Integrated Shield Plans & Cancer Treatment Coverage: Upcoming Changes You Need to Know

●

What Is the Leading Cause of Death in Singapore?

Here’s a statistic for you.

According to the latest data from the Ministry of Health (MOH), the leading cause of death in Singapore is cancer, with the disease accounting for ~6,308 or 28.6 per cent of all deaths in Singapore in 2020:

According to the Health Promotion Board (HPB), ‘about 1 in every 4 to 5 Singapore residents, male or female, is likely to develop cancer in his or her lifetime.’

The good news is that you can have better clinical/management outcomes with early detection and treatment.

However, treatments are not cheap and, in some situations, drain your finances.

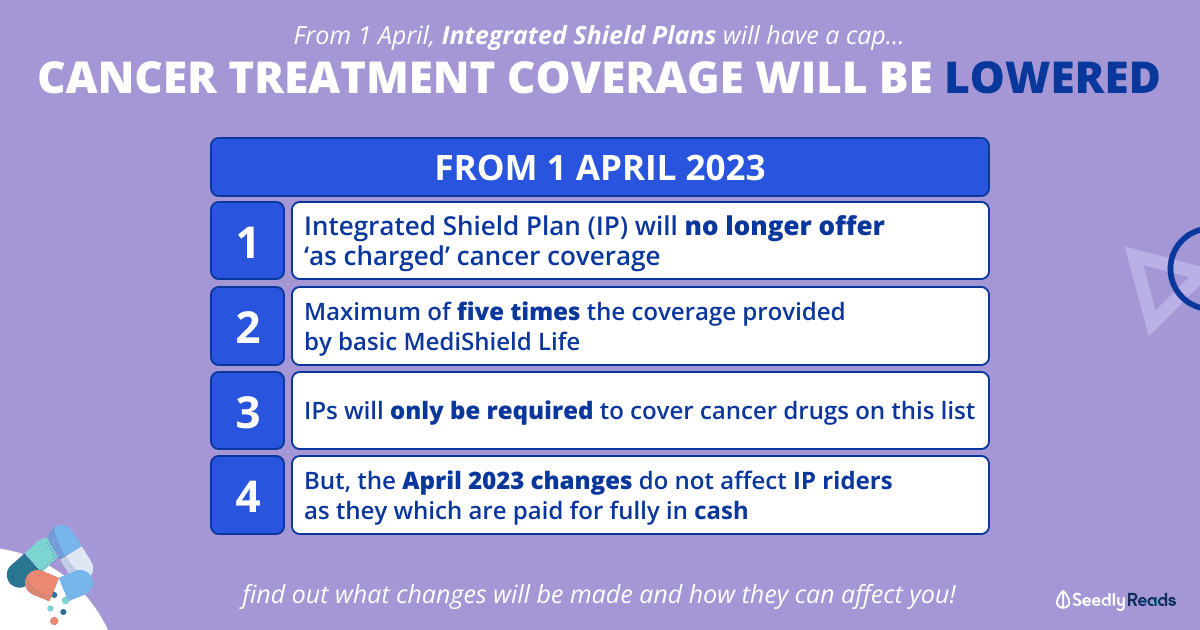

There will be changes to the insurance cap from 1 April 2023. Here’s all you need to know!

TL;DR: Changes To Cancer Treatment Coverages in Singapore

Click here to jump:

- Getting treated for cancer in Singapore

- Upcoming changes to getting insured for cancer treatments in Singapore

- Implications for policyholders

- Other changes that have taken effect since September 2022

Disclaimer: The information contained in this article pertaining to any insurance product or plan is provided and meant for general information only and does not constitute an offer, recommendation, solicitation or advice by Seedly to buy or sell any product(s), plan(s) or investment product(s). It is not and should not be relied on as financial advice and has no regard for any person’s investment and financial needs. If you are unsure whether this product or plan is suitable for you, you may seek personalised financial advice from a qualified insurance advisor.

Cancer Treatment: Cancer Drugs & Services Are Expensive

So here’s the thing.

The cost of cancer drugs in Singapore was getting a bit out of hand.

According to a MediShield Life Council report:

spending on cancer drugs (in Singapore) has been growing at a Compound Annual Growth Rate (CAGR) of 20%, far exceeding the 6% CAGR for non-cancer drugs.

