A Comprehensive Property Market Analysis: How Will COVID-19 Impact Real Estate?

On Labour, Capital, and Entrepreneurship Post-COVID-19 Crisis

We’ve had a flurry of posts saying that the world is healing — dolphins heading back to Venice, elephants getting drunk in vineyards, and having such a clear sky that you could see the Star Wars opening crawl.

Memes and dreams aside, these underplay the huge impact that COVID-19 has had on socio-economic and megatrends that will underscore how we live, play, and work in the years to come.

Here’s how I will approach this:

- Macro Indicators of COVID-19

- COVID-19’s Impact on Labour, Capital, and Entrepreneurship

- How Labour, Capital, and Entrepreneurship Will Impact Real Estate

1) Macro Indicators of COVID-19

i. Unemployment Spikes

Unemployment spikes are more drastic than the 1929 Great Depression, while dips in the Dow Jones Industrial Average (DJIA) follow a similar magnitude.

Consumption-led demand shock has become a larger deal than supply shock.

In layman terms, being afraid to buy and not spend is a bigger problem than not having the money to spend.

ii. COVID-19 Cases Peaking

The earliest countries to implement lockdowns saw COVID-19 cases peak four weeks after lockdown.

There was also an initial forecast of stabilisation of worldwide daily cases by April 2020.

Nonetheless, several factors hindered the world’s recovery from this pandemic.

For example, aggressive testing, governments hiding information, the inability to properly test and confirm a COVID-19 case, and etc.

2) COVID-19’s Impact on Labour, Capital, and Entrepreneurship

i. Labour: Rise of the Gig Economy

COVID-19 has changed how people work.

In fact, there’s a meme floating around that describes this quite aptly:

Jokes aside, we’ve seen a huge shift in culture when companies are forced to embrace work-from-home measures.

Now, all companies are made up of people.

All people have feelings and different behaviours.

Labour in an economic sense is not a worker without feelings.

Their feelings and behaviour dictate how the production is going to be like.

(That’s why you should smile at the cai png auntie more — she’ll give you a larger serving of salted egg chicken!)

Likewise, the entrepreneur cannot force labour to use certain tools (capital) unless they embrace them of their own accord.

If people find Zoom to be horrendously tedious to use…

(Maybe due to bad UI/UX or something.)

No matter how much capital you throw at it, they won’t want to use it and as a result, productivity nosedives.

However, in this COVID-19 situation, we’ve seen the opposite effect.

Companies have no choice but to go digital.

But because online platforms have good UI/UX, it makes it easy for employees (consumers) to transition to online collaboration.

A) A Rise in Acceptance of Cloud-Based Collaborative Platform Tools

“Technology investors recall the legend of Instagram securing 100MM monthly active users in ~2 years and Fortnite snagging 100MM MAUs in ~18 months, but we have never seen a business-focused app rise from 10MM to 200MM daily meeting participants in three months as Zoom’s video collaboration platform just did. Zoom has secured its spot in the record books.”

Zoom reached 200MM in 3 months (20x growth), whereas Instagram and Fortnite took 2 years and 18 months respectively to reach 100MM.

A few observations can be made.

This phenomenon will be replicated throughout the virtual meeting space and in all forms of cloud-based collaborative apps (including entertainment and education)

It helps that the majority of employees in the workforce currently are millennials and their bosses are Gen X and Gen Y.

All of whom understand digital — either being natives or have grown accustomed to it.

This generation of workers grew up using online collaborative tools to speak to their friends as well (think: IIRC, MSN Messenger, Friendster, FaceBook, and Skype).

Naturally, virtual meet-ups are easily accepted for other social situations and aspects of life.

Like leisure and family meet-ups (think: talking to Grandma via FaceTime, or family outings on Zoom through the living room TV).

Even education.

In fact, MOE is doing home-based learning (HBL).

Executive education can also be done through the Masterclass app, YouTube or even Extra Credit.

Floral, baking, and fitness studios can conduct classes online by delivering the necessary equipment and ingredients to participants ahead of time.

B) What Works and What Doesn’t Work With Work-From-Home Measures

Bond Capital, a global technology investment firm, conducted an informal survey with some companies with regard to productivity (over a span of 1.5 months) in this new remote work environment.

