5 Things To Look Out For When Choosing The Right REITs To Invest In

A Basket of S-REITs vs Straits Times Index Exchange Traded Fund (STI ETF)

The humble Singapore REIT.

- If you had bought and held a broad basket of S-REITs 5 years ago and held them until today, your total return (including distributions) would have been an annualised 8.4%, blowing past the 4.4% annual return had you bought an STI ETF.

- Given the less than robust nature of the Singapore retail bond market, there is no getting around the fact that to build a core long-term portfolio as a Singapore retail investor, the S-REIT must form a cornerstone of your portfolio.

5 Key criteria to analyse when investing in REITs

In this article, I will set out a framework of 5 key criteria to analyse when investing in S-REITs.

REITs Report Card

| 10 Highest Total Returns (Jan to Sept 2017) | Market Cap ($million) | Price Change (Jan to Sept 2017) | Total Return (Jan to Sept 2017) | Dividend Indicative Yield (%) |

|---|---|---|---|---|

| CDL Hospitality Trusts | 1,905 | 24.1 | 32.4 | 6 |

| Viva Industrial Trust | 912 | 25.2 | 32.4 | 7.7 |

| Sabana Shariah Comp Industrial REIT | 500 | 23.7 | 31.3 | 8 |

| MapleTree Logistics Trust | 3,377 | 19.7 | 27.6 | 6.2 |

| CapitaLand Retail China Trust | 1,438 | 17.2 | 25.2 | 6.3 |

| MapleTree Greater China Commercial Trust | 3,220 | 20 | 24.3 | 6.4 |

| Frasers Logistics & Industrial Trust | 1,617 | 17.3 | 23.5 | 7.1 |

| Ascendas Hospitality Trust | 942 | 18.4 | 23.1 | 6.8 |

| OUE Hospitality Trust | 1,380 | 16.7 | 23.1 | 6.6 |

| Lippo Malls Indonesia Retail Trust | 1,214 | 14.9 | 22.4 | 8.3 |

| Average | 19.7 | 26.5 | 6.9 |

How They Compare

| Index | 3-month | 2017 YTD | 2016 | 2015 | 3-year return annalised | 5-year return annalised |

|---|---|---|---|---|---|---|

| SGX S-REITs Total Return (%) | 2.3 | 18.3 | 9.2 | -5.5 | 8.8 | 8.4 |

| STI Index Total Return (%) | 1.5 | 14.9 | 3.8 | -11.2 | 2.8 | 4.4 |

Source: The Straits Times

- Over the last five years, S-REITs have provided an annualised total return of 8.4%, nearly double that of the STI ETF at 4.4%

- Total return includes both price moves and reinvested dividends.

Basics: Structure of a REIT

A REIT, or Real Estate Investment Trust, packages a portfolio of Commercial Real Estate into a trust structure (for tax reasons).

This is then listed on the SGX and sold to investors.

Investors who hold units in a REIT (Unitholders) are entitled to regular distributions (either semi-annually or quarterly). REITs are required to pay out more than 90% of their distributable income, to ensure that they enjoy the tax transparency.

Read also: Working Adults: Guide To REITs Investing In Singapore

The legal structure of a typical REIT is set out above, but essentially, these are the key entities:

Trustee

The trustee, HSBC Trustee, is the legal owner of the property and holds the title. They act on behalf of unitholders.

Manager

The Manager, CMTML, manages the REIT, including the investment, finance and investor relations functions. This is the entity that decides which properties to acquire or divest, and on the method of financing and refinancing. In a Sponsored REIT, the manager is wholly owned by the Sponsor.

Property Manager

The day to day management of the property is outsourced to a Property Manager, CRMPL, who is paid property management fees.

Unitholders

Given the trust structure of a REIT, shareholders are known as unitholders, and dividends are distributions. As a unitholder, you sit back and let the professionals run the REIT, collecting your distribution and hopefully, capital appreciation.

Tax Implications

The favourable tax regime for S-REITs has contributed massively to the growth of Singapore as a premier destination for REITs in Asia, ahead even of Hong Kong.

