2 Singapore Blue-Chip Shares With Higher Dividend Yield Than Straits Times Index

Income investors are generally seeking to invest in stable companies that can sustain dividend payments over a long period of time. Moreover, they seek to acquire these companies at relatively attractive valuations. Here, one of the main criteria of an attractive valuation is to have a high dividend yield.

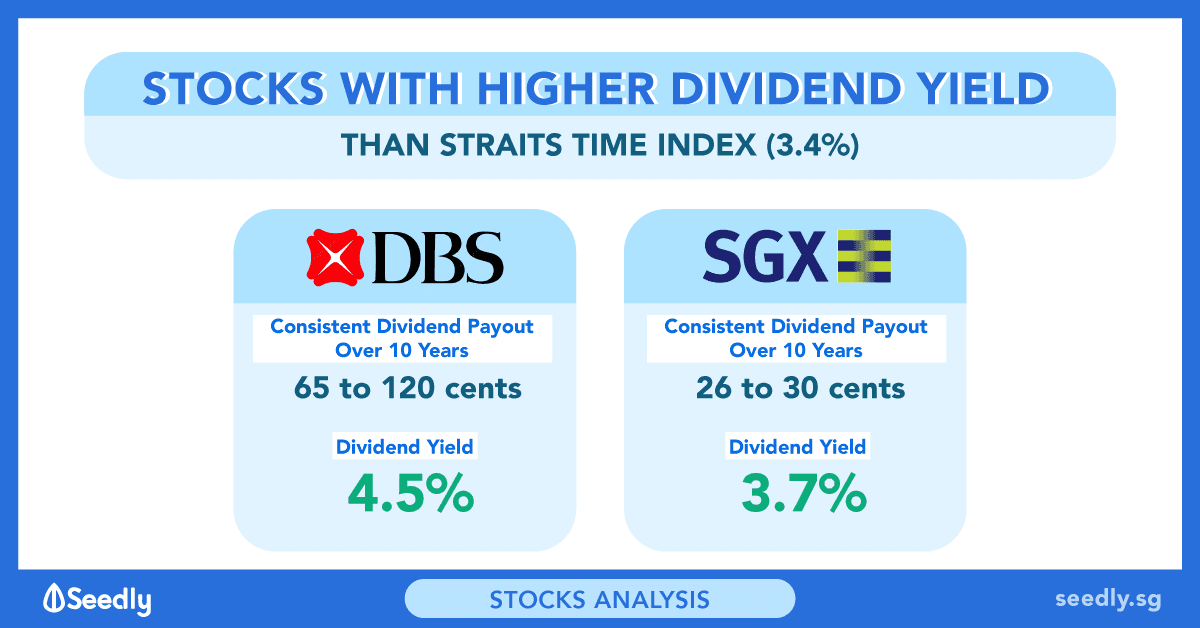

In other words, we are looking for stable blue-chip companies that have above-average market yields. Here, an above-average yield is one that is higher than the SPDR Straits Times Index ETF yield of 3.4%.

With that, let’s look at the two blue chips that meet the above description.

Disclaimer: This is not a sponsored post. Opinions expressed in the article should not be taken as investment advice. Please do your own due diligence.

Blue Chip 1: DBS Group Holdings Ltd

The first company on our list is DBS Group Holdings Ltd (SGX: D05), the biggest among our local banks. DBS Group has been a solid performer in the last decade, growing total income from S$6.0 billion in 2008 to S$13.2 billion in 2018. Similarly, its net profit attributable to shareholders grew from S$ 1.9 billion in 2008 to S$ 5.6 billion in 2018.

Such performance is commendable considering that the bank was already a big company ten years ago. In terms of its dividend track record, DBS Group has performed equally well. Since 2008, its dividend per share (DPS) has risen from 65 cents to 120 cents in 2018. In other words, the dividend was up by 85% during the period.

At its current price of S$26.91, DBS Group is trading at a trailing dividend yield of 4.5%.