Here are some findings:

Productivity is the same or higher.

The group which saw the largest productivity wins is parents with young children.

However, pre-existing management bottlenecks around individual performances or organisational design were amplified.

Companies that already carry out effective written communication and documentation, like Amazon, benefitted the most — allowed for more insightful input and decision making.

C) A Noticeable Shift of Labour Force Towards a Gig Economy

Recently, Gig Economy work has risen and became a viable option.

Some examples include:

- Transportation (Uber, Lyft, Grab, Go-Jek, and etc.)

- Accomodations (Airbnb, Sonder, and etc.)

However, these two industries are hit especially badly due to stay-home measures.

Nonetheless, the demand in the Gig Economy has surged in the areas of:

- Food (Grab, Grabfood, foodpanda, Deliveroo, and etc.)

- Groceries (pandamart, Grab, Fairprice Online, and etc.)

- Delivery (GrabDelivery, Lalamove, and etc.)

There are a few reasons for this phenomenon.

Although the reasons for increased demand are obvious.

What’s interesting are the reasons for this rise in supply.

On top of how the way people work has changed with the acceptance of online platforms.

Unemployment has surged worldwide (see the first chart which shows unemployment rates surging more than during the Great Depression).

This structural unemployment has forced people to seek transition jobs in the Gig Economy to make up for a loss in income

The thing is, there’s money to be made in the Gig Economy.

In fact, a top-earning Deliveroo driver in Singapore earned S$7,095 a month during COVID-19.

Nonetheless, it will be interesting to note how the Gig Economy will be treated in the coming future.

In Singapore, Grab drivers do not have CPF (Singapore’s version of a forced savings plan; 401K) because the government has classified them as transition jobs and are thus not permanent.

This hinders their ability to borrow for housing mortgages (even for the HDBs), and for certain working capital needs.

With a higher per cent of the Singapore population working in the Gig Economy, governments will have to change their policies or face reputational risk.

ii. Capital: Targeting Maslow’s Hierarchy of Needs

Human needs do not change, stay-home or not.

Instead, these needs are fulfilled by online means.

A) Goods And Services During COVID-19

Firstly, online products and services which target and address consumer needs — based on Maslow’s Hierarchy of Needs — during COVID-19 will get traction.

Some examples include:

- Offline goods that can be ordered online BUT require physical delivery for eg. Lazada, Shopee, and other e-commerce platforms. A prime example would be gym equipment being sold out online due to an increased number of purchases by consumers looking to start home fitness regimes.

- Online services that can and have always been accessed online like Massively Multiplayer Online Role-Playing Games (MMORPGs) that have have always been accessed via desktops or smartphones like Fortnite and PUBG. Productivity tools (Slack, Asana, Trello, and etc.) and meeting tools (Zoom).

- Once physical products (such as physical board games) which have shifted online like Saboteur, UNO, Monopoly, and etc.

These online platforms tend to share similar traits:

- Video and chat function

- Security

- High in-app refresh response rate that is real-time

- In-app collaborative tools

These services will see a rise in funding from sources of capital such as venture capital, family offices, and private equity funds.

B) Sustainable Business Models

Second, an increase in spending on these services can potentially make these business models sustainable, and allow them to move away from freemiums.

This is possible because of a projected increase in IT spending on cloud-based products and services for both businesses and consumers .

From a business angle, CEOs and CTOs have mentioned increasing IT spending on these services.

With a lack of other viable platforms in the market, platforms like Zoom — which can provide quality and security (?) — will entrench themselves as a market leader.

The majority market share gives them bargaining power to shift away from a freemium business model to one that is paid.

A good example of this is Zoom only giving users access to 40 minutes for free, after which you’d have to start a new call.

This experience might not reflect well on your company’s professionalism especially during long meetings.

This phenomenon is the same for consumers as well.

In terms of entertainment, Netflix was reported to have doubled its subscribers over COVID-19.

Chinese mobile games reportedly increased net sales by 32 per cent in the first week of February as compared with 2019.

For education, Duolingo saw a 100% increase in active users in China.

For e-sports and online education, the lack of options again presents opportunities for platforms to charge small fees.

The revenue model has become skewed in favour of e-sports, so much so that companies are earning revenue from consumers changing skins.

