Over the years, domestic helpers in Singapore have been providing indispensable help at home, serving the roles of parents by working on household chores and taking care of children.

Did you know that hiring a helper costs $26,810 to $35,525 for two years?

Upon hiring a helper, it is mandatory in Singapore for employers to purchase the helper’s health and personal accident insurance policies.

Some insurance requirements include:

- Medical Insurance: Coverage of at least $15,000 per year ($60,000 from 1 July 2023, with 25% co-payment by employers for amounts above $15,000) for inpatient care and day surgery, including hospital bills for conditions that might not be work-related

- Personal Accident Insurance: Sum assured of at least $60,000 per year, and must cover sudden and unforeseen incidents resulting in permanent disability or death

With the recent enhancements to medical insurance for maids, we have also included the plans that have been updated to meet MOM’s new requirements. These will be labeled “enhanced”.

So, if you’re wondering which maid insurance is best for you, here’s the comprehensive list of the best maid insurance in Singapore!

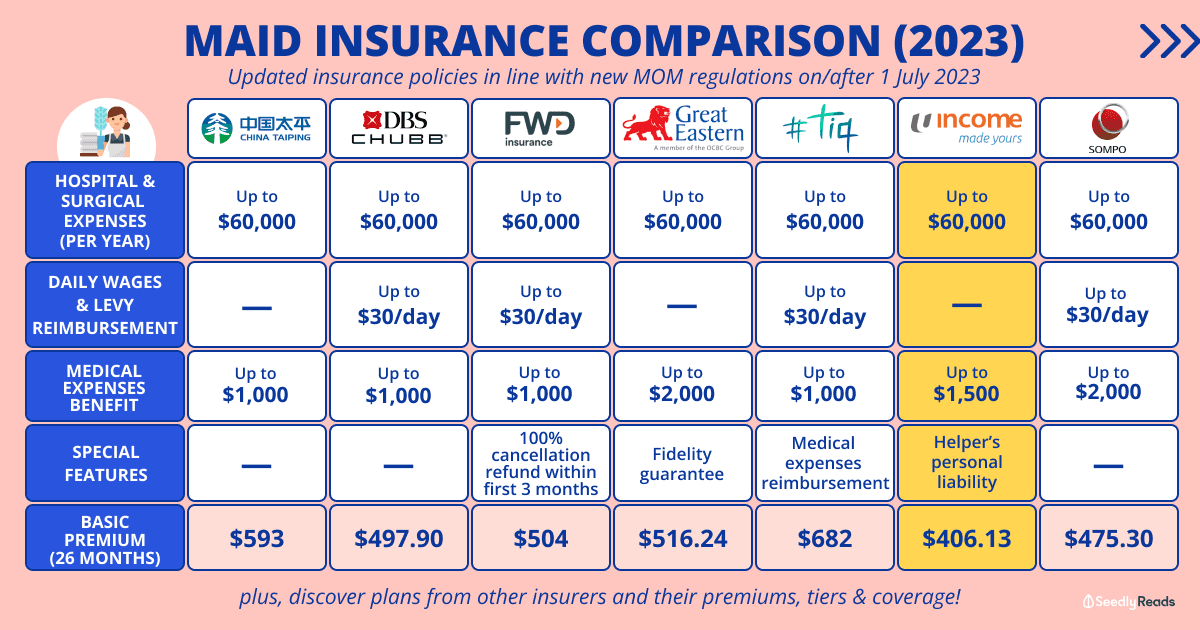

TL;DR: Best Maid Insurance Guide in Singapore 2023

Since most maid work permit contracts are either 12 months or 24 months, and there is a MOM requirement for all insurance to have an additional two months of coverage, maid insurance policies have a coverage period of either 14 or 26 months.

