Best Credit Cards for Online Shopping and Online Payment in Singapore 2020

Online Shopping and Mobile Payments

Online shopping comes with many perks.

Our purchasing journey is now made convenient with technology, and we are now able to access a wider range of products without having to step out of the house.

On the flip side, I now am a proud owner of more pair of shoes than my family combined.

This online shopping addiction, if not dealt with properly, can lead to undesirable consequences.

There are a few ways you can maximise our purchases and save more money.

You can either:

- Use a cashback platform to earn cashback on eligible merchants

- Use the best credit cards for online shopping to maximise your rewards for your online spending in the form of cashback, miles or reward points.

- STOP SHOPPING!

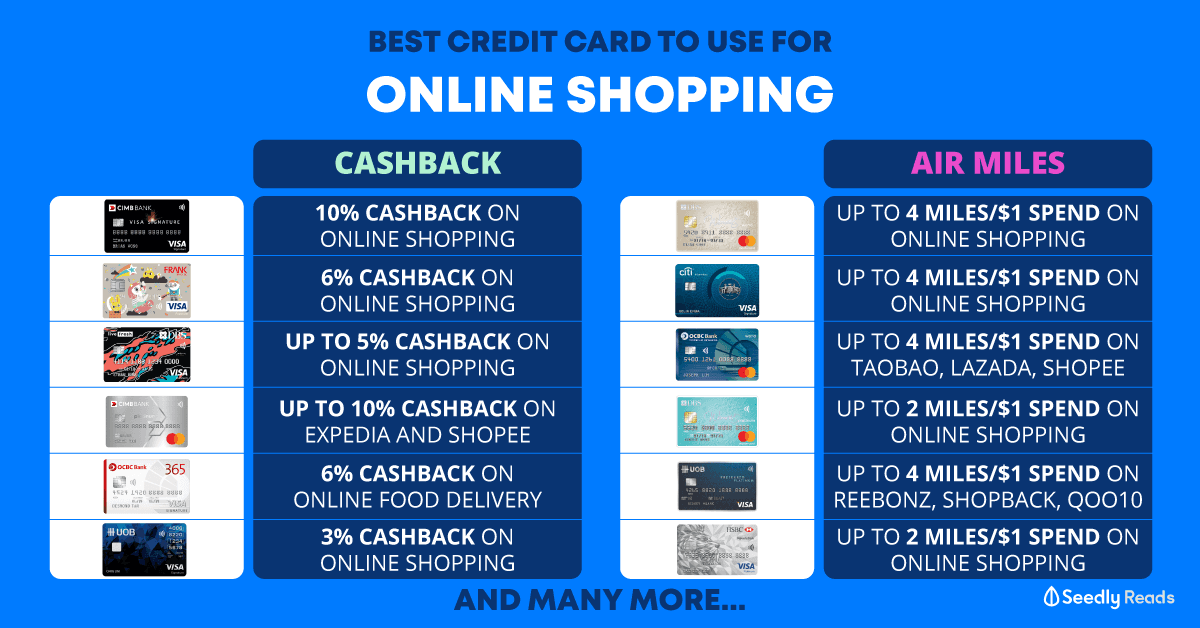

Best Credit Cards for Online Shopping and Payment Online

Here’s a compilation of the best credit cards for your online shopping and online payment needs:

| Credit Card | Online Shopping and Mobile Payment Benefits |

|---|---|

| CIMB Visa Signature | 10% cashback on Online shopping |

| OCBC FRANK Card | 6% cashback on online shopping |

| DBS Woman's World Card | Up to 4 miles/S$1 spend on online shopping |

| DBS Live Fresh Card | Up to 5% cashback on online spend and contactless spend |

