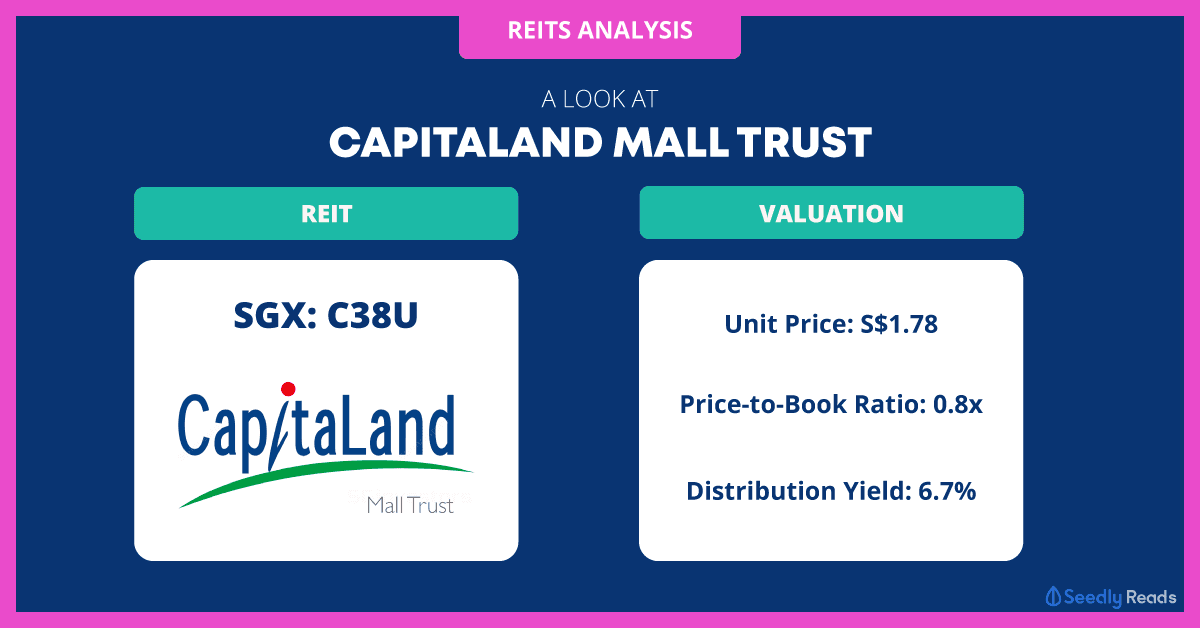

What To Know About CapitaLand Mall Trust (SGX: C38U) At Its Share Price of S$1.78

Sudhan P

Sudhan P●

At the time of writing, CapitaLand Mall Trust (SGX: C38U) is trading at a share price (technically known as unit price for REITs) of S$1.78.

At that unit price, CapitaLand Mall Trust has a price-to-book (PB) ratio of 0.8 and a distribution yield of 6.7%.

As a long-term investor, CapitaLand Mall Trust looks like a buying opportunity to me at its unit price of S$1.78.

Let’s explore why using my 10-step guide to pick the best Singapore REITs.

As a summary, here are the 10 steps I use to pick the best Singapore REITs:

- Growth in Gross Revenue and Net Property Income

- Growth in Distribution Per Unit

- Property Yield of Between 5% and 9%

- Gearing Ratio of Below 40%

- Interest Coverage Ratio of Above 5x

- Healthy Portfolio Occupancy Rate

- Positive Rental Reversions

- Presence of Growth Prospects

- Acceptable Price-to-Book Ratio

- Distribution Yield of Above 5%

Business Background

CapitaLand Mall Trust is the biggest shopping mall owner in Singapore with 15 shopping centres scattered all over the Lion City. Some of the shopping malls it owns are Bugis Junction, JCube, Plaza Singapura, and Tampines Mall.