If a REIT pays out more than 90% of their distributable income, they enjoy full tax transparency. If you as an individual hold units in the REIT, the distributions that you receive are tax exempt as well. This means no tax is levied by IRAS from the time rent is paid by the tenant to the landlord until the time it is distributed to you as the unitholder.

Marvel at this for a moment. If I buy a 1 million dollar investment property in my name, not only do I pay stamp duty and a 7% additional buyer’s stamp duty (ABSD) on my initial purchase, but I also pay income tax on all rental proceeds received from the investment property. By contrast, if I wanted to invest in Vivocity, all I do is to buy units in Mapletree Commercial Trust. I pay no stamp duty or tax on the purchase of my units, and none of the distributions received is taxable. (Note: If the properties are located in a foreign jurisdiction, eg. CapitaLand Retail China Trust which holds China assets), the REIT would be subject to PRC tax regime on their rental income).

Do note, however, that if a corporation holds units in the REIT, this tax treatment no longer applies, and the prevailing 17% corporate income tax is payable.

For this reason, I strongly discourage investing in the REIT ETFs

- Lion-Phillip S-REIT ETF

- NikkoAM-Straits Trading Asia Ex Japan REIT ETF

- Phillip SGX APAC Dividend Leaders REIT ETF)

Not only do you pay an annual fund management fee, you also pay 17% tax on all distributions, which severely reduces the returns on your investment. For a S$100 distribution from the REIT, you only receive about S$82 after deductions. Until the tax regime changes, you are better off creating your own diversified portfolio of REITs.

Update: Following Budget 2018, REIT ETFs are no longer subject to the 17% corporate income tax. I analyse the pros and cons of REIT ETFs in a separate article here.

