As a teenager, I used to think that airport lounges with their chio (Hokkien: pretty) interiors, luxurious lounge chairs, and free-flow food were only reserved for the wealthy…

But boy, was I wrong!

Thanks to my dad, who was a savvy credit card user, I had the chance to enter one of these lounges, which made me feel like I was the one ballin (Slang: leading a ridiculously wealthy lifestyle).

The one I visited had a buffet breakfast, many magazines to read, free WiFi and even shower facilities.

So long as you had the right credit cards, commoners like you and I could get access to these airport lounges for the perfect travel pitstop to relax and recharge.

Intrigued?

Here are the best credit cards for complimentary access to airport lounges!

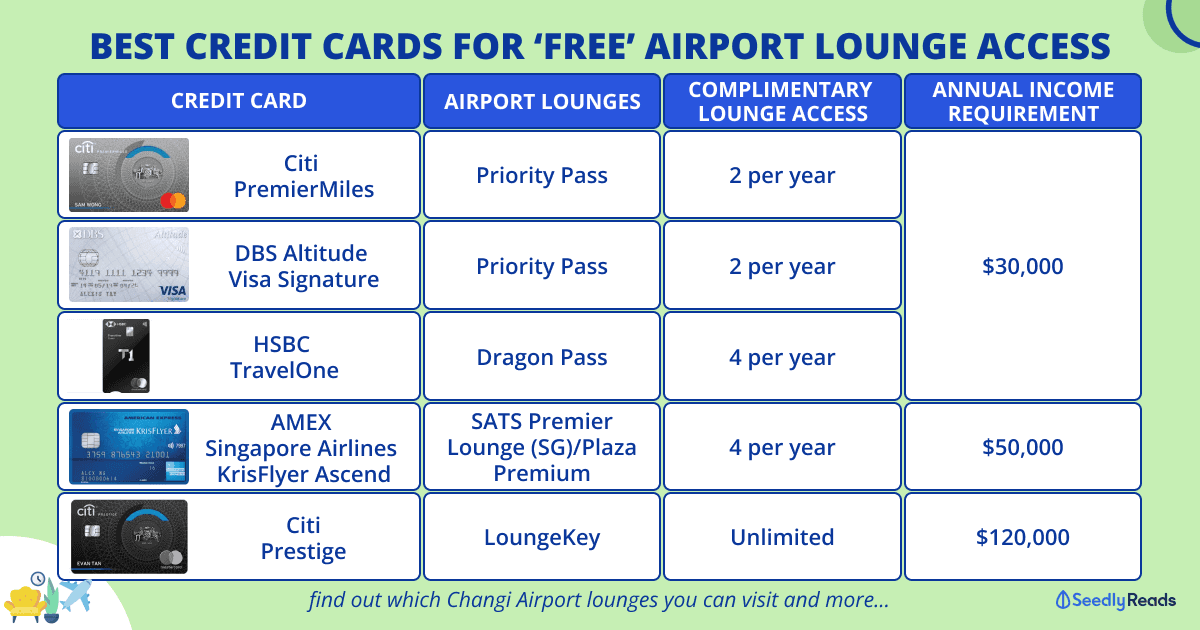

TL;DR: Best Credit Cards for Free Airport Lounge Access

| Credit Card | Airport Lounges | Complimentary Lounge Access | Annual Income Requirement | Redemption |

|---|---|---|---|---|

| Citi PremierMiles Card Apply Now | Priority Pass | 2 per year (Either 2 separate member visits, or 1 concurrent member & guest visit) | $30,000 | Apply for a complimentary Digital Priority Pass™ membership |

| DBS Altitude Visa Signature Card Apply Now | Priority Pass | 2 per year (Either 2 separate member visits, or 1 concurrent member & guest visit) | $30,000 | Apply for a complimentary Digital Priority Pass™ membership |

| Diners Club Cards | Diners Network | 1 per year | $30,000 | Present your card, boarding pass and passport for complimentary access |

| HSBC TravelOne Card Apply Now | Dragon Pass | 4 per calendar year (i.e. eight in first membership year) FYI: Lounge visits cannot be shared with a guest | $30,000 | Apply for a complimentary Dragon Pass membership |

| Maybank Horizon Visa Signature Card Apply Now | Ambassador Transit Lounge (SG), Plaza Premium Lounge (SG, KL, HK) | 1 per month | $30,000 | Charge S$1,000 in a single retail transaction within 3 months prior to the travel date regardless of the number of transactions with the minimum amount charged within 3 months prior to the date of lounge access) |

| Standard Chartered Journey Credit Card Apply Now | Priority Pass | 2 per year (Either 2 separate member visits, or 1 concurrent member & guest visit) | $30,000 | Apply for a complimentary Digital Priority Pass™ membership |