CapitaLand Mall Trust’s shopping malls are strategically located near major transport networks and population catchments. This makes it very convenient for shoppers, for example, to get their stuff from the REIT’s malls after exiting from an MRT station before heading back home.

CapitaLand Mall Trust’s sponsor is CapitaLand Limited (SGX: C31), one of Asia’s largest diversified real estate property companies. A strong sponsor in CapitaLand adds to CapitaLand Mall Trust’s attractiveness.

CapitaLand Mall Trust also owns an 11% stake in CapitaRetail China Trust (SGX: AU8U), the first China shopping mall REIT listed in Singapore.

1. Gross Revenue and Net Property Income (NPI) Check

Check for: Increasing gross revenue and NPI

From 2015 to 2019, CapitaLand Mall Trust’s gross revenue rose 4.1% each year, from S$669.0 million in 2015 to S$786.7 million in 2019.

Meanwhile, net property income grew from S$466.2 million to S$558.2 million, increasing at a faster rate of 4.6% per annum.

| 2015 | 2016 | 2017 | 2018 | 2019 | Compound Annual Growth Rate (CAGR) | |

|---|---|---|---|---|---|---|

| Gross revenue (S$' million) | 669.0 | 689.7 | 682.4 | 697.5 | 786.7 | 4.1% |

| Net property income (S$' million) | 466.2 | 479.7 | 478.2 | 493.5 | 558.2 | 4.6% |

If you notice, CapitaLand Mall Trust’s gross revenue for 2017 fell 1.1% year-on-year.

The decline was largely due to Funan’s closure for redevelopment from 1 July 2016.

However, on a comparable basis (excluding Funan and Rivervale Mall, which was sold in December 2015), gross revenue would have inched up by 0.6%.

Since 2019’s gross revenue has surpassed that of 2016, I’m not too concerned.

We should also note that Funan has opened its doors on 28 June 2019 after a three-year makeover.

Verdict: Pass

2. Distribution Per Unit (DPU) Check

Check for: Increasing DPU

From 2015 to 2019, CapitaLand Mall Trust’s DPU grew around 6% in all.

| 2015 | 2016 | 2017 | 2018 | 2019 | CAGR | |

|---|---|---|---|---|---|---|

| Distribution per unit (Singapore cents) | 11.25 | 11.13 | 11.16 | 11.50 | 11.97 | 1.6% |

DPU in 2016 fell by 1.1% year-on-year largely due to the closure of Funan and divestment of Rivervale Mall.

However, in 2019, DPU has exceeded that of the previous years. So, all’s good here.

Verdict: Pass

3. Property Yield Check

Check for: Property yield of between 5% and 9%

For 2019, CapitaLand Mall Trust’s property yield stood at 5.4%, which is within my range.

Verdict: Pass

4. Gearing Ratio Check

Check for: Gearing ratio below 40%

As of 31 December 2019, CapitaLand Mall Trust had a gearing ratio (also known as aggregate leverage) of 32.9%.

The gearing ratio is well within my threshold of 40% and is also far below the regulatory limit of 45%.

Verdict: Pass

5. Interest Coverage Ratio Check

Check for: Interest coverage ratio above 5 times

As of end-2019, CapitaLand Mall Trust’s interest coverage ratio stood at 4.7x, which is not to my liking.

Verdict: Fail

6. Portfolio Occupancy Rate Check

Check for: Healthy portfolio occupancy rate

CapitaLand Mall Trust’s portfolio is almost fully occupied at a rate of 99.3%, as of 31 December 2019.

During the same period, Funan had an occupancy rate of 99.0%, up from 95.3% at end-2015.

(Reminder: Funan was shuttered for redevelopment on 1 July 2016 and re-opened on 28 June 2019.)

Verdict: Pass

7. Rental Reversion Check

Check for: Positive rental reversions

Rental reversion for 2019 was 0.8%. Even though this looks low, I’m happy that the figure is positive, amid intense competition in Singapore’s retail market.

