CPF Monthly Payouts Default At Age 70: What Could Have Been Done Better? Is It Still A Reliable Retirement Plan?

A recent screenshot of a letter from the Central Provident Fund (CPF) Board might have gone viral on the internet.

- This letter was to a Singaporean who is turning 65 years old in May 2019. According to the understanding of most Singaporeans, 65 is the age where one is eligible for CPF monthly payout.

- The letter, however, states that the payout is at age 70 and one will need to opt out of it to receive the payout earlier.

While there are many angles to approach this topic, I personally decide to craft this article in the point of view of an average Singaporean.

What could have been done better? – Some crazy ideas on the letter to Singaporeans

We take a look at this topic from our point of view as an average Singaporean. We do not represent everyone!

User Experience: ” Should the payout be at 65, and those who wish to withdraw at age 70 apply for it?”

Firstly, from the point of view of a Singaporean who is looking forward to having his CPF payout automatically at age 65:

- The implementation could have been done better by still having the payout start at age 65 automatically (since that was what most older generation would have expected).

- The letter can then include the benefits of pushing your withdrawal age to 70 years old

- The letter then can allow the Singaporean to decide if he wishes to opt-in to withdraw at age 70 instead since this age 70 withdrawal looks rather new to most Singaporeans.

- While the CPF Board might have Singaporeans at heart, the way it was executed might cause a big misunderstanding between Singaporeans and CPF.

User Experience: Two major changes in one “update”

Secondly, most Singaporeans would have missed out the second part of the letter with regards to the need to apply should they want to start their monthly payout earlier:

- The monthly payouts from CPF savings’ age were progressively raised to 65 by the year 2018. Hence, Singaporeans might be fixated on the number 65.

- Most content and news going around the internet would have shouted the number 65 since it was announced.

- While being fixated on the number 65, information such as an automatic payout at 70 unless apply otherwise, can easily raise another round of unwanted confusion.

User Interface: Highlight the new condition

Would have drawn Rainbows and Unicorns beside the sentence, just to get the maximum amount of attention to it.

We understand that the letter from CPF is sent out to the older generation. By simply bolding the sentence might not be enough to capture their attention due to poorer eyesight.

We would have

- Increased the font size of the sentence.

- Make it a different colour.

- Shift it to the top of the letter.

- Remind Singaporeans at the end of the letter again!

Retirement Sum Scheme Monthly Payouts For Singaporeans Turning Age 70 From 2018 Onwards

To clarify the above misunderstanding amongst Singaporeans, here’s what we found out after reading through some of the information on the CPF website.

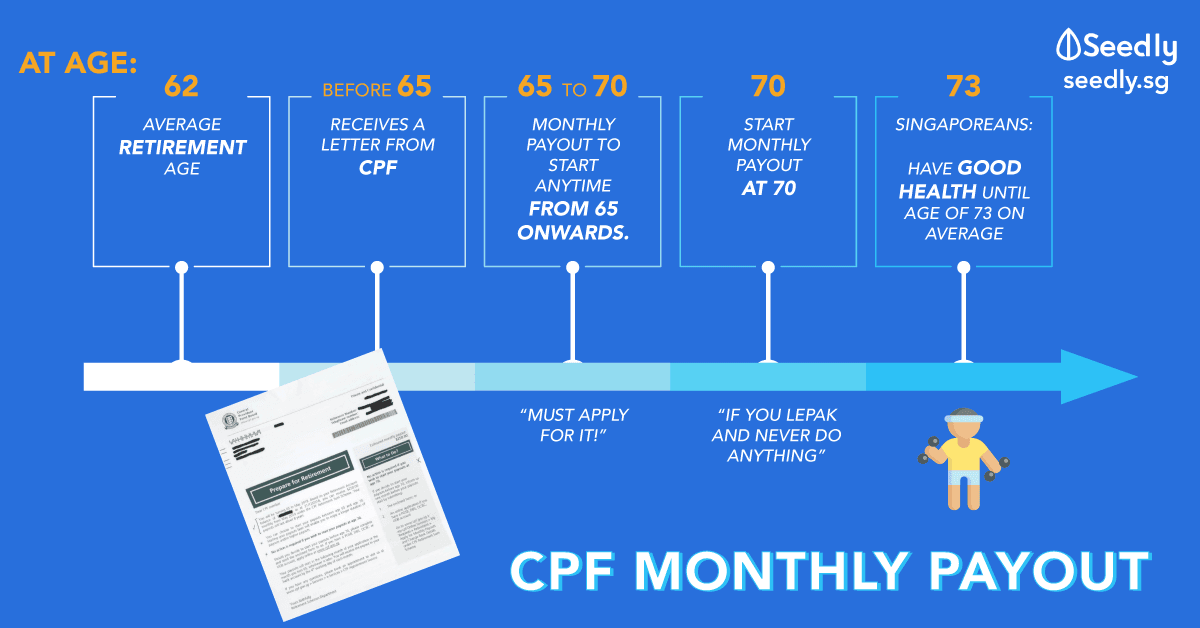

For Singaporeans turning age 70 from the year 2018 onwards, here are some things you need to take note of:

- The CPF Board has automatically start payouts at age 70

- If you wish to receive their payout at an earlier age, you will need to opt out of it.

