I still remember when I received my first paycheck from my first full-time job.

I felt a sense of achievement as I took the first step toward being a responsible adult.

But, I was shocked to discover that a substantial portion of my pay (37 per cent to be exact) was going toward my Central Provident Fund (CPF) accounts.

That’s not all.

I learnt that I had to pay income tax on my salary.

At that time, I was feeling a bit hard done as I felt I could not use all of my hard-earned money in the way I like.

It was only later when I became more financially literate that I began to understand the role CPF plays in my finances. I also discovered that you could pay less income tax when you top up your CPF with cash.

More specifically, from 1 January 2022, CPF members will enjoy tax relief on cash top-ups of:

- Up to $8,000 (previously $7,000) when you top up to your Special/Retirement Account (SA/RA) and/or CPF MediSave Account (MA)*; and

- An additional tax relief of up to $8,000 (previously $7,000) when you top up your loved ones’ SA/RA and/or MA.

This cap is shared between the Retirement Sum Topping-up (RSTU) scheme and voluntary contributions to MA for employees.

FYI: The annual Income Tax relief ceiling is capped at $80,000 per year of assessment.

Here’s what you need to carefully consider…

*The changes related to cash top-ups to MediSave Account do not apply to MediSave contributions made in the capacity of a self-employed person (SEP).

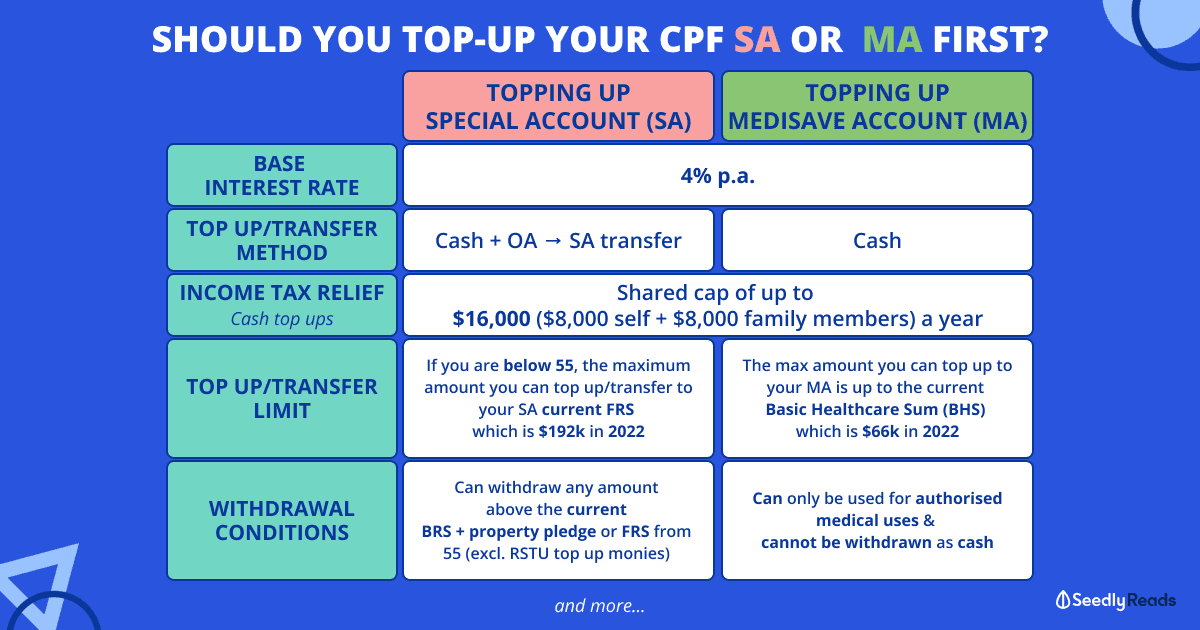

TL;DR: Is It Better To Top up Ma or SA? Should I Top up Ma or SA First?