For the sake of consistency, we’ll be comparing the prices of the 26-month plans. Click on the plans to jump to its section:

| Maid Insurance | Premium Before Discount (26 months) | Special Features |

|---|---|---|

| AIG Domestic Helper Insurance (Enhanced) Apply Now | $911.61 - $1053.37 | - |

| China Taiping Domestic Maid Insurance (Enhanced) | $594 - $1,188 | - |

| DBS Maid Protect II (Enhanced) | $497.90 | - |

| EQ Insurance EQ Maid | $250 - $410.67 | Covers Outpatient Kidney Dialysis & Cancer Treatment |

| FWD Maid Insurance (Enhanced) Apply Now | $504 - $663.99 | 100% cancellation refund within first 3 months Funeral grant: $2,000 |

| GREAT Maid Premier (Enhanced) Apply Now | $516.24 - $749.52 | Covers Employer's liability to the maid: Up to $50,000 |

| Hong Leong Assurance Maid Protect360 Insurance Apply Now | $247.30 - $388.60 | - |

| India International Insurance Maid Bond | $222 - $268.30 | Covers Bereavement Expenses |

| Liberty Insurance MaidCare Maid Insurance (Enhanced) | $550.80 | Covers Outpatient Kidney Dialysis & Cancer Treatment Covers Employer's and Maid's Liability (Any one accident/in the aggregate) |

| MSIG MaidPlus Maid Insurance Apply Now | $216 - $336.96 | - |

| NTUC Income Domestic Helper Insurance (Enhanced) | $406.13 - $431.22 | Covers Domestic Helper Liability |

| Sompo MaidEase Maid Insurance (Enhanced) | $475.30 - $1,305 | Covers Domestic Helper Liability |

| Tiq Maid Insurance (Enhanced) Apply Now | $682 - $822 | Medical expenses reimbursement in the event of abuse by maid: Up to $5,000 |

AIG Domestic Helper Insurance (Enhanced)

AIG’s Domestic Helper Insurance covers the employer’s contents and post-hospital confinement expenses.

For peace of mind, you can also add on optional coverage (up to $2,000) for major cancers, coronary artery bypass surgery, heart attack, kidney failure, stroke, and major organ or bone marrow transplants.

| AIG Domestic Helper Insurance | Classic | Superior | Elite | Premier |

|---|---|---|---|---|

| Premium (26-month) | $911.61 | $984.69 | $971.94 | $1053.37 |

| Accidental Death | Up to $60,000 | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Accidental Permanent Disability | Up to $60,000 | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Hospital & Surgical Expenses | - | Up to $60,000 | - | Up to $100,000 |

| Hospital & Surgical Expenses with 20% Co-insurance | Up to $60,000 | - | Up to $100,000 | - |

| Medical Expenses Benefit | Up to $1,000 | Up to $1,000 | Up to $2,000 | Up to $2,000 |

| Daily Wages & Levy Reimbursements | Up to $30 per day | Up to $30 per day | Up to $30 per day | Up to $30 per day |

| Recuperation Benefit | - | - | - | - |

| Rehiring / Termination Expenses | Up to $250 | Up to $250 | Up to $500 | Up to $500 |

| Alternative Domestic Help Benefit | Up to $300 | Up to $300 | Up to $500 | Up to $500 |

| Replacement Maid Expenses | Up to $200 | Up to $200 | Up to $200 | Up to $200 |

| Repatriation Benefit | Up to $10,000 | Up to $10,000 | Up to $10,000 | Up to $10,000 |

| Maid's Personal Belongings | Up to $2,250 | Up to $2,250 | Up to $4,500 | Up to $4,500 |

| Special Grants | - | - | - | - |

| Third-Party Liability | - | - | - | - |

| Security Bond or Insurance Guarantee Bond (to Singapore's Ministry of Manpower) | Up to $5,000 | Up to $5,000 | Up to $5,000 | Up to $5,000 |

| Special Features | Employer's Content: Up to $15,000 Post Hospital Confinement Expenses: $100 | Employer's Content: Up to $15,000 Post Hospital Confinement Expenses: $100 | Employer's Content: Up to $30,000 Post Hospital Confinement Expenses: $100 | Employer's Content: Up to $30,000 Post Hospital Confinement Expenses: $100 |

China Taiping Domestic Maid Insurance (Enhanced)

China Taiping is the newest contender on this list.

