I know what you’re thinking…

Why would you want to top up your Central Provident Fund (CPF) when there are other financial products out there with better returns and/or better liquidity?

Also, there’re restrictions like the fact that you can only withdraw (some of) your CPF after you turn 55 years old!

But before you judge, let’s have a look at why it might be a good idea and why it might not be a suitable course of action for all.

Disclaimer: this is not a sponsored article. The opinions expressed here are based on our understanding of existing CPF policies. Please do your diligence and check with CPF to clarify your questions before doing anything! Alternatively, you can check ask the friendly community over at Seedly if you have any questions!

Ask Your CPF-Related Questions Now!

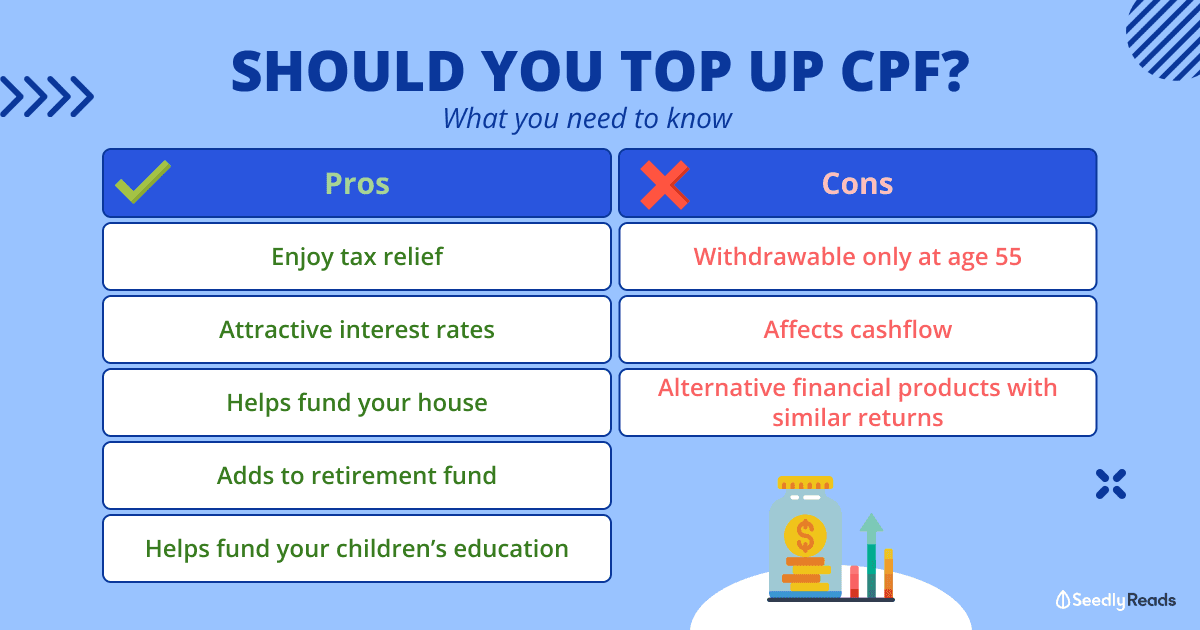

TL;DR – Should You Top Up Your CPF Savings?

There are 4 ways you can top up your CPF savings:

- Voluntary cash contribution to all three accounts (Ordinary, MediSave, and Special Accounts)

- Voluntary cash contribution to MediSave Account only

- CPF Transfers from Ordinary Account to Special or Retirement Account via RSTU

- Cash top-up to Special or Retirement Account via RSTU

Apart from the obvious fact that you’ll have more funds in your CPF accounts, here’s a summary of the benefits of topping up your CPF:

- Enjoy tax relief with your voluntary contribution to MediSave Account and cash top-up to Special or Retirement Accounts

- CPF savings grow faster with higher interest rates

- Ease your load with your housing loan, especially during periods of financial difficulties

- Complement your retirement portfolio and receive monthly payouts

- Take care of your children’s education (temporarily) before they go out into the workforce

However, there are some considerations you need to take note of before you decide to make voluntary cash contributions or transfers.

