Should You Use 'Buy Now Pay Later' Services? Atome vs Grab PayLater vs Hoolah vs OctiFi vs Rely vs Split

●

If you have done any online shopping in Singapore, you might have noticed that some e-commerce merchants are offering you a new way to check out.

Apart from the traditional credit cards/debit cards and digital payment solutions that require you to pay the full amount upfront or the credit cards that offer instalment plans, we now have the Buy Now Pay Later (BNPL) payment option.

With BNPL, you can delay your payments and split them up into weekly or monthly instalments.

Undoubtedly, this payment method is convenient for those on a tight budget who cannot pay the full amount upfront.

This might also explain why BNPL services are gaining popularity in Singapore.

According to a nationally representative survey of 1,008 Singaporeans aged 16 or older done by Milieu (via Finder) in October 2020, about four in 10 Singaporeans or nearly 1.1 million people have used a BNPL service.

But the worrying this is this: about 27 per cent of Singaporeans admitted to being financially worse off due to a BNPL mistake.

The top five BNPL mistakes 27 per cent of the respondents made include:

But is it all that bad?

To me, BNPL services are like fire because they can be a good servant or a bad master.

If used well, they can help you save money. But, if your use of these BNPL services is not controlled, they could burn you badly.

Understanding the potential risks of BNPL schemes, the Monetary Authority of Singapore (MAS) is assessing if a regulatory framework is required to guide such payment services.

This may include a clear disclosure during account opening to ensure that customers are fully aware of any chargeable late fees.

Should you use BNPL services? What are the benefits and risks of doing so?

Here’s all you need to know!

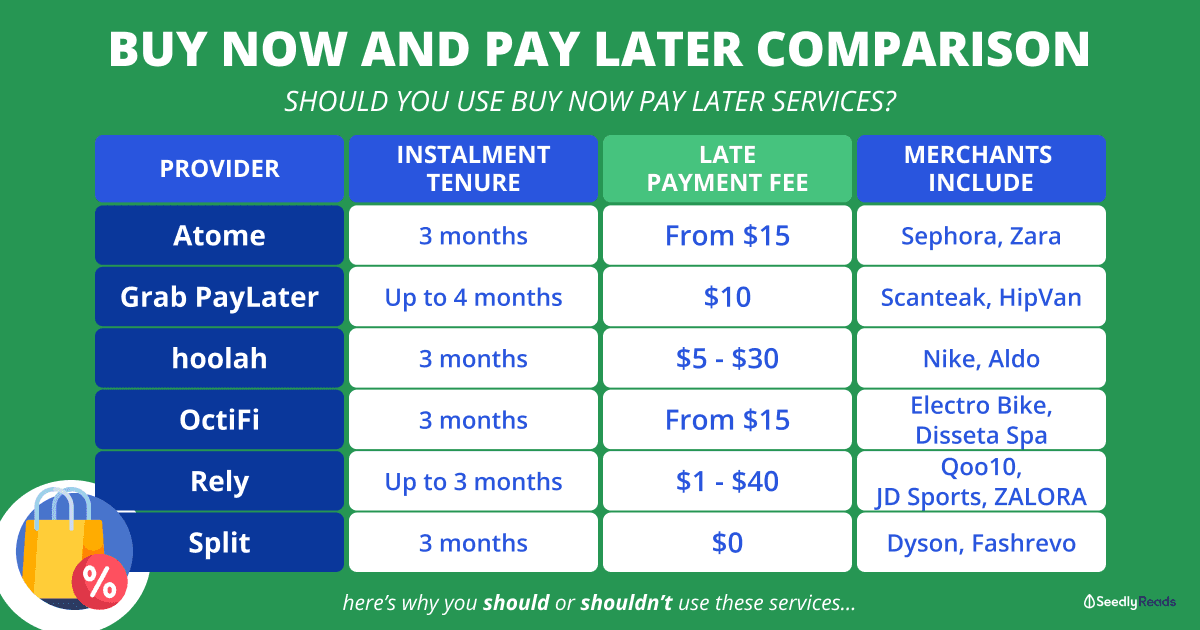

TL;DR: Buy Now Pay Later Services Comparison Singapore: Atome vs Grab PayLater vs Hoolah vs OctiFi vs Rely vs Split

| Buy Now Pay Later Provider | Upfront Payment | Instalment Repayment Tenure | Late Payment Fee | Other Charges/Misc. | Processing Fee | Early Repayment Fee | Payment Method | Notable Merchants |

|---|---|---|---|---|---|---|---|

| Atome | 1/3 of total value of purchase | Over 3 months | $15 admin fee + freezing of Atome account when you miss your second payment If you don't pay the late fee of $15 + the outstanding balance on the third & final month, you will be charged another $15 Total late payment fees are capped at $30 for each transaction | NIL | $0 | $0 | Debit/Credit Card (Any Singapore issued card) | Sephora, Zara, IUIGA, Aldo, Marks & Spencer |