It provides an optional “Bond Protector” cover for an additional premium of $54 that reimburses the insured for the loss of the Security Bond if forfeiture due to

maid’s fault, subject to an excess of S$200.

| China Taiping Domestic Maid Insurance | Plan D1 | Plan D2 | Plan D3 |

|---|---|---|---|

| Premium (26-month, age 50 and below) | $594 | $648 | $702 |

| Premium (26-month, age 50 and above) | $972 | $1,080 | $1,188 |

| Accidental Death | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Accidental Permanent Disability | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Hospital & Surgical Expenses (per year) | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| i. First Dollar Coverage ii. Co-payment (Insured 25% : Insurer 75%) | Up to 15,000 Next 45,000 | Up to 30,000 Next 30,000 | Up to 60,000 - |

| Medical Expenses Benefit | Up to $1,000 | Up to $3,500 | UP to $5,000 |

| Daily Wages & Levy Reimbursements | - | Up to $20 per day (Max 60 days) | Up to $30 per day (Max 60 days) |

| Recuperation Benefit | NIL | Up to $20 per day (Max 60 days) | Up to $30 per day (Max 60 days) |

| Rehiring / Termination Expenses | NIL | Up to $250 | Up to $500 |

| Alternative Domestic Help Benefit | - | - | - |

| Replacement Maid Expenses | - | - | - |

| Repatriation Benefit | - | - | - |

| Maid's Personal Belongings | - | - | - |

| Special Grants | - | - | - |

| Third-Party Liability | - | - | - |

| Security Bond or Insurance Guarantee Bond (to Singapore's Ministry of Manpower) | Up to $5,000 | Up to $5,000 | Up to $5,000 |

| Special Features | Optional Bond Protector (Excess: $200) | Optional Bond Protector (Excess: $200) | Optional Bond Protector (Excess: $200) |

DBS Maid Protect II (Enhanced)

As a local bank, DBS is known to bring all financial services close to their customers, including covering your domestic helper at an affordable premium with DBS Maid Protect II.

| DBS Maid Protect II | Basic |

|---|---|

| Premium (26-month) | $497.90 |

| Accidental Death | Up to $60,000 |

| Accidental Permanent Disability | Up to $60,000 |

| Hospital & Surgical Expenses (per year) | Up to $60,000 |

| Medical Expenses Benefit | Up to $1,000 |

| Daily Wages & Levy Reimbursements | Up to $30 per day (max. 30 days) |

| Recuperation Benefit | - |

| Rehiring / Termination Expenses | Up to $300 |

| Alternative Domestic Help Benefit | - |

| Replacement Maid Expenses | Up to $500 |

| Repatriation Benefit | Up to $10,000 |

| Maid's Personal Belongings | Up to $300 |

| Special Grants | Up to $2,000 |

| Third-Party Liability | Up to $5,000 |

| Security Bond or Insurance Guarantee Bond (to Singapore's Ministry of Manpower) | Up to $5,000 |

| Special Features | - |

EQ Insurance EQ Maid

For the uninitiated, EQ Insurance is a homegrown insurance brand founded in 2007.

The insurance company has two maid insurance: Essential and Enhanced. For a price of $250, you can ensure adequate for yourself and your helper.

Specifically, the plans also cover outpatient kidney dialysis and cancer treatment.

| EQ Insurance EQ Maid (Essential) | EQ Insurance EQ Maid (Enhanced) | |

| Premium (26-month) |

$250.00 | $350.00 |

| Accidental Death | Up to $60,000 | Up to $60,000 |

| Accidental Permanent Disability | Up to $60,000 | Up to $60,000 |

| Hospital & Surgical Expenses (per year) |

Up to $15,000 | Up to $30,000 |

| Medical Expenses Benefit | Up to $2,000 | Up to $3,000 |

| Daily Wages & Levy Reimbursements | Up to $30 per day (max. 30 days) |

Up to $30 per day (max. 30 days) |

| Recuperation Benefit | Up to $20 per day (max. 60 days) |

Up to $30 per day (max. 60 days) |

| Rehiring / Termination Expenses | Up to $350 | Up to $500 |

| Alternative Domestic Help Benefit | – | – |

| Replacement Maid Expenses | – | – |

| Repatriation Benefit | Up to $10,000 | Up to $10,000 |

| Maid’s Personal Belongings | Up to $300 | Up to $300 |

| Special Grants | Up to $1,000 | Up to $3,000 |

| Third-Party Liability | Up to $5,000 any one accident or in aggregate | Up to $5,000 any one accident or in aggregate |

| Security Bond or Insurance Guarantee Bond (to Singapore’s Ministry of Manpower) | Up to $5,000 | Up to $5,000 |

| Special Features | Outpatient Kidney Dialysis or Cancer Treatment: Up to $2,500 | Outpatient Kidney Dialysis or Cancer Treatment: Up to $5,000 |

FWD Maid Insurance (Enhanced)

If you’re looking for a plan that offers better flexibility on cancellation, FWD Maid Insurance offers a 100% cancellation refund within the first three months.

