Best Cancer Insurance in Singapore (2023): Keeping a Peace of Mind in Hard Times

I have not attended a lot of funerals, but of the ones I’ve attended, it’s mostly someone who passed away due to cancer.

As much as I wish life was simpler before adulting kicked in, I didn’t think that cancer was something that I would thought of until I witnessed an old classmate being diagnosed with Stage 4 Lymphoma.

He was only 18 then.

Thankfully, he survived and is doing rather well now.

That’s when I realised, cancer was no longer something for me to ‘only worry when I’m old’.

As I grew older, I’ve also seen how cancer crept into the lives of people around me, sending them into a world of emotional and financial distress.

More often than not, in the process of seeking treatment, their finances have taken a blow due to the lack of insurance coverage.

These diagnoses also made me realise how prevalent cancer was.

Granted, cancer treatment is not affordable, as treatment of cancer per month is estimated to be between $8,000 to $17,000 a month without insurance coverage.

So, are we able to afford treatment without worrying too much financially?

Fortunately, you are able to if you have purchased a cancer insurance with good coverage.

Let’s take a deeper dive on this.

Disclaimer: The information contained in this article pertaining to any insurance product or plan is provided and meant for general information only and does not constitute an offer, recommendation, solicitation or advice by Seedly to buy or sell any product(s), plan(s) or investment product(s). It is not and should not be relied on as financial advice and has no regard for any person’s investment and financial needs. If you are unsure whether this product or plan is suitable for you, you may seek personalised financial advice from a qualified insurance advisor. All currency is in Singapore Dollars.

TL;DR: Cancer Insurance, What It Does & Do You Still Need One If You Have a Critical Illness Insurance?

Click here to jump:

- What is cancer insurance?

- Does Integrated shield plan cover cancer treatments?

- How do you decide between a cancer insurance and critical illness insurance?

- Cancer insurance plans in Singapore

What is Cancer Insurance?

In Singapore, about 39 people are diagnosed with cancer every day, and 1 in 4 people may develop it in their lifetime.

(That’s a scarily high number.)

Thanks to modern technology and better treatment, more people have survived for at least five years from 2010 than they did from 2005.

This increase in survival rate also meant the need to still look at the costs of living after recovery, which might be difficult if one has to deal with massive debts following treatments and operations.

We’ve also seen how much cancer treatments would cost, and insufficient coverage would usually mean a wipe out of savings.

Cancer insurance serves as term insurance that provides coverage for (mostly) all stages of cancer.

It typically offers a lump sum payout upon the diagnosis of cancer, with the amount depending on the stage of cancer.

Cancer insurance also offers pure insurance coverage and is NOT meant for investment, savings or wealth accumulation.

Does Integrated Shield Plan Cover for Cancer?

Some of us might have purchased an Integrated Shield Plan (IPs) as an add-on to your existing Medishield Life.

For the uninitiated, starting from 1 April 2023, IPs will only be required to cover cancer drugs from the Ministry of Health’s (MOH) list of approved outpatient cancer drug treatments.

You might be wondering whether your Integrated Shield Plan provides coverage for cancer.

As a brief recap, Integrated Shield Plans, along with its riders provides coverage for your hospital expenses (bills).

This includes pre-or post-hospitalisation benefits, as well as inpatient and outpatient benefits.

For instance, it helps to cover bills for cancer-related treatments, such as radiotherapy, chemotherapy and immunotherapy.

This would mean that you do not have to worry about those huge medical bills which have resulted from treatment plans.

However, Integrated Shield Plans do not offer a lump sum payout upon diagnosis.

Its main role is to help to lessen one’s financial burden by offering coverage for the hefty medical bills.

Note: Do take a look at your personal Integrated Shield Plan coverage to check out which specific procedures are covered for cancers!

Do You Choose a Critical Illness Plan or a Cancer Insurance Plan?

Some of us might be tempted to get a cancer insurance plan instead of a critical illness insurance plan, due to its affordability.

