Free COVID-19 Vaccine Insurance: Get Payouts and Coverage For Medical Expenses

●

Just a few days ago, my parents received an SMS notification that looked something like this.

“Do you think we should go for the vaccination ah? Heard the side effects very scary leh…”

As of 24 May 2021, a total of 3,728,869 COVID-19 vaccine doses have been administered in Singapore.

As more and more people are progressively getting vaccinated, news of how the side effects felt started spreading as well.

While the COVID-19 Vaccination Programme is a huge step towards our fight against the big COVID-19 monster, many are also starting to be concerned about the side effects that might result from the jab.

If you’re worried about getting severe allergic reactions and the financial implications that might come with it, fret not!

Insurers and financial institutions are also rolling out free COVID-19 vaccine insurance, providing coverage and payouts due to vaccine complications.

This is on top of the government schemes that have been rolled out to alleviate financial worries.

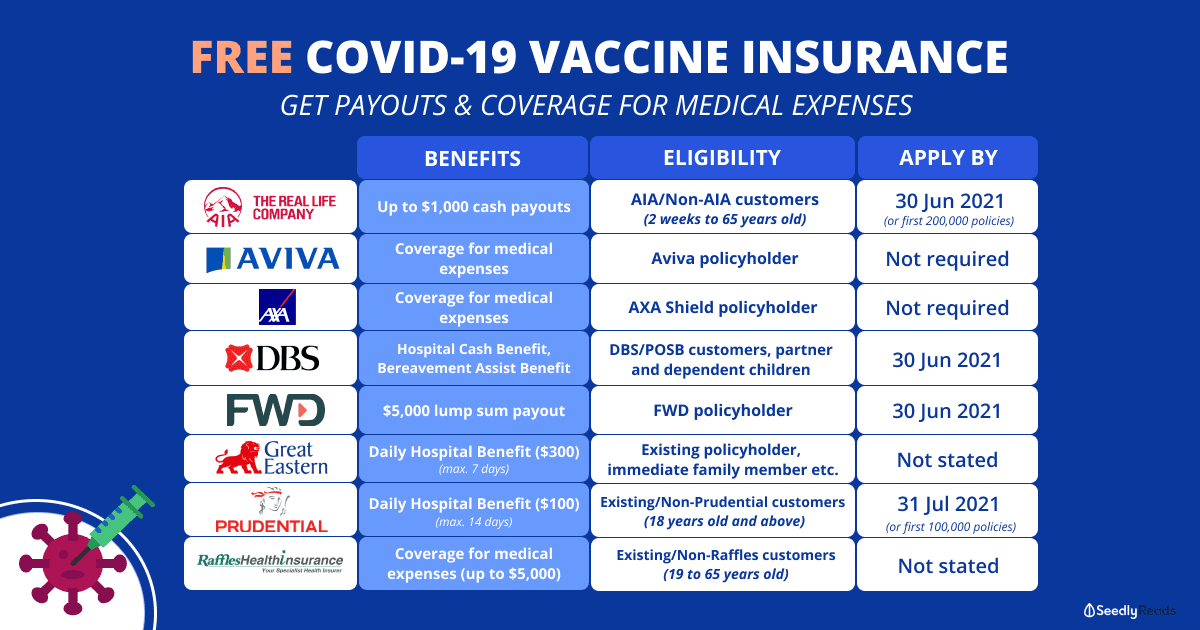

TL;DR: Free COVID-19 Vaccine Insurance: Get Payouts and Coverage For Medical Expenses

| Institution | Benefits | Eligibility | Validity | Apply By |

|---|---|---|---|---|

| AIA | Daily Hospital Income Benefit: $500 per day (up to 2 days), minimum 24-hour hospital stay is required | - Singapore Residents aged 2 weeks to 65 years old (Age Last Birthday) - Both AIA and non-AIA customers may apply | Till 31 Dec 2021 | 30 June 2021 or first 200,000 policies, whichever is earlier |

| Aviva | Coverage for medical bills including hospitalisation or inpatient treatment | Aviva policyholders including MyShield, MyHealthPlus | Till 31 Dec 2021 | No application required |

| AXA | Reimbursement of daily ward charges and treatment charges as charged by the hospital, subject to the Benefit limit as stated in the Benefits Schedule | New and existing AXA Shield customers and other policyholders | Till 31 Dec 2021 | No application required |