| Grab PayLater | 1/4 of total value of purchase or full amount next month | Over 4 months or the next month | Flat $10 admin fee to reactivate your suspended PayLater account if payment is not made on time | You will not receive GrabRewards points for PayLater Instalments | GrabPay Wallet | GrabPay merchants like Scanteak, HipVan etc. | |

| hoolah | 1/3 of total value of purchase | Over 3 months | $5: Order value $99.99 or below $15: Order value between $100 and $999.99 $30: Order value $1000 and above | NIL | Debit/Credit Card (Visa or Master) | Alodo, Converse, NIke, Oppo, Puma | |

| OctiFi | 1/3 of total value of purchase | Over 3 months | $15: Order values up to $999.99 Additional $15 for every $1,000 increase in order value | NIL | Debit/Credit Card (From any bank) | Disseta Spa, Electro Bike, Liminal | |

| Rely | 1/3 or 1/4 of total value of purchase | Over 3 months or 4 fortnights | $1 to $40 depending on order value | NIL | Debit/Credit Card (Visa or Master) | JD Sports, Limited EDT, Omnidesk, SecretLab, Qoo10, ZALORA | |

| Split | 1/3 of total value of purchase | Over 3 months | $0 | NIL | Debit/Credit Card (From any bank) | Dyson, Fashrevo, Switch, The Straits Wine Company |

Cons of Buy Now Pay Later Services

1. Gives a False Sense of Affordability

Call me a financial prude, but I have a rule when it comes to my spending.

Aside from big-ticket items like buying your home or a car, I would not spend money on things that I cannot pay off.

I understand that this comes from a position of privilege. But, I also strongly believe in living within my means.

And from the survey, you can see that people tend to make financial mistakes specific to BNPL services.

I would think that this easy access to credit will give you a false sense of affordability and encourage you to spend more recklessly on your wants.

After all, you are still required to pay the full price for the product.

Although the item is more affordable, you are still on the hook for the product that you buy.

But if you don’t have enough to buy it upfront, you should seriously reconsider if you should be purchasing this product.

On balance, these BNPL services can help you pay for the things that you really need urgently. But again, these BNPL services should be used cautiously.

2. Late Fees

When using BNPL services, there is generally no interest charged on the loan as the services rely on taking a cut from merchant sales and late payment fees for revenue.

But, you need to be aware of the late payment fees which will apply if you use a debit card for your BNPL service.

Although you can find them on the respective BNPL provider’s websites, these are often buried deep in the FAQ or help sections.

Whereas if you use a credit card, you won’t be charged for the late payment fees as the instalments are automatically charged to your credit card.

But, you must pay off your credit card on time as these cards have astronomical interest rates of about 25% per annum (p.a.) and charge late payment fees.

In offering zero interest, these firms make money by taking a cut from their merchants’ revenue sales and charging consumers late payment fees.

Pros of Buy Now Pay Later Services

1. Credit Card Rewards

Although you can use your debit card for BNPL services, it is better to use a credit card as you can get rewards like cashback, miles or points for instalment payments charged to your credit card!

This is unlike the traditional 0% credit card instalment plans that don’t offer credit card rewards. Also, some banks even charge an additional one-time processing fee based on the transaction amount.

P.S. Use our credit card comparison tool to help you find the best credit card for your needs.

In addition, if you are using cashback credit cards that have a cap on the amount spent on the card that earns cashback each month, you can actually spread out your purchase over a few months using BNPL services to maximise your credit card rewards.

Take for example, a cashback credit card like the DBS LiveFresh card.

Although the card offers up to 5% cashback on the eligible online spend category, the total cashback earned will be capped at $20 a month for this category.

This means that you will not receive more cashback if you spend more than $400 a month for this category.

For example, an eligible online purchase of more than $1,000 will mean that you will still only earn only $20 cashback.

However, if you split it up over three months, you will get $45 cashback.

Note that you will not earn credit card rewards with Grab PayLater as most credit cards exclude GrabPay tops from credit card rewards.

2. Freed up Money Can Earn Interest in Your Bank Account or Insurance Savings Plan

In addition, another perk of using BNPL services is that you don’t have to pay for everything upfront.

For example, instead of paying $1,500 upfront, the payments are split up into three instalments of $500 each over three months.

This means that you can keep $1,000 in your account for about two months or so.

However, to enjoy this benefit, you will need to have a high-interest rate savings account.

Or an insurance savings plan that gives you interest on the balance in your account.

But, you won’t be earning too much depending on the account you have.

Better than nothing, I suppose:

Now that you are more aware of the pros and cons, here are some guidelines to follow.

This section needs you to reflect a bit and be honest with yourself.

Who Should Use Buy Now Pay Later Services?

