When I became a pet owner, I didn’t know what I was in for.

Not because I wasn’t sure about the responsibilities as a first-time owner but because I wasn’t clear how much I would be spending as I was nursing a rescued kitten then.

Believe it or not, I only had two credit cards then – a UOB Preferred Platinum and a Citibank Cashback Plus card.

And, when the vet fees piled up during the first month, that’s when I knew I should be getting other cards to reap their rewards. If not, it’s a waste, isn’t it?

I could’ve been racking up miles or saving some money through cashback or cash rebates while making sure my pet’s needs were taken care of.

So, what cards are we looking at? Let’s see.

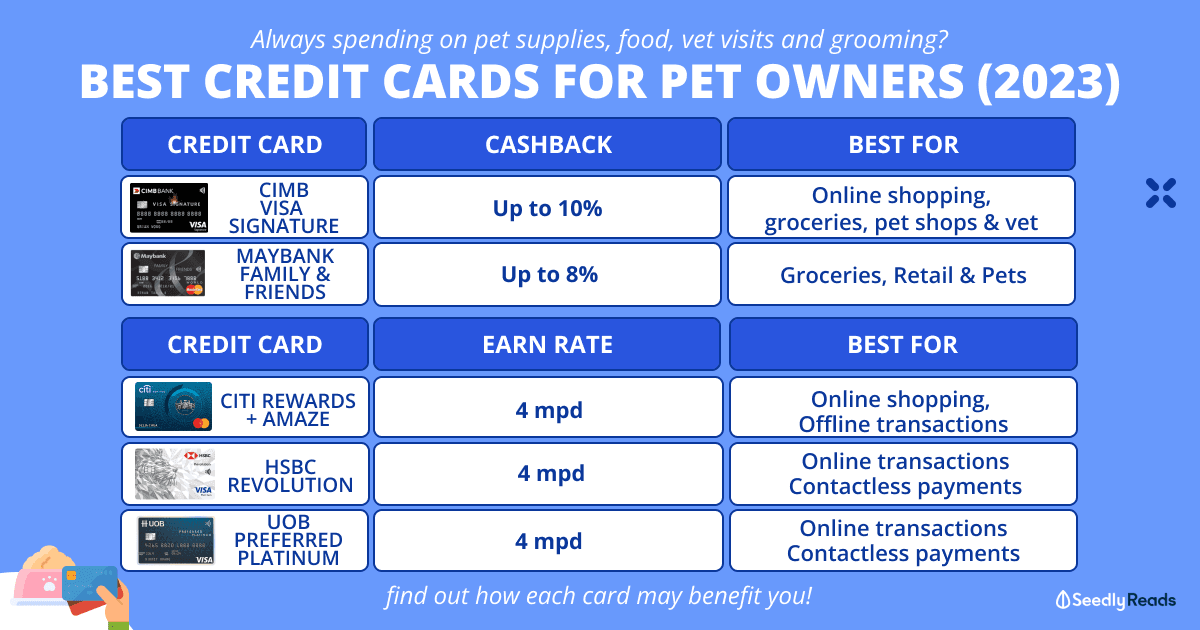

TL;DR: Best Credit Cards For Pet Ownership

| Best Cashback Cards (Overall) | Benefits | Promos |

| CIMB Visa Signature | Up to 10% cashback on online shopping, groceries, pet shops & veterinary service merchants | N.A. |

| Maybank Family & Friends Card | Up to 8% cashback on Groceries and Retail & Pets, capped at S$125 per month + unlimited 0.3% cash rebates for spending below S$800 | Get S$100 cash credit by applying for a new Maybank Credit Card and CreditAble Account, and charge to your Credit Card and/or withdraw from your CreditAble Account a minimum of S$300 for each of the first two consecutive months upon approval |

| Best Miles Cards (Overall) | Benefits | Promos |

| Citi Rewards Card (+ Amaze)

Citi Rewards Card: Instarem Amaze Card: |

4 mpd

|

Receive an Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$503.65) or Nintendo Switch (worth S$469) or Dyson V8 Slim Fluffy™ (worth S$509). Valid till 17 May 2023. |

| HSBC Revolution

|

4 mpd

|

Enjoy up to S$200 cashback when you sign up for an HSBC credit card and the HSBC Everyday Global Account. |

| UOB Preferred Platinum | 4 mpd

|

Get S$350 Grab vouchers for the first 200 new-to-UOB Credit Cardmembers who successfully apply for a selected UOB Credit Card by 31 May 2023 and have spent a minimum of S$1,000 per month for 2 consecutive months from the card approval date. |

Best cashback cards for pet expenses:

- American Express True Cashback

- CIMB Visa Signature Card

- HSBC Revolution

- Maybank Family & Friends

- OCBC Frank Credit Card

- POSB Everyday

- UOB Absolute Cashback

- UOB EVOL Card

Best miles cards for pet expenses:

- Citi Rewards Card

- DBS Woman’s World

- HSBC Revolution

- Maybank Horizon Visa Signature

- OCBC Titanium Rewards

- UOB Lady’s Card

- UOB Visa Signature

- UOB Preferred Platinum Visa

For this article, I’m only looking at local spending and will not be including foreign currency transactions since most pet expenses are incurred locally.

