Perhaps it’s in our Asian blood, but there’s one thing that Singaporeans love: Competition.

The desire to be number one in everything has led to a classic trait found in most of us.

Being kiasu (read: fear of losing out) meant wanting to win in everything.

This is why I suppose most of us would be curious where we stand in terms of our finances as well.

With most of us still largely conservative when it comes to discussing our net worth or salaries, topics like these usually remain a huge mystery.

Our Central Provident Fund (CPF) account is an integral part of our personal finances given its compulsory nature and usually functions as part of our retirement fund.

If you don’t already know, CPF publishes annual reports that not only include financial statements, but also juicy details like CPF balances of members across different age groups.

In this article, we’ll take a look at the data provided by these reports!

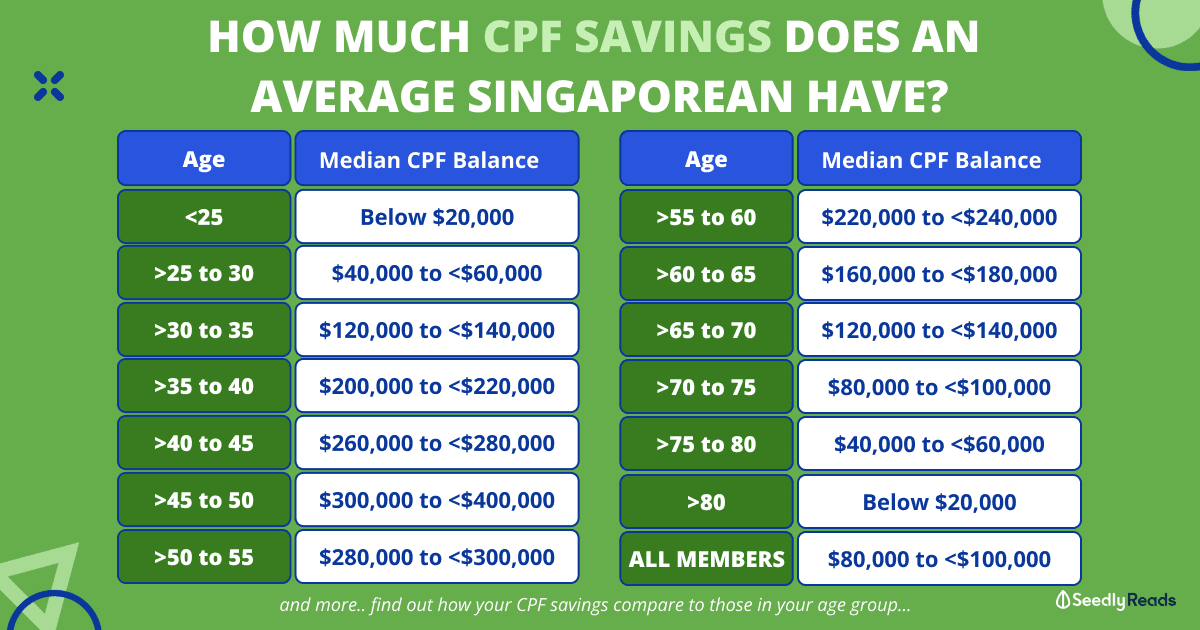

TL;DR: CPF Savings Guide — Average Savings of Singaporeans in CPF by Age Group

Here’s a quick look at the median CPF balances across age groups.

| Age Group | Median CPF Balance |

|---|---|

| Up to 20 | Below $20,000 |

| > 20 - 25 | Below $20,000 |

| > 25 - 30 | $40,000 to <$60,000 |

| > 30 - 35 | $120,000 to <$140,000 |

| > 35 - 40 | $200,000 to <$220,000 |

| > 40 - 45 | $260,000 to <$280,000 |

| > 45 - 50 | $300,000 to <$400,000 |

| > 50 - 55 | $280,000 to <$300,000 |

| > 55 - 60 | $220,000 to <$240,000 |

| > 60 - 65 | $160,000 to <$180,000 |

| > 65 - 70 | $120,000 to <$140,000 |

| > 70 - 75 | $80,000 to <$100,000 |

| > 75 - 80 | $40,000 to <$60,000 |

| Above 80 | Below $20,000 |

| Unspecified | Below $20,000 |

| All Members | $80,000 to <$100,000 |

Scroll down to find out more about the distribution of CPF savings and where you stand! 😉