Verdict: Pass

8. Growth Prospects Check

CapitaLand Mall Trust has a four-pronged approach to grow, as shown below:

The REIT’s Westgate acquisition (portfolio reconstruction), and sprucing up of Funan and Lot One Shoppers’ Mall (active asset management) are part of its growth strategies.

In November 2018, CapitaLand Mall Trust acquired the balance 70% of Westgate it did not own.

Lot One Shoppers’ Mall started its asset enhancement works in the third quarter of 2019. Tony Tan, chief executive of the REIT’s manager, said the following in the earnings release then:

“The rejuvenation of Lot One Shoppers’ Mall is underway. Shoppers can look forward to an expanded public library and reformatted cinema which will offer more entertainment variety for movie goers progressively from 2H 2020.”

More recently, CapitaLand Mall Trust announced a merger with CapitaLand Commercial Trust (SGX: C61U). The merger has many benefits, including the potential for higher DPU.

Last but not certainly the least, CapitaLand Mall Trust, with its well-located malls, can also ride on the growth of the Singapore population, which is estimated to reach 6.5 to 6.9 million by 2030.

Verdict: Pass

9. Price-to-Book Ratio Check

Check for: Acceptable price-to-book ratio

At CapitaLand Mall Trust’s unit price of S$1.78, it is valued at a PB ratio of 0.8x.

Over the past five years, the REIT’s average PB ratio was 1.1x.

Therefore, right now, CapitaLand Mall Trust looks undervalued to me.

Verdict: Pass

10. Distribution Yield Check

Check for: Distribution yield to be above 5%

At CapitaLand Mall Trust’s unit price of S$1.78, it has a distribution yield of 6.7%, which is more than 5%.

Verdict: Pass

The Final Verdict

CapitaLand Mall Trust has a final score of 9/10.

I like CapitaLand Mall Trust mainly for its market leadership in the Singapore retail mall market, growth in DPU, high portfolio occupancy rate, and for having management with foresight.

CapitaLand Mall Trust’s valuations used to be expensive (PB ratio of 1.2x and yield of 4.7% in early January 2020). However, given the Covid-19 scare, its PB ratio and distribution yields have come down to attractive levels for me to consider buying more of its units for my dividend portfolio.

Granted, there could be short-term pains for CapitaLand Mall Trust since lesser people are patronising malls due to the strict measures in place here to eradicate Covid-19.

CapitaLand Mall Trust has also dished out rental rebates, among others, to its tenants to help them in this trying times. The relief package could affect DPU in the next few quarters.

Tony Tan, chief executive of CapitaLand Mall Trust’s manager, explained the rationale for the rebates:

“CMT [CapitaLand Mall Trust] cannot achieve sustainable distributions without embracing and considering the needs of our retailers. We want our tenants and shoppers to know we are in this for the long haul and that we will journey with them during this difficult period. As Singapore’s largest retail REIT, it is incumbent on CMT to take the lead and proactively work alongside our tenants, who are our closest business partners in an increasingly collaborative retail environment. By weathering the challenges together, we can build greater resilience for our retail ecosystem that underpins the long-term growth of our portfolio.”

I applaud the REIT’s manager for reaching out to its tenants and not squeezing them dry amid the Covid-19 storm.

Furthermore, CapitaLand Mall Trust is highly likely to emerge stronger from the pandemic, even if it leads to a recession.

The REIT’s growth in distributable income during the Great Financial Crisis of 2007 to 2009 certainly speaks well of its resilience.

As a long-term investor, I see the short-term weakness, including any DPU cuts, as a rare opportunity to have a larger stake in a well-managed and resilient REIT.

What Are Your Thoughts on CapitaLand Mall Trust?

Why not check the Seedly Community and join the discussion on CapitaLand Mall Trust.

Stock Discussion on CapitaLand Mall Trust

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.

Advertisement