This feature is especially useful during unforeseen circumstances, where there might be a need for replacement of the domestic helper.

In addition, this plan covers pre-existing conditions at no cost and offers outpatient coverage for medical visits at their network of clinics.

These are definitely some attractive features to consider.

| FWD Maid Insurance | Essential | Enhanced | Exclusive |

|---|---|---|---|

| Premium (26-month) | $504.00 | $584.00 | $663.99 |

| Accidental Death | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Accidental Permanent Disability | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Hospital & Surgical Expenses (per year) | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Medical Expenses Benefit | Up to $1,000 | Up to $2,000 | Up to $3,000 |

| Daily Wages & Levy Reimbursements | Up to $30 per day (max. 30 days) | Up to $30 per day (max. 30 days) | Up to $30 per day (max. 30 days) |

| Recuperation Benefit | - | - | - |

| Rehiring / Termination Expenses | $300 | $400 | $500 |

| Alternative Domestic Help Benefit | Up to $20 per day (max. 30 days) | Up to $20 per day (max. 30 days) | Up to $20 per day (max. 30 days) |

| Replacement Maid Expenses | - | - | - |

| Repatriation Benefit | Up to $10,000 | Up to $10,000 | Up to $10,000 |

| Maid's Personal Belongings | Up to $300 | Up to $400 | Up to $500 |

| Special Grants | Up to $2,000 | Up to $2,000 | Up to $2,000 |

| Third-Party Liability | Up to $3,000 | Up to $4,000 | Up to $5,000 |

| Security Bond or Insurance Guarantee Bond (to Singapore's Ministry of Manpower) | Up to $5,000 | Up to $5,000 | Up to $5,000 |

| Special Features | 100% cancellation refund within first 3 months Funeral grant: $2,000 | 100% cancellation refund within first 3 months Funeral grant: $2,000 | 100% cancellation refund within first 3 months Funeral grant: $2,000 |

GREAT Maid Premier Plan

For anyone looking for extensive coverage on liabilities, the GREAT Maid Premier Plan is a newly launched insurance in replacement of MaidGR8.

While most plans have third-party liability coverage of $2,500 to $5,000, this plan provides medical coverage of up to $60,000.

That’s a pretty impressive sum.

For Nanny and Silver plans, if the total amount of hospital and surgical expenses you claim is more than $15,000 in a policy year, you must pay a co-payment as below.

| Hospital and surgical expenses | Co-payment |

| Up to $15,000 | None |

| Above $15,000, up to the limit shown in the schedule | 25% of the amount being claimed |

In addition, there is also coverage of the employer’s liability to the maid of up to $50,000 too.

| GREAT Maid Premier Plan | Nanny | Silver | Gold | Platinum |

|---|---|---|---|---|

| Premium (26-month) | N.A. | $516.24 | $624.24 | $749.52 |

| Accidental Death | Up to $60,000 | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Accidental Permanent Disability | Up to $60,000 | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Hospital & Surgical Expenses (fully paid by insurer) | First $15,000 | First $15,000 | Up to $60,000 (No co-payment) | Up to $60,000 (No co-payment) |

| Hospital & Surgical Expenses Co-payment of 75% by insurers (and 25% for employers) for claim amounts above the first $15,000 | Up to $60,000 (Above $15,000) | Up to $60,000 (Above $15,000) | ||

| Medical Expenses Benefit | Up to $2,000 TCM: Up to $150 | Up to $2,000 TCM: Up to $150 | Up to $3,000 TCM: Up to $150 | Up to $3,000 TCM: Up to $150 |

| Daily Wages & Levy Reimbursements | - | - | Up to $35 per day | Up to $35 per day |

| Recuperation Benefit | - | Up to $20 per day (max. 60 days) | Up to $20 per day (max. 60 days) | Up to $30 per day (max. 60 days) |

| Rehiring / Termination Expenses | - | Up to $350 | Up to $350 | Up to $500 |

| Alternative Domestic Help Benefit | - | Up to $35 per day (max. 60 days) | Up to $35 per day (max. 60 days) | Up to $35 per day (max. 60 days) |

| Replacement Maid Expenses | - | - | - | - |

| Repatriation Benefit | Up to $10,000 | Up to $10,000 | Up to $10,000 | Up to $10,000 |