How Much CPF Should I Have: CPF Savings Across Age Groups

In the latest CPF Annual Report 2021, CPF provided a table that indicates the distribution of regrossed CPF balances across age groups for ALL CPF members as of 31 December 2021.

If you’re wondering what ‘regrossed‘ means, this means that the amounts that are withdrawn under Investment, Education, Residential Properties, Non-Residential Properties, and Public Housing Schemes are included.

How to quickly read it: Locate your age group and the amount of CPF savings you have.

For instance, if you’re 30 and have $100,000 in your CPF account, you’re 1 out of the 21,500 people in that range.

| BALANCE GROUP (S$) | AGE GROUP (YEARS) | TOTAL | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| UP TO 20 | >20 - 25 | >25 - 30 | >30 - 35 | >35 - 40 | >40 - 45 | >45 - 50 | >50 - 55 | >55 - 60 | >60 - 65 | >65 - 70 | >70 - 75 | >75 - 80 | ABOVE 80 | UNSPECIFIED | ALL MEMBERS | BALANCE ($’000) | |

| Below 20,000 | 428,590 | 188,350 | 77,080 | 40,100 | 32,100 | 30,170 | 31,320 | 42,850 | 70,330 | 65,170 | 59,630 | 53,780 | 39,490 | 89,720 | 20,990 | 1,269,670 | 6,320,586 |

| 20,000 to below 40,000 | 1,810 | 25,370 | 44,540 | 20,890 | 15,050 | 12,940 | 12,310 | 13,070 | 15,040 | 16,810 | 17,700 | 18,540 | 14,010 | 26,220 | 130 | 254,410 | 7,515,108 |

| 40,000 to below 60,000 | 510 | 8,950 | 41,280 | 20,550 | 13,550 | 11,710 | 11,280 | 11,710 | 13,880 | 16,220 | 17,180 | 18,800 | 14,880 | 19,660 | 40 | 220,190 | 10,985,301 |

| 60,000 to below 80,000 | 300 | 3,320 | 35,590 | 21,770 | 13,180 | 11,300 | 11,130 | 11,010 | 13,260 | 15,700 | 15,780 | 16,010 | 11,210 | 9,280 | 20 | 188,860 | 13,178,067 |

| 80,000 to below 100,000 | 120 | 1,260 | 28,410 | 22,770 | 13,250 | 10,760 | 10,530 | 10,740 | 12,590 | 14,330 | 13,830 | 15,810 | 8,900 | 5,440 | #0 | 168,750 | 15,158,617 |

| 100,000 to below 120,000 | 90 | 460 | 21,400 | 24,490 | 13,280 | 10,760 | 10,250 | 10,610 | 12,110 | 13,400 | 12,730 | 13,750 | 5,510 | 3,210 | #0 | 152,050 | 16,696,243 |

| 120,000 to below 140,000 | 50 | 160 | 15,180 | 25,150 | 13,230 | 10,470 | 9,980 | 10,030 | 11,480 | 12,300 | 11,870 | 11,240 | 3,850 | 2,050 | #0 | 137,030 | 17,791,836 |

| 140,000 to below 160,000 | 30 | 70 | 9,830 | 24,750 | 13,500 | 10,470 | 9,740 | 9,680 | 10,830 | 12,620 | 11,620 | 9,780 | 2,740 | 1,370 | #0 | 127,010 | 19,037,625 |

| 160,000 to below 180,000 | 40 | 40 | 5,930 | 23,060 | 13,560 | 10,580 | 9,380 | 9,150 | 10,350 | 12,440 | 11,530 | 7,610 | 2,160 | 960 | #0 | 116,800 | 19,840,950 |

