Best Mastercards Singapore: Awesome Mastercard Credit Cards To Consider in 2022

●

If you have been following the news, you might have heard Amazon is not incurring a 0.5% surcharge on all purchases made with a Visa card.

That’s not all. Some other companies have been imposing a surcharge for using Visa credit cards, citing the high fee Visa is charging for using their payment service.

If you would like to avoid these fees.

One of the easiest ways to do so is to get a Mastercard. But which credit card should you apply for?

We got you!

Here are seven of the best Mastercards in Singapore to consider!

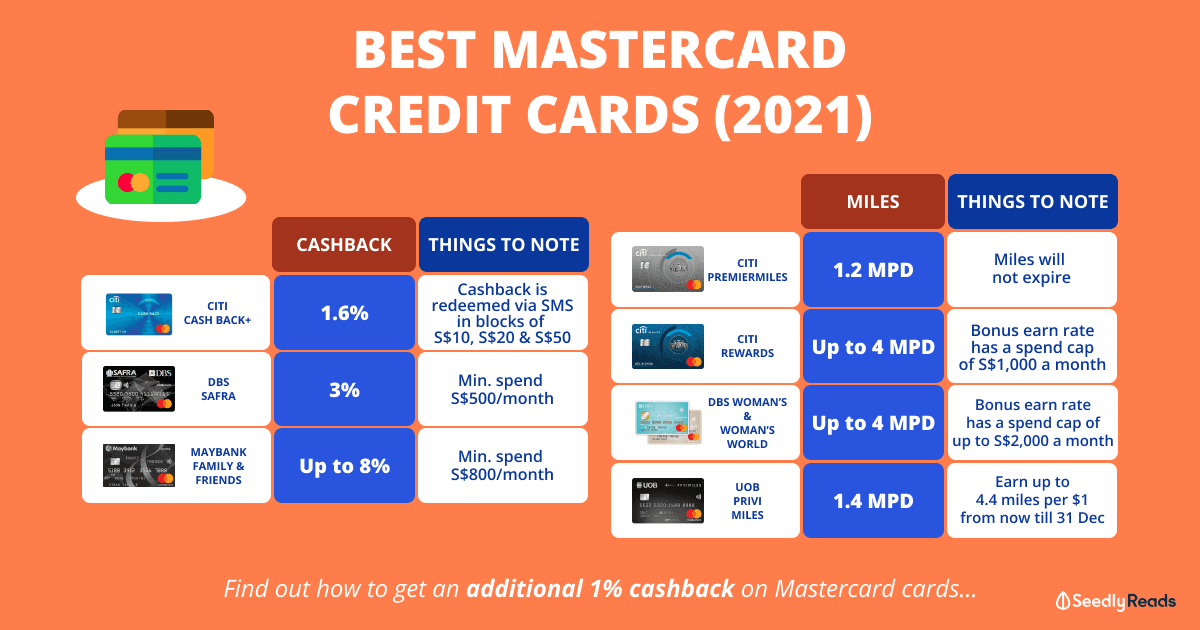

TL;DR: Best Mastercard Credit Cards Singapore: Master Cards Guide

| Credit Card | Reward | Things to Note |

|---|---|---|

| Best For Cashback | ||

| Citi Cash Back+ Card | 1.6% cashback | Cashback is redeemed via SMS in blocks of S$10, S$20 & S$50 |

| DBS SAFRA Card | 3% cashback | S$500 min. spend per month |

| Maybank Family & Friends Card | Up to 8% cashback on 5 selected categories | S$800 min. spend per month |

| Best For Miles/Rewards | ||

| Citi PremierMiles Mastercard | 1.2 miles per S$1 (local spend) | Miles will not expire |

| Citi Rewards Credit Card | Up to 4 miles per S$1 | Bonus earn rate has a spend cap of S$1,000 a month |

| DBS Woman's Card And DBS Woman's World Cards | Up to 2 miles per S$1 and Up to 4 miles per S$1 | Bonus earn rate has a S$1,000 monthly spend cap and Bonus earn rate has a S$2,000 monthly spend cap |

| UOB PRVI Miles | 1.4 miles per S$1 (local spend) | Earn up to 4.4 miles per S$1 on online and mobile contactless spend on dining, food delivery, groceries or at pharmacies from now till 31 Dec 2021 |

Cashback Credit Cards

1. Citi Cash Back+ Card

First up, we have the Citi Cash Back+ Card.