| AMEX Singapore Airlines KrisFlyer Ascend Credit Card Apply Now | SATS Premier Lounge (Singapore) / Plaza Premium | 4 per year (Voucher entitles complimentary access for one member or guest only) | $50,000 | Complimentary access passes given upon approval of their Card application with annual membership fee, and subsequently upon the fully paid renewal of Card Membership in each subsequent Membership year |

| Citi Prestige Card Apply Now | Priority Pass | Unlimited + 1 guest per visit (Each Cardmember may bring in one accompanying guest. Thereafter, subsequent guests will be charged US$35 per person per visit (or at the prevailing rate) by Priority Pass to the Citi Prestige Card account) | $120,000 | Apply for a complimentary Digital Priority Pass™ membership |

| CIMB Visa Infinite Credit Card Apply Now | Dragon Pass | 3 per year | $120,000 | Apply for a complimentary Dragon Pass membership |

| HSBC Visa Infinite Credit Card | LoungeKey | Unlimited | $120,000 | Present your card, boarding pass and quote 'LoungeKey' for complimentary access |

| OCBC Voyage Card | Plaza Premium | Unlimited access to over 130 Plaza Premium VIP airport lounges globally | $120,000 | Complimentary access granted upon card approval and renewal of Card membership fee |

| Standard Chartered Visa Infinite Credit Card | Priority Pass | 6 per year | $150,000 | Apply for a complimentary Digital Priority Pass™ membership |

Contrary to popular belief, you don’t have to be a high-income earner to enjoy complimentary airport lounge access!

The DBS Altitude Visa Signature, Citi PremierMiles, Diners Club, and Maybank Horizon Visa Signature credit cards only require a minimum annual income of $30,000.

That said, remember that annual fees are involved if you want to enjoy these privileges and avoid credit card debt!

Lounge Passes and Memberships

When it comes to lounge passes and memberships, here are the major players:

- Priority Pass – 1,500+ lounges

- LoungeKey – 1,500+ lounges

- Dragon Pass – 1,300+ lounges

- Diners Club – 1,300+ lounges.

Suppose your card has a complimentary membership with any of these lounge passes. In that case, you’ll most likely have access to various lounges currently open at Changi Airport’s Terminal 1, 2, 3, 4 and Jewel.

Changi Airport Lounge Access

| Lounge Pass | Changi Airport Terminal | Changi Airport Lounge |

|---|---|---|

| Priority Pass | T1 | Marhaba Lounge |

| Plaza Premium Lounge | ||

| SATS Premier Lounge | ||

| T2 | Ambassador Transit Lounge | |

| SATS Premier Lounge | ||

| T3 | Ambassador Transit Lounge SATS Premier Lounge |

|

| Marhaba Lounge | ||

| SATS Premier Lounge | ||

| T4 | Blossom Lounge | |

| Jewel | Changi Lounge | |

| Mastercard Lounge Key | T1 | Marhaba Lounge |

| Plaza Premium Lounge | ||

| SATS Premier Lounge | ||

| T2 | Ambassador Transit Lounge | |

| SATS Premier Lounge | ||

| T3 | Ambassador Transit Lounge | |

| Marhaba Lounge | ||

| SATS Premier Lounge | ||

| T4 | Blossom Lounge | |

| Jewel | Changi Lounge | |

| Dragon Pass | T1 | Marhaba Lounge |

| Plaza Premium Lounge | ||

| SATS Premier Lounge | ||

| T2 | Ambassador Transit Lounge | |

| SATS Premier Lounge | ||

| T3 | Ambassador Transit Lounge SATS Premier Lounge |

|

| Marhaba Lounge | ||

| SATS Premier Lounge | ||

| T4 | Blossom Lounge | |

| Jewel | Changi Lounge | |

| Diners Club | T1 | Marhaba Lounge |

| Plaza Premium Lounge | ||

| T2 | Ambassador Transit Lounge | |

| SATS Premier Lounge | ||

| T3 | Ambassador Transit Lounge | |

| SATS Premier Lounge | ||

| T4 | Blossom Lounge | |

| Jewel | Changi Lounge |

Annual Fees

As with most credit cards, you’ll have to pay an annual fee in order to enjoy the complimentary lounge access.

However, some cards, like the DBS Altitude VISA card, offer an annual fee waiver for the first year. However, you’ll have to pay subsequent annual fees to retain the same privileges tied to your card.

Conclusion

When picking a travel credit card, you don’t have to base your decision on which lounge pass the card offers, as the differences are negligible.

Instead, look for a card that best suits your lifestyle and maximises your spending.

For those already having one of the above cards, ensure you don’t miss out on your airport lounge benefits!

Related Articles:

Advertisement