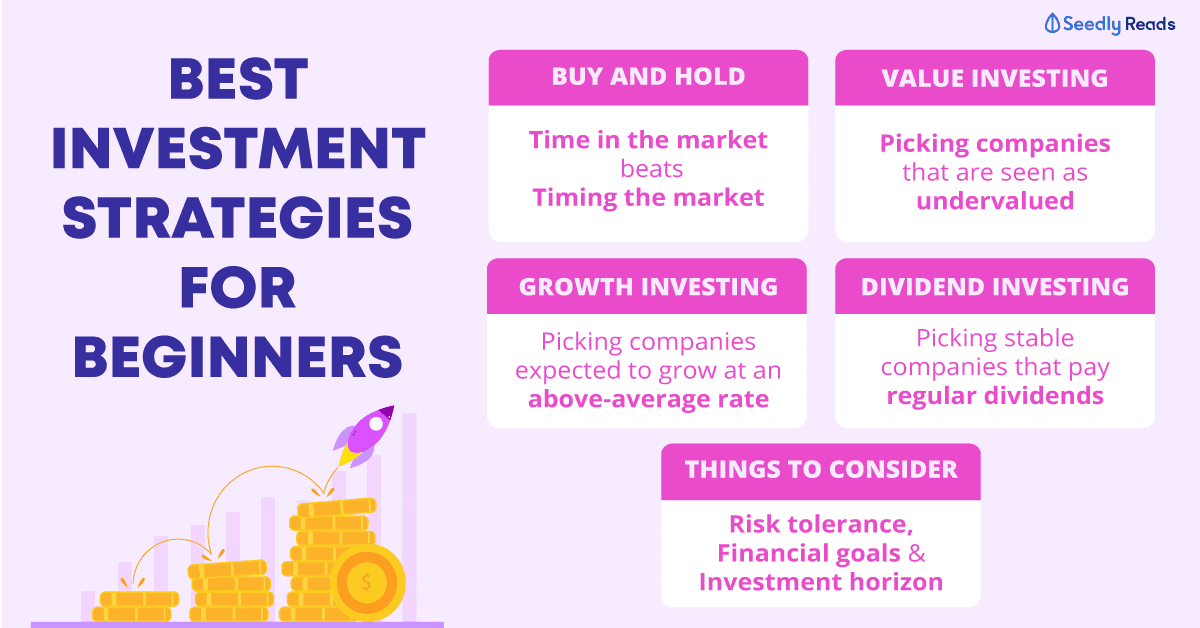

TL;DR: Best Investment Strategies to Consider

- The best investment strategy for you will help you meet your personal finance goals and grow your wealth; all at a comfortable level of risk that will not cause sleepless nights

- It also depends on your investment timeline, how involved you want to be in the investment process and your tolerance for risk

- Like food, variety is the spice of investing. There are many investors who take elements of investing strategies and fuse them to create a personalised strategy that is best for them.

There is more than one way to approach investing, but here are some of the more popular tried and tested investment strategies to get you started.

1. Buy and Hold Investment Strategy

First up we have the passive buy and hold investment strategy. Investors who subscribe to this strategy have a long investment horizon and hold their stocks for long periods of time.

The idea behind this strategy is that stocks are not just numbers to be speculated on, but rather a small ownership stake in the business.

Buy and hold investors believe that ‘time in the market beats timing in the market’, as they expect the company they are investing in to do well in the long term.

If you believe the business will do well over time, you ought to hold the stock as you can benefit from long-term growth and a small, but likely increasing stream of dividend income. This is where the term ‘time in the market beats timing in the market’ comes from.

You can also still sell the stock for a profit, but perhaps at some point in the distant future where returns are likely to be higher than any short-term gains (assuming consistent growth).

To employ this strategy, you will need to first do your due diligence and carefully evaluate your investments and identify long term growth prospects.

Regardless, of whether you are investing in Exchange Traded Funds that track indices or a new and growing company, you will need to do more work initially. But once the initial work is done, holding on to investments is comparatively less troublesome compared to other strategies.

However, this strategy requires discipline, as you will need to stay strong and not panic when the market gets volatile.

Pros

- It just works. Once you have done your due diligence and invested in something like the S&P500 ETF and held it for long; you would profit.

The S&P500 has produced an average annual return of 10 to 11 per cent over the last ten years. Many top investors like Warren Buffett, Jack Bogle, John Templeton and Peter Lynch practice aspects of this buy and hold strategy. - Low maintenance. Holding an investment for long periods is less taxing as you do comparatively less research and trading compared to other strategies.

- Lower fees. When you trade less, you pay fewer fees which helps improve the overall net return of your investment portfolio.

Cons

- Locks up your money. One major drawback of this strategy is that your money is locked into the investment for a long period of time. This incurs a substantial opportunity cost as the money could be reinvested or used for more important things in your life. Investors need to have the self-discipline to not cash out and remember why they invested in this asset in the first place.

