Breakups suck.

But you know what’s worse?

Breaking up when you and your partner have already balloted for an HDB BTO flat.

Yep.

While I’ve shared my experience with regard to the nuances of getting your BTO, as well as the joys of owning your own home.

I’ve also seen plenty of couples who’ve never seen it through.

So before you pop the question and ask “Ai BTO mai?” (Hokkien: Wanna BTO not?).

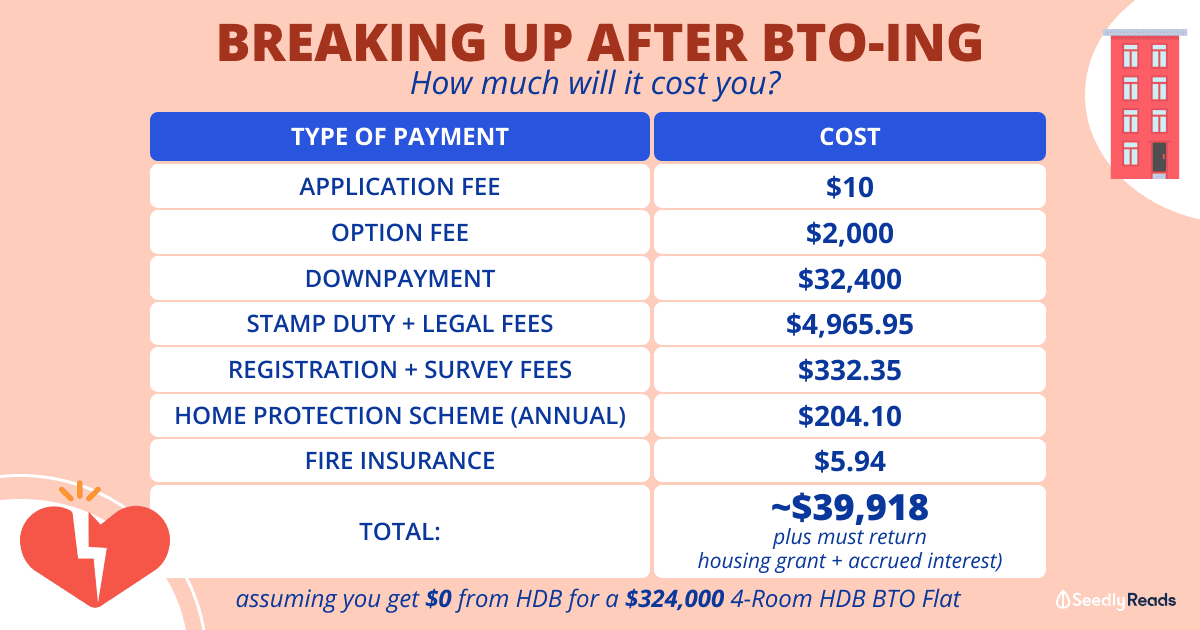

Did you know that you could lose anything from $10 to more than ~$39,918?

Note: the numbers and figures quoted in this article will be based on a 4-room HDB BTO flat from the Hougang Citrine August 2021 HDB BTO Launch.

TL;DR: What Will I Lose If I Break-Up After I BTO?

Using the 4-Room HDB BTO flat price (starts from $324,000) for the Hougang Citrine August 2021 HDB BTO Launch.

We used a 4-room flat as it is the most common type of flat in Singapore.

Here’s how much you’ll stand to lose if you break up:

| Stage in BTO Application | How Much Will I Lose? |

|---|---|

| Before Unit Selection | $10.00 |

| After Booking A Flat but before signing the Agreement For Lease | $2,010.00 |

| After signing The Agreement For Lease but before Key Collection | ~$23,176 (and return housing grant + accrued interest) |

| After Key Collection | ~$39,918 (and return housing grant + accrued interest) |

But there’s more to it than just financial loss…

You’ll also lose your First-Timer Applicant privileges (such as CPF grant eligibility and priority).

And you’ll even get barred from buying or balloting for another BTO flat for a set number of years.

So think twice before committing!

.

.

.

Need another perspective or some advice on your BTO application?

Don’t paiseh!

You can always ask the friendly Seedly Community for help before making your decision!

How Much Money Will I Lose If I BTO and Break Up?

We all know or at least heard of couples who’ve broken up after they’ve applied for a BTO.

And while we kinda know that it’s an emotional and potentially expensive affair.

Most of us don’t know how much we might actually lose if we applied for an HDB BTO and changed our minds.

For this exercise, I’ll be using the following assumptions:

- You applied for a 4-room BTO HDB flat during the Hougang Citrine August 2021 HDB BTO Launch [indicative starting price: $324,000 (excluding grants)].

