Like fire, debt is a good servant but a bad master.

If you manage your unsecured debt well, it can be rewarding. For example, credit cards let you earn cashback, miles or points on your purchases. Personal loans or credit lines can help you tide over a difficult situation when you need cash urgently as well.

This is all well and good if you manage to make your payments on time.

But just like fire, debt can quickly turn into a bad out of control master if you take on too much of it and fall into financial difficulty.

I’m sure you would know, but falling deeply into debt with several creditors can be highly stressful.

You will have to keep track of a thousand and one payment deadlines, and your creditors will regularly remind you of how much you owe them.

Interest rates are also another source of stress, as unsecured credit facilities like credit cards have eye-watering interest rates of about

25 per cent per annum (p.a.).

The more you fall behind on your debts, the bigger the fire and amount you have to repay, and it can get out of control quite fast.

This is where a debt consolidation plan (DCP) can help.

Here is all you need to know!

Information accurate as of 23 October 2020.

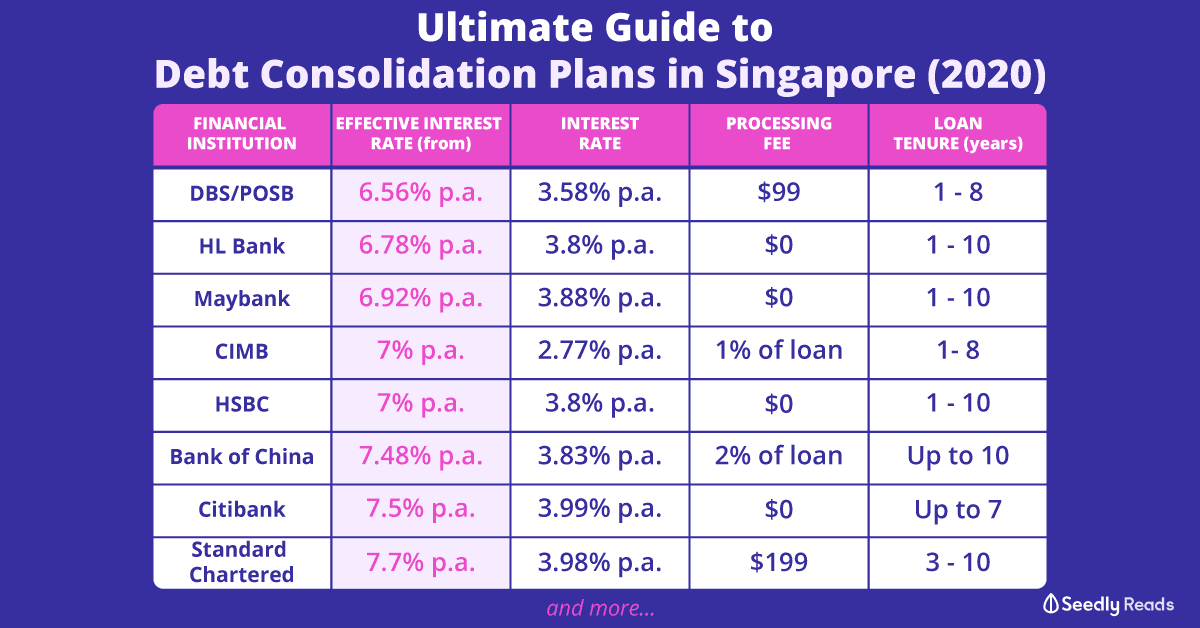

TL;DR: Ultimate Comparison of Debt Consolidation Plans in Singapore

| Financial Institution | Effective Interest Rate (from) | Interest Rate | One-Time Processing Fee | Additional Fees | Loan Tenure | Promo |

|---|---|---|---|---|---|---|

| DBS | 6.56% p.a. | 3.58% p.a. | $99 | Early Termination Fee: 5% of outstanding balance Late Payment Fee: $90 | 1 - 8 years | From now to 31 Dec, Get 3% cashback when refinancing your debt consolidation plan with DBS online. T&Cs apply. |

| POSB | 6.56% p.a. | 3.58% p.a. | $99 | Early Termination Fee: 5% of outstanding balance Late Payment Fee: $90 | From now to 31 Dec, Get 3% cashback when refinancing your debt consolidation plan with POSB online. T&Cs apply. | |

