Turning 55 Soon? Here's A CPF Special Account Shielding Hack You'd Want To Know!

You may not be turning 55 that soon, but it’s always good to start planning earlier so you’ll know what to do when the time comes.

Did you know, flat buyers had to wipe out their CPF Ordinary Accounts before August 2018? Many flat buyers will try to work around this by investing with their funds in their OA.

If you haven’t caught up yet, you now have the option to keep up to $20,000 in your Ordinary Account!

We digressed…

The CPF shielding hack that I’m about to share with you isn’t a really new concept since you’re somewhat doing the same thing, just that it’s for your Special Account!

TL;DR – The CPF Special Account Shielding Hack You Should Know About

What Happens When I Turn 55 Years Old?

You might already be very familiar with this by now but bear with me while I highlight an important point.

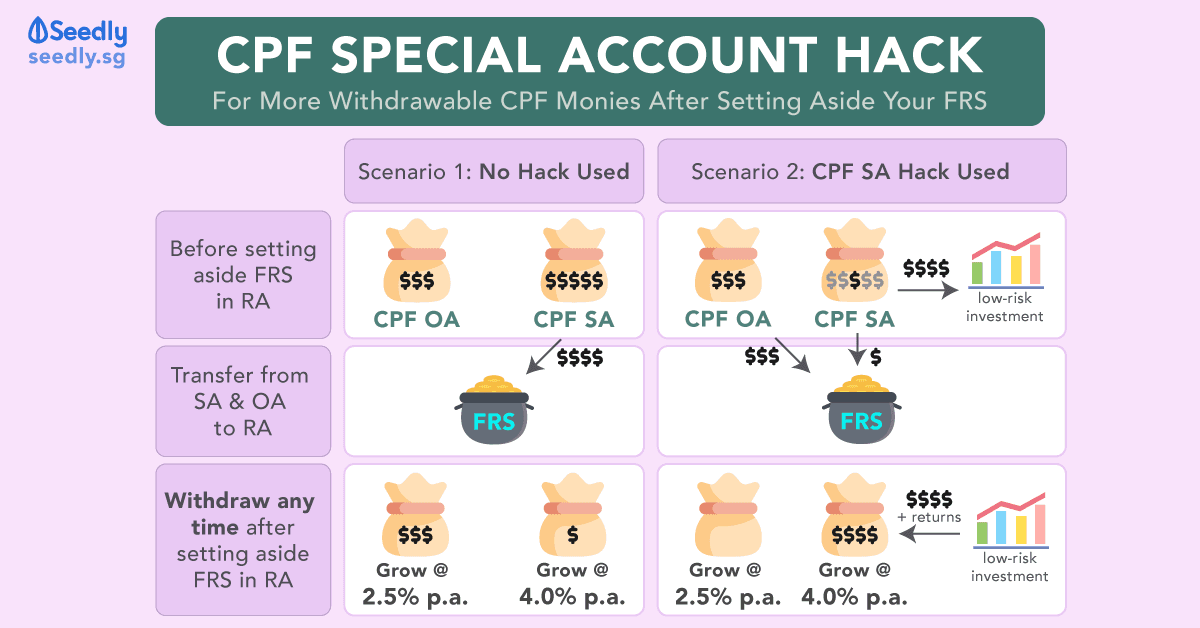

So, when you turn 55 years old, your Retirement Account (RA) will be created automatically to allow you to set aside your retirement funds, up to the prevailing Full Retirement Sum (FRS).

Now, we know that your CPF monies from your Ordinary Account (OA) and Special Account (SA) will be transferred to your RA. Don’t roll your eyes at me, please, I’m getting there!

But do they take 50% from each account?

Turns out, they don’t!

Your monies from your SA will be transferred to your RA first, before taking any from your OA.

Why Does It Matter Where My Full Retirement Sum Comes From?

You must be thinking that it’s all going to be your money in the end, so why does it matter how your FRS is formed, right?

It all boils down to the interest rates in each account!

| CPF Account | Interest Rate |

|---|---|

| Ordinary Account | Up to 3.5% per annum |

| MediSave Account | Up to 5% per annum |

| Special Account | |

| Retirement Account |

Now, even if you aren’t super well-versed with the power of compounding, you will probably be thinking that the money will grow at the same rate regardless of the transfer from SA to RA.