| Maid's Personal Belongings | - | Up to $300 | Up to $300 | Up to $300 |

| Special Grants | - | Up to $1,000 | Up to $1,000 | Up to $3,000 |

| Third-Party Liability | - | Up to $50,000 | Up to $50,000 | Up to $50,000 |

| Security Bond or Insurance Guarantee Bond (to Singapore's Ministry of Manpower) | - | Up to $5,000 | Up to $5,000 | Up to $5,000 |

| Special Features | - | Fidelity guarantee (Excess: $50): Up to $5,000 Optional Bond Protector (Excess: $250): $5,000 | Fidelity guarantee (Excess: $50): Up to $5,000 Optional Bond Protector (Excess: $250): $5,000 | Fidelity guarantee (Excess: $50): Up to $5,000 Optional Bond Protector (Excess: $250): $5,000 |

Hong Leong Assurance Maid Protect360 Insurance

If you’re getting the Hong Leong Assurance Maid Insurance, note that there’s no coverage for alternative domestic helper benefits and replacement maid expenses.

However, it provides medical expense benefits for Traditional Chinese Medicine and Physiotherapy.

Similarly, an annual limit is in place for claiming hospital & surgery expenses.

| Hong Leong Assurance Maid Protect360 Insurance Silver | Hong Leong Assurance Maid Protect360 Insurance Gold | Hong Leong Assurance Maid Protect360 Insurance Platinum | Hong Leong Assurance Maid Protect360 Insurance Diamond | |

| Premium (26-month) |

$247.30 | $305.90 | $399.70 | $488.60 |

| Accidental Death | Up to $60,000 | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Accidental Permanent Disability | Up to $60,000 | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Hospital & Surgical Expenses (per year) |

Up to $15,000 (Max. $30,000) |

Up to $20,000 (Max. $40,000) |

Up to $30,000 (Max. $60,000) |

Up to $40,000 (Max. $80,000) |

| Medical Expenses Benefit | Up to $1,000 | Up to $2,000 | Up to $3,000

TCM: Up to $100 Physio: Up to $250 |

Up to $4,000

TCM: Up to $200 Physio: Up to $300 |

| Daily Wages & Levy Reimbursements | – | Up to $30 per day | Up to $50 per day | Up to $60 per day |

| Recuperation Benefit | – | Up to $20 per day | Up to $30 per day | Up to $50 per day |

| Rehiring / Termination Expenses | Up to $200 | Up to $300 | Up to $500 | Up to $600 |

| Alternative Domestic Help Benefit | – | – | – | – |

| Replacement Maid Expenses | – | – | – | – |

| Repatriation Benefit | Up to $10,000 | Up to $10,000 | Up to $10,000 | Up to $10,000 |

| Maid’s Personal Belongings | – | Up to $1,000 | Up to $2,000 | Up to $3,000 |

| Special Grants | – | Up to $2,000 | Up to $3,000 | Up to $5,000 |

| Third-Party Liability | – | Up to $3,000 | Up to $5,000 | Up to $7,000 |

| Security Bond or Insurance Guarantee Bond (to Singapore’s Ministry of Manpower) | Up to $5,000 | Up to $5,000 | Up to $5,000 | Up to $5,000 |

| Special Features | – | – | – | – |

India International Insurance Maid Bond

Unlike other insurers, India International Insurance provides expenses for bereavement of up to $2,000.

The coverage is decent and competitive at $268.30 for 26 months. On top of that, it offers reimbursement for wages and a levy of up to $50 per day (max. 60 days), which is higher than other policies.

| India International Insurance Maid Bond Standard | India International Insurance Maid Bond Enhanced | |

| Premium (26-month) |

$222.00 | $268.30 |

| Accidental Death | Up to $60,000 | Up to $60,000 |

| Accidental Permanent Disability | Up to $60,000 | Up to $60,000 |

| Hospital & Surgical Expenses (per year) |

Up to $15,000 | Up to $20,000 |

| Medical Expenses Benefit | Up to $1,250

TCM: Up to $150 |

Up to $2,500

TCM: Up to $300 |

| Daily Wages & Levy Reimbursements | Up to $30 per day (max. 60 days) |

Up to $50 per day (max. 60 days) |

| Recuperation Benefit | – | – |

| Rehiring / Termination Expenses | Up to $250 | Up to $250 |

| Alternative Domestic Help Benefit | Up to $20 per day (max. 60 days) |

Up to $30 per day (max. 60 days) |

| Replacement Maid Expenses | – | – |

| Repatriation Benefit | Up to $10,000 | Up to $10,000 |

| Maid’s Personal Belongings | Up to $250 | Up to $250 |

| Special Grants | – | – |

| Third-Party Liability | Up to $5,000 | Up to $5,000 |

| Security Bond or Insurance Guarantee Bond (to Singapore’s Ministry of Manpower) | Up to $5,000 | Up to $5,000 |

| Special Features | Bereavement Expenses: Up to $2,000 | Bereavement Expenses: Up to $2,000 |