| HL Bank | 6.78% p.a. | 3.8% p.a. | $0* | Early Termination Fee: 3% of outstanding balances or $300 (whichever is higher) | 1 - 10 years | *Waiver of processing fee. T&Cs apply. |

| Maybank | 6.92% p.a. | 3.88% p.a. | $0* | Early Termination Fee: 4% of outstanding balances or $300 (whichever is higher) Late Payment Fee: 5% of the minimum monthly repayment or $50 (whichever is higher) | 1 - 10 years | From now to 31 Dec, get a $1,500 cash rebate (first 300 customers) |

| CIMB Bank Berhad | 7% p.a. | 2.77% p.a. | 1% of loan amount | Early Termination Fee: 3% of outstanding balances or $250 (whichever is higher) Late Payment Fee: $80 | 1- 8 years | - |

| HSBC | 7% p.a. | 3.8% p.a. | $0* | Early Termination Fee: 5% of outstanding balance Overdue interest: 2.5% + prevailing interest* on overdue amount Late Payment Fee: $75 | 1 - 10 years | From now to 31 Oct, get 5% cashback when refinancing your debt consolidation plan with HSBC. T&Cs apply. |

| Bank of China (BOC) | 7.48% p.a. | 3.83% p.a. | 2% of loan amount | Early Termination Fee: 5% of outstanding balances or $200 (whichever is higher) Late Payment Fee: 2% of minimum payment or $100 (whichever is higher) | Up to 10 years | - |

| Citibank | 7.5% p.a. | 3.99% p.a. | $0* | Early Termination Fee: Variable rate based on bank | Up to 7 years | Complimentary protection insurance coverage of up to S$160,000 |

| Standard Chartered | 7.7% p.a. | 3.98% p.a. | $199 | Early Termination Fee: 5% of outstanding balances or $250 (whichever is higher) Late Payment Fee: $80 | 3 - 10 years | From now to 31 Dec, get $200 cashback when you apply for a DCP with Standard Chartered. T&Cs apply. From now to 31 Dec, get 5% cashback when refinancing your debt consolidation plan with Standard Chartered. T&Cs apply. |

| OCBC | 8.06% p.a. | 4.50% p.a. | $0 | Early Termination Fee: 5% of outstanding balance Late Payment Fee: $200 | 3 - 8 years | - |

| UOB | 8.22.% p.a. | 4.50% p.a. | $0 | Early Termination Fee: Up to 6 year loan tenure: 5% of outstanding balance or $200 (whichever is higher) 7 or 8 years loan tenure: 8% of outstanding balance or $300 (whichever is higher) Late Payment Fee: $90 | Up to 8 years | - |

What Is a Debt Consolidation Plan?

Well, I’m glad you asked.

The DCP is a debt refinancing program launched by the Association of Banks in Singapore (ABS) back in 2017.

The program was created to help Singaporeans and Permanent Residents with multiple high-interest rate and unsecured debts who are struggling to repay their creditors.

As such, the DCP provides you with the option to consolidate your unsecured debt from credit cards, credit lines or personal loans into a single loan from any of the 14 participating financial institutions (FI) with a lower interest rate.

However, these categories of unsecured credit facilities are excluded from the DCP:

- Credit facilities granted for businesses and business purposes

- Education loans

- Joint accounts

- Medical loans

- Renovation loans

Essentially, you will be borrowing from the FI that you are taking your DCP loan from to pay off all your unsecured debt.

However, you will not see any money, as the DCP amount will be sent directly to repay the FIs you owe money to.

You will also not be able to do a partial consolidation of the outstanding amount you owe as the DCP requires complete repayment of the total outstanding amounts you owe with a single FI.

Once your DCP is approved, you will just have to repay the single DCP loan via monthly instalments for a time period of up to 10 years.

DCP Revolving Credit Facility

Do note that once you have decided to take up the DCP loan, you will not be able to make use of your existing credit facilities.

As such, you will be given a revolving credit facility with a credit limit of 1x your monthly income when you apply for the DCP.