This card is one of the best no-frills cashback cards on the market as it gives you 1.6% cashback on your local and overseas spending.

But note that the card has a foreign currency transaction fee of 3.25%.

There is also no minimum spend requirement and no limit on the cashback earned.

Although other cards provide more cashback on specific spending categories, there are often rewards caps in place.

Speaking of cashback, the cashback you earned goes directly into your account and does not expire.

You can either use the cashback to offset your purchases or redeem your cashback via SMS in blocks of S$10, S$20 and S$50.

In addition, the card has an annual fee of S$192.60. But this is waived for the first year.

The card also has an annual income requirement of S$30,000 for Singapore Citizens (SCs) and Permanent Residents (PRs) and S$42,000 for foreigners.

Citi Cash Back+ Card Promo

New to Citibank credit card applicants will get to enjoy a welcome gift of 4.5% cashback of up to S$5,000 spend (up to S$225 cashback) in the first three months.

Additionally, they will stand to receive either a Dyson Supersonic Hairdryer or Apple Watch SE or S$350 cash via PayNow with no minimum spend after their application is successfully completed.

This promotion is valid from now till 17 October 2021. Terms and Conditions apply

If you are interested, you can read up more about the card and apply below:

2. DBS SAFRA Card

Next, for the cashback credit cards category, we have the SAFRA DBS Card.

I’m not sure why this card is not talked about more as you get to enjoy a very decent 3% cash rebate on your local Mastercard contactless transactions (includes bus/train rides via SimplyGo) and online shopping.

But, note that you will only get a 0.3% cash rebate on all other retail transactions and will have to spend a minimum of S$500 every calendar month to enjoy the cash rebates.

This cash rebate comes in the form of SAFRA$ with a maximum cap of SAFRA$50 per card account per calendar month.

There is also a 3.25% foreign currency transaction fee.

According to DBS, you can redeem your SAFRA$ in three ways:

- Redemption at SAFRA Clubs: Simply offset your purchases on the spot at the SAFRA clubs islandwide.

- Offset Your Credit Card Bill: Login to internet banking to offset your credit card bill

- Redeem For KrisFlyer Miles: KrisFlyer miles will be available for redemption via iBanking in blocks of 10,000 KrisFlyer miles and is based on the conversion rate of 245 Loyalty Dollars = 10,000 KrisFlyer miles. Each conversion is subjected to an administrative fee of S$25 (before GST) and charged to the respective DBS SAFRA Credit Card.

In addition, if you use the DBS SAFRA card at SAFRA participating outlets and facilities, you will get to enjoy one additional SAFRAPOINT per dollar spent on top of the cashback.

The card also has an annual income requirement of S$30,000 for SCs and PRs.

In addition, the card has no annual fee as long as you remain a SAFRA member which is the main drawback of the card.

For the uninitiated, the SAFRA membership is available for individuals who’ve served their time in SAF. But I missed out on an important part where it’s applicable for their dependents (spouses and children) as well!

The membership is open to:

- Operationally Ready NSmen

- Full-time National Servicemen (NSFs)

- Former SAF NSmen (excluding those transferred to the Singapore Civil Defence Force and Singapore Police Force)

- SAF Regulars

- Defence Executive Officers (DXOs)

- Dependents [spouses and children (except NSFs)].

But thankfully, the fees for the SAFRA membership are not too expensive as SAFRA is currently running a promotion from now to 31 December 2021:

If you are a dependent of someone who served in the SAF, you can sign up together with your spouse or your father at these rates under the SAFRA family scheme:

The best part? You can link your DBS/POSB savings accounts to this credit card and use it as an Automated Teller Machine ATM card to withdraw money.

If you are interested, you can read up more about the card below:

3. Maybank Family And Friends Card

Last but not least, for the cashback category, we have the Maybank Family and Friends Credit Card.