Here are the drawbacks of topping up your CPF:

- Your money is locked in and you can only withdraw your CPF savings at age 55

- Cash is king! Plan your voluntary contributions properly, else it will affect your cash flow

- If you’ve done your research, there are other financial products that can give you similar returns and faster too

Basically, there’s no fixed rule here so it really depends on your financial situation. If you plan it right, your CPF could be a viable component of your retirement portfolio.

What Are The Ways To Top Up CPF?

There are actually some good reasons why topping up your CPF savings may be beneficial for you!

But before we talk about that, let’s look at the different ways you can do so.

Voluntary Contributions (VC)

Even though you are already working and contributing monthly to all three CPF Accounts, you can still do cash top-ups if you wish to boost your CPF savings.

Cash Top-Up to Ordinary, MediSave & Special Accounts

That’s right, if you want to increase the savings in your Ordinary Account (OA), you will have to contribute to your MediSave (MA) and Special Accounts (SA) as well.

The amount contributed to each Account will be based on the CPF Allocation Rates for your age range.

For example, if you’re 35 years and below and you decided to top-up $100 to all three accounts, the amount in each account would be as follows:

- Ordinary Account (62.17%): $62.17

- MediSave Account (21.62%): $21.62

- Special Account (16.21%): $16.21

The yearly amount you can top-up is capped by the CPF Annual Limit, which is currently at $37,740.

Cash Top-Up to MediSave Account only

With a longer life expectancy, our medical expenses will probably continue to increase, and topping-up to MediSave can help to ease your future load.

Apart from the CPF Annual Limit, the amount that you can contribute yearly to your MA is capped by the Member’s Basic Healthcare Sum (BHS), whichever is lower.

The current Basic Healthcare Sum (BHS) is currently at $60,000 and is expected to adjust periodically for members below age 65.

Apart from taking care of your future healthcare expenses, you can also enjoy tax relief when you contribute voluntarily to your MediSave Account.

However, this is where it becomes a little bit complicated, the amount of tax relief you can enjoy depends on which is the lowest among the following:

- The amount you contributed to your MediSave Account

- Current Annual CPF Annual Limit minus Your Mandatory Contribution

- Current Basic Healthcare Sum minus Balance in Your Medisave Account before VC

In the event that the amount in your MediSave Account hits the Basic Healthcare Sum, subsequent mandatory contributions (if any) and interest earned will go to your Special Account.

If your Special Account reaches the Full Retirement Sum, subsequent mandatory contributions (if any) and interest earned will go to your Ordinary Account.

Retirement Sum Topping-Up Scheme (RSTU)

Source: areyouready.gov.sg

CPF Transfers

Before you get too excited, CPF transfers only apply when you have enough savings in your Ordinary and Special Accounts to meet the Basic Retirement Sum (BRS), currently at $88,000.

Similarly, the Basic Retirement Sum will be adjusted accordingly to meet the rising costs of living.

The good thing is, CPF is rather flexible about who you can transfer your CPF monies to – just not to your children. There are different criteria and amount transferrable for different recipients to safeguard your own retirement.

| Recipient(s) | Age | Amount Transferrable |

|---|---|---|

| Spouse | Below 55 years old | OA savings after setting aside the current Basic Retirement Sum |

| 55 years old & above | CPF savings after setting aside your Basic Retirement Sum | |

| Parents & Grandparents | Below 55 years old | OA savings after setting aside the current Basic Retirement Sum - If you can meet the current Full Retirement Sum with OA & SA savings, nett amount withdrawn for investments and property OA savings after setting aside the current Full Retirement Sum - If you do not have a property |

| 55 years old & above | CPF savings after setting aside your Basic Retirement Sum - If you can meet the current Full Retirement Sum with OA & SA savings, nett amount withdrawn for investments and property CPF savings after setting aside your Full Retirement Sum - If you do not have a property |

|

| Siblings, Parents-in-law & Grandparents-in-law | Below 55 years old | OA savings after setting aside the current Full Retirement Sum |

| 55 years old & above | OA savings after setting aside your Full Retirement Sum |

Cash Top-Up

Similarly to Voluntary Contributions, you can also do cash top-up under the RSTU. And this is subjected to limits as well.

