Budget 2022: Does the Wealth Tax Make an Impactful Difference?

Alright everyone, what do you think about when you hear Budget is coming?

…Besides GST vouchers and freebies, of course.

The next thing most of you will be concerned about will be the rising taxes.

Especially for those of you who come from low-income families, the rising taxes, such as the upcoming GST increase, will be scarier than any horror movie on your favourite streaming service.

But hey, the rising taxes does not have to be framed in such a bad light.

It isn’t always the low-income families who are hit the worst by rising taxes and higher costs of living.

After all, the government announced some tax adjustments for high-income families in the recent Budget 2022.

Let’s look at these changes and what positive prospects this will bring!

TL;DR: Changes to The Wealth Tax in Singapore

The Latest Tax Adjustments For High-Income Families

During the Singapore Budget 2022, it was stated that wealth taxes are not easy to implement. Even European countries such as Germany, France, and Denmark have stopped levying net wealth.

Two things to note when implementing a wealth tax are:

- It has to target fixed assets that are hard to move around (i.e. Property)

- For the ease of administration, it must be something that isn’t too complicated for the tax collector.

These will be kept in mind when making tax adjustments to tax wealth in Singapore.

Let’s take a look at some of these tax adjustments:

1. Adjustments to Personal Income Tax

First on the list, we have the changes to income tax!

Starting from Financial Year (FY) 2024, the top marginal personal income tax rate will be adjusted to charge a higher tax for those earning a high income.

Note: For FY2024, the assessable period for personal income tax is 1 Jan to 31 Dec 2023.

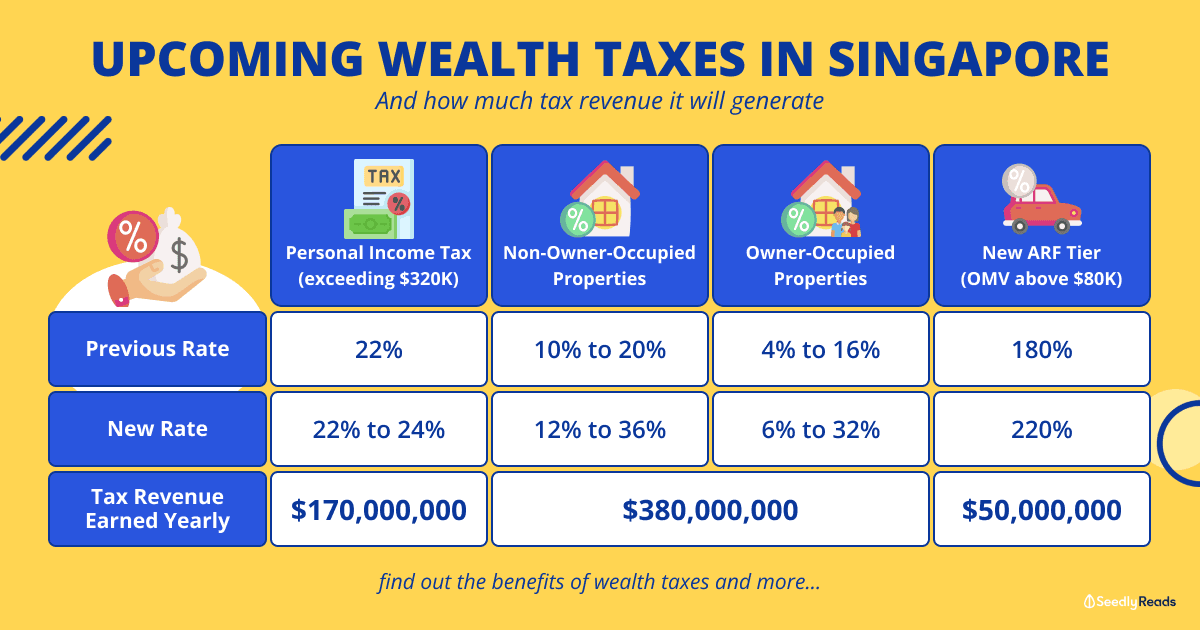

Instead of charging those earning more than $320,000 a fixed 22%, two new marginal rates will be implemented!

So those of you with a chargeable income between $500,000 to $1 million will be taxed at a marginal rate of 23%.

Those with chargeable income exceeding $1 million will be taxed at a marginal rate of 24%.

These new income tax rates are expected to affect only the top 1.2% of taxpayers who earn the highest income in Singapore.

I guess it’s time to look at ways to reduce your income tax!

2. Increase in Property Taxes

The next tax adjustment pertains to property tax.

Regardless of all Annual Value tiers, all non-owner-occupied properties will have their tax rates increased from the original 10% to 20% to the new 12% to 36%.

This also includes investment properties too.

Owner-occupied properties are not off the hook either!

All owner-occupied properties will have their tax rates increased from the original 4% to 16% to the new 6% to 32%

Unlike non-owner-occupied properties, this will only affect the portion of their annual value that exceeds $30,000.

As mentioned earlier, the changes to property tax are made as the principal method of taxing wealth is through fixed assets such as properties.

3. New Additional Registration Fee (ARF) Tier to be Implemented

The last tax adjustment will be towards taxing vehicles.

As we all know, Singapore has limited land space. Hence, we have many different taxes, fees, and schemes that make owning a car in Singapore so expensive!

Of course, this does not stop the rich from purchasing their own vehicles!

So to make our vehicle tax system more progressive, a new ARF tier for cars will be implemented.

This is mainly to target the luxury cars with an Open Market Value (OMV) higher than $80,000.

Vehicles that fall under this new ARF tier will be taxed at a rate of 220%.

Perhaps it’s time to look for more greener ways to travel, such as public transport or bicycles?

How Much of An Impact Will These New Tax Adjustments Make?

So you must be wondering how much of an impact these new changes will make.

| Tax Adjustment | Estimated Tax Revenue Generated Yearly |

|---|---|

| Personal Income Tax | $170 million |

| Property Tax | $380 million |

| New ARF Tier | $50 million |

With all of these tax adjustments, the government expects to generate about $600 million worth of tax revenue yearly.

Besides generating tax revenue, these changes are made to help improve our society, where everyone is encouraged to compete regardless of their social status or wealth background.

Potential Benefits of The Wealth Tax

“Aiyo, I’m not rich anyway, also not my problem what.”

Before you start thinking like that, there are benefits to implementing these tax adjustments for the wealthy in Singapore.

The main objective of a Wealth Tax is to help reduce social inequalities in Singapore by returning a portion of the wealth stock back into our economy.

And why does that concern me?

Because this money will be spent to help cover expenditure in other areas for Singapore.

One such expenditure includes increased healthcare spending due to our ageing population.

Another example would be the schemes to help low-income families cope with the expensive costs of living in Singapore.

Hey, all that money has to come from somewhere, right?

Are Tax Increases Always Bad?

Rising taxes always has such a negative connotation to them.

I remember when the GST increase was first announced, everyone around me was telling me to buy as much as I could before the increase hit.

What they don’t realise is that they are actively contributing to worsening inflation.

Here’s a better way to help combat inflation!

But this mentality towards rising taxes isn’t always right, and as we have mentioned earlier, there are benefits to these tax adjustments.

The worst part?

We are enjoying benefits like our GST vouchers or CDC vouchers, and we take them for granted while we talk bad about these rising taxes.

Hopefully, this article brings an important point worth thinking about.

Advertisement