How Much CPF Do I Need To Retire?

Considering that most people in Singapore are salaried employees who contribute up to 37 per cent of our salary to our Central Provident Fund (CPF), I am sure that you have thought of this question at least once.

And unless you’re a billionaire like Batman who does not need to worry about retirement, I believe it would be prudent for us to plan for our retirement early.

If done well, our CPF can be the foundation on which a comfortable retirement is built.

But because personal finance is like the name suggests personal — each person’s CPF savings are likely to differ.

As such, here’s a tool for you to estimate the balances of your CPF accounts in the future based on your current account information, estimated contributions as well as various assumptions to help you plan for retirement.

We’ll also be answering frequently asked questions about CPF as well.

TL;DR: CPF Calculator 2022 Guide — Use This Tool to Forecast Your CPF Retirement Payout & More

Disclaimer: The article is merely a guide for individuals looking to maximise their CPF. This calculator only serves to provide an estimated forecast of your CPF savings in the future based on the inputs provided. This should not be used for an accurate assessment of the savings you have in your CPF accounts. Use it at your own risk! Also, the information provided by Seedly serves as an educational piece and does not constitute an offer or solicitation to buy or sell any investment product(s). It does not take into account the specific investment objectives, financial situation or particular needs of any person. Readers should always do their own due diligence and consider their financial goals before investing in any investment product(s).

CPF Retirement Calculator

I came across this useful tool as it was recommended by the 1 Million by 65 (1M65) community.

For the uninitiated, the concept behind 1M65, as coined by our SeedlyCommunity member and founder of the 1M65 movement, Loo Cheng Chuan, is really straightforward.

At around 30 years old, both you and your spouse should each have at least $130,000 each in your CPF Special Account (SA) and MediSave Accounts (MA).

The prevailing interest rate of 4 per cent compounded over time will grow both of your combined CPF balances to $1 million by 65 years old.

For math enthusiasts, the 1M65 concept can be distilled into this very simple formula:

$130,000 x (1+0.04)^35years x 2 = $1,000,000

The calculator predicts your CPF balances up to age 55.

But then again life is not that straightforward.

Due to your circumstances, you could achieve this $1 million goal easily.

But, that’s where the CPF Forecast Tool from local Finfluencer Value Warrior comes in.

With this tool, you can see how the choices that you make with your CPF can affect your retirement.

According to Value Warrior, there are a few assumptions you need to take note of:

- The calculation is based on your inputs, the current CPF interest rate, Basic Healthcare Sum (BHS) of $66,000 and Full Retirement Sum (FRS) of $192,000

- CPF Members currently earn an interest of 2.5% for the Ordinary Account (OA) and 4% for the Special (SA), Medisave (MA) and Retirement Account (RA). There is an additional 1% paid on the first $60,000 of your combined CPF balances, with up to $20,000 from the OA.

- Currently, only the additional interest before the formation of the RA at Age 55 is being considered. The additional interest after the formation of the RA at Age 55 is not being considered yet.

- Monthly Salary is the total amount of wages payable to you, before deduction of employee CPF contribution and personal income tax. This is subjected to a monthly CPF contribution cap of $6,000

- The CPF contribution rate used is based on the CPF contribution rate table for employees earning a monthly salary of $750 or more.

- Contributions to the MA is subjected to a cap of $66,000 – also known as the BHS. Any contributions in excess of the BHS will overflow to the SA up to the Full Retirement Sum (FRS) before overflowing to the OA.

- Annual salary increment and bonus will be capped by the Annual contribution limit of $102,000 and the CPF Annual Limit of $37,740.

- Retirement Age is the age where you stop working and stop receiving your salary and CPF contribution.

- FRS or ERS selection determines if FRS or ERS gets transferred to your RA account when you turn 55. Note that CPF will only by default transfer up to FRS to your RA. Topping up your RA up to ERS will have to be manually done.

- Under More Options, you can do the following

- Set FRS and BHS growth rates. They are growth percentages applied to the FRS and BHS yearly to increase the FRS and BHS. The default rates are 3.5% and 5% for the FRS and BHS respectively.

- SA shielding. This limits the transfer of SA to RA up to the amount you specify (minimum $40,000) while the rest of the transfer to RA comes from OA.

NOTE: RSTU and its interest cannot be invested and hence cannot be shielded. You need to account for this and enter the amount in SA that cannot be shielded at 55. - BETA – Functions which are not fully tested (Indicated with a B)

-

- OA transfer to SA. This will transfer the amount specified from your OA to SA for the specified Age range.

- OA withdrawal or refund for housing. Key in a negative value for withdrawal and positive for refund. Amount entered is monthly for the specified Age range.

- Annual Topping up of the SA/RA (via Retirement Sum Top Up Scheme). Note that the top-up will not be considered once the SA/RA reaches FRS/Enhanced Retirement Sum (ERS). The top-up is done at the end of the year in December for the specified Age range.