Here is a broad overview of what topping up either account would involve:

| Topping up Special Account (SA) | Topping up MediSave Account (MA) | |

|---|---|---|

| Top up | SA for members below 55 [Retirement Sum Topping Up Scheme (RSTU)] | MA |

| Base Interest Rate (p.a.) | 4% p.a. | |

| Eligible for tax relief | Cash top-ups made to self or loved ones up to the current Full Retirement Sum (FRS) are eligible for tax relief. | For non self-employed persons: For voluntary top-up to MA up to the Basic Healthcare (BHS), you get to enjoy tax relief You will also enjoy tax relief if you are topping up your CPF accounts voluntarily as a self-employed person |

| Income Tax Relief | Shared cap of up to $16,000 ($8,000 self + $8,000 family members) a year | |

| Limit to Top up | If you are below 55, the maximum amount you can top up to your SA is the current FRS ($192,000 in 2022) | The max amount you can top up to your MA is up to the current BHS ($66,000 in 2022) |

| Withdrawal Conditons | You can withdraw any amount above the prevailing retirement sums from 55 (excluding RSTU top up monies) | Can only be used for authorised medical uses & cannot be withdrawn as cash |

| Application | Top-ups can be made using cash and/or CPF transfer | Top ups can only be made via cash |

But do note that top-ups to your MA or SA are irreversible. You can only use your MA for eligible medical expenses. Whereas for the SA, you can only touch the money when you turn 55.

Click to Teleport

- What is MediSave Account (MA)

- How Much of My CPF Savings Are Allocated to MediSave?

- What’s The Maximum Amount I Can Have In My MediSave Account? Basic Healthcare Sum 2022

- What Happens to My Medisave Savings When It Reaches the Basic Healthcare Sum?

- What Can I Use MediSave For?

- Where Can I Use MediSave?

- CPF MA Voluntary Top Up Limit

- What is the CPF Special Account (SA)

- Why You Should Top Up Your MA First VS Why You Should NOT Top Up Your MA First

- Why You Should Top Up Your SA First VS Why You Should NOT Top Up Your SA First

To understand which account to top up, you need to first understand the MA and SA.

What is MediSave Account (MA)

To help you understand the MA better, I would be reproducing parts of our Ultimate Guide to MediSave: What Can I Use It for & How Much Can I Withdraw?

Our CPF savings help to ensure that Singaporeans save up for three important things in life – retirement, housing, and healthcare.

We have different CPF accounts to cater to these different needs, one of which is our MA where the funds in the account are set aside for future medical expenses.

As such, MediSave can be used to pay for expenses such as premium payments, inpatient care, outpatient care, and long-term care.

Also, MediSave funds in your MA will earn interest of up to 6% per annum.

For context, here is the base interest rate of CPF accounts and the bonus interest you can earn:

How Much of My CPF Savings Are Allocated to MediSave?

Your CPF contributions are distributed to your Ordinary Account (OA), Special Account (SA), and MediSave Account (MA) according to the CPF allocation rates.

For employees, these are the current contribution and allocation rates across different age groups.

| Contribution Rate for Monthly Wages ≥$750 (From 1 Jan 22) | Allocation Rates (% of Total Wages) | |||||

|---|---|---|---|---|---|---|

| Age (Years) | Employer's Contribution | Employee's Contribution | Total | OA | SA | MA |

| ≤35 | 17 | 20 | 37 | 23 | 6 | 8 |

| >35 - 45 | 21 | 7 | 9 | |||

| >45 - 50 | 19 | 8 | 10 | |||

| >50 - 55 | 15 | 11.5 | 10.5 | |||

| >55 - 60 | 14 | 14 | 28 | 12 | 5.5 | 10.5 |

| >60 - 65 | 10 | 8.5 | 18.5 | 3.5 | 4.5 | 10.5 |

| >65 - 70 | 8 | 6 | 14 | 1 | 2.5 | 10.5 |

| >70 | 7.5 | 5 | 12.5 | 1 | 1 | 10.5 |

As we grow older, the proportion drawn from our salary and contributed towards our CPF accounts will decrease.

However, the allocation rates to your MA will increase.

This is to meet our healthcare needs as we get older.

What’s The Maximum Amount I Can Have In My MediSave Account? Basic Healthcare Sum 2022

The Basic Healthcare Sum (BHS) is the estimated amount of savings that an individual needs for basic healthcare needs at retirement age.

The BHS has adjusted annually, and this amount will be fixed for individuals once he/she reaches 65 years old.

The prevailing BHS for CPF aged below 65 years old is currently $66,000 in 2022.

Here’s the BHS for individuals who have turned 65 in recent years:

| Turned age 65 in | Basic Healthcare Sum (Fixed for life) |

|---|---|

| 2022 | $66,000 |

| 2021 | $63,000 |

| 2020 | $60,000 |

| 2019 | $57,200 |

| 2018 | $54,500 |

| 2017 | $52,000 |

| 2016 or earlier | $49,800 |

What Happens to My Medisave Savings When It Reaches the Basic Healthcare Sum?