In short, your CPF monthly payout automatically kicks in at age 70 though you are eligible for payout at age 65, if you wish to kick start your monthly payout anytime earlier, you need to do something about it.

How to start my Retirement Sum Scheme monthly payout earlier?

If waiting till age 70 for monthly payout is too much for you to take, there are two ways you can do so:

Apply for monthly payout online using my cpf

- Login to my cpf using your SingPass

- Submit an online application via My Requests

The payout will start the following month if the application is received, three working days before the end of the month.

Apply for monthly payout online by mail

- Download and fill up this form: FORM RSS30: Apply for Monthly Payouts and Change Bank Details under CPF Retirement Sum Scheme

- Mail it to:

CPF Board

Retirement Schemes Department (RSD)

Robinson Road P.O. Box 3060

Singapore 905060

The payout will start the following month if the application is received, five working days before the end of the month.

Some Singaporean call it a moving goalpost: CPF Life Monthly Payout. Is it still a reliable retirement plan?

A quick story: Putting savings in vintage biscuit tins

During our grandparents’ era, putting stacks of money into biscuit tin is one of the common ways my grandmother keep her savings.

Putting all your savings into a biscuit tin comes with a huge risk. It is not diversified. Losing that biscuit tin equates to losing one’s whole life’s savings.

With that, my grandmother starts hiding cash everywhere else in her room. In her drawer, in different biscuit tins and containers.

” If my grandmother knows better to diversify her retirement savings in her own way, you should too.”

A good retirement plan usually exhibits a few characteristics:

- A good retirement plan is well-diversified and able to withstand changing market conditions quite well.

- A good retirement plan is able to provide one with a recurring income.

- A good retirement plan can weather any unexpected spike in expenses, eg. unexpected medical costs

- A good retirement is predictable, so you know when you can work towards it and when you can receive your money

Given these characteristics, we put CPF to a test:

| Characteristic | Where CPF stands? |

|---|---|

| Able to withstand changing market conditions | Yes. It is guaranteed by the government. |

| Provide one with a recurring monthly income | In form of monthly payout should one hit the Basic Retirement Sum. |

| Weather any unexpected spike in expenses | No. This depends on one's savings and coverage. |

| Predictable | With the recent change in withdrawal age, maybe it is not so predictable at the moment in Singaporean's point of view. |

- CPF exhibits 2 out of the 4 stated characteristics.

Hence, winning the CPF game and hitting the basic retirement sum is still important. But more importantly, Singaporeans should not rely on it 100% as their retirement plan.

One needs to find ways to get himself covered or have enough savings for the unexpected spike in possible medical expenses. One also needs to find other forms of investments products to “bulletproof” his retirement plan.

Read also: Age vs Risk Profile: What Investments Should You Hold At Your Age

Further Reading: “Workers appear to be more concerned about being able to work longer and save more”

We understand that Manpower Minister, Josephine Teo told Parliament on 15 January that Singaporeans appear to be more concerned about being able to work longer and save more.

Understanding that Singaporeans are a hardworking bunch, we are not surprised! But the truth is, working past the age of 70 may not be possible despite increasing longevity.

Here’s why:

- On average, Singaporeans will have their good health until the age of 73.

- With CPF monthly payout coming in at age 65, Singaporeans have 8 years to really “enjoy retirement” should the CPF payout brings them on a higher utility curve (higher level of satisfaction).

- Should the payout come in at age 70, that duration will be down to 3 years.

Facts about the CPF Payout Eligibility Age

To summarise, here are 4 things about the CPF Payout Eligibility Age that Singaporeans should know:

- For Singaporeans born from 1954 onwards, the payout age is 65 years old. This means they can start their monthly payout anytime from age 65.

- Before reaching age 65, Singaporeans will receive a letter from CPF to inform them that they can start to apply for their monthly payouts. An application form is enclosed too.

- Before the year 2018, if one did not apply to start their CPF monthly payout, there will be no payout. With this new measure, the payout starts at 70 should one forget to apply for their payout.

Advertisement