Liberty Insurance MaidCare Maid Insurance (Enhanced)

Liberty Insurance’s maid insurance is another that covers both Outpatient Kidney Dialysis & Cancer Treatment and Employer’s and Maid’s Liability.

However, Plan A lacks coverage on common benefits such as the reimbursements of daily wage and levy and Re-hiring and Termination expenses.

As such, if you’re getting insurance from Liberty, you might be better off with Plan B or C.

| Liberty Insurance MaidCare | Maidcare |

|---|---|

| Premium (26-month) | $550.80 |

| Accidental Death | Up to $60,000 |

| Accidental Permanent Disability | As per scale in Policy |

| Hospital & Surgical Expenses (per year) | Up to $60,000 |

| Medical Expenses Benefit | Up to $2,000 |

| Daily Wages & Levy Reimbursements | Up to $30 per day (maximum 60 days) |

| Recuperation Benefit | - |

| Rehiring / Termination Expenses | Up to $350 |

| Alternative Domestic Help Benefit | - |

| Replacement Maid Expenses | - |

| Repatriation Benefit | Up to $10,000 |

| Maid's Personal Belongings | Up to $250 |

| Special Grants | $1,000 |

| Third-Party Liability | - |

| Security Bond or Insurance Guarantee Bond (to Singapore's Ministry of Manpower) | Up to $5,000 |

| Special Features | Employer's and Maid's Liability (Any one accident/in the aggregate): Up to $20,000 Outpatient Kidney Dialysis/Cancer Treatment: Up to $2,500 |

MSIG Maidplus Plan

The MSIG Maidplus Standard Plan offers coverage in different areas for a comprehensive insurance plan.

For $216 for a 26-month period, this plan includes coverage for rehiring/termination expenses if the maid is unfit for work (due to injury or illness) and replacement maid expenses due to death, injury or illness.

In addition, there is an alternative domestic help benefit of $50 per day (max. 30 days), which is quite a decent sum as compared to other plans.

Also, $300 for the domestic helper’s personal belongings is covered, a coverage that is less commonly seen among insurance plans.

That said, MSIG is running a promotion, and you can get 20% off your premium AND $20 cash via Paynow!

| MSIG Maidplus Standard | MSIG Maidplus Classic | MSIG Maidplus Premier | |

| Premium (26-month) |

$216.00 | $293.76 | $336.96 |

| Accidental Death | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Accidental Permanent Disability | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Hospital & Surgical Expenses (per year) |

Up to $15,000 | Up to $30,000 | Up to $50,000 |

| Medical Expenses Benefit | TCM: Up to $100

Dengue: Up to $100 Dental: Up to $500 |

TCM: Up to $100

Dengue: Up to $100 Dental: Up to $500 |

TCM: Up to $100

Dengue: Up to $100 Dental: Up to $500 |

| Daily Wages & Levy Reimbursements | Up to $30 per day (max. 30 days) |

Up to $30 per day (max. 45 days) |

Up to $30 per day (max. 60 days) |

| Recuperation Benefit | – | – | – |

| Rehiring / Termination Expenses | Up to $300 | Up to $600 | Up to $600 |

| Alternative Domestic Help Benefit | Up to $50 per day (max. 30 days) |

Up to $50 per day (max. 45 days) |

Up to $50 per day (max. 60 days) |

| Replacement Maid Expenses | Up to $500 | Up to $500 | Up to $500 |

| Repatriation Benefit | Up to $10,000 | Up to $15,000 | Up to $20,000 |

| Maid’s Personal Belongings | Up to $300 | Up to $300 | Up to $500 |

| Special Grants | Up to $2,000 | Up to $3,000 | Up to $3,000 |

| Third-Party Liability | Up to $5,000 | Up to $10,000 | Up to $20,000 |

| Security Bond or Insurance Guarantee Bond (to Singapore’s Ministry of Manpower) | Up to $5,000 | Up to $5,000 | Up to $5,000 |

| Promotion (till 30 Apr 2023) | Get $20 Cash via PayNow, 20% off | ||

NTUC Income Domestic Helper Insurance (Enhanced)

NTUC Income’s maid insurance has a unique feature – A domestic helper’s personal liability.

