Remember how much it costs to raise a child in Singapore?

Even though it’ll be amazing if everyone can be financially independent once they start working, that is usually not the case as we’ll all need some time to build our wealth.

That’s why it’s a common phenomenon for us to purchase endowment plans or invest for our children. At the end of the day, we want to make sure that we can provide for and support for our children.

Even for those of you who are not married or have no children yet, I’m sure the thought has crossed your mind when you’re planning with your partner.

In fact, some parents are even looking into topping up their children’s CPF accounts to give them a headstart in life.

When Can You Start Topping Up Your Child’s CPF Accounts?

Did you know, you can actually top-up your child’s CPF account right after they’re born!

But you’ll probably be pretty busy and tired, so take it easy first, ya?

Opening of Your Child’s CPF Accounts

Depending on the year that your child is born, their CPF account might already have been opened and you probably have already started using it.

That’s all thanks to the MediSave Grant for Newborns introduced in 2012 to help lighten the healthcare expenses for your child.

| Date of Birth | Opening of CPF MediSave Account | MediSave Grant Amount |

|---|---|---|

| Before 26 August 2012 | No | $0 |

| Between 26 August 2012 & 31 December 2014 | Yes | $3,000 |

| On & after 1 January 2015 | Yes | $4,000 |

Now, if you’re reading this and your child was born before 2012, don’t worry! Opening your child’s CPF account is as easy as making the first contribution and CPF will do the rest for you.

Plus, you don’t have to go down to any of the CPF Service Centres if you’re making your first contribution to your child’s Special Account.

If you have your information ready, it’s going to take you less than 10 minutes!

- Go to CPF’s e-Cashier page and input your child’s NRIC number under the Payer’s CPF Account Number/NRIC

- Choose the type of top-up you are making

- Indicate the amount you wish to top-up

- Make payment through the various modes of payment available

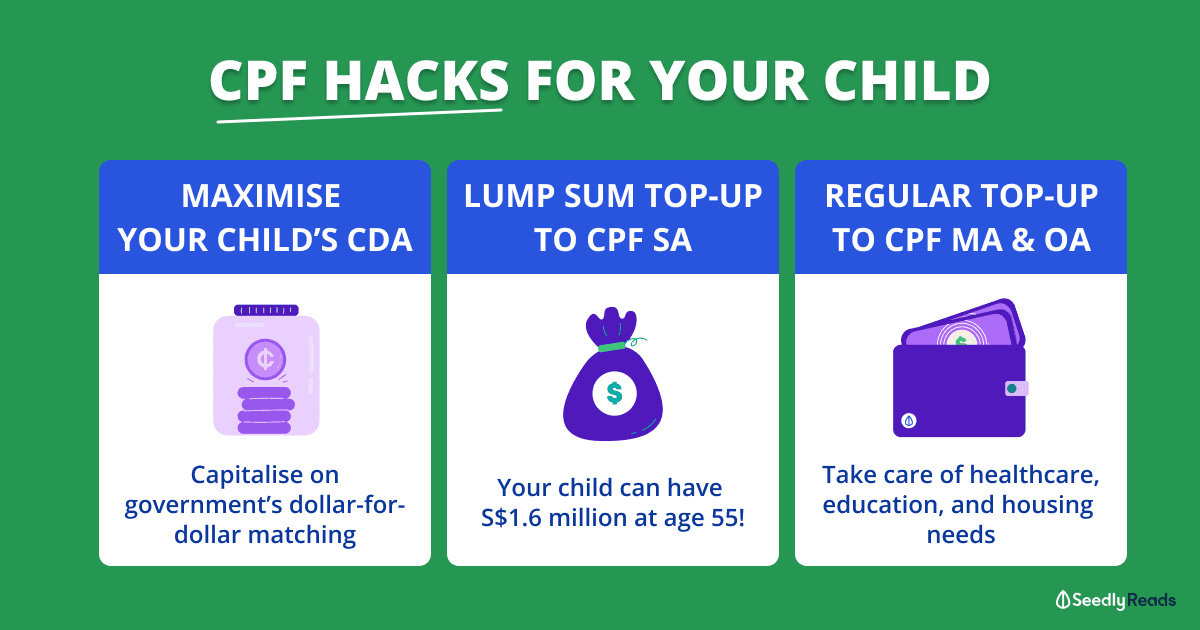

CPF Hacks For Maximising Your Child’s Funds

I’m sure you’re no stranger to the power of compound interest by now, even though the results take a long time to show up.

Maximising Your Child’s Child Development Account (CDA)

You must be thinking what your child’s savings account has to do with CPF hacks, right?

Well, that’s because the unspent balance of your child’s CDA will be transferred to their Post-Secondary School Account (PSEA).

So?

Unused funds in your child’s PSEA will be transferred to their CPF Ordinary Account in the middle of the year in which they turn 31!

Does it make sense now?

Your child’s CDA generates a return of at least 1% per annum effortlessly, you don’t even need to meet different criteria for bonus interest and whatnot.