| Citi Rewards Credit Card | Up to 4 miles/ $1 spend on online shopping |

| CIMB Platinum Mastercard | Up to 10% off on Expedia and Shopee |

| OCBC 365 Credit Card | 6% Cashback on Online food delivery orders (Eg. Foodpanda and Deliveroo) 3% cashback on online grocery deliveries (eg. FairPrice On and RedMart) 3% cashback on online air and cruise ticket purchases 3% cashback on online hotel and tour bookings (e.g. Agoda and Airbnb) |

| OCBC Titanium Rewards Card | 4 miles/$1 spend on online stores such as Alibaba, Lazada, Shopee, Qoo10, Taobao etc. |

| DBS Woman's Card | Up to 2 miles/$1 spend |

| UOB YOLO Card | Up to 10% cashback on online shopping (Eligible cardholders only) 3% Cashback on Online Fashion and Online Travel spend if not eligible. |

| UOB Preferred Platinum Visa Card | Up to 4 miles/$1 spend at online stores such as Qoo10, Reebonz and Shopback |

| Standard Chartered Spree Credit Card | 2% cashback on online shopping 3% when you shop online with foreign currency |

| Bank of China Family Card | 3% cashback on online shopping, groceries and hospital bills |

| CIMB Visa Infinite | 2% cashback on online spending in foreign currency 1% cashback on all other spending (Minimum spend of S$2,000) |

| HSBC Revolution Credit Card | Up to 2 miles/$1 spend on online shopping |

| BOC Zaobao Credit Card | 3% cashback on online shopping |

| UOB KrisFlyer Credit Card | 1.8 KrisFlyer Miles/$1 spend on online shopping 3 KrisFlyer miles/$1 spend on Singapore Airlines, SilkAir, Scoot and KrisShop |

The above table sorted out based on the Most Popular credit cards for online shopping based on real user reviews.

If you are a fan of online market places such as Lazada and Shopee, they each launched their own promotion with various banks in Singapore too.

Note: the various credit cards all come with their respective terms and conditions. So please read through them before deciding which credit card to get!

How Can I Maximise My Savings For Online Shopping and Online Payment?

The two main popular ways of maximising your online purchases are through the earning of cashback or gaining miles.

Depending on the type of credit card that is right up your street, we sort them out for you based on the amount of cashback.

Do take note that for some cards, there is a cap to the amount of cashback or miles you can earn from your online purchases.

Best Cashback Credit Card for Online Shopping Spending and Payment Online

You can save more on your online spend simply by choosing the best cashback credit card on your online expenses.

| Credit Card | Online Shopping and Mobile Payment Benefits | Terms and Conditions |

|---|---|---|

| CIMB Visa Signature | 10% cashback on Online shopping | Minimum spend of $800 a month on card. Cashback capped at $100 per month |

| OCBC FRANK Card | 6% cashback on online shopping | Minimum offline spend of $400 a month required on OCBC FRANK Card. |

| DBS Live Fresh Card | Up to 5% cashback on online spend and Visa contactless spend | Minimum spend of $600 a month on DBS Live Fresh card. |

| CIMB Platinum Mastercard | Up to 10% off on Expedia and Shopee | Minimum spend of $800 a month on CIMB Platinum Mastercard. Cashback Capped at $100 per month. |

| OCBC 365 Credit Card | 6% Cashback on Online food delivery orders (Eg. Foodpanda and Deliveroo) 3% cashback on online grocery deliveries (eg. FairPrice On and RedMart) 3% cashback on online air and cruise ticket purchases 3% cashback on online hotel and tour bookings (e.g. Agoda and Airbnb) | Minimum spend of $800 a month on OCBC 365 credit card. |

| UOB YOLO Card | Up to 10% cashback on online shopping (Eligible cardholders only) 3% Cashback on Online Fashion and Online Travel spend if not eligible. | Minimum spend of $600 a month on UOB YOLO card. |

| Bank of China Family Card | 3% cashback on online shopping | Minimum spend of $800 a month onBOC Family card. 0.3% cashback if minimum spend not met. |

| BOC Zaobao Credit Card | 3% cashback on online shopping | Minimum spend of $600 a month on card. Capped at $30 per month. |

| Standard Chartered Spree Credit Card | 2% cashback on online shopping 3% when you shop online with foreign currency | No minimum spend. Cashback capped at $60 per month. |

| CIMB Visa Infinite | 2% cashback on online spending in foreign currency 1% cashback on all other spending | Minimum spend of $2,000 a month on CIMB Visa Infinite card. |

- Based on the amount of cashback on online shopping, CIMB Visa Signature and OCBC FRANK give the highest cashback for online shopping.

