Growing up in Singapore, a city notoriously known for its attempt at achieving No. 1 status in almost every possible ranking, it has always got me thinking – How could we retire while still grappling with increasingly higher costs of living.

However, in order to be successful in retirement, we would have to earn a minimum gross salary of $6,000 in order to maximise our CPF contributions and its corresponding ROI. As an ordinary employee, it all begins from your first pay cheque (and the 1st contribution of your pay to your respective CPF accounts).

So, what do these accounts do? What are they all about? Simply put, they are government initiatives for retirement planning.

TL;DR: Basics of CPF Accounts

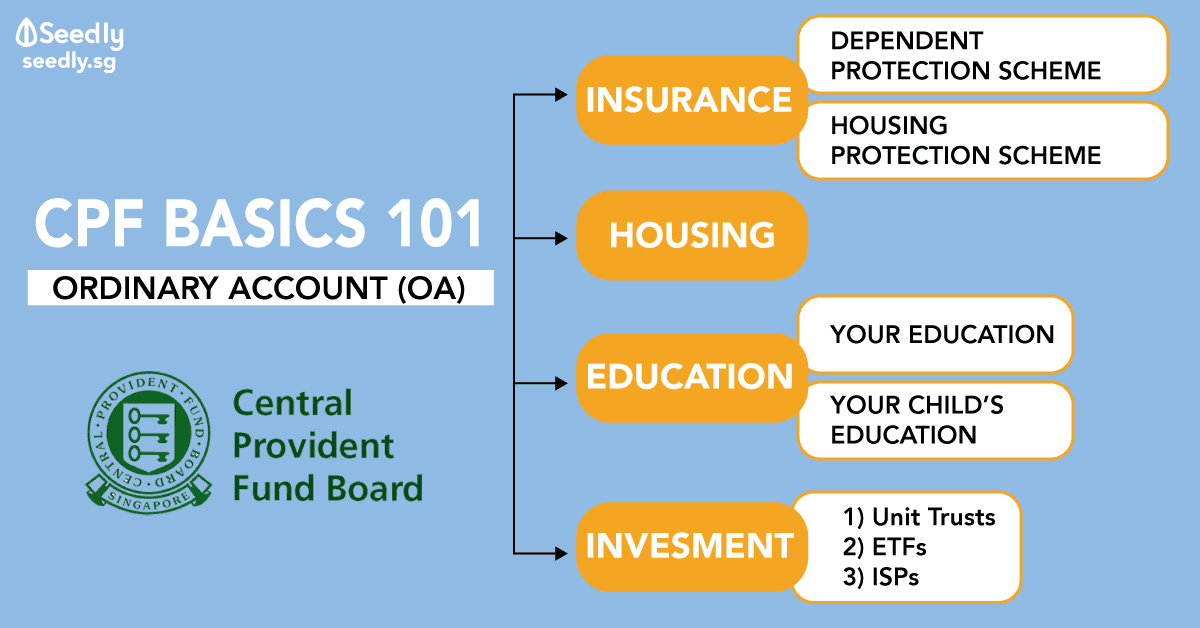

1. CPF Ordinary Account (OA)

What is CPF Ordinary Account used for?:

- Dependent Protection Scheme (DPS) insurance

- Housing Downpayment & Servicing

- Housing Protection Scheme (HPS)

- Education

- CPF Investment Scheme (CPFIS Singapore Stocks)

It has a base interest of 2.5% & an additional 1% interest capped up to $20,000 in the Ordinary Account.

2. CPF Special Account (SA)

What is CPF Special Account used for?:

- Retirement Planning

- Retirement Investment

It attracts a base interest of 4%. Note that for CPFIS, stricter rules are applied on the types of investable products as compared to OA. The additional 1% interest is also paid into this account.

3. CPF Medisave Account (MA)

What is Medisave used for?:

- Healthcare Treatments (E.g. Hepatitis B Vaccination, HPV Vaccinations, Influenza and pneumococcal vaccinations etc.)

- Paying of Insurance Premiums such as MediShield Life and/or Integrated Shield plans, ElderShield, CareShield

Healthcare Treatments

For healthcare treatments, there are withdrawal limits based on your treatments. In other words, you might not be able to use your MA to cover the full costs of your treatment. As a result, people usually enhance their coverage with Medishield Life and/or Integrated Shield plans (ISP) to buffer the medical cost.