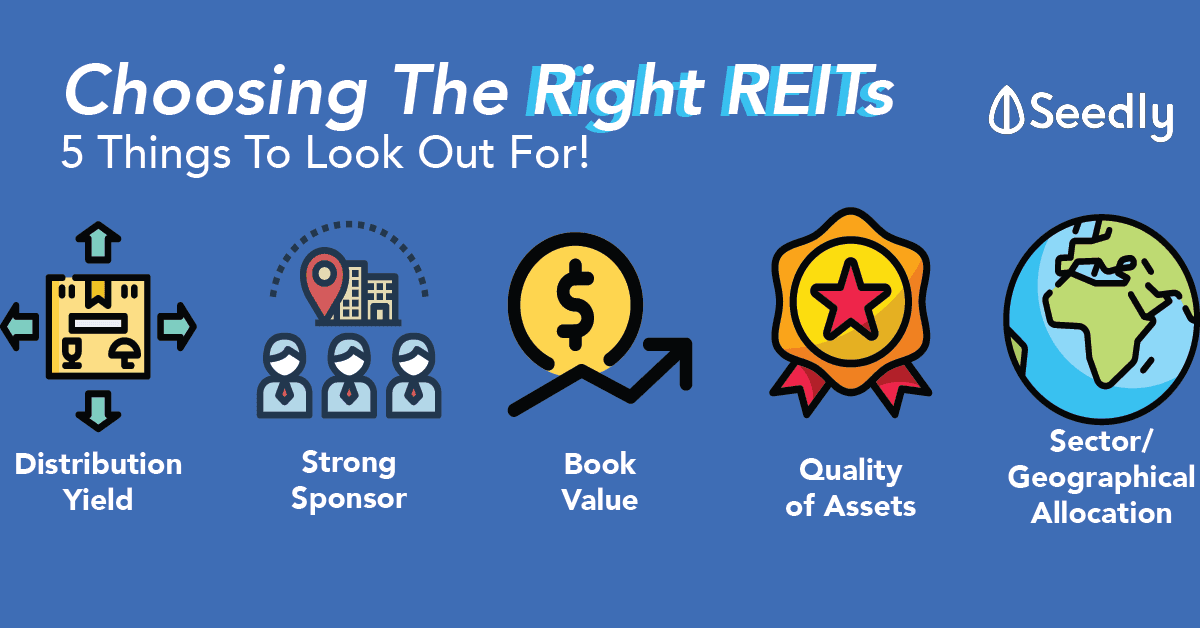

Things To Look Out For Before Investing In REITs

- Strong Sponsor

- Price/NAV or Book Value

- Sector/ Geographical Allocation

- Quality of Assets

- Distribution Yield

Strong Sponsor

The legendary quote by Warren Buffet goes, “Rule No. 1: Never lose money. Rule No. 2: Don’t forget rule No. 1”. The most important rule in investing is to never lose money. As a corollary, you should never make investments in REITs that could potentially go insolvent. 10 years’ worth of distributions can be wiped out overnight if your REIT goes insolvent and you lose most of your principal. Take a look at the case of MacArthurCook Industrial REIT, which went insolvent during the financial crisis, and was acquired by AIMS Financial for cents on the dollar, resulting in huge losses for all existing unitholders.

For this reason, I only invest in REITs backed by a strong Sponsor. For me personally, this includes CapitaLand, Mapletree, Frasers, Ascendas and Far East Organisation. Given the strength of the balance sheet of these Sponsors, including the implicit government links (Temasek) for some of them, I do not see a situation where their Sponsored REITs will ever encounter an insolvency event.

With a strong Sponsor, you also enjoy the following benefits:

- Corporate Governance

Too many of the smaller REITs have management that abuses their positions by playing around with valuations or dressing up acquisitions with income support. You do not want to waste time digging through financial results and SGX announcements to understand the true nature of an asset. Stick to blue-chip REITs, where there is a robust corporate governance framework in place to limit the potential for abuse. - Pipeline

A Sponsor such as a CapitaLand or Mapletree has a deep and robust pipeline of assets ready to be injected into the REIT. This serves as a ready and essential source of growth for the REIT and allows you access to high-quality assets that would not be obtainable via any other means. - Size

With a powerful Sponsor such as CapitaLand or Mapletree behind the REIT, the REIT manager has huge bargaining power when it comes to negotiations. This allows the REIT to have first dibs on prized acquisitions, strong negotiating power when negotiating an acquisition and favourable rates when it comes to refinancing.

REITs and their respective sponsor

| Sponsor | REITs |

|---|---|

| CapitaLand | CapitaLand Mall Trust CapitaLand Commercial Trust CapitaLand Retail China Trust Ascott Residence Trust |

| MapleTree | Mapletree Commercial Trust Mapletree Industrial Trust Mapletree Logistics Trust Mapletree Greater China Commercial Trust |

| Frasers | Frasers Commercial Trust Frasers Centrepoint Trust Frasers Hospitality Trust Frasers Logistics & Industrial Trust |

| Ascendas | Ascendas REIT Ascendas Hospitality REIT |

| Far East | Far East Hospitality Trust |

Price/NAV, or Book Value

Historically, outside of a financial crisis, REITs in Singapore trade between a range of 0.8 to 1.3 times book value.

When buying a REIT, always check its Price/NAV.

Great resources I use regularly to check on Price/NAV and Distribution Yields are http://reitdata.com/ and https://sreit.fifthperson.com/. Do be sure to verify the numbers independently though.

Read also: Ultimate Guide To REITs In Singapore

Compare the Price/NAV of the REIT you are purchasing against comparable REITs. For the blue-chip Sponsored REITs, I look at, I will compare them to a REIT in the same geography and asset class from a competing property developer, to determine if it is overvalued. As a general rule of thumb, the price of REITs trade in tandem, and it is hard to get bargains that have not been discovered by the market. If it is trading at a huge premium to book value (eg. 1.3x), the market is typically pricing in higher than expected growth in the future.

Personally, however, I will never buy a REIT at 1.3x book value, as I find the upside in terms of capital appreciation to be limited, but the downside may be large. Remember that a 20% drop in the REIT price can wipe out 3 years’ worth of distributions for a 6% yielding REIT. My personal rule is to pick up blue-chip REITs aggressively when they are trading close or below book value. In all other situations, I am comfortable paying up to 1.15 times book value if I like the assets and prospects of the REIT, but I will never go beyond 1.15x.

