Best Credit Cards For High-Income Earners (120K Annual Income): Which Card Is Right For You?

Welcome to the world of premium credit cards!

We have complimentary lounge access, complimentary concierge services, complimentary hotel stays, complimentary limousine rides, complimentary…

You get the gist!

Aside from all the complimentary things and the annual income requirement of $120,000, these cards also typically come with a pricier annual fee that cannot be waived.

We’re talking S$378 to S$656.08 per year.

So are any of these premium credit cards worth your money for the perks offered? Here’s what we think and our recommendations based on your lifestyle!

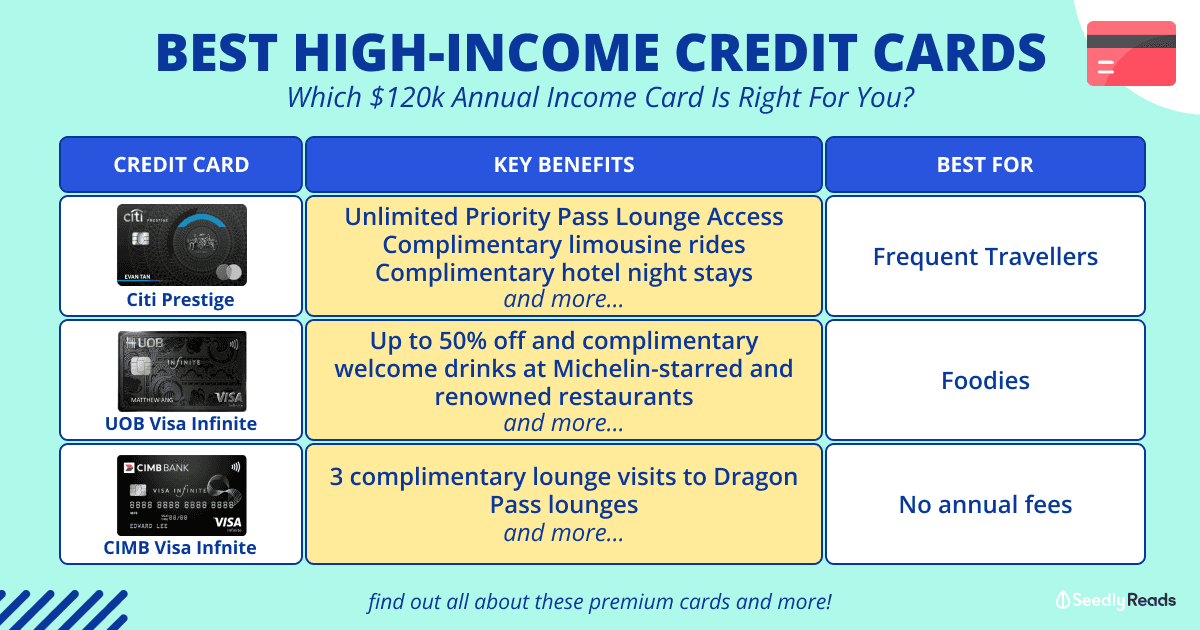

TL;DR: Best Credit Cards For High-Income Earners (120K Annual Income)

| Credit Card | Annual Fee (incl. 9% GST) | Key Benefits |

|---|---|---|

| BOC Visa Infinite Apply Now | S$378.00 | 4 complimentary lounge visits to Plaza Premium lounges Visa Concierge First year annual fee waiver for principal and supplementary cards |

| CIMB Visa Infinite Apply Now | S$0 | 3 complimentary lounge visits to Dragon Pass lounges Up to 25% off selected dining outlets in airports worldwide Visa Infinite Concierge No annual fees |

| Citi Prestige | S$545 | Unlimited Priority Pass Lounge Access + 1 guest 2 complimentary limo rides per quarter with a minimum spend of S$12,000 within the same quarter Enjoy 6 complimentary golf games at highly celebrated golf courses in Singapore, Malaysia, Indonesia, and China Complimentary night stay when you book a minimum, consecutive four-night stay at any hotel or resort 30% additional ThankYou Points Best prices on luxury tours, cruises, private jets, car rental and chauffeur services No miles expiry Citi Prestige Concierge 25,000 miles upon annual fee payment |

| DBS Vantage Visa Infinite Card Apply Now | S$599.50 | Ability to switch between cashback or miles 10 complimentary lounge visits to Digital Priority Pass™ lounges Complimentary Accor Plus Explorer Membership with 1 complimentary hotel night stay and up to 50% off dining Up to 19% off on fuel spending at Esso Visa Concierge 25,000 miles upon annual fee payment 35,000 miles bonus if you spend S$4,000 within 30 days from card approval for new cardmembers |

| HSBC Visa Infinite Credit Card | HSBC Premier customers: S$497.12 Everyone else: S$662.15 | Unlimited LoungeKey Lounge Access Dining and spa privileges at exclusive discounts of up to 50% 1-for-1 offers via Entertainer with HSBC 1 complimentary limousine and airport VIP service with S$2,000 spend per month (capped at 24 per year) HSBC Visa Infinite Concierge 35,000 miles upon annual fee payment |

| OCBC VOYAGE Card | S$498 | Unlimited Plaza Premium Lounge Access 2 complimentary limousine rides per quarter with a minimum spend of S$12,000 within the same quarter Up to 23% off fuel No miles expiry VOYAGE Exchange Concierge 15,000 VOYAGE Miles upon (S$498) annual fee payment |

| Standard Chartered Visa Infinite Credit Card | S$599.50 | Highest miles per dollar on overseas spend in the $120k card category (3 mpd) 6 complimentary visits to Priority Pass lounges Earn reward points on tax payments SCB Visa Infinite Concierge 35,000 miles upon annual fee payment |

| UOB Lady's Solitaire | S$410.40 | 6 mpd on two of seven preferred categories (capped at $3k per month) First year card fee waiver |

| UOB Visa Infinite Metal Card | S$654 | Unlimited Dragon Pass Lounge Access + 1 guest Up to 25% off selected dining outlets in airports worldwide Up to 50% off and complimentary welcome drinks at Michelin-starred and renowned restaurants Earn miles for bill payments with UOB Payment Facility UOB Travel Concierge Visa Concierge 25,000 miles upon annual fee payment Up to 55,000 additional miles when you spend S$4,000 within 30 days from your card approval date and make annual fee payment (till 31 Aug 2023) Additional 15,000 miles with S$100,000 spend in membership year |