| DBS | Daily Hospital Cash Benefit: $100 per day (Up to 14 days) ICU Hospital Cash Benefit: $1,000 (Lump sum) Bereavement Assist Benefit: $10,000 (Lump sum) | - DBS/POSB customers, their partner and dependent child(ren) - Singapore Resident - Age 18 years old and older, dependent child(ren) between 1 month old and 17 years old, or up to 25 years old if child is primarily dependent on applicant | Till 31 Dec 2021 | 30 Jun 2021 |

| FWD | $5,000 lump sum payout for hospitalisation (in ICU or high dependency ward for at least 12 consecutive hours) within 30 days from vaccination | - FWB life, accident and health insurance policyholders - New FWD customers applying for an eligible insurance plan by 30 Jun 2021 | Till 31 Dec 2021 | 30 Jun 2021 |

| Great Eastern | Daily Hospital Cash Benefit of $300 per day (max 7 days) | - Existing Great Eastern customer, an immediate family member or a recipient of an invitation from a Great Eastern Financial representative - Singaporean or Singapore Permanent Resident | 31 Dec 2021 or when an aggregate total of $1 million has been incurred by GREAT Vaccine Fund | Not stated |

| Prudential | Daily hospital cash of $100 per day (max 14 days for each vaccine dose) | - Singapore Residents (Singapore Citizens, Permanent Residents and Foreigners with valid passes) - 18 years old and above, sign up using the Pulse App | 31 Jan 2022 | 31 Jul 2021, available for the first 100,000 sign ups |

| Raffles Health Insurance Singapore | Reimbursement of hospitalisation expenses of up to $5,000 (within 7 days of each vaccine dose) | - Singapore Resident aged between 19 to 65 years old (Age Next Birthday) - Singapore Citizen, Permanent Resident and Foreigner with valid pass - Sign up via the Raffles Connect application | Not stated | Not stated |

Here are the details of the insurance coverage offered by various institutions.

AIA

AIA is offering COVID-19 Vaccine Cover, a free insurance policy that provides up to $1,000 cash payouts for hospitalisation due to COVID-19 vaccine complications.

Benefits:

Daily Hospital Income Benefit (due to COVID-19 vaccine complications): $500 per day (up to 2 days), minimum 24-hour hospital stay is required

Hospital Income Benefit (due to COVID-19): Lump sum benefit of $500

Eligibility: Singapore Residents aged 2 weeks to 65 years old (Age Last Birthday), both AIA and non-AIA customers may apply

Validity: Till 31 Dec 2021

Apply By: 30 Apr 2021 or first 200,000 policies, whichever is earlier

Aviva

Aviva is offering coverage for side effects that have resulted from the COVID-19 vaccination as well.

Individuals that are insured under Aviva’s health insurance plans will be automatically included with no extra cost.

Benefits: Coverage for medical bills including hospitalisation or inpatient treatment

Eligibility: Aviva policyholders, including MyShield, MyHealthPlus, Employee benefit plans with inpatient benefit

Vaccine must be authorised by Health Sciences Authority and the individual must be medically eligible to receive it

Validity: Till 31 Dec 2021

Apply By: No application required

AXA

AXA will be offering coverage for complications arising from COVID-19 vaccinations under AXA Shield, their Integrated Shield Plan, as well as other individual health policies.

This includes medical expenses such as hospitalisation and outpatient expenses, according to the individual’s policy coverage.

Benefits: Reimbursement of daily ward charges and treatment charges as charged by the hospital, subject to the Benefit limit as stated in the Benefits Schedule

Eligibility: New and existing AXA Shield customers, other policyholders such as Group Health & Surgical (GHS), Group Outpatient General Practitioner (GP), Group Specialist (SP) and Foreign Workers Medical Insurance

Validity: Till 31 Dec 2021, 2 months from the date of COVID-19 vaccination

Apply By: No application required

DBS

DBS is partnering with Chubb Insurance to offer all DBS or POSB customers and their immediate family free insurance coverage for vaccine side effects too.

The COVID-19 Vaccine Protect Policy also includes coverage for COVID-19 patients, and also comes with a 2-year DBS Parkway Programme which includes complimentary teleconsultation sessions.