| 180,000 to below 200,000 | 100 | 40 | 3,610 | 20,540 | 14,050 | 10,650 | 9,500 | 8,740 | 9,780 | 11,020 | 11,110 | 6,380 | 1,650 | 700 | - | 107,860 | 20,480,697 |

| 200,000 to below 220,000 | 30 | 20 | 2,090 | 17,580 | 13,890 | 10,900 | 9,390 | 8,450 | 9,310 | 10,600 | 10,380 | 5,090 | 1,230 | 540 | - | 99,490 | 20,878,824 |

| 220,000 to below 240,000 | 50 | 20 | 1,100 | 14,670 | 13,860 | 10,870 | 9,100 | 8,050 | 9,800 | 10,780 | 9,920 | 4,320 | 960 | 400 | - | 93,900 | 21,589,639 |

| 240,000 to below 260,000 | 20 | 10 | 560 | 11,980 | 13,760 | 10,950 | 9,170 | 7,810 | 10,880 | 11,440 | 8,710 | 3,450 | 820 | 320 | - | 89,870 | 22,462,813 |

| 260,000 to below 280,000 | 20 | 10 | 270 | 9,720 | 12,840 | 10,760 | 8,850 | 7,650 | 11,090 | 10,650 | 7,040 | 2,950 | 700 | 280 | - | 82,820 | 22,344,304 |

| 280,000 to below 300,000 | #0 | 10 | 140 | 7,590 | 12,240 | 10,580 | 8,730 | 7,450 | 9,590 | 8,810 | 5,860 | 2,460 | 550 | 230 | - | 74,240 | 21,520,441 |

| 300,000 to below 400,000 | 20 | 20 | 170 | 18,620 | 49,530 | 49,080 | 41,360 | 33,750 | 38,750 | 32,520 | 21,010 | 8,840 | 1,810 | 730 | - | 296,210 | 102,752,485 |

| 400,000 to below 500,000 | 10 | 10 | 10 | 2,510 | 29,820 | 40,150 | 36,210 | 29,340 | 27,960 | 20,610 | 12,440 | 5,010 | 960 | 320 | - | 205,340 | 91,795,608 |

| 500,000 & above | - | - | 10 | 150 | 11,750 | 53,840 | 94,730 | 102,140 | 80,970 | 55,080 | 31,830 | 11,320 | 1,820 | 460 | - | 444,080 | 323,938,258 |

| All Groups | 431,760 | 228,130 | 287,190 | 326,860 | 312,450 | 326,940 | 342,950 | 342,230 | 378,010 | 350,500 | 290,120 | 215,120 | 113,240 | 161,890 | 21180 | 4,128,560 | 774,287,401 |

| Numbers may not add up to 100% due to rounding #Number of CPF members is less than 5 |

|||||||||||||||||

Source: CPF

How Much Does the Average Singaporean Have In Cpf? CPF Balances According to Age Group (%)

Well, that is A LOT of numbers.

Now, let’s further break down the data into percentages for a clearer view.

| BALANCE GROUP (S$) | AGE GROUP (YEARS) | TOTAL | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| UP TO 20 | >20 - 25 | >25 - 30 | >30 - 35 | >35 - 40 | >40 - 45 | >45 - 50 | >50 - 55 | >55 - 60 | >60 - 65 | >65 - 70 | >70 - 75 | >75 - 80 | ABOVE 80 | UNSPECIFIED | ALL MEMBERS | |

| Below $20,000 | 99.27% | 82.56% | 26.84% | 12.27% | 10.27% | 9.23% | 9.13% | 12.52% | 18.61% | 18.59% | 20.55% | 25.00% | 34.87% | 55.42% | 99.10% | 30.753% |

| $20,000 to below $40,000 | 0.42% | 11.12% | 15.51% | 6.39% | 4.82% | 3.96% | 3.59% | 3.82% | 3.98% | 4.80% | 6.10% | 8.62% | 12.37% | 16.20% | 0.61% | 6.162% |