These skins provide no intrinsic in-game value (read: no special character power-ups in-game)

So perhaps we could we classify this as in-game fashion or even a form of luxury-spending?

C) Increased Valuation of Cloud-Based Collaborative Apps

Third, the valuation of cloud-based collaborative apps in all forms will rise.

Here’s a look at the equity valuation (stock price x volume) of some publicly traded stocks:

Netflix, 28 per cent increase year to date (YTD).

Zoom, 120 per cent increase YTD.

Sea Ltd, 36 per cent increase YTD.

Note: this includes Garena and Shopee (which is a loss-making e-commerce site)

iii. Entrepreneurship: Seizing the Online Platform Bandwagon

Undoubtedly, it will be tough to raise cash in such an environment.

What we are seeing from family offices, private equity, and venture capital funds is not new information.

Businesses in transportation, airlines, hospitality, physical entertainment, and discretionary consumer products/services have been hit badly.

Any investments in these areas would require more underwriting or an adjustment of returns.

This means that more cash is needed as a buffer.

For ultra-high-net worth individuals (UHNWI), some are leveraged deeply into their portfolios and require cash holdings in USD for potential margin calls or forced sell-offs of their positions.

However, there are certain businesses that seem to have potential success in this environment.

(Disclaimer: I’m not an entrepreneur so please don’t take my words as the gospel truth.)

My hypothesis is if you find that you have expertise in an area which can meet consumer demand (based on Maslow’s Hierarchy of Needs), you might find yourself becoming your own boss during this rise of the Gig Economy:

- Education or Skills: Fitness, cooking, and etc.

- Entertainment: Fancy being a Tik Tok star? (haha)

- Insurance: This is an interesting topic since more are bolstering their plans to cover COVID-19, accordingly, there are stories about insurance agents who have done well by going digital and have acquired more customers

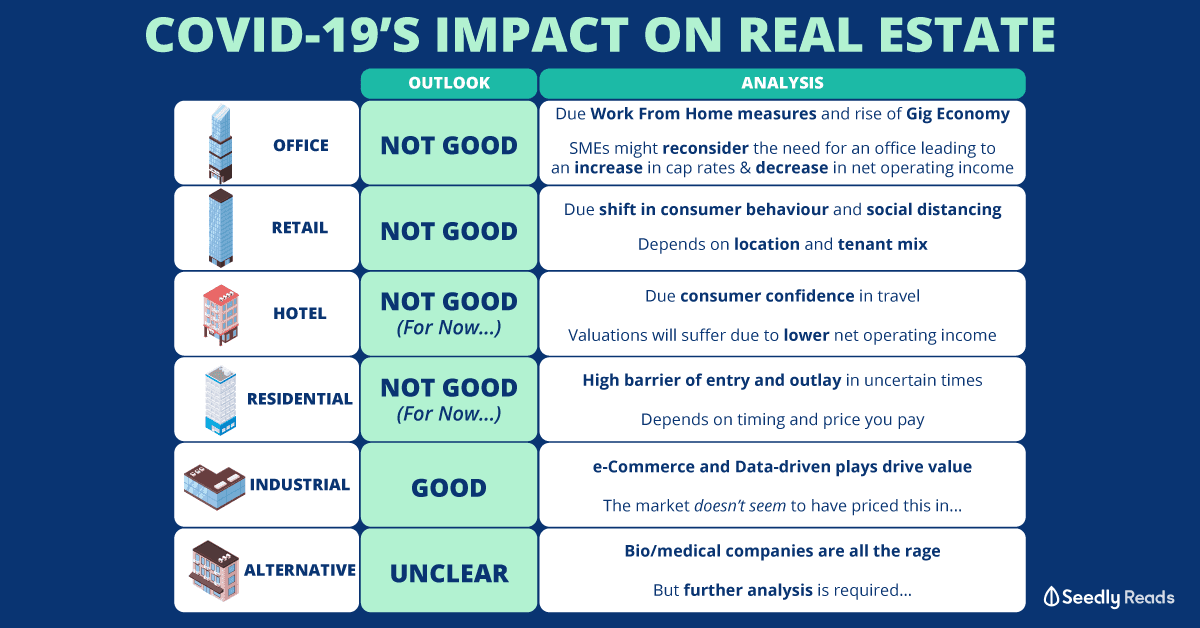

3) Impact of Labour, Capital, and Entrepreneurship on Real Estate

Real estate is an entire asset class on its own.

