As our population ages, new government initiatives have been rolled out to address the growing need for healthcare.

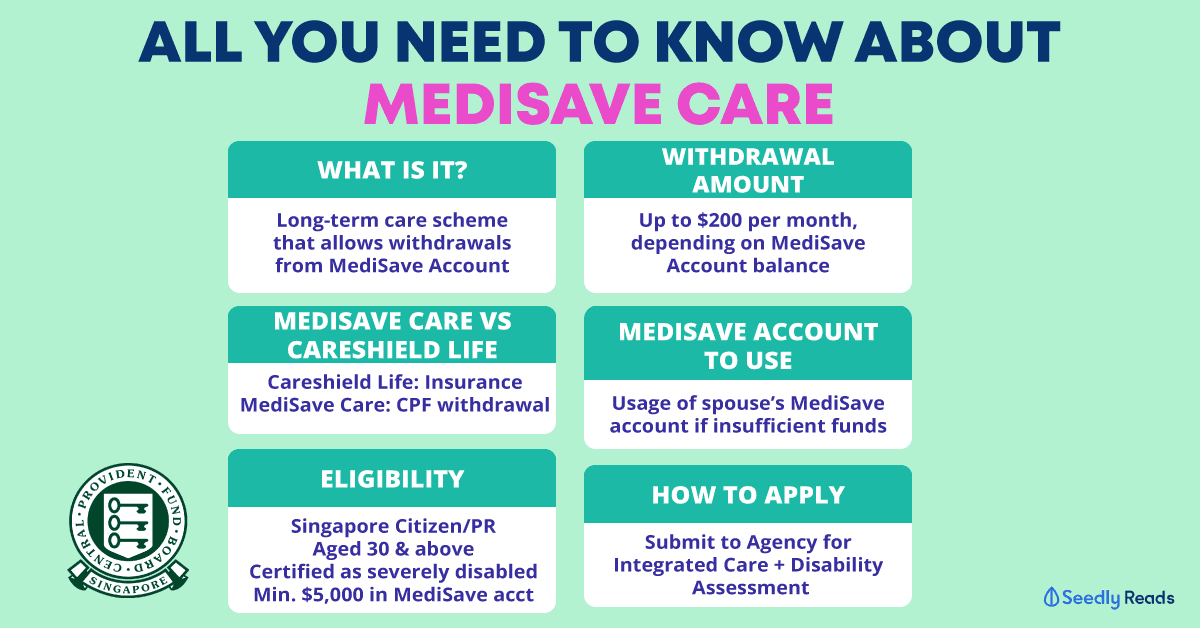

As of 1 October 2020, two long-term care support schemes have been launched: CareShield Life and MediSave Care.

While much has been covered for CareShield Life and its differences from Eldershield, there is little known about MediSave Care.

Here’s a quick guide to what MediSave Care is all about, and how it can help with our long-term care needs!

What is MediSave Care?

Similar to schemes like Careshield Life and Elderfund, MediSave Care, also known as MediSave Withdrawals for Long-Term Care, is a long-term care financing scheme that allows cash withdrawals from MediSave accounts for long-term care needs.

Depending on the MediSave balance amount, Singapore Residents aged 30 and above who are severely disabled will be able to withdraw up to $200/month.

Withdrawals can be made from their own and/or their spouses’ MediSave Accounts to meet their financial needs.

MediSave Care is jointly administered by the Agency for Integrated Care (AIC) and Central Provident Fund (CPF).

What’s the Difference Between MediSave Care & CareShield Life?

Both MediSave Care and CareShield Life are government schemes that are introduced as measures to meet the financial needs for long-term care for Singaporeans.

CareShield Life functions like an insurance scheme that offers payout upon severe disability, with lifetime payouts starting at $600/month and increasing over time.

As for MediSave Care, it is a withdrawal from MediSave accounts as cash for long-term care needs.

This cash withdrawal can be utilised according to an individual’s needs, regardless of it being locally or overseas.

Who Is Eligible for MediSave Care?

To be eligible for MediSave Care, an individual has to be:

- Singapore Citizen or Permanent Resident (includes Singapore Citizens residing overseas)

- Aged 30 and above

- Certified by a MOH-accredited severe disability assessor to be severely disabled (i.e. unable to perform three (3) or more Activities of Daily Living (ADLs):

- eating

- getting dressed

- using the toilet

- bathing

- moving

- walking around, and

- getting from the bed to a chair or vice versa

- Have a minimum MediSave Account balance of $5,000

To apply for this scheme, you may submit an application to the Agency for Integrated Care (AIC) and arrange for a disability assessment by a MOH-accredited severe disability assessor.

MediSave Withdrawals under MediSave Care

The maximum monthly withdrawal quantum that can be withdrawn is tagged to the MediSave balance.

| MediSave Balance | Monthly Withdrawal Quantum |

|---|---|

| $20,000 and above | $200 |

| $15,000 and above | $150 |

| $10,000 and above | $100 |

| $5,000 and above | $50 |

| Below $5,000 | Nil |

As the MediSave balance changes, the MediSave Care withdrawal limit will change accordingly.

This means that if any voluntary CPF contribution is made to the account, the MediSave Care withdrawal limit will be bumped up to its corresponding tier.

Severely disabled Singapore Citizens and Permanent Residents can withdraw from their own and/or their spouse’s Medisave Account if they have insufficient Medisave balances.

The amount that can be withdrawn from their spouse’s Medisave will also be subject to the same MediSave balance thresholds.

In short, this means that the maximum amount that can be withdrawn monthly from both accounts is a combined total of $200.

An example as follows:

If your MediSave Account balance is more than $5,000, the withdrawal will automatically be made from your own MediSave Account first.

Withdrawal Cap for MediSave Care

As compared to Careshield Life, the MediSave withdrawal of $200 is significantly lower than the CareShield Life payout.

Why is the withdrawal amount capped at $200 monthly?

As MediSave is primarily a savings scheme for CPF members to save for future medical expenses, the withdrawal cap is to ensure that individuals can maintain savings to pay for their other healthcare needs.

This includes hospitalisation expenses, approved outpatient care and approved medical insurance premiums.

This is also why there is a minimum MediSave Account balance of $5,000 that is required before any withdrawal can be done.

In addition, the Government will also review the MediSave withdrawal limits regularly to ensure that basic long-term care costs remain affordable for Singaporeans.

Individuals who have difficulties and are in need of financial assistance may apply for ElderFund, or may seek other means of support through initiatives like the MediFund and ComCare.

Payment for Disability Assessment

As mentioned above, individuals do have to arrange for a disability assessment and submit an application to AIC to apply for the MediSave Care scheme.

Do note that MediSave cannot be used to pay for the costs of the disability assessments.

However, both the Careshield Life and MediSave Care share the same disability assessment, and the costs for the first disability assessment will be waived.

For individuals who are not insured by CareShield Life and are planning to apply for the MediSave Care scheme, disability assessment fees will be fully reimbursed by the Government if the application outcome is successful.

What Are Your Thoughts on The MediSave Care Scheme?

Head on over to the SeedlyCommunity and share your thoughts!

Advertisement