This card offers attractive cash rebates of up to 8% on daily essentials like groceries, dining and transport across Singapore and Malaysia.

So here’s the cool thing about this card.

You enjoy the freedom to choose five out of eight of the following cashback categories to suit your spending habits and earn the cashback of up to 8% on:

- Groceries: Stock up your daily necessities from grocery stores, supermarkets or shop your groceries online.

- Dining And Food Delivery: Feast in delight with your family and friends or order food to have them delivered at your convenience.

- Transport: Fuel up or service your car, hail for a ride or simply tap and go for bus and train trips.

- Data Communication & Online TV Streaming: Always stay connected with your mobile and home internet plans, stream your favourite shows online or enjoy an array of entertainment with your TV cable subscription.

- Retail & Pets: Shop for your kids and treats your pets to promote their well-being.

- Online Fashion: Indulge in online retail therapy anytime and anywhere.

- Entertainment: Catch the latest movie or treat yourself to a live concert or play.

- Pharmacy & Wellness: Get your daily essentials and supplements.

Unlike its close competitor, the POSB Everyday Card, Maybank has next to no merchant restrictions and covers some crowd favourite merchants from supermarkets like DON DON DONKI, RedMart, to Deliveroo or Foodpanda for food delivery, and Grab / GOJEK rides for Transport, Disney+ and Netflix for Streaming services.

However, a few things to take note of:

- To get the 8% cash rebate, cardholders need to spend a minimum of S$800 per calendar month which is relatively high.

But, if you do not hit the monthly minimum spend, you will only receive a miserly 0.3% cashback. - There is also a cashback cap of $125 per calendar month, capped at $25 per chosen category. But on balance, this is quite generous compared to its competitors.

- Once you have chosen the cashback categories, your choices are locked in for one year.

- There is also a 2.75% foreign currency transaction fee.

In addition, the card has an annual fee of S$180. But this is waived for three years.

The card also has an annual income requirement of S$30,000 for SCs and PRs and S$60,000 for foreigners.

Maybank Family And Friends Card Promo

New to Maybank credit card applicants will stand to receive a Garmin vivomove Style smartwatch worth S$469.

But you will need to apply for Maybank Credit Card and a CreditAble Account to be eligible.

In addition, you will need to spend a minimum of S$300 a month for two consecutive months (Aggregate amount from Credit card and/or Creditable).

But this is valid only for the first 2,000 applicants. Terms and Conditions apply.

After the first 2,000 applicants, they will only receive a S$100 cash credit.

But this promotion is only valid only for new Maybank cardholders. You will also have to apply for a Maybank Credit Card and a CreditAble Account to be eligible. Terms and Conditions apply

If you are interested, you can read up more about the card below:

Miles Credit Cards

4. Citi PremierMiles Mastercard

First, up for the miles category, we have the Citi PremierMiles Mastercard.

This card is one of the most popular general spend miles cards for those who want to get rewards but don’t want to pay a high fee for them.

Here are some highlights of the Citi PremierMiles Mastercard and the cashback benefits on offer:

- Foreign Currency Spend: S$1 = 2 Citi Miles

- Local Spend: S$1 = 1.2 Citi Miles

- Flexible Redemption: 1 Citi Mile can be exchanged for 1 Mile with KrisFlyer, Asia Miles, Qantas and other airlines’ Frequent Flyer and Hotel Loyalty Programs

- No Expiry: Citi Miles will not expire

- VIP Access: Two complimentary visits every year to airport lounges worldwide

- Travel Insurance: Up to $1,000,000 of insurance coverage

- Minimum Spend: No minimum spend required.

But, note that the card has a foreign currency transaction fee of 3.25%.

In addition, the card has an annual fee of S$192.60. But this fee is waived for two years.

The card also has an annual income requirement of S$30,000 for SCs and PRs and S$42,000 for foreigners.

Citi PremierMiles Mastercard Promo

New to Citibank credit card applicants will get to enjoy a welcome gift of either a Dyson Supersonic Hairdryer or Apple Watch SE or S$350 cash via PayNow after their application is successfully completed.