- You’re a First-Timer Applicant

- Your average monthly household income is $5,000

- You take a CPF Housing Loan

to give you a better idea of the repercussions when you choose to BTO and break up.

Cancellation of Flat Application Before Unit Selection

| What Do I Lose? | What Happens If I Wish To Apply For Another BTO HDB Flat? | |

|---|---|---|

| BTO Application Fee | $10 | First-timer Applicants: Privilege will be revoked for 1 year if you reject again (you have 2 chances) First-timer Married Couples (Family Unit): The higher priority accorded due to previous unsuccessful applications will be reset to zero |

As a First-Timer Applicant, your housing needs are more pressing.

As a result, you enjoy greater priority when you apply for a new HDB flat.

Here are some of the benefits for couples, with a first-timer applicant, applying for a new BTO HDB flat:

- A higher proportion of flat supply for first-timers

- More ballot chances (you get 2 ballot chances)

- Additional ballot chances for unsuccessful attempts

- May be eligible for Staggered Downpayment Scheme

If you decide to cancel your application…

Even if you have not been called up HDB to book (or select) a flat.

HDB will consider you as having rejected a chance to select a flat.

This means that if you cancel your application again.

Your First-Timer Applicant privilege will be revoked for one year.

Total Amount Payable

If you’ve changed your mind about applying for an HDB BTO.

Download and complete the Cancellation of Application (before Selection) form for submission.

How much you will lose: $10.00

After Booking A Flat But Before Signing The Agreement For Lease

| What Do I Lose? | What Happens If I Wish To Apply For Another BTO HDB Flat? | |

|---|---|---|

| BTO Application Fee | $10 | First-timer Applicants: Additional chances for balloting will be reset to zero Barred from buying or balloting for another BTO flat for one year |

| Option Fee | $2,000 | |

The option fee varies depending on the flat type that is booked.

| Flat Type | Option Fee Payable |

|---|---|

| 2-room Flexi Flat | $500 |

| 3-room Flat | $1,000 |

| 4-/5-room/3Gen/Executive Flat | $2,000 |

The total amount that you lose isn’t that huge, but it’s no chump change either.

However, the biggest problem is that you’ll not be allowed to apply to buy or ballot for another HDB flat for one year.

Plus, any additional chances accumulated from previous unsuccessful applications will be reset to zero so whatever advantage you garnered initially is lost.

Total Amount Payable

If you’re absolutely sure you want to cancel at this stage.

Download and complete the Cancellation of Flat (before Signing the Agreement for Lease) form for submission.

How much you will lose: $2,010.00

After Signing The Agreement For Lease But Before Key Collection

By this stage, the stakes are a little higher.

| What Do I Lose? | What Happens If I Wish To Apply For Another BTO HDB Flat? | |

|---|---|---|

| BTO Application Fee | $10 | First-timer Applicants: Additional chances for balloting will be reset to zero Barred from buying or balloting for another BTO flat for one year |

| Option Fee | $2,000 | |

| Downpayment (5% of property purchase price) | $16,200 | |

| Buyer's Stamp Duty | $4,680 | |

| Legal Fees | $285.95 | |

| Housing Grant(s) | $45,000 + accrued interest | |

| Total | ~$23,176 Not inclusive of HDB Housing Grant and accrued interest |

|

Downpayment

Assuming you take an HDB housing loan and you qualify for the Staggered Downpayment Scheme.

You’ll need to put down a 5% downpayment.

That amounts to $16,200 for a 4-room HDB BTO flat with a property price of $324,000.

If you’re taking a bank loan, you would’ve paid 10% or $32,400 as a downpayment instead.

Buyer’s Stamp Duty

Using the Inland Revenue Authority of Singapore’s Stamp Duty Calculator, you’ll need to pay $4,680.

P.S. if you’re using HDB’s lawyers, you might be able to get them to apply to IRAS for a refund of your Buyer’s Stamp Duty.

Legal Fees

Legal fees include Conveyancing Fees and Caveat Registration Fees.

Conveyancing fees are calculated:

- First $30,000: $0.90 per $1,000

- Next $30,000: $0.72 per $1,000

- Remaining Amount: $0.60 per $1,000

Note: the minimum conveyancing fee chargeable is $20 and it is subjected to GST.

Based on the HDB Legal Fees Enquiry Calculator, you’ll need to pay $221.50 (inclusive of GST).

The Caveat Registration Fee of $64.45 (inclusive of GST) is payable when you sign the Agreement for Lease.

