[Update]: Every Singaporean Child Aged 7 to 20 Will Get $200 in Their Edusave or Post-Secondary Education Account (PSEA)

Parents and students, rejoice!

There will be a one-off top-up of $200 for Singaporeans aged between 7 to 20 as part of the Household Support Package announced during Budget 2021.

This sum will be credited directly to the recipient’s accounts.

No action is required from the recipient’s end, and this is on top of the annual Edusave contribution.

All eligible recipients will be receiving letters next month, once the top-up is successful.

As a student, the Post Secondary Education Account (PSEA) was something that confused me.

It was money that I didn’t know I had, and I was inclined to use the funds but was not sure how.

For those who are as blur as I was about your Post Secondary Education Account, here is a quick 60-second guide on what you need to know so that you can better spend your PSEA money!

What Is The PSEA Account?

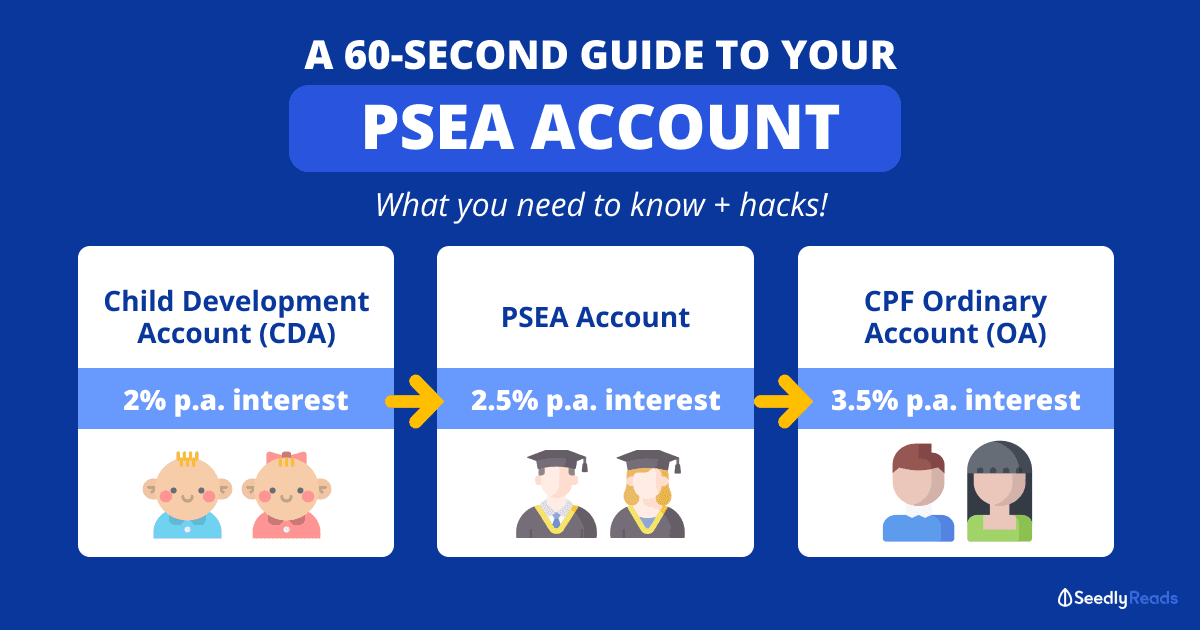

The PSEA consists of any unused Edusave funds that were previously in the Edusave account.

When the account holder is 16 years old, money from the education account is automatically transferred into the PSEA account.

With the PSEA account, you get an interest of 2.5% per annum, and this account will be held until you are 30 years old.

At the age of 30, any remaining funds you have will be transferred to your CPF Ordinary Account (OA), which can be used for housing, education, and investments. This is beneficial, as your CPF OA has a higher interest of up to 3.5%!

So What Can I Use The Money In My PSEA Account For?

The use of your PSEA account is rather limited to your educational purposes.

Generally, you can use your funds to offset the cost of approved programs, similar to how you would use your Edusave.

Some examples you can use your PSEA account for include:

- Paying for loans and approved financing schemes

- Paying for school programs such as an overseas exchange, or an excursion trip with the school

- Establishing a standing order for recurring charges

- Approved ad-hoc withdrawals.

- School fees or other school-related courses.

How Do I Use It?

To withdraw money from your PSEA account, you have to first establish a Standing Order with MOE, or submit an ad-hoc withdrawal application.

The form to use will depend on the approved institution you are in. Please consult the approved institution you are studying in on which form to use.

Establish A Standing Order With MOE

This is a one-time application. All you have to do is download the PSEA Standing Order form and submit the completed application form to your institution.

Ad-Hoc Withdrawal Application

The ad hoc withdrawal application is an application for a one-time withdrawal for a specific purpose.

You will have to submit the ad hoc withdrawal application forms for each specific withdrawal.

For those who need it, here’s the Ad Hoc Withdrawal form for your convenience.

How Much Money Do I Have In My PSEA Account?

You can call the Edusave/PSEA hotline at 6260 0777 to check your balance! Your account balance will be refreshed and updated every Wednesday as well.

PSEA Account Hack: How To Maximise Your PSEA Account?

There’s nothing much to do with your PSEA account, other than the important fact that your unused PSEA savings will be transferred to your CPF Ordinary Account, giving you a higher interest rate of up to 3.5%, as compared to 2.5% from PSEA.

As a student, I have always felt compelled to spend everything in my PSEA account, since I had the misconception that money that isn’t spent from your PSEA account will be gone to waste.

As such, I emptied my PSEA Account on my school exchange trip to Berlin.

If you are looking to maximise your PSEA account, a way to do it is through maximising your Child Development Account (CDA) when you are much younger.

The Child Development Account is part of the government’s baby bonus scheme.

If you have a child, your child will receive an upfront grant of $3,000.

The government will match any savings made to your child’s CDA on a dollar-for-dollar basis. This money will then be rolled over to your child’s PSEA account when he or she turns 13.

Want to find out more about other CPF hacks to give your child a headstart? Here’s how to do so!

Advertisement