Pro-tip: Look for a credit card that offers rewards or cashback for spending on pet-related expenses, as they may offer higher rewards or cashback for spending on pet grooming or veterinary services, which can help you save money in the long run. Secondly, there might be credit card offers or privileges at some pet grooming and veterinary clinics, so check with the service provider.

Merchant Category Codes

The Merchant Category Code (MCC) comprises four digits and serves to characterize a merchant’s primary business activities.

In the realm of credit card rewards, MCCs hold significant importance as banks provide bonus miles or cashback based on MCCs. Hence, selecting the appropriate MCC can make all the difference in earning a substantial number of miles on a considerable purchase or ending up with no rewards.

However, regular consumers like us would not be familiar with the MCCs unless we take the effort to memorise their codes before making any purchases.

Here comes a new service called Max, a website launched recently that utilises the Visa Merchant Lookup API to furnish MCCs.

What you need to do is:

- Set up an account

- Key in the merchant

And the merchant code would appear just like that.

Isn’t this extremely convenient?

Without further ado, let’s take a look at the cards!

Disclaimer: This is a non-sponsored article. The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before signing up for any products.

Best Cashback Credit Cards For Pet Expenses & Bills

American Express True Cashback

| Cashback | Up to 3% cashback for the first 6 months on all eligible purchases you make locally and overseas, up to S$5,000 spent in the first 6 months as a welcome bonus.

Thereafter, you will get unlimited 1.5% cashback on all eligible purchases. |

| Eligible categories | Travel expenses, Grocery shopping, Online shopping, Large expenses like home improvement, Education fees, Insurance, Healthcare, Utilities & Telco |

| Best for |

|

| Payment method | Online, In-store |

| Minimum spend | NIL |

| Promotions | Enjoy a welcome bonus of 3% cashback on up to S$5,000 eligible purchases within the first 6 months. |

The American Express True Cashback card offers 3% cashback for the first 6 months on all eligible purchases you make locally and overseas, up to S$5,000 spent in the first 6 months as a welcome bonus.

On top of that, there is an unlimited 1.5% for all eligible purchases, and you can receive this cashback immediately.

This card allows you to earn cashback regardless of whether you purchase your pet supplies and food online or offline.

CIMB Visa Signature Card

| Cashback | Up to 10% cashback on online shopping, groceries, pet shops & veterinary service merchants.

*Capped at S$100 cashback per statement month, at S$20 per category |

| Eligible categories | Online shopping platforms with pet-related items: Alibaba, Amazon, Ezbuy & Shopee

Grocers: Grocery spending shall include all local and overseas transactions made in supermarkets. All grocery transactions made online will be eligible under this category Pet Shops and Veterinary Services: The spending shall include all local and overseas transactions made at all Pet Shops and for Veterinary Services |

| Best for | Online, In-store |

| Payment method | Any |

| Minimum spend | S$800 per month. If not, you will receive unlimited 0.2% base cashback. |

| Promotions | N.A. |

| Sign up | Apply Now |

The CIMB Visa Signature card is one to hold if your monthly expenses are at least S$800.

What’s great about this card is that there are no annual fees applied. In fact, all CIMB cards don’t have an annual fee.

Do note that the transactions performed for online shopping do not include pet stores, but you can purchase your pet-related items from any of these e-commerce websites which will still allow you to be eligible under the Online Shopping category: Alibaba, Amazon, Ezbuy & Shopee

HSBC Revolution Credit Card

| Cashback |

*Bonus 10X points are capped at S$1,000 spend per calendar month |

| Eligible categories | Food deliveries, online shopping, travel & any other spending |

| Best for | Online, In-store |

| Payment method | Online transactions or contactless payment through Visa PayWave, Apple Pay, and Google Pay |

| Minimum spend | NIL |

| Promotions | Enjoy up to SGD200 cashback when you sign up for an HSBC credit card and the HSBC Everyday Global Account. |

| Sign up | Apply Now |

The HSBC Revolution is kinda like a powerhouse for both cashback and miles chasers.