That’s not all! The government will also match the amount you saved in your child’s CDA, dollar-for-dollar.

Not to say that you shouldn’t use the money in your child’s CDA for their needs, but if your financial situation allows, think of it as another high-returns investment for your child and just let the interest accumulate!

After which, if you are able to do so after the transfer from CDA to PSEA, your child’s funds will grow at the same rate of 2.5% interest as their CPF Ordinary Account!

A Lump Sum Top-Up To Full Retirement Sum In Special Account

Let’s say your child was born in 2021 and you’ve taken care of all your personal and retirement needs.

You still have the equivalent of the Full Retirement Sum (i.e. $186,000) lying around, so you decided to top up your child’s Special Account to the Full Retirement Sum.

| Your Child's CPF Special Account | |

|---|---|

| Initial Lump Sum Top-Up | $110,866.27 |

| Balance after 25 years | $301,287.79 |

| Balance after 55 years | $1,000,000.07 |

Pretty impressive right?

Don’t forget, that’s just the power of compounding from the initial sum of $186,000 that you have topped up.

Once they are in their 20s, your child will also be making their own CPF contributions since they will be working, which means the amount will grow even more!

Smaller But Regular Contributions To Their Special & MediSave Account

I get it, not everyone has the ability to come up with the Full Retirement Sum at one go, since most of us may still be trying to hit it ourselves.

Even if you can’t afford to put a lump sum in, making regular contributions also helps!

Imagine you contribute $2,400 per year instead, for 25 years since they can take care of their own finances when they start working.

| Your Child's CPF Special Account | |

|---|---|

| Yearly Contribution for 25 years | $2,400 |

| Balance after 25 years | $110,346.19 |

| Balance after 55 years | $357,896.56 |

It’s definitely pale in comparison to a lump sum contribution, but hey, $358k is no small feat either!

Regardless of the amount of contribution and the length of compounding, you’d have saved a substantial amount for your child in the long run.

Plus, you’re not just restricted to the Special Account, you can also make regular top-ups to their MediSave Account for their healthcare needs.

Just take note of the Basic Healthcare Sum, which is the limit for MediSave funds. Either way, the funds will flow into their Special Account, so all’s good!

Smaller But Regular Contributions To Their Ordinary Account

Wondering how you’re going to fund your child’s education?

Or thinking about helping them out with their housing needs?

Similarly, you can also make regular contributions to their Ordinary Account to address those concerns!

I guess the biggest downside is that the interest rate is slightly lower at 2.5%. But it’s still great as compared to just keep the cash in the bank!

Another thing to note is you can’t choose to just top up to Ordinary Account only, as the amount you top-up will be distributed to their MediSave and Special Accounts as well.

Now that we’ve gotten the technical stuff out of the way, we can look at the pros and cons of topping up your children’s CPF accounts.

Why Else Should You Top Up Your Child’s CPF?

Secure Warchest for their Retirement

The minimum age of 55 for withdrawal is the key to this strategy, as it ensures that the funds are not misused.

Who knows, the minimum age may even be raised in the future, given our life expectancy.

I’m sure we all aim to pass on our financial knowledge to our children as well and hope for them to make wise financial decisions in life.

However, there is also a possibility that your child may become a little complacent if they knew that there is a sizable sum of money that they can tap on easily.

I mean, they’ll still be working, of course.

But they may not be as motivated to build their wealth as we were when starting from scratch.

And remember, since CPF LIFE shouldn’t be our full retirement portfolio, helping your child settle this part of the equation gives them more time to focus on other aspects of retirement planning.

Freedom to Follow Their Passion

With part of their retirement planning secured, your child can have the freedom to pursue their passion without having to worry that much about finances.

Granted, they still have to take care of their daily expenses and other basic financial needs. But at least, they are able to pursue a career that they are interested in, albeit not a very well-paying one.

Or they can take that gap year that we’ve always wanted to take, to gain experience from spending time and interacting with people overseas.

Is There A Reason Why You Shouldn’t Top Up Your Child’s CPF?

Now, we’ve got to be objective, don’t we?

Even though CPF is one of the safest investment available, there are still some risks involved.

Interest Rates May Change

The main reason why we would consider topping up our child’s CPF account is the attractive interest rates that CPF offers.

Even though it has been consistent for a long time, CPF interest rates are reviewed and adjusted on a regular basis.

Since there’s still a long way to go for your child, there is a possibility that the interest rates may be reduced if the economy doesn’t do well.

Bringing us to our next point…

Other Financial Products With Liquidity & (Potentially) Higher Returns

Yea, this is a valid concern.

There are so many financial products available in the market, with similar or higher returns that you or your child can tap on.

Furthermore, these financial products are easier to liquidate if there’s an emergency as they are not locked in until your child is 55 years old.

Before you decide to make any lump sum or regular top-up to your child’s CPF, just remember, take care of your own retirement needs first.

Otherwise, they will end up having to take care of your expenses as well, which defeats the purpose of wanting to give them a headstart.

Advertisement