Historical Price/NAV ratios:

Sector / Geographical allocation

REITs are broadly split into the following categories, based on their real estate portfolio:

- Commercial (Offices)

- Retail (Shopping Malls)

- Hospitality (Hotels or Serviced Residence)

- Industrial (Warehouses, factories)

- Others (Healthcare, Data Centers etc)

The conventional thinking behind a broad, diversified REIT allocation is to diversify risks. If retail is getting hammered due to massive competition from Lazada and Qoo10, your distribution from CMT or Frasers Centerpoint trust may fall, but the theory is that your Commercial, Hospitality and Industrial REITs will pick up the slack.

Of course, this is outside of a financial crisis level event, where global commercial real estate prices fall across the board. Hence while diversification among REITs is important, do remember that at the end of the day, these are all investments in real estate, and they are not an effective hedge in a recession. For this reason, you should always ensure you have a portion of your net worth in risk-free assets.

Each industry and geography have their own cycles.

For example, retail is having a bad time in recent years due to increasing competition form e-Commerce, while office rents are going from strength to strength due to tighter supply and the economic recovery.

Unless you are in real estate, it is incredibly hard to pick up on and front run these market movements, as I find that the anticipated future outlook is already priced into the trading price. You are far better off taking a long-term view and ensure you are broadly diversified across geography and industries, to maintain a stable distribution.

I personally split my REIT portfolio distribution by the following allocation, while being careful not to be overly concentrated in any one country:

| Category | Allocation |

|---|---|

| Commercial | 25% |

| Retail | 25% |

| Hospitality | 25% |

| Industrial | 25% |

| Others | 0% |

- There are not many S-REITs that within the “Others” category (notable ones are Keppel DC REIT, Parkway Life REIT, NetLink Trust).

- While I prefer to keep to the traditional classes, feel free to allocate up to 20% of your REIT portfolio to this category.

Quality of Assets

The properties held by the REIT are key, since that is what you are investing in. A test I like to use is to imagine whether, if I had sufficient money, I would want to own the property. For example, given a choice to own Vivocity or Aperia Mall, I would take Vivocity hands down. It has a fantastic location with a strong footfall and minimal competition in the region, as well as a potential stream of endless AEIs, that would far make up for the increased valuation. When asking if you like the asset, you can consider the following questions:

- Location

Is the property located in a good catchment area? Is there strong competition in the vicinity? Is it centrally located near the CBD? Is the area marked for future redevelopment? - Quality of Asset

How old is the Property? How many years are left on the lease? Is the property an ageing one which will require Capex going forward? Has it just completed a round of AEI that rejuvenated the ageing asset? - Value Add

Value Add is the X-factor when evaluating a REIT. After purchasing a property, can the manager improve the asset to increase its yield? A fantastic example is what CapitaLand has done with Plaza Sing in tweaking the tenant mix, the opening of Atrium, and the AEIs, that have contributed shopper stickiness and footfall. Every time I visit Plaza Sing I marvel at the unique tenant mix and the crowds. Viva Business Park is another great example where Viva Industrial Trust took a dingy old industrial building, spruced it up and added Decathalon, Burger King and other F&B, attracting crowds and increasing rental yields. There is no easy, proven way to determine the X-factor. You just have to look at all the facts and take a rational position based on what you know. This is the “gut feel”, the “luck” in investing. If you are sufficiently diversified across blue chip REITs however, you have already limited your downside, and chances are, among your portfolio of REITs, a few of them will turn into superstars. - Capitalisation rate

A lower cap rate translates into a higher valuation for the property, and vice versa. Ensure that the cap rates being used are in line with market standards for the country. As an early 2018, the indicative cap rates for developed markets are:

Singapore: 4-5%

UK: 4%

HK: 3%

Europe: 3.5%

Australia: 5%

If you are investing in a blue-chip REIT, this is typically less of an issue, as they have an army of auditors, independent directors and internal audit to prevent abuse of valuations.