Will it be better to have more OA funds going into your FRS in your SA?

Looking at the difference of 1.5% in interest rate, pretty much yes!

If you’re planning this far ahead, you’re likely to have quite a substantial amount left in your OA and SA after setting aside your FRS, or even the Enhanced Retirement Sum.

Also, most of us are still going to work after turning 55 years old, so you’ll probably continue contributing to your accounts.

Even if you aren’t working, the monies will continue to accumulate interest.

By allocating more of your OA funds to your FRS, the remaining funds can grow faster since the majority of them are parked in your SA with a 4% interest rate.

Therefore, when you choose to withdraw the remaining CPF savings, which is any time after you turn 55 years old, you’ll have a bigger pool of money.

CPF Shielding Hack: How Can I Transfer More Funds From Ordinary Account To My Full Retirement Sum?

Here comes the fun part!

What is this CPF shielding hack, and how can I do so?

All you need to do to ensure that more funds from your OA end up in your FRS is to invest using your SA funds!

Easy, right? Chotto matte!

What Should I Invest In?

| Investment Products | Can you investing using your CPF savings from | Remarks | |

|---|---|---|---|

| CPFIS-OA | CPFIS-SA | ||

| Unit Trusts (UTs) | Yes | Some | UTs with higher risk not included in CPFIS-SA |

| Investment-linked insurance products (ILPs) | Yes | Some | (ILPs with higher risk not included in CPFIS-SA) |

| Annuities | Yes | Yes | - |

| Endowment Policies | Yes | Yes | - |

| Singapore Government Bonds (SGBs) | Yes | Yes | - |

| Treasure Bills (T-bills) | Yes | Yes | - |

| Exchanged-Traded Funds (ETFs) | Yes | No | - |

| Fund Management Accounts | Yes | No | - |

| Fixed Deposits (FDs) | No products at the moment | - | |

| Statutory Board Bonds | No products at the moment | - | |

| Bonds Guaranteed by Singapore Government | No products at the moment | - | |

| Shares | Up to 35% of investible savings | No | Share must be offered by a company incorporated in Singapore, denominated in Singapore dollar and must be listed on the Singapore Exchange (SGX) Main Board. |

| Property Fund | Up to 35% of their investible savings | No | Fund must be incorporated in Singapore, denominated in Singapore dollar and must be listed on the Singapore Exchange (SGX). |

| Corporate Bonds | Up to 35% of their investible savings | No | Bonds must be offered by a company incorporated in Singapore, denominated in Singapore dollar and must be listed on the Singapore Exchange (SGX) Main board. |

| Gold ETFs | Up to 10% of their investible savings | No | Only SPDR Gold Shares |

| Other Gold products (Gold certificates, Gold savings accounts, Physical Gold) | Up to 10% of their investible savings | No | Please approach UOB for the list of gold products offered. |

The range of investment products for SA funds is definitely limited as compared to those for OA funds.

But you’ll want to make sure that you choose low-risk investments for your SA funds.

I know, it’s a little counter-intuitive since the general advice is to beat SA’s interest rates.

But with this Special Account hack, you won’t want to expose your funds to investments with higher risks since it might eat into your capital.

After all, you will be returning the funds back into your SA for the beautiful 4% – 5% interest rate after your FRS has been set aside, so think of your SA investment as a temporary account.

Another important thing to note is that you should be looking at short-term investments for this hack.

So no endowment policies, since they usually have a longer time frame.

Since you only need the funds to be stored elsewhere temporarily while your FRS is being set aside, you’ll want it back in SA as soon as possible, again for the wonderful risk-free interest rate!

When Should I Do It?

Again, this sounds like I’m contradicting general investment advice but for this CPF SA hack to work, you have to time when you invest.

And only you’ll know when you should do it since it’s dependent on your birthday…

Since some of the short-term investments can be as short as 6 months, if you invest too early (i.e. right after turning 54), the money will go back into your SA before your FRS is set aside.

That just defeats the purpose of the entire hack!

Even though this hack uses a short-term investment, you should still do your due diligence to find out which is more suitable for you!

Do you have any other secret CPF hacks? Let us know in the comments below!

Advertisement