If there is one card that you can hold for anything, this is probably the one as it wins in all departments for its versatility.

Similar to the CIMB Visa Signature, there’s also no annual fee applied for this card.

HSBC states that you can get an additional 1% cashback* on your credit card spending with the HSBC Everyday+ Rewards Programme when you:

- Step 1 Save: Deposit fresh funds of a minimum of $2,000 (or $5,000 for HSBC Premier customers) into your HSBC Everyday Global Account each calendar month.

- Step 2 Transact: Perform a minimum of five Eligible Transactions^ each calendar month.

Note: The additional 1% HSBC Everyday+ Cashback is capped at $300 (or $500 for HSBC Premier customers) per calendar month.

*HSBC Everyday+ Rewards Programme T&Cs apply.

^Eligible transactions refer to posted transactions in SGD made with HSBC credit cards and/or HSBC Everyday Global Debit Card, GIRO bill payments in SGD made via HSBC Everyday Global Account and/or fund transfers from HSBC Everyday Global Account to a non-HSBC account.

Needless to say, this card also works as a miles card.

At 4 mpd for online transactions and contactless payment, you can expect to earn miles rather quickly.

But from January 2024, the HSBC Revolution card’s whitelist will narrow to exclude Travel. Merchants categorized under MCCs 4722 and 7011 will no longer qualify for earning 4 miles per dollar (mpd). As such you will need to find an alternative card for transactions with Klook, Pelago, various online travel agencies (OTAs), as well as Airbnb and specific hotels.

Maybank Family & Friends

| Cashback | Up to 8% cash back on Groceries and Retail & Pets, capped at S$125 per month + unlimited 0.3% cash rebates for spending below S$800

*Capped at $15 Daily$ *Capped at S$80 combined cashback across all categories (S$25 cashback per calendar month per category) |

| Eligible categories | Groceries, Dining & Food Delivery, Transport, Data Communication & Online TV Streaming, Retail & Pets, Online Fashion, Entertainment, Pharmacy, Sports & Sports Apparel, Beauty & Wellness |

| Best for | Online, In-store |

| Payment method | Online transactions

Mobile contactless payments |

| Minimum spend | S$800 per month |

| Promotions | Get S$100 cash credit by applying for a new Maybank Credit Card and CreditAble Account, and charge to your Credit Card and/or withdraw from your CreditAble Account a minimum of S$300 for each of the first two consecutive months upon approval |

It’s not hard to hit a minimum of S$800 per month if you consolidate all your spending on the Maybank Family & Friends Card.

When there’s any urgent need to purchase items for your pet at a retail store, Retail & Pets is an eligible category for you to earn cashback from.

OCBC Frank Credit Card

| Cashback | Up to 8% cashback per month on SGD transactions made online or in-store via contactless payments (capped at S$25)

Up to 0.3% cashback on all other eligible spends (capped at S$25) Up to 2% cashback on transactions made at selected green merchants including SimplyGo, BlueSG, Scoop Wholefoods, etc. (capped at S$25) |

| Eligible categories | Any SGD Transactions made online and via mobile contactless (refer to Terms and Conditions for exclusions)

Eligible transactions made at selected green merchants must be made via any Visa |

| Best for | Online shopping: Online purchases made in SGD Contactless transactions, any purchases made via Apple Pay, Samsung Pay, Google Pay, Fitbit Pay, or Garmin Pay in SGD |

| Payment method | Online

Mobile contactless payment |

| Minimum spend | S$800 per month |

| Promotions | N.A. |

OCBC Frank Credit Card is a no-frills card that allows you to reap cashback as long as you meet the minimum spend and did not use it for any excluded merchants.

There’s a catch though. The cashback you can earn is capped at S$25 per month for each spending category, but you can earn up to S$100 cashback per month.

You should make use of the green merchant’s list to get the 2% cashback!

POSB Everyday

| Cashback | Up to 5% cash rebates on groceries online and offline

Up to 3% cash rebates at Pet Lovers Centre |

| Eligible categories | Supermarkets: NTUC, Sheng Siong, and Cold Storage

Online merchants: RedMart, Qoo10, Amazon & Shopee Pet Lovers Centre |

| Best for | Online, In-store |

| Payment method | Any |

| Minimum spend | S$800 per month |

| Promotions | Get S$150 cashback when you sign up for the POSB Everyday Card by 30 June 2023.

Here’s how: 1) Apply online with promo code 150CASH 2) Charge a minimum of S$800 within the first 60 days from the card approval date *Exclusive to applicants who do not hold any Principal DBS/POSB Credit Card and have not canceled any DBS/POSB Credit Card(s) in the last 12 months. |

| Sign up | Apply Now |

If your pet has a raw or cooked food diet, the POSB Everyday card might just be the card for you because you can get cash rebates for purchasing from the grocers.