You are free to use the money that you borrowed however you wish, but, do note that there will be fees charged by the participating FI for use of the revolving credit facility according to their terms and conditions.

Who Is the Debt Consolidation Plan For?

However, not everyone is eligible for the DCP.

Who is Eligible For a Debt Consolidation Plan (DCP)?

According to the ABS, you will need to be a:

- Singapore Citizen or Permanent Resident.

- Earn between S$20,000* and below S$120,000 per annum with Net Personal Assets of less than $2 million.**

- Have total interest-bearing unsecured debt on all credit cards and unsecured credit facilities with financial institutions in Singapore that exceeds 12 times of your monthly income.

*As the DCP is a commercial product, all offers received by applicants who meet the stated income criteria are subject to the assessments of individual financial institutions.

**The term “Net Personal Assets” refers to the total value of the individual’s assets less his liabilities. Assets should be substantiated by documents provided by the applicant.

If the total outstanding balance from your unsecured debts does not meet the required amount you will be better served looking at personal loans like a personal instalment loan or balance transfer from your credit card.

If you do not qualify, check out our article about other debt schemes in Singapore that will help you get out of debt!

How Many Debt Consolidation Plans Can I Have?

Do note that you can only have one active DCP loan at any point of time.

However, you can refinance the DCP loan with another participating FI, three months after your current DCP loan is approved.

But, you might have to pay an early termination fee imposed by the FI you are taking your DCP loan from.

As such we would encourage you to read the full terms and conditions of the DCP plan you will be taking up.

What Will be The Total DCP Amount?

When you apply for your DCP loan, the total amount disbursed (subject to FI approval) will be the sum of the total outstanding balance of your unsecured debts.

This includes the interest accrued and any other miscellaneous fees and charges incurred on your unsecured debts.

Also, if this is your first DCP loan, the total DCP amount disbursed will include a mandatory and additional ≤5 per cent allowance above the total DCP loan amount.

The allowance is designed to cover any incidental fees, interest and charges accrued from the time when the DCP loan is approved until DCP amount is dispersed to the FIs you currently owe money to.

After the charges are settled, any leftover allowance will be refunded to you from the FI you applied for your DCP loan with.

If you are refinancing your DCP loan, you will not need to take up the allowance.

However, the total amount disbursed will be determined based on FI assessment of your financials.

In the event that the DCP amount approved by the participating FI you are applying to is not enough to fully cover your unsecured debts, you are still liable to repay the shortfall with the current FIs you owe money to.

Early Repayment of DCP Loan

If you happen to come into money, you can most repay your DCP loan.

But, you might need to pay an early repayment free from the respective FI you applied for your DCP loan with.

As such, please check with your respective FI if they have any specific repayment fee if any.

For more information, you may proceed to ABS’s website.

Debt Consolidation Plan Comparison Singapore

To help you with your decision, we have elected to compare the top FIs in Singapore providing DCPs.

Officially, the Association of Banks in Singapore has stated that there are 14 participants(subject to revision) in this program:

- American Express International, Inc. (Amex)

- Bank of China Limited Singapore

- CIMB Bank Berhad

- Citibank Singapore Limited

- DBS Bank Ltd

- Diners Club Singapore Pte Ltd

- HL Bank

- HSBC Bank (Singapore) Limited

- Industrial and Commercial Bank of China Limited (ICBC)

- Standard Chartered Bank (Singapore) Limited

- Maybank Singapore Limited

- Oversea-Chinese Banking Corporation Limited

- RHB Bank Berhad

- United Overseas Bank Limited

| Financial Institution | Effective Interest Rate (from) | Interest Rate | One-Time Processing Fee | Additional Fees | Loan Tenure | Promo |

|---|---|---|---|---|---|---|

| DBS | 6.56% p.a. | 3.58% p.a. | $99 | Early Termination Fee: 5% of outstanding balance Late Payment Fee: $90 | 1 - 8 years | From now to 31 Dec, Get 3% cashback when refinancing your debt consolidation plan with DBS online. T&Cs apply. |

| POSB | 6.56% p.a. | 3.58% p.a. | $99 | Early Termination Fee: 5% of outstanding balance Late Payment Fee: $90 | From now to 31 Dec, Get 3% cashback when refinancing your debt consolidation plan with POSB online. T&Cs apply. | |