Blue Chip 2: Singapore Exchange Limited

Singapore Exchange Limited (SGX: S68), or SGX, is the second company on our list.

For readers who aren’t familiar with the company, SGX is the only stock exchange operator in Singapore.

Similar to DBS Group, SGX has consistently paid a dividend over the last decade, growing DPS from 26 cents in FY09 to 30 cents in FY18. Though its dividend was up by “only” 15% during that period, income investors would have benefitted from its consistent dividend payout over the years.

Going forward, SGX is well-positioned to continue its dividend payout. For one, it’s the only stock exchange in Singapore.

Thus, we can expect the company to continue to benefit by providing necessary services to the financial markets. Moreover, it could also grow its business over time by providing additional services to meet the needs of market participants.

At its latest price of S$8.04, its trailing dividend yield is 3.7%.

Conclusion

The above are two blue-chip companies with above-average dividend yields (when compared to the broader market).

Though these companies generally have stable business operations, it’s important that investors do not take past results as a guarantee of future performance. After all, businesses do change and that these companies are not shielded from such changes.

Thus, it is important that investors evaluate the future prospects of these companies before investing in them, especially since these companies can only sustain their future dividends through strong business performance.

Want More In-Depth Analysis And Discussion?

Why not check out Seedly’s QnA and participate in the lively discussion surrounding stocks like DBS Group Holdings Ltd and Singapore Exchange Limited many more!

Stock Discussion on DBS Group Holdings Ltd

Stock Discussion on Singapore Exchange Limited

Seedly Guest Contributor: The Motley Fool

For our Stocks Analysis, the Seedly team worked closely with The Motley Fool, who is an expert in the field, to curate unbiased, non-sponsored content to add value back to our readers.

The Motley Fool offers stock market and investing information, offering people suggestions on how to take control of their money and make better financial decisions.

The Motley Fool Singapore primarily covers the Singapore market, though we also bring investing news from around the world. We also host a range of educational content, written for everyday people. We feel that the best person to make your financial decisions is you, and we want to help you take control of your own money. The Motley Fool also champions shareholder values and advocates tirelessly for the individual investor.

If you have any questions on the mentioned stocks, feel free to discuss them with the Seedly Community here.

Read other articles by The Motley Fool:

- Bad News: Investors Should Avoid SPH Shares

- Which Is The Better Dividend Stock: DBS Group Or UOB?

- 8 Key Numbers To Understand CapitaLand Mall Trust Better

- Ascendas REIT Vs Mapletree Industrial Trust: Which Is The Better Buy?

- Singtel Vs Starhub: Which Stock Is The Better Buy?

- 2 Billion-Dollar REITs Yielding Above 6%

- StarHub Shares Have Fallen 64% In 5 Years: Is It A Bargain Now?

- 3 Blue-Chip Stocks Yielding More Than Your CPF Ordinary Account

- 3 Singapore Blue-Chip Stocks That Have More Than Doubled Their Profits In The Last Decade

- Singapore’s Top 10 Dividend Shares Among the World’s Best

- The Better Dividend Share: SIA Engineering Company Ltd or Singapore Technologies Engineering Ltd?

- Big Week For Earnings With DBS, OCBC, UOB And Two Property Giants

- 2 Singapore Blue-Chip Companies That Announced Weaker Results Recently

- How Singapore-Listed Banks Performed in 2018

- 5 Blue-Chip Shares That Have Raised Their Dividends In 2018

- 5 Singapore REITs That Have Grown DPU in 2018

- 3 Singapore Companies That Have Paid Dividends For More Than 20 Years

- 2 REITs To Watch This Week – Mapletree Commercial Trust And Mapletree Industrial Trust

- 2 REITs That Have Performed Well Recently – Mapletree Industrial Trust and Fraser Centrepoint Trust

- 2 Companies That Have Recently Announced Growth – DBS and Sheng Siong

- Keppel KBS US And Sasseur REIT Delivered 20%+ Return To Investors In 2019

Advertisement