CareShield Life: All You Need To Know About This Long-Term Care Insurance Scheme

By now, you should have heard of CareShield Life.

Which is basically ElderShield 2.0, newer but with better coverage, and a funky new name.

It’s part of the Government’s initiative to better address our ageing population.

On 1 Oct 2020, all Singapore residents between 30 to 40 years old have started paying premiums and be included in this national long-term care insurance scheme.

And from 6 Nov 2021 onwards, Singaporeans and permanent residents born 1979 or earlier and who are not severely disabled can also sign up for CareShield Life.

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any insurance product(s). It does not take into account the specific objectives or particular needs of any person. We strongly advise you to seek advice from a licensed insurance professional before purchasing any insurance products and/or services.

What is CareShield Life?

Similar to ElderShield, CareShield Life offers a payout upon severe disability to help finance the long-term care cost.

You will receive lifetime cash payouts as long as you are severely disabled.

Severe disability is defined as needing assistance in at least three of these activities of daily living:

- eating

- getting dressed

- using the toilet

- bathing

- moving

- walking around, and

- getting from the bed to a chair or vice versa

These payouts will increase over time — starting from S$600 a month in 2020.

The premiums are fully payable via MediSave.

And there are Government subsidies available if you need help paying for the premiums.

Is CareShield Life An Improvement From ElderShield?

Overall, yes.

The payouts are definitely higher.

The original ElderShield 300 provided S$300 per month for 5 years.

When it was upgraded to ElderShield 400, you received S$400 per month for 6 years.

With the new CareShield Life, you now receive S$600 per month from the start and the payouts will increase over time, for life.

Am I Automatically Under CareShield Life?

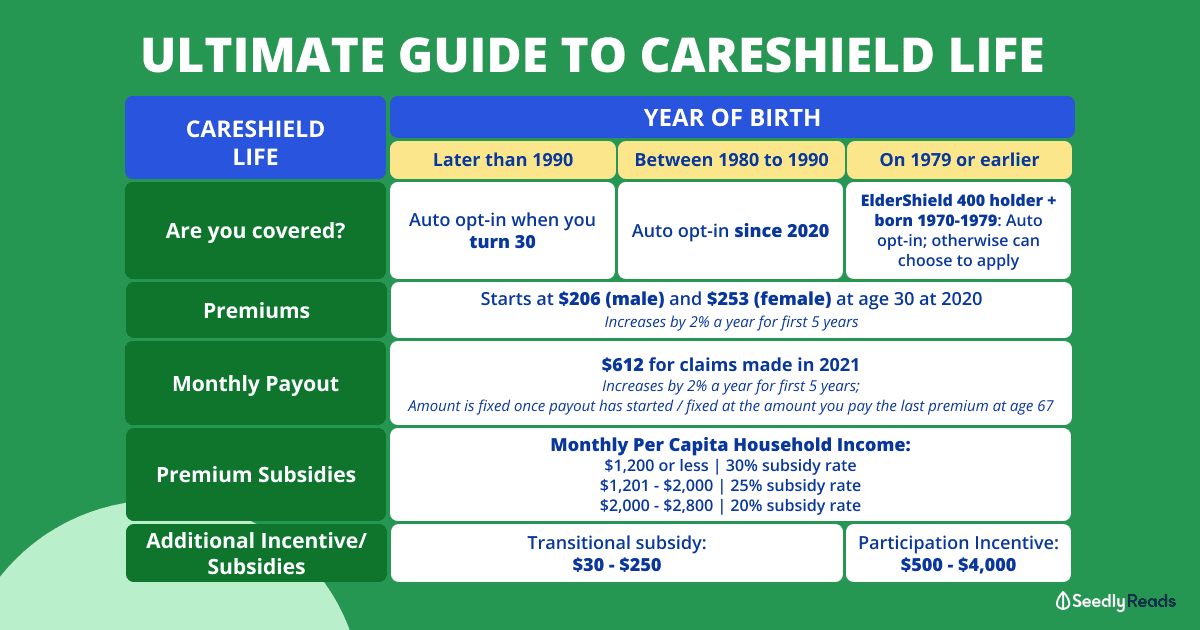

| Year of Birth | CareShield Life Details |

|---|---|

| On 1979 or earlier | Automatically opt in if you are an existing ElderShield 400 policyholder born between 1970 and 1979 or can apply to join from 6 Nov 2021 onwards if not severely disabled |

| Between 1980 to 1990 | Automatically opt in if you are between 30 to 40 years old in 2020 |

| Later than 1990 | Automatically opt in when you turn 30 |

Singaporeans born between 1980 and 1990 have been automatically covered since 1 Oct 2020, regardless of pre-existing medical conditions and disability.