Existing cardholders will receive $30 cash via PayNow with no minimum spend.

This promotion is valid from now till 17 October 2021. Terms and Conditions apply.

If you are interested, you can read up more about the card and apply below:

Note that the CitiPremierMiles cards have switched to the Mastercard network.

5. Citi Rewards Card

Next up, we have the Citi Rewards Card.

Here are some of the key features and benefits of the Citi Rewards Card:

- Fashion Retail Spend: 4 miles (10 points) per S$1

- All Online Spend: 4 miles (10 points) per S$1 spent on rides, online food delivery, online groceries and more (excludes e-wallet top-ups and travel)

- Select Offline Retail Spend: Bags, clothes and shoes at certain departmental stores in Singapore and abroad

-

Source: Citibank | Rewards Card Terms and Conditions - All Other Retail Spend: 4 miles (1 point)

- Transfer Cost: Citi ThankYou Points can be transferred to 11 different frequent flyer schemes like KrisFlyer, Asia Miles, Etihad Guest and more.

- Minimum Spend: No minimum spend required.

But, here’s an important point you need to take note of.

The bonus 4 miles per dollar earns rate has a spending cap of S$1,000 every monthly statement cycle. After you exceed the spend cap and earn a maximum of 4,000 miles, you will only earn miles at a much-reduced rate of 0.4 miles per dollar.

Also, the card has a foreign currency transaction fee of 3.25%.

As for the annual fee, the card has a low annual fee of S$192.60, which is waived for the first year.

The card also has an annual income requirement of S$30,000 for SCs and PRs and S$42,000 for foreigners.

Citi Rewards Card Promo

New to Citibank credit card applicants will get to enjoy a welcome gift of either a Dyson Supersonic Hairdryer or Apple Watch SE or S$350 cash via PayNow after their application is successfully completed.

Existing cardholders will receive S$30 cash via PayNow with no minimum spend.

Terms and Conditions apply.

In addition, you can earn up to 30,000 Citi ThankYou Points when you spend S$3,000 within the first 3 months.

If you are interested, you can read up more about the cards and apply below:

6. DBS Woman’s Card And DBS Woman’s World Card

Next up, we have the DBS Woman’s Card, a card with somewhat confusing branding as the card can be used by men and women.

Nostalgia aside, you will be glad to know that this card is excellent for online spending and it is not only one of the best credit card for women, it is also a real good card for men.

The DBS card comes in two variants the primary DBS Woman’s Card and the more atas DBS Woman’s World Card, which has a higher income requirement:

| DBS Woman’s Card | DBS Woman’s World Card | |

|---|---|---|

| Age | 21 years and above | |

| Income | S$30,000 and above per annum (Singaporean) S$45,000 and above per annum (Foreigner) |

S$80,000 and above per annum (Singaporean or Foreigner) |

| Annual Fees | S$160.50 (Principal Card) S$80.25 (each Supplementary Card) |

S$192.60 (Principal Card) S$96.30 (each Supplementary Card) |

| Annual Fee Waiver | 1 year^ | |

| Late fee | S$100 (For outstanding balance above S$200) | |

| Finance Charges | 26.80% p.a. chargeable on a daily basis (subject to compounding) | |

Source: DBS

Note: All fees indicated are inclusive of GST where applicable.

^ Charge a minimum of S$15,000 or S$25,000 each year to DBS Woman’s Card or DBS Woman’s World Card respectively to receive the annual fee waiver for the following year. If the minimum spend criteria is not met, or if the card is cancelled within each year of the Principal Cardmember’s Card opening date, the annual fee will be imposed.

The value proposition of this card is also quite simple you get a whole lot of miles on online purchases:

For the DBS Woman’s card, you earn up to five DBS Points/10 miles per S$5 spent online and one DBS Point/two miles per S$5 spent on other purchases.

For the DBS Woman’s card, you earn up to 10 DBS Points/20 miles per S$5 spent online, three DBS Points/two miles per S$5 spent on overseas purchases and one DBS Point/two miles per S$5 spent on other purchases.