The BHS is the maximum amount that one can have in his/her MediSave account.

Any MediSave account savings above the BHS will be transferred to one’s Special Account (SA) or Retirement Account (RA) to supplement his/her retirement savings.

For CPF members who have met the Full Retirement Sum (FRS) of $192,000 in 2022, any excess savings will be transferred to the Ordinary Account (OA).

For context, here are the various CPF retirement sums for members who turn 55 from 2017 to 2027:

| 55th birthday in the year of | Basic Retirement Sum (BRS) | Full Retirement Sum (FRS) 2 x BRS | Enhanced Retirement Sum (ERS) 3 x BRS |

|---|---|---|---|

| 2017 | $83,000 | $166,000 | $249,000 |

| 2018 | $85,500 | $171,000 | $256,500 |

| 2019 | $88,000 | $176,000 | $264,000 |

| 2020 | $90,500 | $181,000 | $271,500 |

| 2021 | $93,000 | $186,000 | $279,000 |

| 2022 | $96,000 | $192,000 | $288,000 |

| 2023 | $99,400 | $198,800 | $298,200 |

| 2024 | $102,900 | $205,800 | $308,700 |

| 2025 | $106,500 | $213,000 | $319,500 |

| 2026 | $110,200 | $220,400 | $330,600 |

| 2027 | $114,100 | $228,200 | $342,300 |

Source: CPF

What Can I Use MediSave For?

Our MediSave funds can be used for medical care and hospitalisation expenses.

Here are some ways one can use his/her MediSave for:

- Premium Payments:

- MediSave can be used to pay for approved health insurance premiums including MediShield Life, Integrated Shield Plans, Eldershield, or Careshield Life.

- Premiums for MediShield Life, Eldershield or Careshield Life can be fully paid by Medisave.

- For supplement plans such as Integrated Shield Plans and Careshield Life Supplements, MediSave can be partially used to pay for premiums as well, up to Additional Withdrawal Limits.

- Health Screening Tests, Vaccinations and Medical Scans:

- MediSave can also be used for preventive treatments including vaccinations, health screening, and CT/MRI scans.

- Under the MediSave500/700 scheme, individuals can use up to $500 (for non-complex chronic patients) or $700 (for patients with complex chronic conditions) to pay for approved vaccinations and health screening.

- Outpatient Treatments:

- MediSave can also be used to pay for chronic disease treatments, for 20 approved chronic conditions under the Chronic Disease Management Programme (CDMP).

- A cash co-payment of 15% would apply for these treatments.

- Similarly, Under the MediSave500/700 scheme, individuals can use up to $500 (for non-complex chronic patients) or $700 (for patients with complex chronic conditions) to pay for these treatments.

- Inpatient Care:

- There are various hospitalisation and day surgery expenses that can be paid with MediSave.

- Long-term Care:

- MediSave can also be used to help with long-term care costs, including rehabilitation, palliative care, and disability care.

Where Can I Use MediSave?

You can use your MediSave at all public healthcare institutions and approved private hospitals and medical institutions.

There is a list of MediSave-approved clinics under the MediSave 500/700 scheme as well, and the list is available on the Community Health Assist Scheme (CHAS) website.

CPF MA Voluntary Top Up Limit

The maximum amount you can voluntarily top up to your MediSave Account is the difference between your Basic Healthcare Sum (BHS) and your current MediSave balance.

Once your BHS has been reached, no further voluntary top-ups can be made to your MediSave Account. If you exceed your BHS from the top-up, the full amount of your top-up will be refunded to you.

Also, if you turn 65 in 2022, the BHS that applies to you will be $66,000 for the rest of your life

Here’s an example

Sarah currently has $50,000 in her MA.

The BHS in 2022 is $66,000.

With this new rule, she will instantly know that she can contribute up to $16,000 ($66,000 – $50,000), which is the difference between her current MediSave balance and the current BHS.

However, Sarah can only enjoy income tax relief of up to $8,000 a year if she makes a cash top-up to her MA. As this annual cash top-up income tax relief cap is shared between top-ups to her MA and SA, she will not be any to enjoy any further income tax relief from topping up her SA that year.

What is the CPF Special Account (SA)

To put it simply, your CPF SA is purpose-built to fund your retirement in your golden years.

The CPF SA has a base interest rate of 4% and a bonus interest rate of up to 6% p.a. depending on your age:

If you think that you can do better than what CPF offers, you can invest your CPF SA funds under the CPF Investment Scheme (CPFIS).