In my opinion, you should use BNPL services if you are:

- Disciplined with your spending and pay your bills on time

- Able to clearly distinguish between needs and wants.

- Have the money to pay for the whole of your purchase upfront. If you don’t have the money and your purchase is necessary, you should at least have a stable income regularly every month.

Who Should Not Use Buy Now Pay Later Later Services?

In my opinion, you should NOT use BNPL services if you have

- Poor impulse control.

- Find it difficult to distinguish between needs and wants.

- Do not have the money to pay for the purchase upfront and don’t have stable income coming in regularly every month.

Buy Now Pay Later Services Comparison Singapore: Atome vs Hoolah vs Jungle vs OctiFi vs Rely vs Split

Now that you know what you are getting into, here is a comparison of the top BNPL providers in Singapore.

| Buy Now Pay Later Provider | Upfront Payment | Instalment Repayment Tenure | Late Payment Fee | Other Charges/Misc. | Processing Fee | Early Repayment Fee | Payment Method | Notable Merchants |

|---|---|---|---|---|---|---|---|

| Atome | 1/3 of total value of purchase | Over 3 months | $15 admin fee + freezing of Atome account when you miss your second payment If you don't pay the late fee of $15 + the outstanding balance on the third & final month, you will be charged another $15 Total late payment fees are capped at $30 for each transaction | NIL | $0 | $0 | Debit/Credit Card (Any Singapore issued card) | Sephora, Zara, IUIGA, Aldo, Marks & Spencer |

| Grab PayLater | 1/4 of total value of purchase or full amount next month | Over 4 months or the next month | Flat $10 admin fee to reactivate your suspended PayLater account if payment is not made on time | You will not receive GrabRewards points for PayLater Instalments | GrabPay Wallet | GrabPay merchants like Scanteak, HipVan etc. | |

| hoolah | 1/3 of total value of purchase | Over 3 months | $5: Order value $99.99 or below $15: Order value between $100 and $999.99 $30: Order value $1000 and above | NIL | Debit/Credit Card (Visa or Master) | Alodo, Converse, NIke, Oppo, Puma | |

| OctiFi | 1/3 of total value of purchase | Over 3 months | $15: Order values up to $999.99 Additional $15 for every $1,000 increase in order value | NIL | Debit/Credit Card (From any bank) | Disseta Spa, Electro Bike, Liminal | |

| Rely | 1/3 or 1/4 of total value of purchase | Over 3 months or 4 fortnights | $1 to $40 depending on order value | NIL | Debit/Credit Card (Visa or Master) | JD Sports, Limited EDT, Omnidesk, SecretLab, Qoo10, ZALORA | |

| Split | 1/3 of total value of purchase | Over 3 months | $0 | NIL | Debit/Credit Card (From any bank) | Dyson, Fashrevo, Switch, The Straits Wine Company |

For the majority of the BNPL providers, the main differences lie in the late payment fees and the noteworthy merchants you should consider.

Here is a close look at them.

Atome Review

First up, let’s take a look at Atome.

In terms of late repayment fees, Atome charges have been reduced.

From 13 September 2021, Atome will charge a $15 late repayment fee and freeze your account when you miss your second payment.

If you don’t pay the late fee of $15 and the outstanding balance on the third and final month, you will be charged another $15.

Thus, the total late payment fees are capped at $30 for one transaction.

As for their merchants, the lineup has notable names like Sephora, Zara and Marks and Spencer, which is quite decent.

Grab PayLater Review

Next, we have Grab PayLater.

Their late repayment fees are amongst the lowest as you only need a pay a flat $10 admin fee to reactivate your suspended PayLater account if payment is not made on time.

In terms of merchants, you can use Grab PayLater for Grab services like Grab rides, GrabFood and GrabExpress.

Also, you can use Grab PayLater at a small group of merchants like Scanteak and HipVan.

However, the utility is still limited as you will have to top-up your GrabPay wallet to use Grab PayLater.

hoolah Review

Next up, we have hoolah.

Their late repayment fees are tiered, which makes it a bit more reasonable:

- $5: Order value $99.99 or below

- $15: Order value between $100 and $999.99

- $30: Order value $1000 and above.

They also have notable merchants like Nike, Puma and Oppo.

OctiFi Review

Next, we have OctiFi.

Their late payment fees are on the higher side as it is a flat $15 fee for the first $999.99 and goes up by $15 for every $1,000 increase in order value.

This is one of OctiFi’s weak points in terms of merchants, as I could hardly find any merchant I know.

Rely Review

Rely is up next.

Their late payment fees are middle of the road as it can range from $1 – $40 based on order value.

In terms of merchants, Rely is a winner as it has e-commerce giant Qoo10 onboard.

Split Review

Last but not least, we have Split.

Good guy Split charges no late payment fees.

They also have brands like Dyson and The Straits Wine Company on board.

If you find this article helpful, do save it for reference!

Advertisement