Unlike RSTU CPF Transfers, you are able to top-up your children’s Special Account in cash even if they have not started working.

| Age | Account | Top-Up Limit | Retirement Sums 2024 |

|---|---|---|---|

| Below 55 years old | Special Account | Up to current Full Retirement Sum - Including nett SA savings under CPF Investment Scheme | Full Retirement Sum is currently $205,800 |

| 55 years old and above | Retirement Account | Up to current Enhanced Retirement Sum | Enhanced Retirement Sum is currently $308,700 |

Likewise, you can also enjoy tax relief when making cash top-ups for yourself and your loved ones.

As with all tax relief, there are some criteria and limits to your tax relief for making cash top-up under the RSTU scheme, depending on the age group and recipients.

| Recipient | Age | Eligibility | Amount of Tax Relief | Conditions |

|---|---|---|---|---|

| Yourself | Below 55 years old | Current Full Retirement Sum - Including SA savings & nett SA savings under CPF Investment Scheme | Equivalent to amount of top-up made | Capped at $7,000 per calendar year |

| 55 years old and above | Current Full Retirement Sum minus RA savings | |||

| Spouse, Parents, Grandparents, Siblings, Parents-in-law, Grandparents-in-law | Below 55 years old | Current Full Retirement Sum - Including SA savings & nett SA savings under CPF Investment Scheme | Equivalent to amount of top-up made | Capped at $7,000 per calendar year Topping-up for spouse/siblings if: - their annual income does not exceed $4,000 OR - they are handicapped |

| 55 years old and above | Current Full Retirement Sum minus RA savings |

How To Top Up CPF Money?

Now depending on what you want to do with the top-up money, either voluntary contribution or RTSU, you can either add funds via CPF Transfer or Cash Top-up.

For CPF Transfers, you will be required to go through the my cpf portal

For cash top-up, there are multiple ways to do it like through PayNow QR codes, AXS Machines, GIRO, E-cashier, and more.

Benefits of Topping Up CPF

Lower Your Payable Income Tax

As you’ve seen from above, you can enjoy tax relief by making cash top-ups to your CPF accounts.

It’s a win-win situation: you save for your retirement AND pay lesser income tax!

But just remember, the personal income tax relief cap of $80,000 applies to all cash top-ups made as well, so plan well to optimise it!

Attractive Interest Rates

You probably already know by now that it is not a wise move to put all your money in the bank since the interest rates are relatively low.

But at the same time, if you were to invest… with higher interest rates comes more risk.

Making voluntary contributions to your CPF accounts can help to grow your savings over time as they offer rather attractive interest rates, minus the risk (somewhat)!

| CPF Account | Interest Rate |

|---|---|

| Ordinary Account | Up to 3.5% per annum |

| MediSave Account | Up to 5% per annum |

| Special Account | |

| Retirement Account |

Read here for our step-by-step guide on how to top up your CPF SA for improved interest rates and income tax relief

Fund Your Housing (Especially If You Are Self-Employed!)

While Singaporeans are extremely lucky to have subsidised housing, it’s still a hefty sum to deal with when the cost of living continues to rise!

This is a classic “save your money for a rainy day” example.

If you’re currently employed, you’re already making mandatory contributions to your Ordinary Account, which you can use to pay your HDB housing loan.

If you’re self-employed, you are only required to contribute to your MediSave Account. However, you can choose to make contributions to your Ordinary Account as well in order to enjoy more interest on your savings and use them to pay off your HDB housing loan – if you choose to, of course.

More savings in your Ordinary Account can also tide you through potential periods of unemployment or financial difficulties which should help defray the cost of your housing loan. (Choy, touchwood!)

Complement Retirement Portfolio (For Yourself And Your Loved Ones)

It’s never too early to plan and set aside funds for your retirement!

With the prevailing interest rates of your SA and RA, along with the magic of compound interest, a small amount of money can eventually grow into a substantial amount.

Also, by having sufficient savings in your RA six months before you reach your payout eligibility age (PEA), you will automatically be placed on CPF LIFE.