This means that when your domestic helper is legally responsible for the following:

- Accidentally injuring someone; or

- Damaging or causing loss to someone else’s property while performing her duties as a foreign domestic helper in Singapore

NTUC Income would cover the legal costs and expenses for representing or defending your domestic helper or the amount awarded against your domestic helper by the court in Singapore up to the maximum amount shown in the schedule’s relevant section.

| NTUC Income Domestic Helper Insurance | Basic | Standard | Enhanced |

|---|---|---|---|

| Premium (26-month) | $406.13 | $418.98 | $431.22 |

| Accidental Death | Up to $60,000 | Up to $60,000 | Up to $80,000 |

| Accidental Permanent Disability | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Hospital & Surgical Expenses (per year) | Up to $60,000 | Up to $60,000 | Up to $60,000 |

| Medical Expenses Benefit | Up to $1,500 | Up to $2,000 | Up to $3,000 |

| Daily Wages & Levy Reimbursements | - | Up to $20 per day (max. 30 days) | Up to $35 per day (max. 30 days) |

| Recuperation Benefit | - | - | - |

| Rehiring / Termination Expenses | - | - | - |

| Alternative Domestic Help Benefit | - | - | - |

| Replacement Maid Expenses | - | Up to $150 | Up to $500 |

| Repatriation Benefit | Up to $10,000 | Up to $10,000 | Up to $10,000 |

| Maid's Personal Belongings | - | - | - |

| Special Grants | - | Up to $2,000 | Up to $3,000 |

| Third-Party Liability | - | - | - |

| Security Bond or Insurance Guarantee Bond (to Singapore's Ministry of Manpower) | Up to $5,000 (not applicable for Malaysian helpers) | Up to $5,000 (not applicable for Malaysian helpers) | Up to $5,000 (not applicable for Malaysian helpers) |

| Special Features | Domestic helper's personal liability (per policy): Up to $25,000 | Domestic helper's personal liability (per policy): Up to $25,000 | Domestic helper's personal liability (per policy): Up to $75,000 |

SOMPO MaidEase (Enhanced)

The SOMPO MaidEase Plan includes Fidelity Guarantee coverage in an unfortunate event where there are fraudulent or dishonest acts that involve the loss of money or property.

| Insurance Premium for 26 Months (inclusive of GST) | Standard | Prestige | Prestige Plus | |

|---|---|---|---|---|

| Insurance Benefits Only | 40 Years Old and Below | $475.30 | $686.40 | $878.40 |

| Above 40 Years Old | $643.40 | $934.30 | $1,202.40 | |

| Insurance + Letter of Guarantee | 40 Years Old and Below | $523.90 | $735.00 | $927.00 |

| Above 40 Years Old | $692.00 | $982.90 | $1,251.00 | |

| Insurance + Letter of Guarantee + Waiver of Counter Indemnity | 40 Years Old and Below | $577.90 | $789.00 | $981.00 |

| Above 40 Years Old | $746.00 | $1,036.90 | $1,305.00 | |

| SOMPO MaidEase | Standard | Prestige | Prestige Plus |

|---|---|---|---|

| Accidental Death | Up to $60,000 | Up to $70,000 | Up to $70,000 |

| Accidental Permanent Disability | As per scale in Policy | As per scale in Policy | As per scale in Policy |

| Hospital & Surgical Expenses | Up to $120,000 (Annual limit: $60,000) | Up to $140,000 (Annual limit: $70,000) | Up to $160,000 (Annual limit: $80,000) |

| Medical Expenses Benefit | Up to $2,000 TCM: Up to $100 Dengue: Up to $150 Ambulance: Up to $100 | Up to $3,000 TCM: Up to $100 Dengue: Up to $250 Ambulance: Up to $100 | Up to $4,000 TCM: Up to $100 Dengue: Up to $250 Ambulance: Up to $100 |

