Which Child Development Account (CDA) Should You Open for Your Child in 2022?

Ruth Lum

Ruth Lum●

The trick to acing personal finance is to start early.

How early, you ask? As early as your child is born!

And the Child Development Account (CDA) can help you with that.

Besides receiving a token sum from the government for contributing to the birthrate, you can also look into depositing their yearly ang bao money to start building their savings while they grow up.

Check out our comparison of all the CDA accounts in Singapore to find out which one is best for you and your child’s needs!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised financial advice. Readers should always do their own due diligence and consider their financial goals before committing to any financial product and consult your financial advisor before making any decisions.

Information is accurate as of 20 September 2021. Do not that the rates and promotions are subject to change without prior notice.

TL;DR: What is The Best Child Development Account (CDA) Account For Your Child?

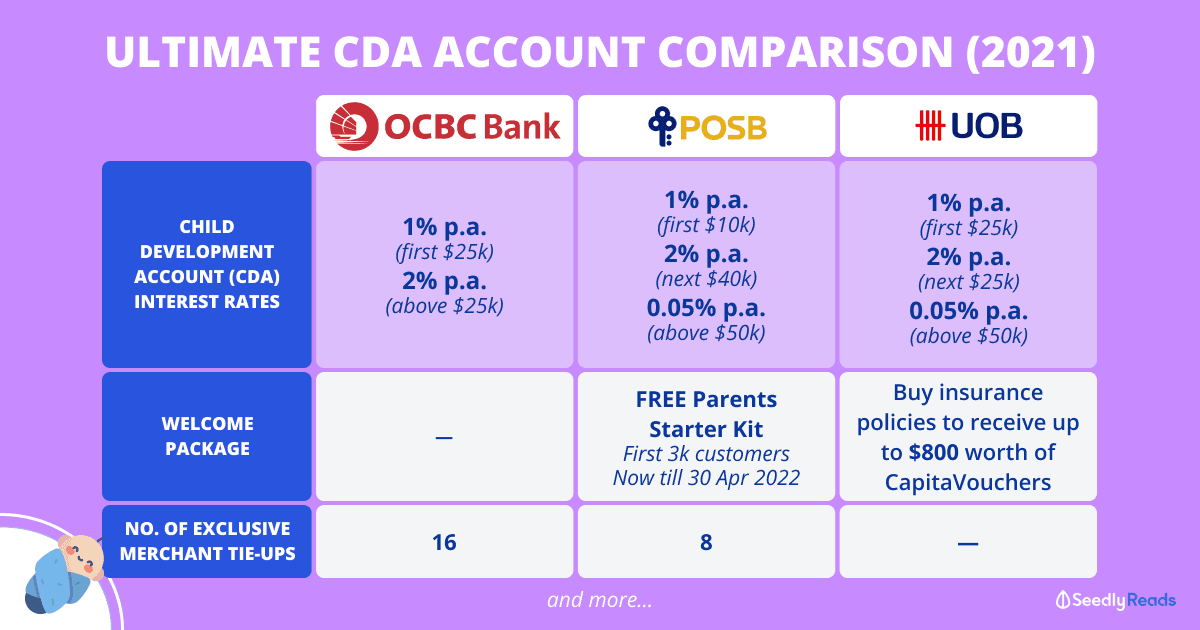

| OCBC CDA | POSB Smiley CDA | UOB CDA | |

|---|---|---|---|

| CDA Account Interest Rates | 1% p.a. first $25,000 2% p.a. above $25,000 | 1% p.a. first $10,000 2% p.a. next $40,000 0.05% p.a. above $50,000 | 1% p.a. first $25,000 2% p.a. next $25,000 0.05% p.a. above $50,000 |

| Welcome Package | - | The POSB Parent Starter Kit consists of the following items: -1 x Nursing Shawl by Philips -1 x Pampers Premium Care Tape Diapers – Newborn Size by P&G -1 x Disposable Breast Pads by Philips -1 x Breast Milk Storage Cup by Phillips Limited to the first 3,000 redemptions on a first-come-first-serve basis, while stocks last. Promotion period is from 1 July 2020 to 30 April 2022 | Purchase an insurance policy to protect yourself or your child and receive up to S$800 worth of CapitaVouchers*. |

| Number of Exclusive Merchant Deals | 16 | 8 | - |

What is the Child Development Co-Savings (Baby Bonus) Scheme?