Distribution Yield

A bird in hand is worth two in the bush. DPU is real money in your hands; share price appreciation is not. Even if locked in, the tendency is to plough your gains into a new investment to offset the lost income. Eventually, when the market corrects, the birds in the bush remain in the bush.

The distribution yield of a REIT fluctuates depending on the stage of the economic cycle we are in. As you can see in the table below, this can go to 12% during a financial crisis, but outside of crisis situations, distribution yield typically trades in a 5.5-7% range.

As a personal rule, for blue-chip S-REITs, I will only invest if I get a 5.8% yield or above. This is in addition to the 1.15x book value rule that I have set for myself above.

Beyond the yield, it is important to understand the sustainability of distributions. Whether it’s a company‘s accounts or an investor‘s returns, only one thing is real – cash flow. Everything else can be dressed up. Look at the cash flow from operations, and understand whether cash flow is increasing steadily, whether it is in decline, whether it is erratic, and understand why. If for example CMT’s cash flow is in a slight decline, this is likely due to the competitive retail climate and competition from e-Commerce. This is important so you know whether to hold or to sell, and allows you to be confident in your investment thesis if the REIT price were to fall precipitously.

Consider the following example. Say 5 years ago, you had $1.0 million in the bank earning 4% interest. Today, you have the same $1.0 million in the bank earning 1%. Do u feel poorer? I think most people don’t. Say 5 years ago, you invested in ABC Reit yielding 6% and it has been paying the same DPU annually. But because of macro market sentiments, the “market value” is now $900,000. Yet having looked at the cash flows, the cash flow from operations is steady, with a 0.5% growth. Do you feel poorer? Would you sell the REIT? Once you understand the business and its underlying cash flows, you are freed from the vagaries of market pricing. A fall in prices, when cash flows are stable, is a buying opportunity, not a cause for panic. As long as you do not sell at the current market price, you have already outperformed the alternative in cash by collecting a constant distribution.

Honourable Mention: Interest rates

REITs, and real estate in general are a highly levered industry, with a typical gearing of between 30-45%. An increase in interest rates affects the cost of borrowings and refinancing of the REITs. Without a corresponding increase in rental yields, this leads to a fall in your distribution. An increase in interest rates also increases the attractiveness of competing investments and diverts capital away from REITs. Accordingly, an increase in interest rates impacts REITs significantly, and many financial advisors advocate being mindful of interest rates.

However, one should be mindful of such advice, lest it becomes a fool’s errand. Nobody, apart from the Federal Reserve or President Trump, knows conclusively where interest rates will be 12 months from now. If it were possible, such a movement would already be reflected in the unit price.

Hence while I am constantly mindful of the threat posed by interest rates and keep a watchful eye on them, I do not attempt to trade REITs based off prevailing views on interest rate movement. I prefer to take a long-term view when investing in REITs. So long as the distributions remain stable, the REIT does not go insolvent, there is good growth from a robust pipeline, I am a happy investor.

Closing Thoughts

For most investors, owning a portfolio of blue-chip REITs is likely to provide the best total returns with the least risk and volatility. The key then is to manage your emotions. Stick to the rules that I have set out above, and do not deviate from them even when REIT prices are going up 5% a day. The market may be comprised of fools, but it does not mean you have to be one.

Many investors are so afraid of missing out when they see the REIT prices going up. And when the price is going down, they are always hoping to get it cheaper.

The key is to do your research to determine if you like the properties and to buy when you are happy with the price.

If prices drop, buy more, as your yield on cost increases.

If you have no more resources, then sit tight and wait it out.

Nobody can hope to buy at the bottom all the time but the key is holding power.

Similarly, don’t think that you will buy winners all the time. Ultimately it’s the law of averages, the good, bad and the ugly.

If you can just generate a 6-8% annual return in SGD assets overtime for a conservative portfolio, you have already blown past returns from cash, and outperformed your peers who invested in properties.

Seedly Contributor: Financial Horse

For readers who are interested in the lifestyle aspect of personal finance, check out Seedly’s content on REITs!

Advertisement