Those born after 1990 will be automatically covered when you turn age 30, regardless of pre-existing medical conditions and disability.

Existing ElderShield 400 policyholders born between 1970 and 1979 will be auto-enrolled from 1 Dec 2021.

All other Singaporeans and permanent residents born in 1979 and earlier can choose to sign up for CareShield life from 6 Nov 2021 onwards.

This is because this group consists of ElderShield 300 policyholders, uninsured and older individuals who will face relatively higher annual premiums.

This allows them the freedom to choose whether to opt in CareShield Life.

What Are the Premiums for CareShield Life?

Premiums begin from age 30 to 67 (a total of 38 premiums over your lifetime).

They currently start at $206 for male and $253 for female — starting at age 30 for both.

The premiums will increase at a rate of 2% a year for the first 5 years.

FYI: the rate at which it will increase for subsequent years will be decided again by the CareShield Life Council

You will continue to be covered for life once you have completed paying your premiums, which will happen in the year you turn age 67 or 10 years after you join the scheme, whichever is later.

Anyone with a severe disability at the joining age of 30 has to pay only the first premium in order to qualify for lifetime payouts.

For anyone eligible for a payout, he or she will stop paying premiums even if they are younger than the last premium payment age of 67 years.

What is the Estimated Monthly Payout?

| Birth Year | Monthly Payout for severe disability if a successful claim is made in Year X | |||||

|---|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| 1954 and earlier | N.A. | $612 | ||||

| 1955 | $612 | $624 | ||||

| 1956 | $624 | $637 | ||||

| 1957 | $637 | $649 | ||||

| 1958 | $649 | $662 | ||||

| 1959 to 1979 | ||||||

| 1980 and later | $600 | |||||

Source: Ministry Of Health

Payouts will increase by 2 per cent per year for the first 5 years (2020 to 2025).

Do note that once you start collecting a payout, this amount will be fixed and will not increase, even when the scheme’s payout increases in the future.

Similarly, the payout amount will be fixed at the amount the year you pay the last premium at age 67.

Is There A Huge Difference Between CareShield Life vs ElderShield?

For CareShield Life, the payout upon disability is at least 50% higher.

The payout also lasts a lifetime.

| ElderShield | CareShield Life | |

|---|---|---|

| Able to opt out? | Yes | No |

| Payable by Medisave | Yes | Yes |

| Premiums start at | 40 years old | 30 years old |

| Premiums stop at | 65 years old | 67 years old (or later according to retirement age) |

| Annual premiums* | $175 (Men); $218 (Women) | $200 (Men); $250 (Women) - Increase 2% every year |

| Premiums are paid for (years) | 26 | 38 |

| Government subsidy | No | Yes |

| Payout starts when | Unable to do at least 3 Activities of Daily Living (ADLs) | |

| Payout amount | $400/month | $600/month (starting 2020) |

| Duration of payout | Six years | Lifetime |

Source: The Straits Times

*Using premiums for ElderShield from age 40 and CareShield Life from age 30

| ElderShield | CareShield Life | |

|---|---|---|

| Total Premiums Paid | S$4,600 | S$7,800* |

| Total Estimated Payouts | S$28,000^ | S$144,000* |

Note: Figures are rounded to the nearest hundred.

^ ElderShield has a payout of 6 years.

*Premiums are before subsidies. Figures assume a 2% increase in premium per year.

How To Join CareShield Life?

Existing ElderShield 400 policyholders born between 1970 and 1979 will be auto-enrolled from 1 Dec 2021.

All other Singaporeans and Singapore PR born in 1979 or earlier can choose to join CareShield Life from 6 Nov 2021 onwards by signing up online.

Do note that It is not compulsory for those who are not automatically enrolled in CareShield Life.

However, if you wish to opt in for CareShield Life, you will be required to pay more premiums (by topping up).

Is There An Incentive To Join Careshield Life?