Cancer drugs accounted for one-quarter of total drug spending in 2019, at $375 million. If this current trajectory continues, cancer drug spending is projected to reach $2.7 billion in 2030.

In response, the council appointed a Cancer Drug committee comprised of private and public sector oncologists to review MediShield Life’s coverage of cancer drug treatments.

The committee then recommended that the MOH put together a list of economical outpatient cancer drug treatments covered under MediShield Life in September 2022.

The Government has since accepted the council’s recommendations and will:

- Create a list of clinically proven and cost-effective outpatient cancer drug treatments

- Allow these cancer drug treatments to be claimable under MediShield Life

- Set more granular claim limits to provide better coverage based on the cost of each treatment.

For what it’s worth, these recommendations are similar to what developed countries like South Korea, Australia, and the United Kingdom have implemented.

MOH-Approved Outpatient Cancer Treatment Drug List

For the uninitiated, an Integrated Shield Plan (IP) rides on top of your existing MediShield Life to provide additional coverage for Class B1 or A wards, even for private hospitals and is managed by private insurers. Premiums are typically payable using MediSave up to your annual limits.

Some individuals also add on riders to cover deductibles (the fixed amount you must pay before your insurance kicks in) and co-insurance (the percentage you must pay after your insurance kicks in), and this is paid in cash.

From 1 April 2023, the Cancer Drug List framework will also apply to IP coverage.

This means that your IP might not cover cancer drugs not on the list, as IPs will be required to only cover treatments on the MediShield Life Cancer Drugs List and set claim limits for each cancer drug treatment.

This framework will apply to all IPs renewed or sold from April 2023.

This is a marked change from the status quo as most IPs provide “as-charged” coverage for outpatient cancer drug treatments, subject to an overall policy year limit which could exceed $2 million.

However, these changes do not affect IP riders, which are paid for wholly in cash.

Based on the MediShield Life Council’s recommendation, the MOH has developed this Cancer Drug List on economical and clinically proven cancer drug treatments.

This list is updated every four months to keep up with advancements in medicine. It covers about 90 per cent of the cancer treatments in the public sector. It includes some commonly used treatments that are not as clinically proven or economical but have been exempted from this exclusion.

Since the implementation of the approved drug list in September 2022, cancer drug prices have dropped by an average of 30 per cent for the public sector at the time of writing, with some falling by as much as 60 per cent.

However, this has so far not been reflected in the private sector.

If you’re following, there is another change to the use of IP for cancer treatments in Singapore.

Integrated Shield Plan Cancer Drugs & Services Coverage Capped At Five Times

Starting from 1 April, IP will increase their coverage for cancer treatments up to a maximum of five times the coverage provided by basic MediShield Life.

This means a reduction in coverage compared to the current policy of most insurers who cover policyholders’ bills “as charged” with patients bearing the usual deductible and co-payment.

The change will apply to all IP policyholders upon renewal, regardless of their ward class or plan type. Those currently undergoing cancer treatment will receive an extension of their current coverage for an additional six months to complete their regimen.

Cancer Treatment Involving One Type of Approved Drug

For MediShield Life, depending on the drug used, the amount that drugs can be covered by insurance ranges from $200 to $9,600 a month.

For IPs, coverage at five times would come to a maximum of $1,000 to $48,000 a month.

Combination Treatment Involving More Than One Approved Drug

The insurance can pay for only the most expensive drug used when more than one drug on the Cancer Drug List is prescribed.

Likewise, if a combination therapy is used and the drugs are on the list, all the drugs in the combination will be covered up to the $9,600 a month cap.

Implications For Cancer Patients in Singapore

Chances are, you will be affected as about 7 in 10 Singapore residents have IPs, which is an essential insurance policy for most.

With all these changes, those who intend to seek help from private hospitals are expected to fork out more out-of-pocket expenses as the coverage seems to be based on drugs at public hospitals.

MediShield Life coverage of drugs is based on the heavily subsidised prices at public hospitals. Five times (of Integrated Shield Plans) might not be enough as the private sector is not able to buy such medicines at the same price as public institutions, which purchase collectively in large amounts.

~ Oncologist interviewed by The Straits Times

The general sentiment seems to hover around the fact that if you are a patient in a private hospital and do not have a rider for your IP, the coverage will not be enough.

In fact, about one in three (or more than 70 per cent) of the 2.9 million people in Singapore do not have riders, even though they have IPs.