Every Singaporean baby is eligible for the Baby Bonus scheme, which is Singapore’s way of saying “Make more babies!”

When you open a CDA account for your child, your child will receive the following benefits under the baby bonus scheme:

Baby Bonus Payout (1st Child) Payout (2nd Child) Payout (3rd, 4th Child) Payout (5th Child Onwards)

One-Off Baby Support Grant (Nuclear Family)

for Singaporean children born between 1 Oct 2020 & 30 Sep 2022$3,000

Cash Gift (Nuclear Family) $8,000 $8,000 $10,000 $10,000

CDA First Step Grant

(Nuclear Family + Unwed Parents)$3,000 $3,000 $3,000 $3,000

CDA Dollar-for-Dollar Matching

(Nuclear Family + Unwed Parents)$3,000 $6,000

(enhanced from Jan 2021 was $3,000)$9,000 $15,000

Total Up to $17,000 Up to $20,000 Up to $25,000 $31,000

Source: Ministry of Social and Family Development

Unfortunately, unwed parents (e.g. single parents) in Singapore are not eligible for the Baby Support Grant and the Baby Bonus Cash Gift Component.

Your child will only receive the First Step Grant and Dollar for Dollar Matching of Savings if they are deemed to be a nuclear family by the Ministry of Social and Family Development (MSF).

Here are the requirements:

- Your child is a Singapore Citizen; and

- The child’s parents are lawfully married.

Also, here are more details about the benefits.

1. Baby Bonus Cash Gift: $8,000 to $10,000 (Nuclear Family)

Parents who form nuclear families with their children can apply to receive the Baby Bonus Cash Gift for every child they have.

They can apply as early as eight weeks before the birth of their child.

The money, which is given in cold hard cash will be credited to the parents’ selected bank account and can be used without restrictions.

2. Baby Support Grant: $3,000 (Nuclear Family)

In addition, a one-off Baby Support Grant will be given to parents of children Singaporean children born between 1 Oct 2020 to 30 Sept 2022.

Also, parents of Singaporean babies born before 1 Oct 2020 with an estimated delivery date between 1 Oct 2020 to 30 Sept 2022 will now be eligible for the grant.

Each couple will get $3,000 for each child born during this time period.

The money will be credited into the same bank account which parents used to receive the Baby Bonus Cash Gift and will be credited from 1 Apr 2021, or within the first month of enrolment into the Baby Bonus Scheme; whichever is later.

You’ll be happy to know that there are no restrictions on the use of the Baby Support Grant.

For information on the Baby Support Grant and Baby Bonus Cash Gift amount, eligibility, and disbursement schedule for your child, please use this Baby Bonus Online Eligibility Check tool

3. CDA First Step Grant: $3,000 (Nuclear Family + Unwed Parents)

You will be getting $3,000 that will be deposited into your child’s CDA under the government’s CDA First Step Grant.

The good thing about this grant is that there is no initial deposit from parents required.

4. CDA Dollar-for-Dollar Matching of Savings: $3,000 – $15,000 (Nuclear Family + Unwed Parents)

For those who didn’t know, the government also matches every dollar you save into your child’s CDA account.

Meaning if you deposit $3,000 into your child’s CDA account, the government will deposit $3,000 into the same account as well!

There are however caps on the dollar to dollar matching scheme depending on how many children you have.:

- First Child: Up to $3,000

- Second Child: Up to $6,000*

- Third and Fourth Child: Up to $9,000

- Fifth Child Onwards: Up to $15,000.

Also, MSF announced in end-February 2021 that the dollar-for-dollar matching cap for the second child has been increased to $6,000 from $3,000 previously.

Thus if your child is a Singaporean whose date of birth or estimated date of delivery (EDD), is on or after 1 January 2021; he/she will be eligible for the higher matching amount of $6,000.

What Is the Child Development Account (CDA) And What Can It Be Used For?

The CDA is special savings account for Singaporean children and can be opened with either POSB/DBS, OCBC or UOB, to help build up funds that can be used for childcare or medical expenses at approved institutions (AIs).