| Daily Wages & Levy Reimbursements | Up to $30 per day (max. 60 days) | Up to $30 per day (max. 60 days) | Up to $40 per day (max. 60 days) |

| Recuperation Benefit | Up to $20 per day (max. 60 days) | Up to $20 per day (max. 60 days) | Up to $30 per day (max. 60 days) |

| Rehiring / Termination Expenses | Up to $300 | Up to $500 | Up to $500 |

| Alternative Domestic Help Benefit | Up to $10 per day (max. 30 days) | Up to $15 per day (max. 30 days) | Up to $20 per day (max. 30 days) |

| Replacement Maid Expenses | - | - | - |

| Repatriation Benefit | Up to $10,000 | Up to $10,000 | Up to $10,000 |

| Maid's Personal Belongings | Up to $300 | Up to $500 | Up to $500 |

| Special Grants | Up to $2,000 | Up to $2,500 | Up to $3,000 |

| Third-Party Liability | - | - | - |

| Security Bond or Insurance Guarantee Bond (to Singapore's Ministry of Manpower) | Up to $5,000 | Up to $5,000 | Up to $5,000 |

| Special Features | Waiver of Counter Indemnity for Letter of Guarantee: Up to $5,000 | Waiver of Counter Indemnity for Letter of Guarantee: Up to $5,000 Fidelity Guarantee: $3,000 | Waiver of Counter Indemnity for Letter of Guarantee: Up to $5,000 Fidelity Guarantee: $5,000 |

Tiq Maid Insurance (Enhanced)

One unique feature of Tiq Maid Insurance Plan is the coverage of physical abuse by the maid. In an unfortunate event of abuse by the maid to the elderly, child, or handicapped, there is coverage of up to $5,000.

| Tiq Maid Insurance Plan A | Tiq Maid Insurance Plan B | Tiq Maid Insurance Plan C | |

| Premium (26-month) |

$682 | $737 | $822 |

| Accidental Death | Up to $60,000 | Up to $65,000 | Up to $70,000 |

| Accidental Permanent Disability | Up to $60,000 | Up to $65,000 | Up to $70,000 |

| Hospital & Surgical Expenses (per year) |

Up to $60,000 (25% co-insurance after first $15k) |

Up to $60,000 (25% co-insurance after first $15k) |

Up to $60,000 (25% co-insurance after first $15k) |

| Medical Expenses Benefit | Up to $1,000 | Up to $2,000 | Up to $3,000 |

| Daily Wages & Levy Reimbursements | Up to $30 per day (max. 30 days) |

Up to $30 per day (max. 30 days) |

Up to $30 per day (max. 30 days) |

| Recuperation Benefit | Up to $10 per day (max. 30 days) |

Up to $15 per day (max. 30 days) |

Up to $20 per day (max. 30 days) |

| Rehiring / Termination Expenses | Up to $250 | Up to $300 | Up to $350 |

| Alternative Domestic Help Benefit | Up to $10 per day (max. 30 days) |

Up to $15 per day (max. 30 days) |

Up to $20 per day (max. 30 days) |

| Replacement Maid Expenses | – | – | – |

| Repatriation Benefit | Up to $10,000 | Up to $10,000 | Up to $10,000 |

| Maid’s Personal Belongings | – | – | – |

| Special Grants | Up to $500 | Up to $1,000 | Up to $2,000 |

| Third-Party Liability | Up to $5,000 | Up to $7,500 | Up to $10,000 |

| Security Bond or Insurance Guarantee Bond (to Singapore’s Ministry of Manpower) | Up to $5,000 | Up to $5,000 | Up to $5,000 |

| Special Features | Medical expenses reimbursement in the event of abuse by maid: Up to $5,000 | Medical expenses reimbursement in the event of abuse by maid: Up to $5,000 | Medical expenses reimbursement in the event of abuse by maid: Up to $5,000 |

| Promotion (till 30 Jun 2023) | 20% discount with promo code “TIQSINGSEEDLY“. The promotion is valid till 30 June. | ||

Related Articles:

- Insurance: How To Review & Why You Should

- Best Insurance Options for Those With Pre-existing Conditions

- Travel Insurance Claim Guide: From Baggage Loss, Trip Cancellations to COVID-19

- Best Cancer Insurance in Singapore: Keeping a Peace of Mind in Hard Times

- Best Travel Insurance in Singapore (2023): Travel With a Peace of Mind

Advertisement