Besides, there’s a signup promotion from now till 30 June 2023 where you can get up to S$150 cashback!

UOB Absolute Cashback

| Cashback | 1.7% unlimited cashback on all spending including insurance, school fees etc. |

| Eligible categories | No spend exclusions |

| Best for | Any |

| Payment method | Any |

| Minimum spend | NIL |

| Promotions | NIL |

| Sign up | Apply Now |

The UOB Absolute Cashback card has what I believe is one of the highest unlimited cashback rates.

You can virtually use it for anything, but just not for Grabpay wallet top-ups because it has been nerfed to 0.3%.

UOB EVOL Card

| Cashback | Up to 8% cashback on Online Spend and Mobile Contactless Spend

Up to 0.3% cashback on all other spend Capped at S$60 cashback cap per statement month (S$20 per category) |

| Eligible categories | Refer to Terms & Conditions for exclusions |

| Best for | In-store |

| Payment method | Any |

| Minimum spend | S$600 per month |

| Promotions | Be the first 50 new-to-UOB Credit Cardmembers in the month to sign up and meet a min. monthly spend of S$800 within the first 2 months.

All you need to do is to register for this promotion via an SMS to 77862 before 30 Jun 2023: SMS EVOLGIFT‹space› last 4 alpha-numeric characters of NRIC/passport (eg. EVOLGIFT 123A) |

| Sign up | Apply Now |

Say your expenses are low in general, the UOB EVOL Card is one that might be suitable for you.

You can use the card for any pet-related purchases online and in-store (must be mobile contactless) and still be able to get your cashback without having to overspend.

Best Miles Credit Cards For Pet Expenses & Bills

Pet grooming and vet visits are costly routines for many pet owners, with each trip ranging from at least $30 to $150 for grooming.

As for vet visits, you can expect to spend at least $70 per vet consultation, with some racking up at least a few hundred or a thousand.

When this happens, you might want to use a miles card instead of a cashback card since these bills can be unexpectedly high.

Citi Rewards Credit Card + Amaze

| Earn rate | 4 mpd |

| Eligible categories | When used alone: Online shopping (excluding travel)

When paired with an Amaze card: In-store (excluding travel and contactless payment) *Capped at S$1,000 per statement month, excludes travel |

| Best for | Online shopping: Any except travel

Offline: Only when paired with an Amaze card |

| Payment method | Online transactions, Mastercard |

| Promotions | Receive an Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$503.65) or Nintendo Switch (worth S$469) or Dyson V8 Slim Fluffy™ (worth S$509)

Valid till 17 May 2023. |

| Sign up | Citi Rewards Card:

Instarem Amaze Card: |

When paired with the Instarem Amaze card, Citi Rewards Credit Card is often compared to the HSBC Revolution credit card.

You can virtually use this card for anything online except these overseas spending: airlines, hotels, car rentals, and other travel transactions.

This would be an easy way of earning 4 mpd on all transactions (except travel) as it converts all offline spending into online transactions when you’re at the vet or groomer’s where you have to make physical payments.

DBS Woman’s World Credit Card

| Earn rate | 4 mpd |

| Eligible categories | Online spending

Capped at S$2,000 per month |

| Best for | Online shopping |

| Payment method | Online transactions |

| Promotions | Get S$150 cashback when you apply with the promo code ‘150CASH’ and make a min. spend of S$800 within 60 days of card approval.

Valid till 30 Jun 2023. |

| Sign up | Apply Now |

This is a card designed for those who love to shop online (including the travel category).

If you only purchase pet supplies and food online, this should be the card for you. However, it might not be useful if you use it at the groomer’s or vet clinics.

Though the card is marketed as a Woman’s card, males are welcome to apply for it too!

Maybank Horizon Visa Signature Card

| Earn rate | 3.2 mpd on restaurant dining, petrol, public transport, hotel bookings at Agoda

(min spend. S$300 per month) |

| Eligible categories | On Grab and taxis |

| Best for | Transporting pets |

| Payment method | Any |

| Promotions | NIL |

Though it’s 3.2 mpd and not 4 mpd, I’m still listing Maybank Horizon Visa Signature card as it’s useful for the transportation of pets.

Some of us who don’t own a car will have to either call for a taxi or Grab to ferry our pets to and fro.

This will be useful to those who love to earn some miles especially if they engage in ride-hailing services all the time.