There are incentives for those born before 1979 or earlier to join CareShield Life by 31 Dec 2023:

| Birth Year | Annual Participation Incentive | Total Additional Participation Incentives for Merdeka Generation (MG) & Pioneer Generation (PG) seniors | Total Participation Incentives over 10 years* |

|---|---|---|---|

| 1975 – 1979 | $50 | N.A. | $500 |

| 1970 – 1974 | $100 | $1,000 | |

| 1965 – 1969 | $150 | $1,500 | |

| 1960 – 1964 | $200 | $2,000 | |

| Before 1960 | $250 | $1,500 | $2,500 for non-MG and non-PG seniors $4,000 for MG and PG seniors |

*Participation incentives will be spread equally over 10 years and will be used to offset the annual premium payable in that year. It will only be applicable if Singapore Citizens born on 1979 or earlier join in the first two years from end-2021.

Are There Any Premium Subsidies Available for CareShield Life?

As with any Government initiative, there most certainly are.

All Singapore Citizens will receive up to S$250 over the first 5 years to help pay for the premiums of CareShield Life.

There are transitional subsidies for Singapore Citizens born 1980 or later, in the first 5 years from 2020 to 2024:

| Birth Year | Year | Total Transitional Subsidy | ||||

|---|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | 2023 | 2024 | ||

| 1994 | - | $30 | $30 | |||

| 1993 | - | $40 | $30 | $70 | ||

| 1992 | - | $50 | $40 | $30 | $120 | |

| 1991 | - | $60 | $50 | $40 | $30 | $180 |

| 1980 - 1990 | $70 | $60 | $50 | $40 | $30 | $250 |

Additional premium subsidies are also available for people with a monthly per capita household income of:

| Monthly Per Capita Household Income | Subsidy Rate |

|---|---|

| S$1,200 or less | 30% |

| S$1,201 – S$2,000 | 25% |

| S$2,001 – S$2,800 | 20% |

Overall, the premium subsidies and benefits are similar to MediShield Life.

You can use your MediSave to pay for the premiums.

And also use your MediSave to pay for your dependant’s premiums.

If I Am on ElderShield, Can I Opt for CareShield Life?

CareShield Life is not compulsory for those who are already on ElderShield.

(Besides those who are born between 1970 and 1979 and are on ElderShield 400, who will be automatically opted in from 1 Dec 2020.)

If you are under Eldershield Life and want to opt in for CareShield Life.

You can upgrade to CareShield Life from 6 Nov 2021.

If you have opted out of ElderShield but want to opt-in for CareShield Life…

You can do so provided that you are not currently disabled.

Examples for Opting In to CareShield Life While on ElderShield:

Should You Upsize Your CareShield Life With a Supplement Plan?

CareShield Life supplements are policies that supplement the coverage of the basic CareShield Life policy.

In general, these supplement policies will make it easier for you to make claims as most of them reduce the ADL claim criteria from three out of six ADLs down to even one out of six ADLs.

Also, the monthly payouts from the supplement policies can go up to $5,000, and most are add-ons to the basic CareShield Life monthly payouts.

Premiums can be paid using cash or your own or your family members’ (i.e. spouse, parents, children, siblings or grandchildren) Medisave within the Additional Withdrawal Limit (AWL).

If you’re looking to increase your coverage, we did a comparison of the CareShield Life supplements that are currently available!

Erm… Is the Government Trying To Make a Profit Off Us Through CareShield Life?

There were 1.3 million ElderShield policyholders in 2017.

Meaning a total of S$3.3 billion in premiums was collected.

However, only about $133 million was paid out in claims…

So what happened to the surplus? Hmmm…

Also, previously when ElderShield was covered by only 3 insurers in Singapore.

It resulted in ‘profits’ which had raised questions as to why the Government is implementing CareShield Life.

However, according to this statement, the Government assured us that:

- The premiums collected and returns from investments will stay within the fund so that policyholders can benefit through higher payouts or premium rebates

- Today, premiums collected under ElderShield are more than the claims paid out, as most policyholders are relatively young

- But the premiums collected do not become Government surpluses, rather, they are meant for future claims — when policyholders become older and more of them make claims for severe disabilities (see the graphic below)

For CareShield Life, all premiums collected will remain within the fund.

And will only be disbursed to policyholders.

It will NOT be transferred to other Government schemes.

CareShield Life: All You Need To Know About This National Insurance Scheme

So there you have it.

With CareShield Life, we’ve got a little more assurance that we will be financially supported in an unfortunate case of severe disability.

If you have any questions or would like to hear different perspectives from others on this, you know where to go!

Advertisement