Benefits:

| Sum Insured | |

|---|---|

| Post COVID-19 Vaccination Cover | |

| Daily Hospital Cash Benefit | $100 per day (Up to 14 days) |

| ICU Hospital Cash Benefit | $1,000 (Lump sum) |

| Bereavement Assist Benefit | $10,000 (Lump sum) |

| COVID-19 Cover | |

| Daily Hospital Cash Benefit | $100 per day (Up to 14 days) |

| ICU Hospital Cash Benefit | $1,000 (Lump sum) |

| Bereavement Assist Benefit | $10,000 (Lump sum) |

30 days coverage for COVID-19 from application date

14 days coverage for any unexpected effects from COVID-19 vaccination following each vaccination taken on or before 31 Dec 2021

Eligibility: DBS/POSB customers, their partner and dependent child(ren) with the following criteria:

- Singapore Resident

- have not travelled overseas in the last 14 days;

- do not have any fever, flu-like or respiratory symptoms (e.g. cough, runny nose and sore throat)

- Age 18 years old and older, dependent child(ren) between 1 month old and 17 years old, or up to 25 years old if child is primarily dependent on applicant

Validity: Till 31 Dec 2021

Apply By: 30 Apr 2021

FWD

FWD has recently announced complimentary insurance to cover COVID-19 vaccine complications, offering a $5,000 lump sum payout.

This is available for their existing eligible customers or customers who are buying a life policy between 1 Apr to 30 Jun 2021.

Benefits: $5,000 lump sum benefit for hospitalisation (in ICU or high dependency ward for at least 12 consecutive hours) within 30 days from vaccination

Eligibility: FWD life, accident and health insurance policyholders, including:

- Big 3 Critical illness

- Term Life Plus

- Cancer insurance plan

- Heart Attack insurance plan

- Stroke insurance plan

- International Health insurance plan

- Term Life

- Essential Life

- COVID-19 insurance plan

- DIRECT-Term Life

- Invest First

- Future First

New customers have to apply for an eligible insurance plan within the campaign period (till 30 Jun 2021).

Validity: Till 31 Dec 2021

Apply By: 30 Jun 2021

Great Eastern

Great Eastern has set aside $1 million to the GREAT Vaccine Fund, providing daily hospital cash benefits of $300 per day for eligible individuals who are hospitalised due to allergic reactions sustained from the COVID-19 vaccination.

Benefits: Daily Hospital Cash Benefit of $300 per day, for a maximum of seven consecutive days

Eligibility: Existing Great Eastern customer, an immediate family member or a recipient of an invitation from a Great Eastern Financial representative and is:

- Singaporean or Singapore Permanent Resident

- Medically eligible for vaccination

Validity: 31 Dec 2021 or when an aggregate total of $1 million has been incurred by GREAT Vaccine Fund

The eligible period is a period of 3 months from the date the customer receives the first dose of COVID-19 vaccine.

Apply By: Not stated

Prudential

Prudential is offering the PRUSafe COVIDCover, which is a complimentary insurance plan which offers daily hospital cash of $100 per day.

This coverage is available for all users (aged 18 and above) of the Pulse app, and individuals do not have to be an existing Prudential customer to enjoy this benefit.

Benefits: Daily hospital cash of $100 per day, subject to a maximum of 14 days for each vaccination dosage

Eligibility: Singapore Residents (Singapore Citizens, Permanent Residents and Foreigners with valid passes)

18 years old and above, sign up using the Pulse App

Validity: 31 Jan 2022

Apply By: 31 Jul 2021, available for the first 100,000 sign ups

Raffles Health Insurance Singapore

Raffles COVID Safe Cover is a complimentary plan offered by Raffles Health Insurance, and provides reimbursement of hospitalisation expenses of up to $5,000 at Raffles Hospital Singapore due to COVID-19 vaccine side effects.

It covers the period within 7 days of each COVID-19 vaccine dose.

Individuals do not have to be an existing Raffles Health Insurance customer.

Benefits: Reimbursement of hospitalisation expenses of up to $5,000, covers a period within 7 days of each vaccine dose

Eligibility: Singapore Resident aged between 19 to 65 years old (Age Next Birthday), includes all Singapore Citizens, Permanent Residents and Foreigners with valid passes

Sign up via the Raffles Connect application

Validity: Not stated, to sign up before taking the vaccination

Apply By: Not stated

Would You Be Taking the COVID-19 Vaccine Under the COVID-19 Vaccination Programme?

With all these concerns, would you be taking the COVID-19 vaccine?

If so, which one would you choose to take?

Let us know at Seedly!

Advertisement