In total, you will have to pay $285.95 (inclusive of GST) for legal fees.

Housing Grants

Any grants you get, for example, the Enhanced CPF Housing Grant (EHG) would also have to be returned with interest.

Assuming your monthly average household income is $5,000.

That means you have to return the disbursed $45,000 plus any accrued interest.

Total Amount Payable

If you die die must break up at this stage

You’ll need to download and complete the Cancellation of Flat (after signing Agreement for Lease) form for submission.

How much you will lose: ~$23,176 (plus must return HDB Housing Grant and accrued interest)

Apart From Money, What Else Do I Lose?

You’ll have to wait 1 year from the date of cancellation before you can apply or be included as an essential occupier for a:

- New HDB flat

- DBSS flat from developers

- EC unit from developers

- Resale flat with CPF housing grant

- Resale flat that’s announced for SERS

And if you applied as a first-timer family, any additional chances that you may have accumulated from your previous unsuccessful BTO applications will also be reset to 0.

Oh, after the 1-year wait-out period, the debarment will be lifted and you will be treated as a first-timer.

Since you technically did not enjoy any housing subsidy upon cancelling your HDB BTO flat.

After Key Collection

By this point, you’ll need to submit your marriage certificate within three months from your BTO completion date.

You could apply for a deferment, but that’s subjected to HDB’s approval on a case-by-case basis.

After collecting your key, you would have paid the balance of your property’s purchase price using:

- cash

- CPF, or

- bank loan

On top of that, there’s a whole slew of fees and insurance to pay for.

| What Do I Lose? | What Happens If I Wish To Apply For Another BTO HDB Flat? | |

|---|---|---|

| BTO Application Fee | $10 | No First-Timer Applicant privilege Barred from buying or balloting for another BTO flat for a number of years |

| Option Fee | $2,000 | |

| Downpayment (10% of property purchase price) | $32,400 | |

| Buyer's Stamp Duty | $4,680 | |

| Legal Fees | $285.95 | |

| Lease In-Escrow Registration Fee (if HDB acts for you) | $38.30 | |

| Survey Fee (for 4-room flat) | $294.05 | |

| Home Protection Scheme (Annual Fee) | $204.10 | |

| Fire Insurance | $5.94 | |

| Housing Grant(s) | $45,000 + accrued interest | |

| Total | ~$39,918 Not inclusive of HDB Housing Grant and accrued interest |

|

At this stage, you’ll effectively be surrendering possession of your HDB BTO flat.

While HDB might offer you some compensation, that amount will be at their discretion (read: don’t count on it).

And if you’re funding this purchase with a bank loan, you’re going to need a large sum of money to repay the loan.

Registration Fee

There are two types of registration fees:

- Lease In-Escrow registration fee of $38.30 — if HDB acts for you in the flat purchase

- Mortgage In-Escrow registration fee of $38.30 — if you take a loan from the bank

Survey Fee

The survey fee varies depending on the flat type.

| Flat Type | Survey Fee (before GST) |

|---|---|

| 1-Room | $150 |

| 2-Room | $150 |

| 3-Room | $212.50 |

| 4-Room | $275 |

| 5-Room | $325 |

| Executive Flat | $375 |

Expect to pay $294.05 (inclusive of GST) for a 4-room flat.

Home Protection Scheme (HPS)

Using CPF’s HPS Premium Calculator, and assuming:

- You are 30 years old

- You take up a $291,600 loan amount

- Your loan is a 25-year tenor

The annual premium payable is $191.

Fire Insurance

HDB’s current appointed insurer is FWD Singapore Pte Ltd. Fire Insurance for a 4-room flat will cost you $5.94 (inclusive of GST).

Total Amount Payable

Assuming the worst-case scenario where you don’t get a single cent back from HDB…

How much you will lose: ~$39,918 (plus must return HDB Housing Grant and accrued interest)

That’s almost $40,000!

Closing Thoughts

The costs calculated here are just estimates and will differ depending on a variety of circumstances.

And all of this is assuming you haven’t gotten married yet.

FYI: I’ve worked out earlier that an average wedding will cost a whopping $27,610!

Can you imagine having to pay for the wedding AND your BTO flat only to call it off?

Damn siao please.

There’s always the case for applying for a BTO first since project launches in an area or estate which you want to live in in the future do not come by every quarter.

Well… if your relationship is in a place where you’re serious about each other and have thought about your future together.

Then sure.

Having the “Ai BTO mai?” talk would help bring your relationship to the next level.

But remember to weigh that against the financial implications and repercussions to your eligibility for future BTO projects if your relationship doesn’t weather the application process.

Advertisement