So you want to save without conditions?

Previously, we wrote an article for best saving accounts for working adults, but most of the time, the interest tiers come with many conditions like Salary crediting, Paying bills and Credit Card spending. We also wrote a detailed comparison of the best savings accounts in Singapore.

Now, what if you wanted something simple and easy to understand? This is the article for you.

Who is this article for?

- Self-employed, Freelancers

- Property agents or Financial Planners

- Couple Joint Accounts (JA)

- People with extra cash who may want to park somewhere (sizeable emergency or opportunity fund)

Key Considerations:

- Simple, better interest rates which beat the normal 0.05% p.a for NO requirements

- Liquid funds, where you can withdraw or close the account when you need it

- A known reputable bank with easy to assess with Internet and mobile banking

Editor’s note: We do not get any commissions from any of these recommendations.You will start to realize also that very often, the best products do not give any perks (thus consumers discover them via blog posts like this rather than comparison sites) Updated to October 2017

The 4 main players

Winner: CIMB Fast Saver is the best No Condition Savings Account

In Singapore, CIMB FastSaver is a simple winning product:

- Flat 1% p.a for first $50k savings (Beyond $50k, at 0.6% p.a)

- Easy to start up with $1k minimum deposit and highly liquid (can withdraw anytime)

- Insured up to $50k by SDIC (Singapore Deposit Insurance Corp)

If you are a self-employed, financial planner, or property agent, simply stick to this account and pair it with a powerful Miles Card or Cashback Card and you are pretty much set!

Editor’s note: I’m actually starting a Joint Account (JA) with my other half, so this is the account that we are going to put our funds in as well 🙂 A straightforward product, even their website is so easy to understand.

Limitations of CIMB account:

- Not a very modern online and mobile banking interface

- Few other value-added services (e.g investment brokerages, insurance)

- Fewer retail outlets and cash withdrawal point etc.

In addition, if you are keen to ask questions or discuss more on savings accounts and card deals, please do join our open Facebook Group where you can learn from fellow folks residing in Singapore who are all learning together.