Do note that these two types of plans are different in nature.

In my opinion, cancer insurance should not be a substitute for a critical illness plan, but rather a complement.

Both types of insurance do offer lump-sum payouts upon diagnosis of cancer.

Critical Illness (CI) insurance offer coverage for 37 severe-stage critical illnesses as defined by the Life Insurance Association (LIA), which includes major cancers.

Depending on the plan, some might offer coverage for additional illnesses as well.

Basic CI plans would offer coverage for the later stages of illnesses and would include less common conditions as compared to cancer insurance.

Newer CI plans have since included early-stage coverage, making it more comprehensive than before.

However, this would translate to higher premiums.

Cancer insurance, as its name suggests, is cancer-specific.

It covers different stages of cancers and may include relapse cases.

Cancer insurance might also offer more holistic coverage when one is down with cancer.

This might be beneficial given how prevalent cancer is today, where this extra ‘safety net’ might provide a sense of security.

Or it might be suitable for someone who does not have the budget for an early critical illness insurance, but wish to be covered for earlier stages of cancer.

This type of insurance is a solution for them who previously had barriers buying cancer coverage, which might be what most people are primarily concerned with.

You Already Have a Critical Illness Plan. Do You Still Need a Cancer Insurance Plan?

This would be highly subjective and based on personal coverage needs.

If you have a family history of cancer and may be concerned about the financial burden it might potentially bring, cancer insurance plans might make sense as the for you to consider.

Having a critical illness plan ensures that you’re sufficiently covered against critical illnesses.

With a cancer insurance plan, it can help do the heavy lifting when it comes to the diagnosis and treatment of cancer.

As such, this might be a worthy option if you’re looking to get more protection for cancer.

Also, with the underwriting limits for cancer being separated from CI coverage, it could act as a complement to your existing CI plans if your CI limits have been maxed out based on your age group.

With budget being a concern to most, it is important to prioritise your coverage needs, and see which products would meet these needs in the most cost-effective manner.