OCBC Titanium Rewards Card

| Earn rate | 4 mpd |

| Eligible categories | Online spending and certain retail spending (refer to Terms and Conditions)

Capped at S$13,335 per membership year |

| Best for | Online: Alibaba, AliExpress, Amazon, Daigou, Ezbuy, Qoo10, Shopee, Lazada, Taobao

In-store: Mustafa Centre, IKEA, and merchants with specific Merchant Category Codes |

| Payment method | Online transaction |

| Promotions | NIL |

| Sign up | Apply Now |

OCBC Titanium Rewards card is good for large expenses as the bonus cap is on an annual basis. While it can be used for most of the popular e-commerce platforms, retail-wise, it’s quite limited.

You would have to check the MCCs before proceeding with any high-value purchases just in case.

UOB Lady’s Card

| Earn rate | 6 mpd |

| Eligible categories | Beauty & Wellness, Dining, Travel, Family, Entertainment, Fashion and Shopping, Transport

Capped at S$1,000 per calendar month |

| Best for | Select one category |

| Payment method | Any |

| Promotions | Get S$350 Grab vouchers for the first 200 new-to-UOB credit card customers who successfully apply for an eligible UOB Credit Card between 1 May 2023 and 31 May (both dates inclusive) and spend a min. of S$1,000 for 2 consecutive months from their card approval date, they will receive Grab vouchers worth S$350. |

| Sign up | Apply Now |

If you haven’t heard, the UOB Lady was enhanced earlier this year to allow you to earn 6 mpd instead of 4 mpd!

So far, this is the only card in the market that allows you to do so. It is, however, only available for females.

If you’ve chosen Family as your bonus category and make frequent purchases at groceries to cook for your pets, it’s safe to know that UOB$ merchants like Cold Storage and Giant will still give you miles and bonus points (up to 3.6 mpd).

Similarly, you can switch to Transport if ferrying your furkid is what you do all the time especially if you need to send it for training.

UOB Visa Signature Card

| Earn rate | 4 mpd |

| Eligible categories | Overseas transactions (including online), Petrol, and Contactless transactions

Capped at $2,000 per month (i.e. UNI$4,000) *Card transactions made overseas but effected in Singapore dollars will be treated as transactions in Singapore dollars and will earn UNI$1 for every S$5 spent. |

| Best for | Contactless payment (excluding UOB$ merchants) |

| Payment method | Contactless payment using Visa payWave or mobile payment |

| Promotions |

Get S$350 Grab vouchers for the first 200 new-to-UOB Credit Cardmembers who successfully apply for a selected UOB Credit Card by 31 May 2023 and have spent a minimum of S$1,000 per month for 2 consecutive months from the card approval date. |

| Sign up | Apply Now |

Excluding UOB$ merchants, the UOB Visa Signature card is pretty much useful when used for contactless payments at the vet or groomer.

UOB Preferred Platinum Visa

| Earn rate | 4 mpd |

| Eligible categories | Selected Online Transactions (local or overseas) |

| Best for | Online shopping, Contactless payment

Capped at S$1,110 per calendar month |

| Payment method | Contactless payment via Apple Pay, Fitbit Pay, Google Pay, or Samsung Pay |

| Promotions |

Get S$350 Grab vouchers for the first 200 new-to-UOB Credit Cardmembers who successfully apply for a selected UOB Credit Card by 31 May 2023 and have spent a minimum of S$1,000 per month for 2 consecutive months from the card approval date. |

Similar to UOB Visa Signature, the UOB Preferred Platinum is great for contactless payment without category exclusions.

It’s no wonder this card is what most people go for when they first started their miles games. I’ve personally used this card for vet visits and I’d say it’s worth getting when I review my monthly statement.

Best Credit Cards For Pet Insurance

As you might already know, most credit cards do not offer rewards for paying your regular expenses like rent, insurance, income tax, season parking, and condominium maintenance fees, and this includes pet insurance.

But, here’s where services from companies like CardUp, ipaymy, RentHero, and banks like Citibank, Standard Chartered, and UOB come into play.

Afterthoughts

Getting a credit card requires you to be disciplined with the way you spend.

If you haven’t read up on the difference between a cashback and a miles card, it’s probably time for you to do so. After all, pet ownership is a journey and your expenses may or may not increase as your pet ages.

Have something to share? Head over to the Seedly Community to share!

Related Articles:

- Best Credit Cards For Petrol in Singapore (2023): Latest Petrol Prices & Discounts

- Visa Credit Card Surcharge Fees in Singapore: Avoid These to Protect Your Hard Earned Money!

- Best Credit Cards for Public Transport (2023)

- 11 Best Credit Cards for Utility Bills In Singapore 2022

- Best Credit Cards for Complimentary Airport Lounge Access

Advertisement