| $40,000 to below $60,000 | 0.12% | 3.92% | 14.37% | 6.29% | 4.34% | 3.58% | 3.29% | 3.42% | 3.67% | 4.63% | 5.92% | 8.74% | 13.14% | 12.14% | 0.19% | 5.333% |

| $60,000 to below $80,000 | 0.07% | 1.46% | 12.39% | 6.66% | 4.22% | 3.46% | 3.25% | 3.22% | 3.51% | 4.48% | 5.44% | 7.44% | 9.90% | 5.73% | 0.09% | 4.574% |

| $80,000 to below $100,000 | 0.03% | 0.55% | 9.89% | 6.97% | 4.24% | 3.29% | 3.07% | 3.14% | 3.33% | 4.09% | 4.77% | 7.35% | 7.86% | 3.36% | #0 | 4.087% |

| $100,000 to below $120,000 | 0.02% | 0.20% | 7.45% | 7.49% | 4.25% | 3.29% | 2.99% | 3.10% | 3.20% | 3.82% | 4.39% | 6.39% | 4.87% | 1.98% | #0 | 3.683% |

| $120,000 to below $140,000 | 0.01% | 0.07% | 5.29% | 7.69% | 4.23% | 3.20% | 2.91% | 2.93% | 3.04% | 3.51% | 4.09% | 5.22% | 3.40% | 1.27% | #0 | 3.319% |

| $140,000 to below $160,000 | 0.01% | 0.03% | 3.42% | 7.57% | 4.32% | 3.20% | 2.84% | 2.83% | 2.87% | 3.60% | 4.01% | 4.55% | 2.42% | 0.85% | #0 | 3.076% |

| $160,000 to below $180,000 | 0.01% | 0.02% | 2.06% | 7.06% | 4.34% | 3.24% | 2.74% | 2.67% | 2.74% | 3.55% | 3.97% | 3.54% | 1.91% | 0.59% | #0 | 2.829% |

| $180,000 to below $200,000 | 0.02% | 0.02% | 1.26% | 6.28% | 4.50% | 3.26% | 2.77% | 2.55% | 2.59% | 3.14% | 3.83% | 2.97% | 1.46% | 0.43% | — | 2.613% |

| $200,000 to below $220,000 | 0.01% | 0.01% | 0.73% | 5.38% | 4.45% | 3.33% | 2.74% | 2.47% | 2.46% | 3.02% | 3.58% | 2.37% | 1.09% | 0.33% | — | 2.410% |

| $220,000 to below $240,000 | 0.01% | 0.01% | 0.38% | 4.49% | 4.44% | 3.32% | 2.65% | 2.35% | 2.59% | 3.08% | 3.42% | 2.01% | 0.85% | 0.25% | — | 2.274% |

| $240,000 to below $260,000 | 0.005% | 0.004% | 0.19% | 3.67% | 4.40% | 3.35% | 2.67% | 2.28% | 2.88% | 3.26% | 3.00% | 1.60% | 0.72% | 0.20% | — | 2.177% |

| $260,000 to below $280,000 | 0.005% | 0.004% | 0.09% | 2.97% | 4.11% | 3.29% | 2.58% | 2.24% | 2.93% | 3.04% | 2.43% | 1.37% | 0.62% | 0.17% | — | 2.006% |

| $280,000 to below $300,000 | — | 0.004% | 0.05% | 2.32% | 3.92% | 3.24% | 2.55% | 2.18% | 2.54% | 2.51% | 2.02% | 1.14% | 0.49% | 0.14% | — | 1.798% |

| $300,000 to below $400,000 | 0.005% | 0.01% | 0.06% | 5.70% | 15.85% | 15.01% | 12.06% | 9.86% | 10.25% | 9.28% | 7.24% | 4.11% | 1.60% | 0.45% | — | 7.175% |