Standalone Cancer Insurance Plans in Singapore

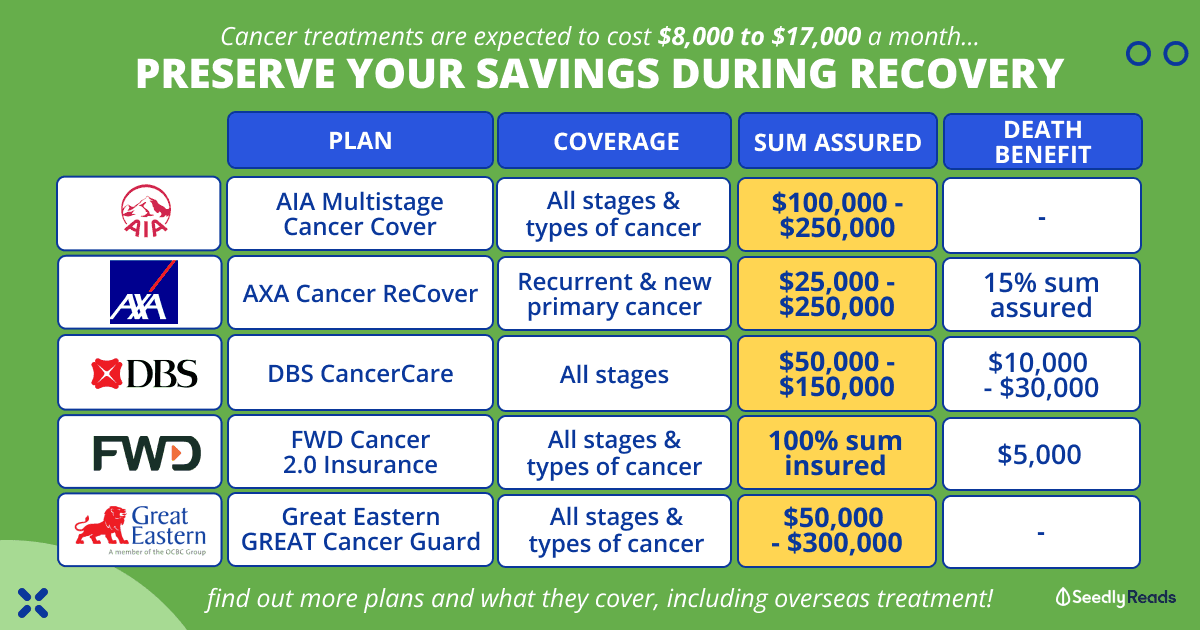

Here’s a compilation of the cancer insurance plans that are currently available in Singapore.

| Insurance | Coverage | Sum Assured | Death Benefit | Policy Renewal | Health Declaration | Age |

|---|---|---|---|---|---|---|

| AIA Multistage Cancer Cover | All types of cancer, at all stages | $100,000, $150,000 or $250,000 | - | 20-year coverage | 3 simple questions asked | Available for applicants aged 16 to 55 |

| AXA Cancer ReCover (For Cancer Survivors) | Recurrent or new primary cancers Free coverage for child (15% of sum assured for advanced stage, capped at S$25,000) | $25,000 to $250,000 | 15% sum assured (death or terminal illness) | 5, 10, 15, 20, or 25 years | Health declaration form to be filled | Life Assured: 5 to 65 years old Policyholder: 18 to 99 years old |

| DBS CancerCare | Early stage cancer: - Carcinoma in situ - Early Prostate Cancer - Early Thyroid Cancer - Early Bladder Cancer - Early Chronic Lymphocytic Leukemia - Gastro-intestinal Stromal Cancer Intermediate stage: - Carcinoma in situ of Specified Organs treated with Radical Surgery Advanced stage: Major cancers | Headstart: $50,000 Essential: $100,000 Advantage: $150,000 | Headstart: $10,000 Essential: $20,000 Advantage: $30,000 | Guaranteed renewable every five years No evidence of health required for renewal until age 70 | No | Available for applicants aged 18 to 75 |

| FWD Cancer 2.0 Insurance | All types of cancer, at all stages | 100% sum insured regardless of the stage of cancer diagnosed Pre-early cancer coverage: Additional payout of 10% sum insured or $10,000 (whichever is lower), even for early tumour diagnosis and treatment | 100% benefit payout if cancer is found to be cause of death | Coverage for 1 year, automatically renews every year up to age 85 | 1 simple health declaration required | Available for applicants aged 18 to 65 |

| Great Eastern GREAT Cancer Guard Apply Now | All types of cancer, at all stages | Lite: $50,000 Plan A: $100,000 Plan B: $150,000 Plan C: $200,000 Premier: $300,000 | - | Guaranteed renewal till age 85 | Simple health declaration required | Available for applicants aged 18 to 55 |

| MSIG CancerCare Plus Apply Now | Early stage cancer - Carcinoma in Situ - Early Prostate Cancer - Early Thyroid Cancer - Early Bladder Cancer - Early Chronic Lymphocytic Leukaemia - Gastro-Intestinal Stromal Cancer All major cancers | Accelerated Benefit (Early Stage Cancer): $50,000 - 50% of basic benefit Major Cancer Benefit: $100,000 | - | Automatic renewal every year up to age 84, even after payout of Accelerated Benefit for Early Stage Cancer | 3 simple health declarations | Available for applicants aged 20 to 65 |

| NTUC Income Cancer Protect | Early and advanced stage cancer coverage Existing non-cancer related medical conditions (e.g. diabetes and hypertension) may be covered, subjected to underwriting | $50,000, $80,000 or $100,000 Early-stage benefit: 25% of sum assured Advanced-stage benefit: 125% of sum assured (if no claims made previously) Accidental Death (before age 70): up to 100% of sum assured | $5,000, or 100% of premiums if it happens within a year from cover start date | Guaranteed renewal every 10 years, up till age 84 | Medical questionnaire required | Available for applicants aged 30 to 64 |