- CIMB Visa Signature, however, has a cashback cap of $100 per month.

- OCBC FRANK requires you to spend $400 a month on offline spend.

- DBS Live Fresh is next down the line with up to 5% cashback on online spend and Visa contactless spend. A minimum spend of $600 is required.

In order to maximise your cashback or cash rebate from your online spend, it is important to understand the terms and condition of your cashback credit card.

The amount of cashback you receive from your online shopping depends on a few factors:

- The amount of cashback your credit card entails you to on the category of purchase.

- The amount of money you spend

- The maximum amount of cashback you can receive per month for your credit card

- The minimum spend required on your credit card in order to qualify for cashback

Best Air Mile Credit Card for Online Shopping Spending and Payment Online

If you prefer to convert your online spend to air miles, here’s a compilation of some of the best miles card for online shopping spend and online payment.

| Credit Card | Online Shopping and Mobile Payment Benefits | Terms and Conditions |

|---|---|---|

| DBS Woman's World Card | Up to 4 miles/S$1 spend on online shopping | Capped at 8,000 miles per month |

| Citi Rewards Credit Card | Up to 4 miles/ $1 spend on online shopping | Capped at 4,000 miles per month |

| OCBC Titanium Rewards Card | 4 miles/$1 spend on online stores such as Alibaba, Lazada, Shopee, Qoo10, Taobao etc. | Capped at 48,000 miles (120,000 OCBC$) per year |

| DBS Woman's Card | Up to 2 miles/$1 spend | Capped at 4,000 miles per month |

| UOB Preferred Platinum Visa Card | Up to 4 miles/$1 spend at online stores such as Qoo10, Reebonz and Shopback | Capped at 4,000 miles (UNI$2,000) per month |

| HSBC Revolution Credit Card | Up to 2 miles/$1 spend on online shopping | Capped at 400 miles (1,000 HSBC Rewards points) per month for online spend |

| UOB KrisFlyer Credit Card | 3 miles/$1 spend on Singapore Airlines, SilkAir, Scoot and KrisShop 1.2 KrisFlyer Miles/$1 spend on online shopping 3 KrisFlyer miles/$1 spend on Singapore Airlines, SilkAir, Scoot and KrisShop | No cap |

- As banks label their points differently (eg. OCBC$, UNI$), it is important that we convert them to the same unit, miles, when deciding on the card to apply for

- The highest miles awarded for every dollar spend on online shopping is 4 miles per dollar. There are 5 cards that offer such conversion rate

- DBS Woman’s World Card, Citi Rewards Credit Card, OCBC Titanium Rewards Card, DBS Woman’s Card and UOK Preferred Platinum Visa Card offers up to 4 miles/$1 spend for online shopping

- DBS Woman’s World Card has the highest cap for miles per month at 8,000 miles per month

In order to maximise the number of miles earned from your online shopping, it is important to pay attention to understand the terms and condition for your miles card.

The amount of miles you can earn depends on a few factors:

- The amount of miles your air miles credit card entails you to on the category of purchase

- The amount of money you spend

- The maximum amount of miles you can receive per month or per year for your miles credit card

While we recommend maximising every dollar you spend with the use of your preferred credit card, mismanaging our budget and spending more than what we can afford is unhealthy.

Given that online shopping is now seamless and convenient with the help of credit cards and technology, there is a higher tendency that we overspend.

It is important to keep track of our monthly expenses.

Advertisement