Do note that the Baby Bonus Cash Gift and the Baby Support Grant funds are excluded from this category and can be used without restrictions. But, children of unwed parents can enjoy CDA benefits if they were born on, or after 1 September 2016.

Here is how you can use your child’s CDA:

Approved Uses of the CDA

The CDA can be used to offset baby expenses including, but are not limited to:

- Child Care Centres

- Kindergartens

- Special Education Schools

- Providers of Early Intervention Programmes

- Providers of Assistive Technological Devices

- Medical-related expenses (eg. Approved Vaccinations at Polyclinics)

- MediShield or Medisave-approved Private Integrated Plans

You can view a full list of approved institutions (AIs) registered with the Ministry of Social and Family Development (MSF) where you can use your child’s CDA here.

P.S. Here is a guide on how to maximise your child’s CDA account:

Best CDA Accounts Comparison: POSB vs OCBC vs UOB

With that out of the way, here is our comparison of the CDAs!

| OCBC CDA | POSB Smiley CDA | UOB CDA | |

|---|---|---|---|

| CDA Account Interest Rates | 1% p.a. first $25,000 2% p.a. above $25,000 | 1% p.a. first $10,000 2% p.a. next $40,000 0.05% p.a. above $50,000 | 1% p.a. first $25,000 2% p.a. next $25,000 0.05% p.a. above $50,000 |

| Welcome Package | - | The POSB Parent Starter Kit consists of the following items: -1 x Nursing Shawl by Philips -1 x Pampers Premium Care Tape Diapers – Newborn Size by P&G -1 x Disposable Breast Pads by Philips -1 x Breast Milk Storage Cup by Phillips Limited to the first 3,000 redemptions on a first-come-first-serve basis, while stocks last. Promotion period is from 1 July 2020 to 30 April 2022 | Purchase an insurance policy to protect yourself or your child and receive up to S$800 worth of CapitaVouchers*. |

| Number of Exclusive Merchant Deals | 16 | 8 | - |

*Terms & Conditions Apply. To find out more, do contact UOB.

Verdict

If you look at the freebies, only POSB is currently offering a free POSB Parent Starter Kit for parents who open a POSB Smiley CDA account for their kids.

Whereas OCBC and UOB are currently not offering any free promotional packs.

As for the exclusive merchant deals, UOB does not have any merchant tie-ups while OCBC has almost double the amount that POSB has.

But, you would want to only look at the deals that you will be really making use of instead of just focusing on the number of merchants on board.

OCBC has 16 merchant tie-ups across four categories which you can enjoy when you use your OCBC Baby Bonus Card that comes with the OCBC CDA:

As for POSB, they have eight merchant tie-ups across four categories which you can enjoy when you use your POSB Baby Bonus Nets card that comes with the POSB CDA account.

If you have less than $50,000 in your child’s CDA account, POSB offers the best deal in terms of interest rate as it has a lower threshold (next $40,000) on the amount that earns 2% interest in your child’s CDA account compared to UOB and OCBC (2% on next $25,000).

Thus, in our opinion, POSB is the obvious choice for your child’s CDA account due to the better interest rates, deals and free welcome package.

The Complete Guide: Best Children’s Savings Account (CDA)

Being a parent is not easy, but getting a headstart on your child’s personal finance would definitely help.

If you have any queries or concerns about parenting, know that you are not alone!

You can share your thoughts with our fellow parents in the Seedly Community. 👪

Related Articles

- Best Saving Account in Singapore (2022): Which Bank Is Best for Monthly Interest?

- Best Fuss-Free Savings Accounts With No Conditions in Singapore 2022

- Best Savings Accounts for Kids 2022: Best Places to Grow Your Child’s Money

- Cheat Sheet: Best Savings Accounts in Singapore For Working Adults? – Highest Interest Rates

- Ultimate Cash Management Accounts Comparison

- This Month’s Singapore Savings Bonds (SSB): Interest Rates & How To Buy

- Best Saving Accounts For Students

- Still Holding Onto Your First Savings Account? Here’s Why You Should Change It

- Cheat Sheet: Best Savings Accounts With No Conditions

- Working Adults: Which Savings, Expenses And Investment Accounts Should I Start With?

Advertisement