| Prudential PRUCancer 360 | All types of cancer, at all stages | $10,000 to $300,000 Maximum sum assured for age 1 – 16 is $100,000 | - | Maximum renewal age is 95 | 1 health question | Coverage from age 1 to 100 |

| Tiq Cancer Insurance | All types of cancer, at all stages | $50,000, $100,000 or $200,000 (No claim discount equivalent of 6% will be applied to renewal premium) | $5,000 | Renewable yearly up to age 85 | Depending on assessment of application | Available for applicants aged 17 to 65 |

| Tokio Marine TM Protect Cancer | All types of cancer, at all stages | $50,000 to $150,000 Early-stage benefit: 50% of sum assured | $5,000 | Guaranteed renewal till age 85 | 7 health-related questions | Available for applicants aged 30 to 65 |

| Singlife Cancer Cover Plus (recommended to complement it with Singlife Health Shield) | • Outpatient Cancer Drug Treatments (on the Cancer Drug List ‘CDL’) • Outpatient Cancer Drug Treatments (non-CDL) • Outpatient Cancer Drug Services • Inpatient and Outpatient Cell, Tissue and Gene Therapy • Inpatient and Outpatient Proton Beam Therapy • Overseas Treatment: - Outpatient Cancer Drug Treatments (on the Cancer Drug List ‘CDL’) - Outpatient Cancer Drug Treatments (non-CDL) - Outpatient Cancer Drug Services - Inpatient and Outpatient Cell, Tissue and Gene Therapy - Inpatient and Outpatient Proton Beam Therapy | Coverage: In excess of deductibles (Up to $1.5 million per policy year) Deductibles: Outpatient Cancer Drug Treatment (on the CDL): 10% co-insurance + 5 times MediShield Life claim limit per month Outpatient Cancer Drug Treatment (Non-CDL): 10% co-insurance + $30,000 per year Outpatient Cancer Drug Services: 10% co-insurance + 5 times MediShield Life claim limit per year Inpatient and Outpatient Cell, Tissue and Gene Therapy: 10% co-insurance + $150,000 per year Inpatient and Outpatient Proton Beam Therapy: 10% co-insurance + $70,000 per year Overseas treatment1 (with pre-authorisation): Singlife Cancer Cover Plus deductibles for the covered cancer treatments in the benefit schedule will apply | A few health-related questions required | Available for applicants aged 75 and below | ||

Similar to all other types of insurance plans, there is no apple-to-apple comparison due to its variables, and price should not be the sole reason for selecting a plan.

Once again, do approach your trusted financial adviser if you wish to know more about specific plans listed above.

Changes to Cancer Drug Insurance Coverage From 1 April 2023

Unfortunately, in our current society where high stress, a poor diet and a lack of sleep is apparent (hustle culture, sigh), our health starts taking a toll on us.

Besides cancer, critical illnesses such as Type II diabetes is another key area of concern for many.

In a situation where illness strikes, the last thing we would want to do is to worry about our finances.

If you recall that I’ve mentioned that from 1 April 2023, IPs will only cover cancer drugs on the MOH-approved list. This is a marked change from the status quo as most IPs provide as-charged coverage for outpatient cancer drug treatments, subject to an overall policy year limit which could exceed $2 million.

However, these changes do not affect IP riders, which are paid for wholly in cash.

That said, besides getting properly insured, another important (and often neglected part) for us to remember to go for regular health checks.

Related Articles:

- A Beginner’s Guide To Health Insurance: All You Need To Know & Types Available

- The Ultimate Female Insurance Plans Comparison (With Free Health Checkup)

- Key Types of Insurance Policies You Should Get In Singapore (2023)

- Best Insurance Options for Those With Pre-existing Conditions

- Integrated Shield Plan Riders Co-Payment Change: Is This Good for Consumers?

Advertisement