In case you missed it, Bitcoin exchange traded funds (ETFs) are now officially a thing!

Yes, the U.S. Securities and Exchange Commission has approved the first U.S.-listed ETFs to track bitcoin.

You can now invest in Bitcoin, the world’s largest cryptocurrency, without directly holding it.

But what does this really mean for us and the crypto market?

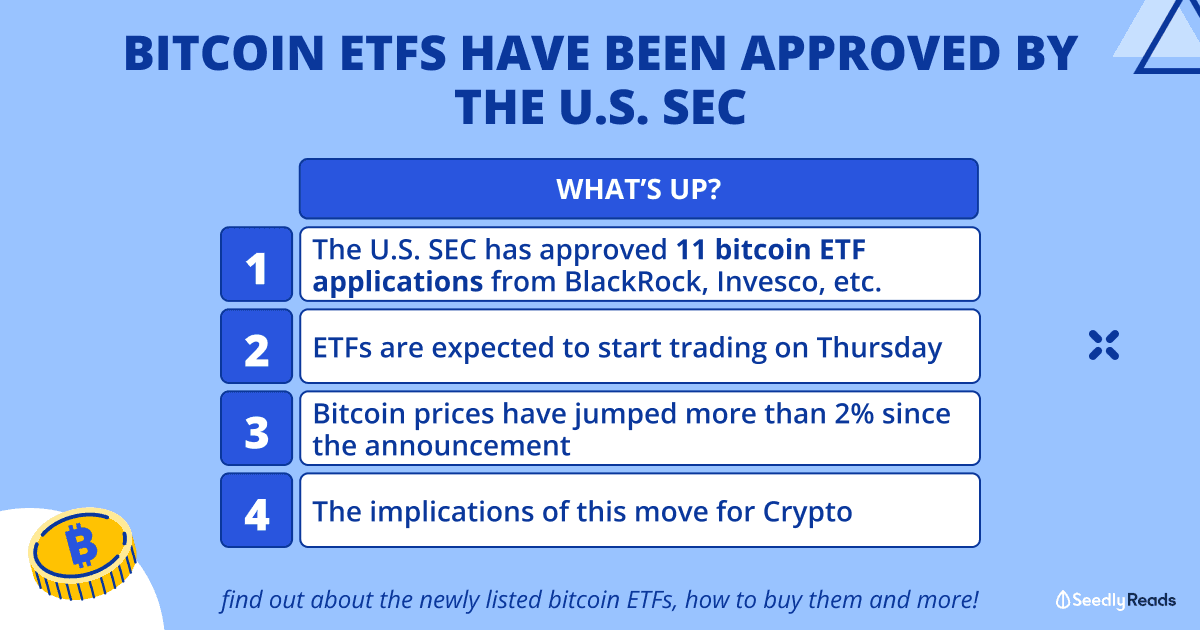

TL;DR: Bitcoin ETFs Have Been Approved By the U.S. SEC

- The U.S. SEC has approved 11 applications for Bitcoin ETFs including from BlackRock, Invesco, and ARK.

- Funds are expected to start trading as early as Thursday.

- SEC Chair Gensler has said that the move was “the most sustainable path forward”, but highlighted that they did not endorse bitcoin which is risky and volatile.

- Bitcoin prices have jumped more than 2 per cent since the announcement.

Disclaimer: Spot Bitcoin ETFs are not approved by MAS for offer to retail investors. The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Seedly does not recommend that any cryptocurrency should be bought, sold, or held by you. Readers should always do their own due diligence and consider their financial goals before investing in any investment product and consult your financial advisor before making any investment decisions.

Bitcoin ETFs Available Now

On January 10, 2024, the U.S. SEC approved 11 applications for Bitcoin ETFs. They are:

- ARK 21Shares Bitcoin ETF (BZX: ARKB)

- Bitwise Bitcoin ETF (NYSE: BITB)

- BlackRock’s iShares Bitcoin Trust (NASDAQ: IBIT)

- Fidelity Wise Origin Bitcoin Trust (BZX: FBTC)

- Franklin Bitcoin ETF (BZX: EZBC)

- Grayscale Bitcoin Trust (NYSE: GBTC)

- Hashdex Bitcoin ETF (NYSE: DEFI)

- Invesco Galaxy Bitcoin ETF (BZX: BTCO)

- Valkyrie Bitcoin Fund (NASDAQ: BRRR)

- VanEck Bitcoin Trust (BZX: XBTF)

- WisdomTree Bitcoin Fund (BZX: BTCW)

Some of these products are expected to begin trading as early as Thursday.

Why Did The SEC Approve Bitcoin ETFs Only Now?

For a decade, the SEC has rejected bitcoin ETFs due to worries that they could be easily manipulated. However, after a federal appeals court ruled that the agency was wrong to reject an application from Grayscale Investments, they were forced to reexamine their position.

According to SEC Chair Gensler, green-lighting these products was “the most sustainable path forward”, but highlighted that they did not endorse bitcoin which is risky and volatile.

What Does This Mean For The Crypto Market?

The approval of these products have been dubbed as a watershed moment for bitcoin and the crypto market. Indeed, this move by the SEC is a game-changer for investors as it gives us exposure to bitcoin without directly owning it.

Moreover, it is a major boost to the crypto market which has seen a tumultuous history full of scandals and insolvencies.

Read more

According to analysts at Standard Chartered interviewed by Reuters, the ETFs could induce as much as $100 billion worth of inflows by the end of this year. Other analysts have said that inflows would be closer to $55 billion over five years.

Assuming a best case scenario, the price of Bitcoin could reach near $200,000 by the end of 2025, more than quadrupling the current value of the crypto coin, Standard Chartered Bank said.

How Do I Invest In Bitcoin ETFs?

Bitcoin ETFs work the same as any regular ETF. Just hop on to your favourite brokerage, search for your desired bitcoin ETF ticker and invest!

If you need a more in-depth guide:

Related Articles

Advertisement