Changes to MediSave Withdrawal Limits For Cancer Treatment in Singapore

Since September 2022, there have been changes to the MediSave withdrawal limits for outpatient cancer scans and outpatient chemotherapy treatment too.

For cancer services such as consultation fees, tests and supportive drugs that treat nausea or infections caused by the treatment, MediShield Life will be raised from $1,200 to $3,600 a year now.

And those who are on IPs will be covered up to a maximum of $18,000 a year, or about $1,500 a month.

| From Sep 2022 | Revised (From Apr 2023) |

|

|---|---|---|

| MediShield Life | Ranges from $200 to $9,600 per month for cancer drug treatments on the positive list Additional $1,200 per year for cancer drug services | Ranges from $200 to $9,600 per month for cancer drug treatments on the positive list Up from $1,200 to $3,600 per year for cancer drug services |

| MediSave | $1,200 per month for cancer drug treatments with MediShield Life claim limit above $5,400, and $600 per month for other treatments on the positive list Additional $600 per year for cancer drug services and/or other cancer scans.^ | - |

Source: MOH

^ MediSave can also be used for scans for post-treatment monitoring and radiotherapy patients

Also, the new MediShield Life claim limits for cancer drug treatments will be set based on post-subsidy bills.

Changes to Medication Assistance Fund Subsidies For Cancer Treatment in Singapore

According to the MOH, public healthcare patients receive up to 75 per cent subsidy for cancer drugs that fall under the Standard Drug List (SDL) and Medication Assistance Fund (MAF) list.

The Government has also raised the eligible income criteria for MAF subsidies so that more Singaporeans will benefit. Subsidies of up to 50 per cent has been extended to Singaporeans with per capita household income (PCHI) between $2,800 and $6,500 per month:

FYI: PCHI is calculated by taking the total gross household monthly income divided by the total number of family members living together.

| Monthly Per Capita Household Income (PCHI) | Subsidy Tier (Singapore Citizens) | |

|---|---|---|

| Current | Revised | |

| $0 ≤ PCHI ≤ $2,000 | 75% | |

| $2,000 < PCHI ≤ $2,800 | 50% | |

| $2,800 < PCHI ≤ $3,300 | 0%* | 50% |

| $3,300 < PCHI ≤ $6,500 | 40% | |

| PCHI > $6500 | 0%* | |

Source: MOH

*In exceptional deserving cases, MAF may be extended upon appeal.

One more thing, this MAF subsidy enhancement applies to both cancer and non-cancer drugs on the MAF list. This means that eligible patients will get to enjoy more affordable treatment.

What About Those Who Have Difficulties Paying For Cancer Drugs?

Singaporeans who face difficulties paying for cancer drug treatments and related services after subsidies, insurance and MediSave can apply or MediFund for further assistance.

Afterthoughts

I’m not sure about your intention, but for me, the main objective of getting an IP is to pay for non-subsidised treatments in cases where subsidies are not applicable.

It’s human nature to expect as much coverage as you can get when you get your health insurance because we all know that healthcare is not cheap.

While the implementation of the approved Cancer Drug List framework and the fine-tuning of granular claim limits to provide better coverage based on the cost of each treatment has brought some effect on the affordability of cancer drug treatments, including bringing insurance premiums down, the changes feel like a double-edged sword.

No doubt, consumers who are paying a premium for IP will feel unfair as they are expecting to be covered financially since they are always told that claims could be made “as charged”.

However, now it’s no longer the case, and they can only claim to a certain amount, it’s easy to feel that the safety net has been “snatched away”.

Likewise, since IP no longer covers all drugs that patients need, it’s hard for those who have complications to determine if they can even consider private healthcare now, even though they bought IP with the idea that they can opt for private healthcare.

After all, cancer treatment is not affordable, as treatment of cancer per month is estimated to be between $8,000 to $17,000 a month without insurance coverage.

What are your thoughts on the changes to cancer coverage? Share them with the Seedly community!

Related Articles:

- Can You Afford Cancer Treatment? An Insight On The True Cost Of Cancer Treatment In Singapore

- Best Cancer Insurance in Singapore: Keeping a Peace of Mind in Hard Times

- Best Insurance Options for Those With Pre-existing Conditions

- Insurance Policies You Need in Singapore For Each Age Group

- A Beginner’s Guide To Health Insurance: All You Need To Know & Types Available

Advertisement