| HL Bank | 6.78% p.a. | 3.8% p.a. | $0* | Early Termination Fee: 3% of outstanding balances or $300 (whichever is higher) | 1 - 10 years | *Waiver of processing fee. T&Cs apply. |

| Maybank | 6.92% p.a. | 3.88% p.a. | $0* | Early Termination Fee: 4% of outstanding balances or $300 (whichever is higher) Late Payment Fee: 5% of the minimum monthly repayment or $50 (whichever is higher) | 1 - 10 years | From now to 31 Dec, get a $1,500 cash rebate (first 300 customers) |

| CIMB Bank Berhad | 7% p.a. | 2.77% p.a. | 1% of loan amount | Early Termination Fee: 3% of outstanding balances or $250 (whichever is higher) Late Payment Fee: $80 | 1- 8 years | - |

| HSBC | 7% p.a. | 3.8% p.a. | $0* | Early Termination Fee: 5% of outstanding balance Overdue interest: 2.5% + prevailing interest* on overdue amount Late Payment Fee: $75 | 1 - 10 years | From now to 31 Oct, get 5% cashback when refinancing your debt consolidation plan with HSBC. T&Cs apply. |

| Bank of China (BOC) | 7.48% p.a. | 3.83% p.a. | 2% of loan amount | Early Termination Fee: 5% of outstanding balances or $200 (whichever is higher) Late Payment Fee: 2% of minimum payment or $100 (whichever is higher) | Up to 10 years | - |

| Citibank | 7.5% p.a. | 3.99% p.a. | $0* | Early Termination Fee: Variable rate based on bank | Up to 7 years | Complimentary protection insurance coverage of up to S$160,000 |

| Standard Chartered | 7.7% p.a. | 3.98% p.a. | $199 | Early Termination Fee: 5% of outstanding balances or $250 (whichever is higher) Late Payment Fee: $80 | 3 - 10 years | From now to 31 Dec, get $200 cashback when you apply for a DCP with Standard Chartered. T&Cs apply. From now to 31 Dec, get 5% cashback when refinancing your debt consolidation plan with Standard Chartered. T&Cs apply. |

| OCBC | 8.06% p.a. | 4.50% p.a. | $0 | Early Termination Fee: 5% of outstanding balance Late Payment Fee: $200 | 3 - 8 years | - |

| UOB | 8.22.% p.a. | 4.50% p.a. | $0 | Early Termination Fee: Up to 6 year loan tenure: 5% of outstanding balance or $200 (whichever is higher) 7 or 8 years loan tenure: 8% of outstanding balance or $300 (whichever is higher) Late Payment Fee: $90 | Up to 8 years | - |

For now, the cheapest DCP you can take up is from either DBS or POSB with an interest rate of 3.58% p.a. and an effective interest rate that starts from 6.56% p.a.

However, do note that they are charging a $99 one-time processing fee.

However, this processing fee is offset by the 3% cash back they are offering, so long as your DCP loan amount is $3,300 and above.

Do note that we have omitted Amex, RHB Bank Berhad, and ICBC as they are currently not offering formal DCP plans.

I have also made calls to their customer service to confirm this.

How to Apply

You can approach any of the above mentioned FIs to apply for a DCP.

The following documents need to be submitted at the point of application:

- Copy of NRIC (front and back); and

- Latest Credit Bureau Report; and

- Latest Income Documents (refer to the application form for acceptable income docs); and

- Latest credit card and unsecured credit loan statements (physical or online); and

- Confirmation letter evidencing unbilled principal balances for unsecured credit instalment plans (If any)

- Settlement notice from the original DC bank (only applicable to DCP refinancing applications)

Credit Bureau Report

Speaking of Credit Bureau Reports, your record will be updated with the “Debt Consolidation” product code as the DCP is viewed as an unsecured credit product.

Unfortunately, this DCP information will stay on your Credit Bureau Report for three years after your DCP plan is paid off.

Got Any Questions About Loans and Debts?

Why not head on over to our friendly SeedlyCommunity who are more than happy to help!

Advertisement