But, you can only invest your SA savings into various CPF-approved instruments after setting aside $40,000 in your SA.

When you turn 55, a new CPF account, i.e. the RA is created for you.

The CPF RA is then filled up by withdrawing your SA and OA Account monies (SA monies will be deducted first followed by the OA cash balance if the SA cash balance is insufficient) to build the prevailing FRS ($192,000 in 2022).

An important point to note is that the SA does not have an account limit.

But, you can only make a cash top up to your SA account via the Retirement Sum Topping-Up Scheme (RSTU) and make transfers from your OA to your SA up to the prevailing FRS.

This amount is also net of any SA balance withdrawals made to invest through the CPF Investment Scheme (CPFIS):

Just remember that transferring money from the OA to SA earns you a higher interest rate but that any transfers you make into your SA are irreversible.

There are also tax relief benefits.

From 1 Jan 2022, you will enjoy annual tax relief of:

- Up to $8,000 (previously $7,000) for cash top-ups to your own SA/RA and/or MA*

- And up to $8,000 (previously, $7,000) for cash top-ups to your loved ones’ SA/RA and/or MA*.

This cap is shared between the Retirement Sum Topping-up (RSTU) scheme and voluntary contributions to employees’ MediSave Account (MA).

A few things to take note of:

- Only cash top-ups to the SA/RA within the prevailing FRS ($192,000 in 2022) are eligible for tax relief

- The amount of tax relief you get from RSTU top-ups is limited by the $80,000 annual personal income tax relief cap.

With that in mind, let’s go into which account you should top up first.

But first, you need to remember that both the SA and MA have a base interest rate of 4% p.a., and topping up either account would let you enjoy tax relief.

Why You Should Top Up Your MA First

If you are below the age of 55, topping up your MA might prove more useful as you can use your MA funds for your healthcare needs. In contrast, you can only access your SA funds when you turn 55.

In addition, when you top up your MA to the current BHS ($66,000 in 2022), any CPF contributions, mandatory or voluntary, will flow into your SA, OA or RA as follows:

Thus, the CPF contributions that flow into the SA are not part of the RSTU and hence the restrictions pertaining to RSTU funds do not apply.

Why You Should NOT Top Up Your MA First

So the main downside of topping up your MA first is that the funds that are only for your healthcare needs.

There is no way to withdraw your MA funds unless you fall sick (touch wood).

You could end up in a situation where you could have a substantial amount in your MA which cannot be used except for paying for things like MediShield Life, CareShield Life and ElderShield Life premiums.

Blessing in disguise I would say, after all, health is wealth.

Another thing to consider is that the BHS is increasing by about $3,000 every year:

| Age in 2022 | Year when cohort turned age 65 | Cohort BHS (fixed for life) |

|---|---|---|

| 65 | 2022 | $66,000 |

| 66 | 2021 | $63,000 |

| 67 | 2020 | $60,000 |

| 68 | 2019 | $57,200 |

| 69 | 2018 | $54,500 |

| 70 | 2017 | $52,000 |

| 71 and above | 2016 or earlier | $49,800 |

Source: CPF

This means that you will have to keep topping up your MA to enjoy the benefits of SA/RA or OA top-ups free of RSTU restrictions.

Why You Should Top Up Your SA First

As mentioned above, topping up your SA will help you build your retirement fund, which compounds at a safe base interest of 4% p.a.

This can really add up and let you receive bigger CPF LIFE payouts when you retire.

In addition, you will be granted the freedom to withdraw any amount above the current BRS with a property pledge or FRS set aside in your RA when you turn 55.

But do note that you cannot withdraw any cash top-ups made via the RSTU.

This would mean that your SA becomes something like a high-interest rate savings account.

Why You Should NOT Top Up Your SA First

There are also some cons of topping up your SA via the RSTU to consider.

These RSTU monies are set aside for your retirement needs and can only be used for monthly payouts under the Retirement Sum Scheme or CPF LIFE.

Any amount topped up to your SA/RA is irreversible and cannot be withdrawn till you hit the retirement age. You get a more generous base interest of 4% p.a. because your money is put aside for the long term.

For this reason, CPF does not allow you to withdraw RSTU Monies except for your retirement:

Also, CPF states that your SA funds cannot be used for:

- Other CPF schemes for education, investment, insurance, housing, CPF transfers etc;

- Withdrawals from RA (including property owners); and

- Via exemption from setting aside a retirement sum in the RA.

Read More

Advertisement