Paying of Insurance Premiums

- MA use to pay for MediShield Life and/or ISP for medical expenses coverage; and/or

- Used to pay for ElderShield and CareShield Life which provides you a monthly income upon disability

We will be discussing on ElderShield & CareShield Life further when we go deeper into each specific account topic.

CPF Allocation Rates (Includes both employer & your contribution)

| Employee Age | Allocation Rates from 1 Jan 2016 (based on % of wage) | |||

|---|---|---|---|---|

| Ordinary Account | Special Account | Medisave Account | $ of wage | |

| 35 and below | 23 | 6 | 8 | 37 |

| Above 35 to 45 | 21 | 7 | 9 | 37 |

| Above 45 to 50 | 19 | 8 | 10 | 37 |

| Above 50 to 55 | 15 | 11.5 | 10.5 | 37 |

| Above 55 to 60 | 12 | 3.5 | 10.5 | 26 |

| Above 60 to 65 | 3.5 | 2.5 | 10.5 | 16.5 |

| Above 65 | 1 | 1 | 10.5 | 12.5 |

Do also note that it is compulsory for every self-employed persons to contribute to their MediSave Account.

CPF Ordinary Account (OA)

With introductions done, let’s dive straight into CPF-OA (Ordinary Account) and it’s specific uses.

Insurance

CPF-OA Dependent Protection Scheme (DPS), as the name suggest, is to protect your dependent(s). Simply put, it is a term life insurance by the CPF board. With a protection value of $46,000, it is likely meant for final expenses and up to 1 to 2 years of income only,

CPF-OA Dependent Protection Scheme (DPS), as the name suggest, is to protect your dependent(s). Simply put, it is a term life insurance by the CPF board. With a protection value of $46,000, it is likely meant for final expenses and up to 1 to 2 years of income only,

CPF-OA Housing Protection Scheme (HPS), as the name suggest, is to protect your housing loan liability(ies). It is a decreasing term insurance by the CPF Board.

Housing

CPF OA can be used for the 1st 10% downpayment of your house especially if you’re a graduate who has only worked for 3 to 4 years.

If you’re taking a bank loan, a minimum of 5% must be in cash, followed by 20% which can be paid by cash or CPF. However, there are also CPF limits which you should take note of.

Case in point: The CPF Housing Withdrawal Limit

It is 120% of the valuation limit (or market value at time of sale). You may use the calculator here to find out how much CPF you can use to service your housing loan. If you hit the limit, you will NOT be able to service your house with CPF any longer. Hence, do take note of the withdrawal limit most houses would hit the aforementioned limit in 20 years.

Education

You may also apply to use your CPF-OA for education purposes. Be it:

- Your own education

- Your children’s education

Note: The accrued interest (amount you owe your interest to yourself) starts the moment you withdraw it from your account. This works exactly the same way as your housing loan (which you will need to repay back to CPF).

If you sell your house and use it for education loans, do note that all monies would be repaid back to CPF-OA, before you even get any monies out.

Investment

You may also treat CPF-OA as a “warchest” or fixed deposit for investment needs. Click here to find out what you can invest in.

That said, here are some general ones for your consideration:

- Unit Trust

- Investment Linked Insurance Products

- Annuities / Endowments (Rates are slightly better than CPF-OA around 2.8-3.5% depending)

- Gold & Gold equivalents like SPDR Gold (But only 10% of investible)

- Individual Companies Stocks (But only 35% of investible)

- Exchange Traded Funds (Index-Linked ones such as Nikko AM or SPDR ETF)

These investment tools can help grow your OA savings faster.

Should you decide the above investment tools to be unsuitable for you but still wish to earn the higher 4% interest of CPF-SA, you may also transfer the funds to it (up to Full Retirement Sum (FRS), at risk free rates but at arguably less liquidity than CPF OA.

Seedly Contributor: Ethan Loh Tat Tian

Formally a property manager, Tat Tian is experienced in all things personal finance with a particular emphasis on insurance!

Advertisement