You have the traditional stuff like office, retail, hotels, residential, and industrials.

Then you have alternatives such as data centres, co-living, co-working, student housing, senior living, and bio/medical labs.

These also run the gamut from more VC-like capital-light investments to more REPE (real estate private equity)-like capital heavy investments.

It also depends on whether you are currently an existing owner or are looking to buy such assets.

i. Office Real Estate: WFH Forces SMEs to Rethink Their Need for an Office

Large corporations have a brand they would like to portray.

Being located in an office lends a sense of grandeur and power which only physical space can provide.

However, with more and more S&P 500 companies being technology firms.

And seeing how most of these firms work on business models which utilise decentralisation, it questions the need to house everyone (for eg. the software team) in an office.

In ASEAN alone, SMEs take up more than 50 per cent of a country’s GDP and are often the largest source of local employment across major economic sectors.

With a small team and lesser cash in the bank, SMEs usually pay rents which take up a high per cent of their revenue.

As such, several start-ups and SMEs in Singapore have turned to shared office spaces and simply book a conference room every Friday just to catch-up with the team.

Overall COVID-19 will transform how accepting the workforce is towards work-from-home and participation in the Gig Economy.

Naturally, office space will become redundant.

With a 20 to 50 per cent decrease in leasing demand, due to the sizeable SME workforce, this will have a huge impact on the net operating income (NOI) of office spaces.

And we can see this through the capitalisation rates.

Side note: Capitalisation rates (cap rate) are easy to understand. If they’re 3 per cent, it means you’ll take 100/3 = 33.3 years to recoup your value of the property from net operating income alone. The higher your cap rate, the faster you’ll take to recoup your purchase of the property. If you’re an SME, you’ll want to buy a property at a higher cap rate — assuming your NOI is constant. Since the value of your property is lower, you’ll take lesser years to recoup the value.

In Singapore, prime office cap rates are sub 3 per cent pre-COVID-19 and will likely see a 40 basis points (bps) increase during COVID-19.

There are two observations here:

- Increase in cap rates

- Decrease in NOI (due to lesser potential rent)

This means that the value of office properties will face a double whammy and might see a dip in value.

Verdict on Office Real Estate Investments

Not good.

But still remains a trophy asset.

ii. Retail Real Estate: Shift in Consumer Behaviour Patterns

In order to practice active social distancing, people don’t go to malls now — even in parts of the world where the lockdown is lifted.

China is a prime example.

In fact, a Walmart branch in Shanghai has seen customer traffic drop by more than half as more are staying home and buying online instead.

However, the entertainment scene is a little unclear: will bars and clubs stop the music due to consumers avoiding such crowded environments?

Looking towards China again, the country arguably leads the way in retailtainment.

Its K11 Art Malls curate unique, artisanal, and niche luxury products and gadgets.

In doing so, they’ve reinvented the retail experience by mixing art and lifestyle and making it Instagrammable.

Their success can be attributed to the creation of an experience, which addresses the Millennial and Gen Z generations’ need for social affirmation.

I am also guilty of indulging in this experience when I visited Guangzhou’s K11 Art Mall in 2018.

However, not all malls have that experiential element like a K11 Art Mall.

So depending on the location and tenant mix, we will definitely see retail properties lose some of its shine.

Verdict on Retail Real Estate Investments

Not good.

Depends on whether you are a heartland or destination mall.

iii. Hotels: Temporary Closures and a Dip in Occupancy Rates

The most well-travelled people (in terms of days, not quality) are business people.

And most are afraid to travel, much less stay in hotels, as long as a viable COVID-19 vaccine is unavailable.

As a result, brands like Marriott have seen their stock value decrease by 48 per cent YTD.

DBS has also released a research report talking about the privatisation of hotel REITs.

Note: privatisation comes if hotel REITs continue trading at a low valuation and are not active in raising capital and/or recycling assets

However, REIT sponsors are unlikely to give up their valuations and their secret stash of goodwill hidden within these valuations.

It’s also worth noting that in mid-February, 90 Marriott hotels and 150 Hilton properties were shut temporarily.