Disclaimer: This table only includes cards with an annual income requirement of $120k and features only key benefits. This is a non-sponsored article. The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before signing up for any products.

Jump to:

Best High-Income Credit Cards For Earning Miles or Cashback

If you’re looking to chase miles or cashback, these cards, while decent, are not the cards you are looking for.

There are many better credit cards out there that earn better miles per dollar or cashback:

The only exception is the UOB Lady’s Solitaire card that gives you a whopping 6 mpd on two of seven preferred categories (capped at $3k per month).

Here are the earn rates for high-income credit cards:

| Credit Card | Local Earn Rate | Overseas Earn Rate |

|---|---|---|

| BOC Visa Infinite Apply Now | Unlimited 1.8% cash rebate on selected green merchants and electrical vehicle charging Unlimited 1.6% cash rebate on all other qualifying purchases made in Singapore Unlimited 0.3% cash rebate for selected insurance and education spend | Unlimited 1.8% cash rebate on qualifying overseas spend |

| CIMB Visa Infinite Apply Now | Unlimited 2% cashback with S$2,000 spend within statement month on the following transactions: Travel, Online Spend in Foreign Currencies Unlimited 1% cashback on all other spend | Unlimited 2% cashback with S$2,000 spend within statement month |

| Citi Prestige | 1.3 mpd | 2 mpd |

| DBS Vantage Visa Infinite Card Apply Now | 1.5 mpd or 1.5% cashback | 2.2 mpd or 2.2% cashback |

| HSBC Visa Infinite Credit Card | 1 + 0.25 mpd (if you have spent S$50,000 in the previous year) | 2 + 0.25 mpd (if you have spent S$50,000 in the previous year) |

| OCBC VOYAGE Card | 1.3 mpd | 2.2 mpd |

| Standard Chartered Visa Infinite Credit Card | 0.4 + 1 mpd (S$2,000 min. spend per statement cycle) | 2 + 1 mpd (S$2,000 min. spend per statement cycle) |

| UOB Lady's Solitaire | 0.4 mpd 6 mpd on two of seven preferred categories (capped at $3k per month) | 0.4 mpd 6 mpd on two of seven preferred categories (capped at $3k per month) |

| UOB Visa Infinite Metal Card | 1.4 mpd | 2.4 mpd |

Which Card Should I Sign Up For?

If you’ve read through the first table thoroughly, you’ll notice that one card immediately stands out from the rest with a S$0 annual fee.

Yes, that’s right, the CIMB Visa Infinite is “free for life for all Principal and Supplementary cards” as stated on their website.

Signing up for this card entitles you to some key benefits such as:

- 3 complimentary lounge visits to Dragon Pass lounges

- Up to 25% off selected dining outlets in airports worldwide

- Visa Infinite Concierge

- Complimentary travel insurance of up to S$1 million

It’s also nice to have an unlimited cashback card handy but the cashback rate isn’t much compared to other non-$120k credit cards.

You can’t say no to free things!

Aside from the CIMB Visa Infinite, the best card for you really depends on how far you can utilise the benefits to recoup the annual fee.

That said, we have a couple recommendations if you are a frequent traveler or a foodie below.

Frequent Travellers

For globe trotters, these $120k credit cards are right up your alley with amazing welcome gifts in the form of miles, complimentary lounge access, concierge services, travel insurance, and more.

One card that stands out from the rest is the Citi Prestige card.

It has everything you need for travel. Unlimited lounge access to Priority Pass lounges plus one guest, complimentary limousine services (with a minimum spend), complimentary when you book a minimum, consecutive four-night stay at any hotel or resort, AND best prices plus benefits on luxury tours, cruises, private jets, car rental, and chauffeur services.

Citi also has a wider variety of transfer partners than most banks to convert your reward points to miles. Oh and did I mention? ThankYou points earned with this card have no expiry!

Read more:

Foodies

Love indulging yourself at fine-dining establishments and even Michelin-starred restaurants?

The UOB Visa Infinite Metal Card is the preferred choice.

You’ll get a variety of dining perks such as:

- 50% off à la carte weekday lunch food bill for 2 diners in Pan Pacific, PARKROYAL hotels in Singapore, and Si Chuan Dou Hua

- 30% off total dining bill in Pan Pacific and PARKROYAL hotels in Singapore

- 20% off total dining bill at PARKROYAL COLLECTION Marina Bay restaurants

- Up to 25% off selected dining outlets in airports worldwide

- Complimentary welcome drink for you and your guests at a curated list of Michelin-starred and fine-dining restaurants

- Complimentary bottle of wine during your birthday month when you spend a minimum of $500 at selected restaurants

With such great discounts and complimentary drinks, it shouldn’t take you long to recoup the S$654 annual fee, even if you don’t utilise the lounge access benefits!

Advertisement