Since one DBS Point is worth two airline miles, the conversion ratio for miles per dollar (MPD) in SGD is as follows:

| DBS Woman's Card | DBS Woman's World Card | |

|---|---|---|

| Local Spend | 0.2 mpd | 0.4 mpd |

| Overseas Spend | — | 1.2 mpd |

| Online Transactions | 2 mpd | 4 mpd |

Note that there is a spending cap of S$1,000 per calendar month on all online spending for the Woman’s card and S$2,000 for the Woman’s World card. If you spend any more than that, you will only earn 0.4 airline miles per dollar.

But, there is no minimum spend for this card.

Another thing to take note of is that DBS points expire after just one year, and there is a 3.25% fee charged by DBS for any foreign currency transactions on the Woman’s cards.

Thus, you should avoid transacting in foreign currencies.

You can exchange DBS points for KrisFlyer miles, Cathay Pacific Asia Miles and Qantas Frequent Flyer points.

Each transfer will cost you S$26.75 regardless of the number of points transferred.

DBS Woman’s Card Promo

New to DBS credit card applicants will get to enjoy a welcome gift of S$300 cashback with the promo code ‘OCTFLASH.’

This promotion is valid from now to 18 October 2021.

Also, a minimum spend of S$300 within 30 days of card approval is required. Terms and Conditions apply.

If you are interested, you can read up more about the cards and apply below:

7. UOB PRVI Miles Mastercard

Last but not least, we have the UOB PRVI Miles Mastercard.

The card offers:

- Foreign currency spend: S$1 = 2.4 miles (UNI$5 per S$5 spend)

- Local Spend: S$1 = 1.4 miles (UNI$3.50 per S$5 spend)

- Public Transport Spend (Bus and Train Rides/SimplyGo): S$1 = 1.4 miles (UNI$3.50 per S$5 spend)

- Redemption: UNI$ points earned can be used to redeem cashback or vouchers for shopping, dining and more.

- SMART$ Scheme: But, you will earn SMART$ when you use the UOB PRIVI Miles Mastercard at the following places:

- Cold Storage

- GIANT

- Guardian

- Jasons

- Market Place

- Thus, you should avoid using your card at these merchants, as you will earn miles at a lower rate if you spend at these stores.

Do note that any ‘UNI$ balance shall expire two years from the last day of each periodic quarter (“UNI$ period”) in which the UNI$ was earned.’ You can check the expiry date of the UNI$ in your UOB app.

There is also no spending cap, and no minimum spend requirement.

But there is a 3.25% foreign currency transaction fee.

In addition, the card has an annual fee of S$256.80. But this fee is waived for the first year.

The card also has an annual income requirement of S$30,000 for SCs and PRs and S$40,000 for foreigners.

UOB PRVI Miles Mastercard Promo

But, now is a good time to sign up for the UOB Privimiles Mastercard as UOB is currently running a promotion from now till 31 December 2021.

Cardholders can earn up to 4.4 miles per $1 online and mobile contactless spend (UNI$11 per $5 spend) on dining, food delivery, groceries, or pharmacies.

In addition, new to UOB credit card applicants will stand to receive S$300 cashback.

Note that this promotion is valid till 31 October 2021 and is only applicable to subsequent 100 new UOB card applicants.

Also, a minimum spend of S$1,500 must be made on eligible goods and services within 30 days from card approval is required.

Terms and Conditions apply.

If you are interested, you can read up more about the card and apply below:

Bonus: Get Extra 1% Cash Back!

That’s not all.

Did you know that you can earn an extra 1% cashback on top of other card rewards?

You simply have to sign up for an Instarem multi-currency account and apply for the Instarem Amaze card.

Next, you will have to link your Mastercard credit card to the Instarem Amaze card.

FYI: You can link up to five Mastercard debit or credit cards to the card, eliminating the need to carry multiple cards with you.

Thus, the 1% cashback we talked about comes in addition to existing cashback on your linked debit and credit cards.

But, you will need to spend a minimum of S$5 per transaction and spend at least S$500 per quarter to enjoy the Instarem Amaze cashback.

There is also a S$100 cap on the cashback you can receive per quarter.

You can read more about Instarem Amaze here.

Related Articles:

Advertisement