If average daily rates (ADRs) and occupancy per cents continue to stay low, the RevPAR (revenue per available room) is sure to take a huge hit.

Naturally, valuations will suffer as a result of this lower net operating income.

Verdict on Hospitality-related Real Estate Investments

Not good now.

But low valuations are a good thing because like airlines, hospitality is bound to bounce back due to future.

The biggest problem here is the timing.

iv. Residential Real Estate: Buying the Mortgage Market, Not Necessarily New Builds

I’ve talked about the mortgage market before when I discussed what the recession is like for a 1990s working adult.

You can find homes (within the S$1 million to S$1.5 million price range) on the market that were bought 2 to 3 years ago.

Their owners are unable to meet mortgage payments and their properties have now been collateralised by the banks.

However, new builds face an issue.

Singapore private property prices have turned negative, dropping 1.2 per cent in Q1 2020 amidst COVID-19.

Some have attributed this drop in demand due to a lack of Chinese buyers.

With that said, the dip in prices could also be due to an increase in supply too.

But overall, it is clear that a drop in demand is the main reason for this drop in prices.

Residential properties in Singapore aren’t cheap either.

With a 20% downpayment required, and the need to commit the bulk of your income to service mortgage payments, most would rather hoard cash now than upgrade in a period of uncertainty.

Much less purchase an investment property for a paltry 3 per cent rental yield.

Verdict on Residential Real Estate Investments

Not good now.

Singapore will remain land-scarce and people will eventually want to upgrade their homes.

This depends on timing again, and the price you pay.

V. Industrial Real Estate: E-Commerce and Data-Driven Plays Drive Value

As mentioned earlier, Maslow’s Hierarchy of Needs drives consumer consumption.

For entertainment that can’t be achieved because I can’t go out; I’ll do it online and this consumes more data and cloud space.

I’ll still need to buy groceries and consumer goods; I’ll buy it online with Lazada, Shopee, Grab, and foodpanda.

The key question is whether this will become the new norm, as seen in China where physical customer footfall fell by as much as 50% despite the lift in lockdown measures.

Will it become an ingrained culture to just buy online instead of visiting the supermarket?

Will it be more acceptable to seek entertainment online than physically go out?

Rental rates are unlikely to dip as ultimately industrial real estates are still needed to serve core consumer needs — regardless of whether they shift online or not.

Instead, it might increase when there’s more demand.

Verdict on Industrial Real Estate Investments

Good.

However, the market doesn’t seem to have priced this in.

Look at the stock prices of EC World REIT (SGX: BWCU), Mapletree Industrial Trust (SGX: ME8U) and etc.

Keppel DC REIT (SGX: AJBU) is almost reaching a 3% dividend yield… so that’s a different matter.

VI. Alternatives Real Estate: Depends on Its Derived Demand

The demand for real estate is an example of derived demand.

“What about student housing and co-living spaces,” you ask?

Schools are shut and it’s home-based learning time.

And unless you’re providing long-term housing to individuals for your co-living property, it’s going to be a tough battle.

As the world races to find a vaccine, bio/medical companies are all the rage.

However, this might not translate into an immediate need for more space.

Verdict on Alternatives Real Estate Investments

Unclear.

Further analysis is required.

Conclusion: Real Estate 2.0 (A Whole New World)

It is scary to think that what we know about real estate and its demand and valuations are going to drastically change due to Mr Chief Transformation Officer, COVID-19.

However, real estate will never die.

Instead, it will evolve.

Unless we start living and earning money in alternative realities, like in the movie Ready Player One, where virtual reality is used to escape hell on earth.

That’ll be a real shocker to the world of real estate.

Seedly Contributor: Benjamin Wong

Investment Professional @ Alvarium | Board Advisor @ Payboy | Co-founder @ The Mentoring Circle; Atomos Watch Club & Cogito Collective

Benjamin Wong is a private equity investment professional with prior experience in private equity, management consulting, legal and entrepreneurship, covering diverse industries in Asia.

He was previously at Baring Private Equity Asia, Yamato Capital Partners, Kantar Consulting, Shopee, UOB, CMA CGM, and EDB.

He started his first startup in Junior College focusing on FinTech.

Advertisement