You can also choose the plan and when you want to start receiving your monthly payouts:

| Retirement Account Savings at 55 | Standard Plan | Escalating Plan | Basic Plan |

|---|---|---|---|

| Basic Retirement Sum $88,00 | $730 - $790 | $570 - $620 (initial amount) Payouts increase by 2% every year | $690 - $720 |

| Full Retirement Sum $176,000 | $1,350 - $1,450 | $1,040 - $1,140 (initial amount) Payouts increase by 2% every year | $1,280 - $1,320 |

| Enhanced Retirement Sum $264,000 | $1,960 - $2,110 | $1,510 - $1,660 (initial amount) Payouts increase by 2% every year | $1,860 - $1,920 |

I’m sure you can see why some might choose to top up their CPF savings as it’ll help eventually grow and increase the amount you will receive when you retire.

Although there are many other products out there to help in your retirement planning, this should at least form a complementary base to build your ideal retirement lifestyle.

Similarly, when you contribute now to help grow your parents’ CPF savings to meet the Full or Enhanced Retirement Sum in the future, you’re ensuring that they have a steady source of income in their golden years.

This should ideally offload some of the financial responsibility that you would have to bear if you’re the sole breadwinner of the family.

Fund Your Children’s Education

If you can eliminate a big financial worry in life, why wouldn’t you?

Under the CPF Education Scheme, if you have sufficient savings in your Ordinary Account, you are able to apply for an education loan with your Ordinary Account savings to pay for your child’s diploma or degree programme.

But of course, with all loans come repayment.

A year upon graduation, your child can either make a lump sum cash payment or work out a monthly instalment plan.

Disadvantages of Topping Up CPF

Is There A Reason Why I Shouldn’t Do A Top Up To CPF?

Ultimately, your money is a finite resource, just as there are upsides, there are downsides as well.

While CPF is arguably a safe way to grow your funds, there are some downsides to making voluntary contributions and top-ups as well.

Withdrawal Age And Amount

That’s right, you can only start withdrawing your CPF monies when you are 55 years old.

But wait, it’s NOT ALL OF IT.

You are only able to withdraw $5,000 or your remaining Ordinary and Special Accounts savings after setting aside your Full Retirement Sum, whichever is higher.

Note: the only time you can withdraw all of your Ordinary and Special Account savings is when you have less than $5,000 in both accounts. Which is not a very pleasant scenario, right?

| Balance in OA & SA at 55 | Amount which you can withdraw at 55 |

|---|---|

| $5,000 or less | All your Ordinary and Special Account savings |

| Between $5,000 and your Full Retirement Sum | $5,000 |

| More than your Retirement Sum | $5,000 or Ordinary and Special Account savings after setting aside your Full Retirement Sum *whichever is higher |

The FRS will be slowly dispensed to you via whichever CPF LIFE scheme you choose. So that means that the money you have locked in your CPF is purely for your retirement.

This brings me to my next point.

Your Cash Flow Is Affected

Ladies and gentlemen, in case you aren’t aware, voluntary contributions and top-ups are irreversible. Meaning there is no turning back once you’ve done it. Even if you need the money suddenly.

So like the saying goes, don’t put all your eggs in the same basket!

It’s extremely important to first set aside an emergency fund (most agree that you need enough to cover at least 3 to 6 months of your monthly expenses) just in case of any unexpected situations where you might need a large sum of money to tide you over.

Any extra cash that you have can then considered to be put into buffing up your CPF accounts.

(Potentially) Better Financial Products In The Market

Yes, I know, there are obviously other financial products out there that can potentially beat the returns guaranteed by CPF.

But such products are risky and the returns may not always be guaranteed.

Read also: The Ultimate Guide To Investing In Singapore

Personally, I don’t have a huge appetite for risk so I would be extremely careful if I choose to bank on other products to grow my retirement fund instead of my CPF.

However, if you do your research, talk to your advisors, understand your risk appetite as well as the products you choose to invest in, then you’re always free to consider other options to build your retirement nest egg!

Closing Thoughts

I might seem a little naggy, but remember: As great as CPF potentially can be, it shouldn’t be the only aspect in your retirement portfolio!

Also, everyone’s financial situation and circumstances are different, so only you will know if making voluntary top-ups and contributions to your CPF is best for you.

If you’d like suggestions or more perspectives on the matter, why not ask our friendly community over at Seedly if you have any questions!?

If you’re really shy, you can also ask anonymously!

Advertisement