| $400,000 to below $500,000 | 0.002% | 0.004% | 0.003% | 0.77% | 9.54% | 12.28% | 10.56% | 8.57% | 7.40% | 5.88% | 4.29% | 2.33% | 0.85% | 0.20% | — | 4.974% |

| $500,000 & above | — | — | 0.003% | 0.05% | 3.76% | 16.47% | 27.62% | 29.85% | 21.42% | 15.71% | 10.97% | 5.26% | 1.61% | 0.28% | — | 10.756% |

| All Groups | 431,760 | 228,130 | 287,190 | 326,860 | 312,450 | 326,940 | 342,950 | 342,230 | 378,010 | 350,500 | 290,120 | 215,120 | 113,240 | 161,890 | 21180 | 4,128,560 |

| Numbers may not add up to 100% due to rounding #Number of CPF members is less than 5 |

||||||||||||||||

As expected, the majority of individuals below 25 years old have less than $40,000 in their CPF accounts.

The distribution starts to vary greatly, especially for those aged between 30 to 40.

This period is also where most of us are on different career trajectories as well.

What’s interesting to note is that there is a whopping 15.85% of individuals between 35 to 40 years old with CPF balances between $300,000 to $400,000.

And 9.54% having between $400,000 to $500,000.

If you’re one of them, you’ll well on your way to becoming a CPF millionaire.

It’s also heartening to note that about 43.76% of those aged between 40 to 45 years old have at least $300,000 in their accounts.

(And I suspect a lot of them are in our Seedly Community, given how financially woke most of the people here are.)

There’s also a whopping 27.62% of individuals aged from 45 to 50 with more than $500,000 in their accounts.

How Does My CPF Balance Compare to Those in My Age Group?

Now you might be wondering – how do I fare against my peers in the same age group?

Here’s where we can look at the median CPF balances (i.e. 50% percentile) across the age groups.

Note: We look at the median instead of the mean due to the skewed distribution across some age groups (e.g. below 20 and above 80).

Using this graph above, we can see the variations across different age groups, showing how the concentration of individuals with high CPF balances increases accordingly, and then decreases again when individuals reach retirement.

As for the median CPF balances, here are the results:

| Age Group | Median CPF Balance |

|---|---|

| Up to 20 | Below $20,000 |

| > 20 - 25 | Below $20,000 |

| > 25 - 30 | $40,000 to <$60,000 |

| > 30 - 35 | $120,000 to <$140,000 |

| > 35 - 40 | $200,000 to <$220,000 |

| > 40 - 45 | $260,000 to <$280,000 |

| > 45 - 50 | $300,000 to <$400,000 |

| > 50 - 55 | $280,000 to <$300,000 |

| > 55 - 60 | $220,000 to <$240,000 |

| > 60 - 65 | $160,000 to <$180,000 |

| > 65 - 70 | $120,000 to <$140,000 |

| > 70 - 75 | $80,000 to <$100,000 |

| > 75 - 80 | $40,000 to <$60,000 |

| Above 80 | Below $20,000 |

| Unspecified | Below $20,000 |

| All Members | $80,000 to <$100,000 |

Ways To Increase CPF Savings: How Much Is CPF Interest Rate?

Now you’ve seen the numbers and have a rough gauge of where you stand.

If you have more in your CPF account than an average Singaporean, congratulations!

But if you have yet to reach those numbers, don’t worry as well.

There are various ways to increase your CPF savings and make your CPF money work for you.

Some of these methods have been widely covered by our existing articles, which include:

- Topping up your CPF Special Account

- Transfer from your CPF Ordinary Account to Special Account

- Keep $20,000 in your CPF Ordinary Account instead of wiping it out for an HDB loan

- Doing voluntary top-ups to CPF accounts

- Invest using the CPF Investment Scheme

By starting some of these hacks early, you can still ride on the compounding effect of the attractive interest rates that CPF offers.

That being said, as we all know that CPF top-ups are irreversible, please only do so if that is something that aligns with your financial goals, and do assess your own financial situation before making any decisions.

And if you have any burning CPF questions… you know where to find your answers!

Advertisement