- Annual Topping up or deduction of MA. Key in a negative value for deduction and positive for topping up. Note that the top-up will not be considered once the MA reaches BHS. The top-up is done at the end of the year in December for the specified Age range.

CPF Projection Calculator

The calculator can be really simple or advanced depending on your inputs.

For this illustration, we will be using the example of a hypothetical youth that is just starting out in the workforce and trying to survive as a young working adult.

According to the Ministry of Manpower’s (MOM’s) Labour Force in Singapore 2021 report, the median monthly income for those aged 20 – 24 years old amounts to $2,691 a month (including employer CPF contributions).

So let’s assume that our hypothetical youth who is aged 23 and born on 1 January 1999 earns that amount.

We will be using the $2,691 number as the calculator requires that we input total wages before the deduction of employee CPF contribution and personal income tax.

Other assumptions include:

- $0 in their OA, SA and MA

- Annual increment of 3 per cent

- No annual bonus

- FRS growth rate of 3.5 per cent p.a.

- BHS growth rate of 5 per cent p.a.

- No top-ups to CPF.

- No withdrawals as it is hard to predict how much the general population will withdraw for their housing or medical needs, but you could always key in your own inputs.

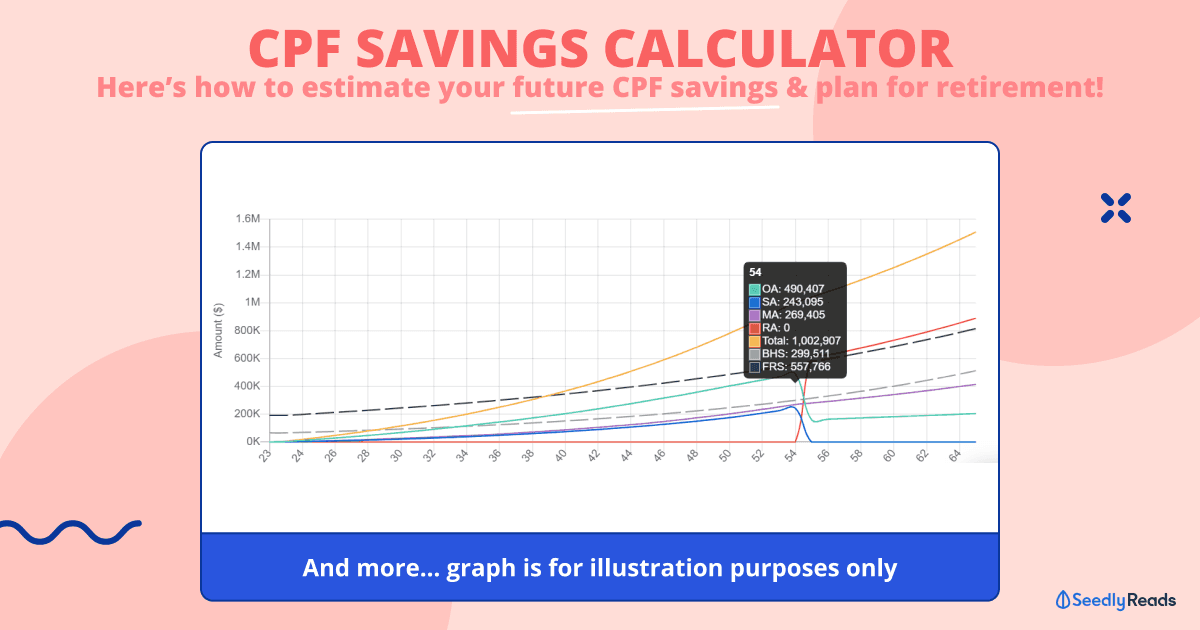

Here’s what we got in graph form:

And table form:

| Age (Years) | OA Amount | SA Amount | MA Amount | RA Amount |

|---|---|---|---|---|

| 23 (Input) | $0.00 | $0.00 | $0.00 | $0.00 |

| 23 | $3,740.66 | $993.72 | $1,310.52 | $0.00 |

| 24 | $11,587.74 | $3,171.94 | $4,108.97 | $0.00 |

| 25 | $19,863.61 | $5,600.28 | $7,129.33 | $0.00 |

| 26 | $28,585.96 | $8,254.82 | $10,385.16 | $0.00 |

| 27 | $37,773.14 | $11,107.32 | $13,890.76 | $0.00 |

| 28 | $47,444.18 | $14,169.63 | $17,661.23 | $0.00 |

| 29 | $57,618.80 | $17,454.27 | $21,712.50 | $0.00 |

| 30 | $68,317.43 | $20,974.43 | $26,039.29 | $0.00 |

| 31 | $79,561.28 | $24,744.01 | $30,601.25 | $0.00 |

| 32 | $91,372.30 | $28,777.70 | $35,407.89 | $0.00 |

| 33 | $103,773.26 | $33,090.98 | $40,469.37 | $0.00 |

| 34 | $116,787.73 | $37,700.14 | $45,796.16 | $0.00 |

| 35 | $130,440.18 | $42,621.82 | $51,399.68 | $0.00 |

| 36 | $143,794.64 | $48,318.15 | $57,816.11 | $0.00 |

| 37 | $157,785.76 | $54,344.08 | $64,620.01 | $0.00 |

| 38 | $172,438.55 | $60,715.84 | $71,830.81 | $0.00 |

| 39 | $187,778.90 | $67,450.41 | $79,468.81 | $0.00 |

| 40 | $203,833.64 | $74,565.53 | $87,555.28 | $0.00 |

| 41 | $220,630.56 | $82,079.78 | $96,112.44 | $0.00 |

| 42 | $238,198.44 | $90,012.55 | $105,163.54 | $0.00 |

| 43 | $256,567.07 | $98,384.11 | $114,732.87 | $0.00 |

| 44 | $275,767.33 | $107,215.67 | $124,845.87 | $0.00 |

| 45 | $295,831.18 | $116,529.38 | $135,529.09 | $0.00 |

| 46 | $315,499.84 | $126,999.51 | $147,461.45 | $0.00 |

| 47 | $336,028.40 | $138,044.71 | $160,066.43 | $0.00 |

| 48 | $357,449.40 | $149,692.67 | $173,376.81 | $0.00 |

| 49 | $379,796.54 | $161,972.34 | $187,426.83 | $0.00 |

| 50 | $403,104.68 | $174,913.96 | $202,252.31 | $0.00 |

| 51 | $424,128.55 | $190,969.91 | $218,066.20 | $0.00 |

| 52 | $445,678.01 | $207,668.11 | $234,512.65 | $0.00 |

| 53 | $467,766.21 | $225,034.23 | $251,616.95 | $0.00 |

| 54 | $490,406.62 | $243,095.00 | $269,405.43 | $0.00 |

| 55 | $160,119.11 | $0.00 | $280,181.65 | $600,379.37 |

| 56 | $164,122.09 | $0.00 | $291,388.91 | $624,394.55 |

| 57 | $168,225.14 | $0.00 | $303,044.47 | $649,370.33 |

| 58 | $172,430.77 | $0.00 | $315,166.25 | $675,345.14 |

| 59 | $176,741.54 | $0.00 | $327,772.90 | $702,358.95 |

| 60 | $181,160.07 | $0.00 | $340,883.81 | $730,453.30 |

| 61 | $185,689.08 | $0.00 | $354,519.17 | $759,671.44 |

| 62 | $190,331.30 | $0.00 | $368,699.93 | $790,058.29 |

| 63 | $195,089.58 | $0.00 | $383,447.93 | $821,660.63 |

| 64 | $199,966.82 | $0.00 | $398,785.85 | $854,527.05 |

| 65 | $204,965.99 | $0.00 | $414,737.28 | $888,708.13 |

As you can see at the age of 54, our working adult would have accumulated a tidy sum of $1,002,907 in his/her CPF accounts with

- $490,407 in their OA

- $243,095 in their SA

- and $269,405 in their MA.

But when our young working adult turns 55 things change.

CPF Retirement Account And CPF Retirement Sum in 2022

In 2022, the retirement sum figures look a bit like this:

- Basic Retirement Sum (BRS): $96,000

- Full Retirement Sum (FRS): $192,000

- Enhanced Retirement Sum (ERS): $288,000.

With that in mind, our young working adult would have ~$600,379 transferred from their SA and OA (SA take priority) to their CPF RA at the age of 55, to form the projected FRS at that age.

This will leave them ~$160,119 in their OA, $0 in their SA and ~$280,182 in their MA.

FAQs

Voluntary CPF Contribution, Top Up CPF Special Account and More

But if you have done the math and would like to accumulate more funds in your CPF, we got you.

There are various ways to increase your CPF savings and make your CPF money work for you.

Some of these methods have been widely covered by our existing articles, which include:

- Topping up your CPF Special Account

- Transfer from your CPF Ordinary Account to Special Account

- Keep $20,000 in your CPF Ordinary Account instead of wiping it out for an HDB loan

- Doing voluntary top-ups to CPF accounts

- Invest using the CPF Investment Scheme.

By starting some of these hacks early, you can still ride on the compounding effect of the attractive interest rates that CPF offers.

That being said, as we all know that CPF top-ups are irreversible, please only do so if that is something that aligns with your financial goals, and do assess your own financial situation before making any decisions.

CPF Contribution Calculator

One more thing.

You can use this calculator from CPF to check the CPF contributions payable if you are a private sector / non-pensionable government employee who is a Singapore Citizen or Singapore Permanent Resident (SPR) from their third year of obtaining SPR status.

Retirement Planning Singapore: How Much Do I Need To Retire at 65 in Singapore?

Also, if you were wondering how much you will need to retire at 65 in Singapore, check out our article How Much Singaporeans Need To Save Now To Retire At 55 Or 62 Years Old where we took an in-depth look at the issue:

Got Any Burning CPF Questions?

And if you have any burning CPF questions… you know where to find your answers!

Advertisement