I’ve never been very familiar with the CPF scheme, yet time and again I’ve heard complains from Singaporeans about the Retirement Sum rising, and how hard it is to get your money out if you don’t meet the desired retirement sum.

What exactly is the CPF Retirement Sum? What does reaching BRS (Basic Retirement Sum) or FRS (Full Retirement Sum) mean?

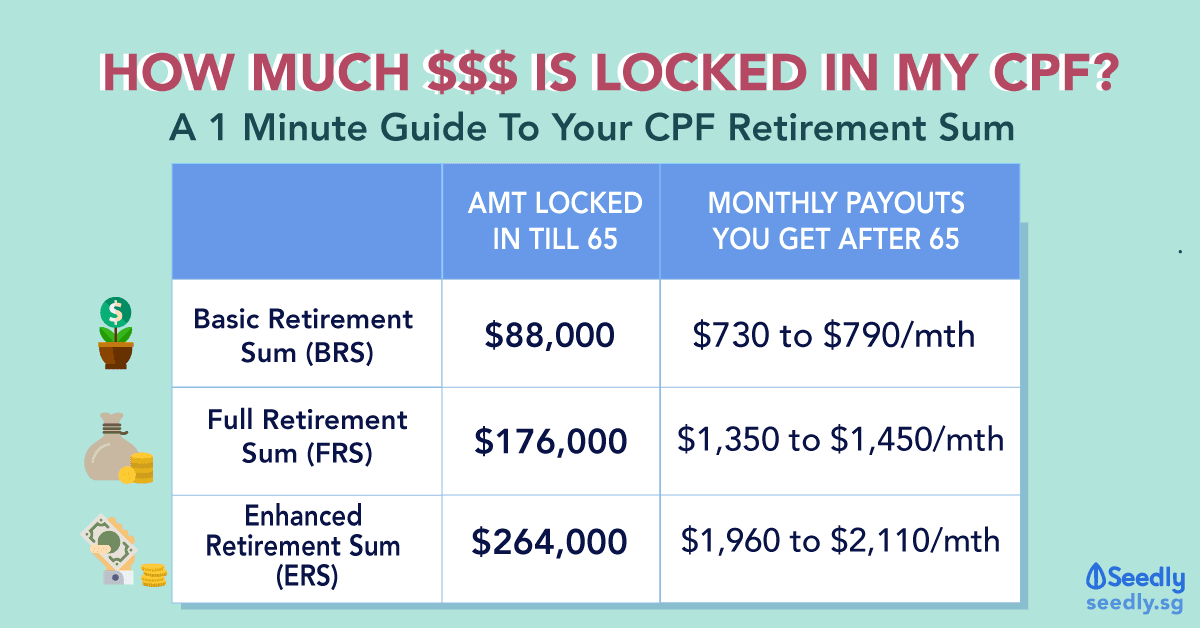

For the uninitiated, here is a quick, one-minute guide on everything you need to know about your CPF Retirement Sum!

TL;DR: Everything You Need To Know About Your CPF Retirement Sum

| Amount 'Locked In' Till Age 65 | Monthly Payouts You Will Get When You Turn 65 | |

|---|---|---|

| Basic Retirement Sum (BRS) | $88,000 | $730 to $790 |

| Full Retirement Sum (FRS) | $176,000 | $1,350 to $1,450 |

| Enhanced Retirement Sum (ERS) | $264,000 | $1,960 to $2,110 |

What Is The CPF Retirement Sum?

When you turn 55, savings from your Special Account, followed by your Ordinary Account, up to your Full Retirement Sum of $181,000, will be transferred to your Retirement Account to form your retirement sum, which will provide you with monthly payouts.

When you have your retirement account, you have to leave behind a Retirement Sum, that you can only use at the age of 65. At age 65, you will be receiving payouts from this account.

A Retirement Sum is basically the amount of retirement savings that is set aside for your retirement. You will get life-long monthly payouts from CPF to get you through your retirement.

The rest of the money not allocated to your Retirement Sum can be withdrawn and used from the age of 55.

In short, when you turn 55, you can withdraw:

- $5,000 or your Ordinary and Special Account savings above the Full Retirement Sum, whichever is higher

and - Any Retirement Account savings (excluding top-up monies, government grants, and interest earned) above the Basic Retirement Sum as long as you own a property.

How Much Is The CPF Retirement Sum?

Here’s the confusing part: The CPF Retirement Sum is not a single, fixed amount. In fact, there are three retirement sums: the Basic Retirement Sum, Full Retirement Sum, and Enhanced Retirement Sum.

The amount you receive in monthly payouts will depend on which of the three retirement sums you manage to meet.

For those turning 55 in 2019, your retirement sums are as follows:

| Amount 'Locked In' Till Age 65 | Monthly Payouts You Will Get When You Turn 65 | |

|---|---|---|

| Basic Retirement Sum (BRS) | $88,000 | $730 to $790 |

| Full Retirement Sum (FRS) | $176,000 | $1,350 to $1,450 |

| Enhanced Retirement Sum (ERS) | $264,000 | $1,960 to $2,110 |

Because the retirement sums are calculated with inflation and cost of living in mind, the retirement sum will increase year on year, and will not be fixed at the stated price.

How Much Can I Withdraw From CPF From Age 55?

Now, we mentioned earlier that you can withdraw the excess amount from your retirement sum from the age of 55. Here are some of the conditions you have to meet, to withdraw your excess money based on the BRS, FRS, and ERS:

| Basic Retirement Sum | Full Retirement Sum | Enhanced Retirement Sum | |

|---|---|---|---|

| Conditions: | If you want to withdraw your funds till the BRS, you will need to: - Own a property, - Place a charge or pledge on your property. **Usually only done by those who need really need the money. | Most people try to hit the FRS, before withdrawing any of the excess from age 55. | If you have funds that exceeds the Enhanced Retirement Sum: When you turn 55, you can choose how much you want to leave in your account for retirement. |

What If I Don’t Hit The Basic Retirement Sum? Then How?

This is a common concern amongst freelancers and self-employed persons. Here are some possible scenarios that may happen, and the actions you can take thereafter:

| Scenario | What You Can Do |

|---|---|

| If you have $5,000 or less in your RA | You can withdraw the entire amount. That also means you won't be getting any retirement payouts. |

| If you have more than $5,000 but less than BRS | You can withdraw $5,000. At age 65, you will be getting monthly payouts that are pro-rated based on what you have. |

| If you have less than FRS, but more than BRS | You can withdraw $5,000. If you own a property and have sufficient property charge, you can withdraw anything above the BRS. |

Common Questions On The CPF Retirement Sum

What If My CPF Retirement Account Runs Out Of Money? Will My Monthly Payouts Stop?

If you were born in 1958 and after, and have at least $60,000 in your Retirement Account six months before you reach the age where you can receive payouts (age 65 or later), you are automatically enrolled in CPF LIFE.

CPF Life gives guarantees lifetime payouts for your retirement. This means that even if you have drained out your retirement account, you will still be receiving payouts.

If you’d like to know more about CPF Life, check out this CPF For Beginners Guide that we’ve made.

How Can I Achieve FRS?

If you are looking to hit the Full Retirement Sum, you can check out Jacq’s article on how to achieve FRS. Do keep in mind that the retirement sum has a projected increase of ~3% year on year!

Still Unsure About Your CPF Retirement Sum?

The CPF scheme is complicated, and it isn’t something that’s easily understood overnight. If you have any questions related to the CPF Retirement Sum, don’t hesitate to ask our Seedly QnA Community!

Advertisement