- Market crashes. ETFs or large established companies can still fail. Although nothing short of an extinction-level event can wipe out the markets of developed economies, market crashes still happen. This is evidenced by the latest Black Monday 2020 market crash. When events like this happen, the growth in your investment portfolio might get wiped out. If you have a sudden need for cash, it will be a bad time for you to crash out at this time.

2. Value Investing Strategy

Do you love a good bargain? Then value investing may appeal to you.

This investment strategy is employed by renowned investors like Warren Buffett and his mentor Benjamin Graham.

Value investors conduct Fundamental analysis (FA) of an investment, examining financial factors like a company’s balance sheet, economic factors like the state of the economy and how competent the company’s management is.

It is the process of finding underpriced stocks, buying them, and holding them for the long-term until the market sees the value in the company and what it does.

Such stocks are usually smaller companies as they have a greater potential to see a large increase in their share prices.

Value investors are also long-term investors of quality companies.

(P.S. Check out our guide to value investing if you would like to find out more about this strategy.)

This strategy requires you to be very active in managing your portfolio. You will need to monitor the market and keep track of the news to identify undervalued stocks.

Pros:

- Huge profits. When done right, value investing has the potential to generate huge profits when you manage to identify the gap and buy stocks that appear to be trading at less than their perceived intrinsic value. When the market rebounds and catches on, the market value of the stock will rise accordingly.

Cons:

- Risky business. Value Investing is more for risk-loving investors, rather than those looking for stability. The main risk here is that there will be times that the gap might not close. The market may have already priced the asset at its ‘true’ value which renders the research done on its intrinsic value meaningless.

- Low liquidity. For stocks that are not performing well, liquidity might be low which may lead to a high bid-ask spread and increase the cost of investing.

- Might catch a falling knife. One aspect of value investing is to identify companies that may be doing poorly at the moment. However, it is not always clear when a stock has hit its lowest point.

3. Growth investing Strategy

This strategy revolves around investing in fast-growing companies that often produce attractive returns for their investors.

Growth stock companies tend to be growing at a rate faster than the broader market. When you buy growth stocks the primary objective you want to achieve is to buy the stock and sell it at a higher price to turn a profit.

But unlike value stocks, you are looking to invest in companies that are not undervalued but companies that have the potential for huge share price gains in the future.

Typically growth stock companies produce innovative products that have the potential to disrupt the market in the future, but there are exceptions.

Growth stock companies can be highly effective companies with great business models that are able to effectively capture the demand for their products.

Growth stocks tend to perform well when the economy is growing but do poorly when the economy is doing poorly as well.

For this investment strategy, you will need to have a long term investment horizon.

Pros

- Investing in the right company can increase your returns at a rate which is higher than that of the overall market

Cons

- No dividends will be given out to offset investor’s risk, as the company tends to reinvest their earnings

- Volatile stock prices.

- Exposed to higher risk.

4. Dividend Investing Strategy

If you are an investor who is looking draw a regular investment income, the dividend investing strategy is the way to go.

(P.S. Check out our comparison of growth and dividend investing if you would like to find out more about this strategy.)

Dividend stocks are stocks that give dividend payouts based on their profits over the year. Should an investor invest in a dividend stock, he receives income in the form of dividend given out by the stock.

P.S. Dividend investing is also known as income investing.

Dividend investing offers investors a way to draw an income from their investments as well as enjoy the fuzzy feeling one gets when you see your share prices go up (gradually).

These fixed-income investments provide a steady stream of income with varying risk profiles based on the risk investors is looking to take up.

A dividend investing strategy involves investing in assets like bonds, defensive dividend-paying stocks, and dividend-paying ETFs and mutual funds.

Pros

- Investors receive regular returns in the form of dividend payouts. This dividend payouts can be reinvested.

- Dividend-paying stocks have a better track record of performing better when the market is weak.

Cons

- A large amount of capital is usually required from investors, as the stock price is high.

- Since price is less volatile, increase in stock price is lesser than growth stocks. In other words, some investors may find it boring.

- Dividend payments not guaranteed. companies can reduce dividends anytime if there’s a reason to.

Closing Thoughts

As mentioned earlier, there is no one size fit all strategy. You can mix and match certain aspects of the strategies to accommodate your financial goals and risk tolerance.

But, here are some rough guidelines.

If you have a high tolerance for risk and have a long investment horizon, you may want to adopt the buy and hold, growth and value investing strategies.

If you have a moderate tolerance for risk with a comparatively shorter investment horizon, you may want to adopt the value and dividend investing strategies.

Lastly, if you have a low tolerance for risk and a short investment horizon, you might want to focus more on the dividend investing strategy.

Got Any Questions About Investment Strategy?

Why not join the discussion over at our friendly SeedlyCommunity where you can ask questions and clear your doubts about investments!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.

Advertisement