An Example: Calculation of Interest at $20K balance

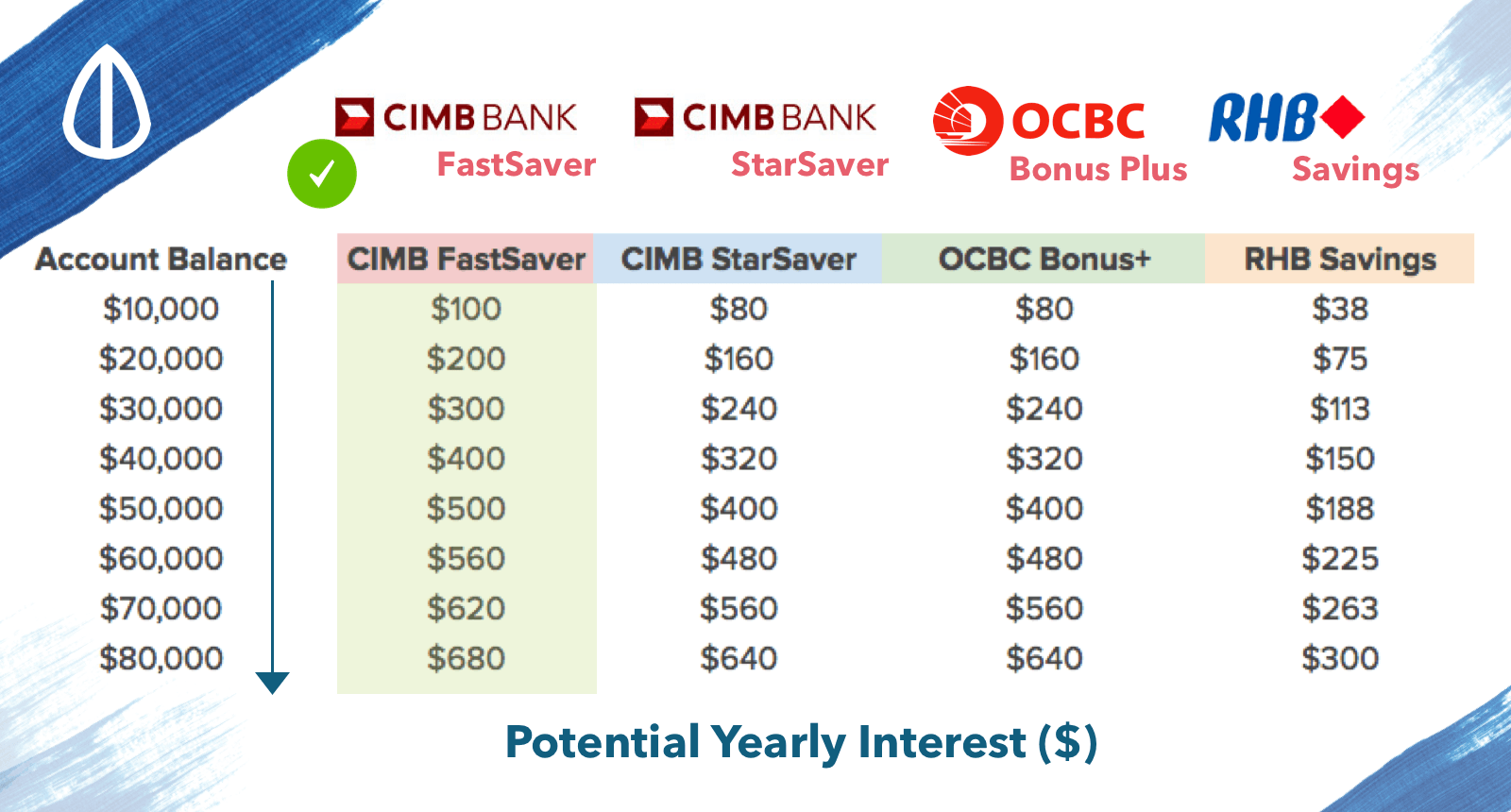

You can see below in this screenshot where I have calculated all the respective interest rates with an example of a $20k bank balance. The important numbers are highlighted in Yellow.

Further Reading – Detailed Information

1) CIMB FastSaver Savings Account

Again, as mentioned above, this is a very simple product with some key features:

- 1% p.a up to $50k account balance

- 0.6% p.a beyond $50k account balance

- Minimum startup deposit $1k

2) CIMB StarSaver Savings Account

This is an even more simple product with 1 main flat interest rate feature:

- 0.8% p.a for entire account balance

- Minimum startup deposit $5k

3) OCBC Bonus Plus Savings Account

This is a common product with a twist to help drive higher interest rate than most other bank accounts:

- 0.05% base interest

- 0.75% bonus interest for months you don’t withdraw

- Minimum startup deposit $10k

4) RHB Savings Account

This is also a very simple product with 1 main flat interest rate feature, much like the CIMB StarSaver one:

- 0.375% p.a for entire account balance

- Minimum startup deposit $500

5) Hong Leong Finance Fixed Savings Account

This is a very unique product where it has various components to it:

- Mainly targeted towards joint account holders and contributors

- Base interest rate of 0.20% p.a on account balance

- Further bonus interest rate of up to 1.70% p.a from GIRO transfers

I thought this was interesting but will pass because of the idea that this bank is not as common and I foresee the withdrawals, transfers to be tougher than the others like CIMB or OCBC. Cheers!

6) Citi MaxiGain Savings Account

This is a very unique but a tad confusing product and is rather similar to the OCBC Bonus Plus where it has various components to it:

- Mainly targeted towards fixed amount savings with no withdrawals

- Base interest at 80% of the 1-month Singapore Dollar Interbank Offer Rate (1-month SIBOR) (eg. 0.8% if the SIBOR is 1%)

- Bonus interest rate that steps up each month (Starting from 0.1% p.a. to a maximum of 1.2% p.a.)

- Minimum startup deposit at $10k

I thought this was interesting but will pass on this if I were a self-employed as withdrawals are also very key to the daily living expenses etc. However, would consider this if I have a lump sum of cash and consider this versus other fixed deposit schemes by other banks!

Related Articles

- Best Fuss-Free Savings Accounts With No Conditions in Singapore 2022

- Best Savings Accounts for Kids 2022: Best Places to Grow Your Child’s Money

- Cheat Sheet: Best Savings Accounts in Singapore For Working Adults? – Highest Interest Rates

- Ultimate Cash Management Accounts Comparison

- This Month’s Singapore Savings Bonds (SSB): Interest Rates & How To Buy

- Best Saving Accounts For Students

- Still Holding Onto Your First Savings Account? Here’s Why You Should Change It

- Which Child Development Account (CDA) Should You Open for Your Child in 2022?

- Working Adults: Which Savings, Expenses And Investment Accounts Should I Start With?

Advertisement