Budget 2022: Middle Income Concerns and Other Issues Addressed

So recently, the government announced Budget 2022.

I’m sure most of you probably tuned in because you are worried about the upcoming GST increase…

Thankfully it’s not happening just yet.

There are also those of you who are watching Budget 2022 just to see how much worth of GST vouchers you can get.

Although so many things were addressed that day, some of us still had some concerns recently addressed by our Minister of Finance, Mr Lawrence Wong.

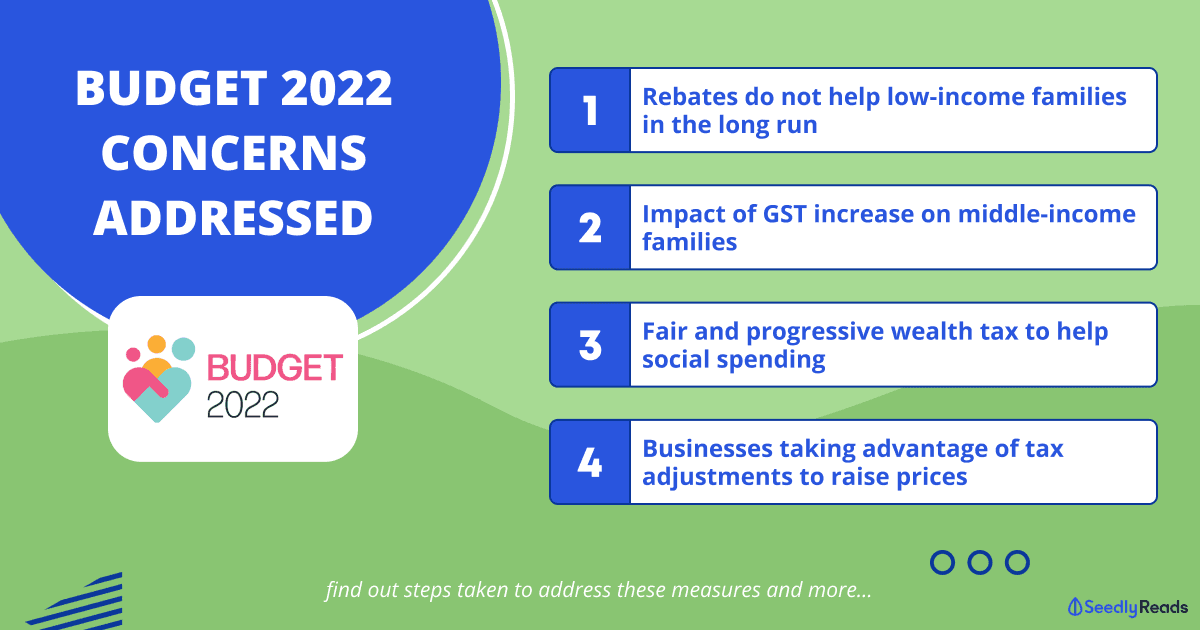

So what are some of the concerns we have for Budget 2022?

One of the concerns relates to middle-income families caught in between the recent tax adjustments and rebates, as well as businesses taking advantage of the tax adjustments to make more profits.

Let’s take a look at all of the concerns addressed!

TL;DR: Budget 2022 Concerns Addressed

Concern #1: Rebates Do Not Help Low-income Families in the Long Run

Singapore is known to be one of the most expensive cities to live in.

One of the biggest concerns for the low-income families living in Singapore is their inability to keep up with the rising costs of living.

Amidst the announcements for tax adjustments and the inevitable rise in GST, who wouldn’t be worried about struggling to make ends meet?

Luckily, low-income families need not worry too much!

Budget 2022 has announced a whole set of measures to help them cope with the rising costs.

Temporary measures have been put in place, such as:

- The Household Support Package which gives them Utilities Rebates, CDC Vouchers and support for children’s education.

- The Enhanced Assurance Package which will provide families support over the next five years.

More permanent measures to help low-income families are also being implemented, such as:

- Enhanced GST vouchers which will help them cover the difference made by the GST increase.

- Increasing the incomes of lower-wage workers through progressive wages and Workfare.

Feel free to read more about the enhanced GST vouchers and support packages here!

Concern #2: Impact of GST Increase on Middle-income Families

The GST hike affects everyone, whether you are earning a high income or just barely making ends meet.

Although support for low-income families has been announced to help them slowly adjust to the rising costs of living.

What about the middle-income families who are caught in the middle, unable to receive the support meant for low-income families, yet still heavily affected by tax hikes?

Rest assured, since there will be support for everyone!

The support packages such as the Enhanced GST Vouchers, Household Support Package and the Enhanced Assurance Package will also cater to middle-income families.

Furthermore, middle-income families still get to enjoy subsidies in various forms, such as housing, healthcare, or education for their children.

So you have nothing to worry about!

So… What Defines a Middle-income Family?

But what actually defines a middle-income family?

Putting it simply, middle-income families are those who do not qualify for some benefits that are given to low-income families, nor do they earn an income high enough to afford a luxurious lifestyle.

But what is the income range for middle-income families?

Let’s look at support for low-income families first.

An example of a support programme for them includes the Home Access Programme, which helps support families with a monthly gross income of less than $1,900.

Based on the latest personal income tax adjustments, the changes start from those earning $320,000 or higher.

Therefore, a rough estimate for the income range of middle-income families will be between $1,900 to $320,000.

Disclaimer: The range is a rough estimate based on government support and the latest income tax changes. This does not take into account factors such as household size, etc.

Concern #3: Fair and Progressive Wealth Tax to Help Social Spending

Along with supporting low-income and middle-income families, the recent tax adjustments also included a wealth tax.

These tax adjustments have in mind those earning the highest income in Singapore.

Just as those from low-income families will receive the greatest amount of support from the government, those earning a higher income should provide more.

The extra tax revenue generated from the tax adjustments will be channelled towards social spending to help make a better Singapore.

Examples of these expenditures will include the expected increase in healthcare expenditure and the new green sustainability measures, which will greatly benefit Singaporeans in the long run.

Furthermore, part of the spending will be used in the support packages for the low-income families, ensuring a fairer Singapore as the wealth is evenly distributed in the economy.

Concern #4: Businesses Taking Advantage of Tax Adjustments to Raise Prices

The last concern Singaporeans have for Budget 2022 will be regarding businesses using the tax adjustments to raise prices and earn a larger profit.

While the GST hike is a major concern for many of us in Singapore, it’s worse when you think about businesses using this as an opportunity to exploit us, the consumers.

Hence, a Committee Against Profiteering (CAP) will be set up to protect us from the unfairly raised prices.

They will take action against any businesses using the GST hike as a cover to exploit their customers.

Therefore, there’s no need for us to worry about paying extra necessarily!

Closing Thoughts

Change is never easy, sometimes to take a bigger step forward, we have to be willing to sacrifice certain things.

In Singapore, although the tax adjustments may be a struggle for all of us to make ends meet, there are multiple measures taken to help us ease into these changes.

If you’re worried about rising costs due to inflation, here’s how you can ensure you don’t lose money from it!

Wondering how you can maximise some of the government support you will be getting?

Here are some interesting ways to spend your CDC vouchers!

Honestly, we have it a lot easier compared to other countries, with so many measures to help us ease into these tax changes and subsidies for things like housing and healthcare.

Hence, we gotta remember to count our blessings!

Advertisement