Credit Cards With Complimentary Travel Insurance And Why It May Not Be Enough!

Did you just say complimentary?

It’s no secret that Singaporeans love free things as evident from snaking queues whenever there are giveaways.

Some of us flock to complimentary travel insurance that comes with our credit cards like bees to honey when going on vacation. After all, why pay for insurance when you can get it FOC (free of charge)?

But what are the best credit cards for complimentary travel insurance? And are those complimentary travel insurances really enough for your travel needs?

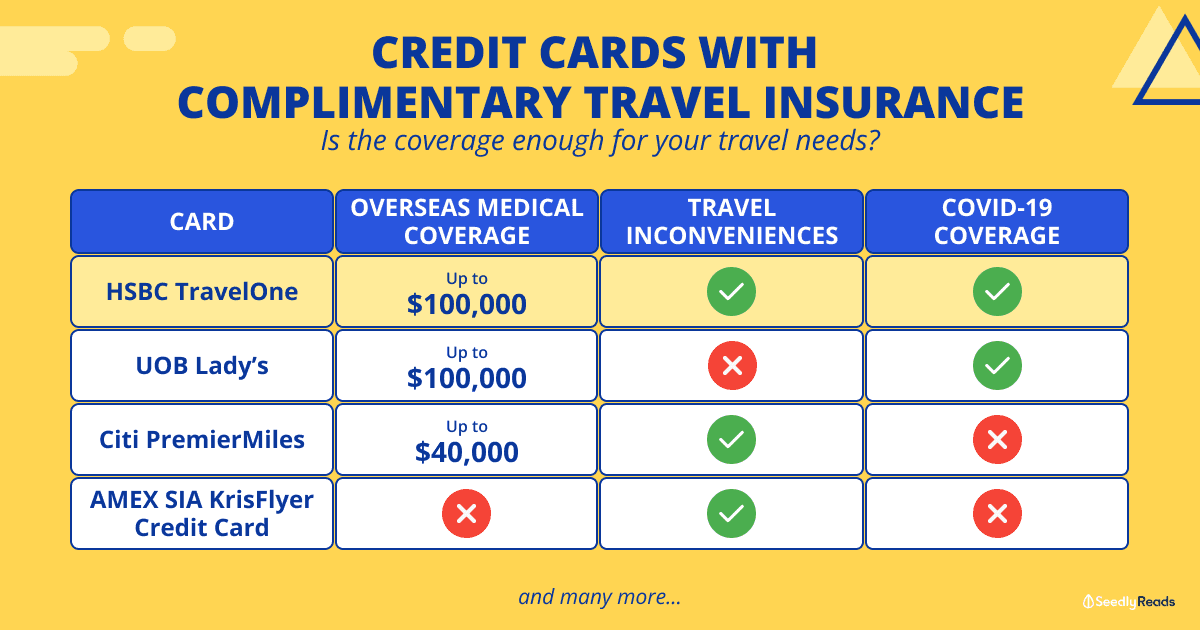

TLDR: Best Credit Cards With Complimentary Travel Insurance

- The best credit card with the best overall complimentary travel insurance coverage is the HSBC TravelOne Card.

- Most Citibank and American Express credit cards also have good complimentary travel insurance coverage but are lacking one or two important coverages.

In this article

- How Do I Get Complimentary Travel Insurance With Credit Cards?

- Credit Cards With The Best Complimentary Travel Insurance Coverage

- Are Complimentary Travel Insurances Enough for Your Travel Needs?

Disclaimer: The cards listed in this article exclude corporate, private, premier, and invite-only credit cards. The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before purchasing any financial products.

How Do I Get Complimentary Travel Insurance With Credit Cards?

For those of us who have been in the credit card space for a while now, you’ll notice that quite several cards offer complimentary travel insurance when you charge your full airfare to that specific credit card.

Let me repeat when you charge your FULL airfare to that credit card. So if you are a miles-chaser and only have a cashback card with complimentary travel insurance, you are going to have to choose between earning good miles on your airfare or free travel insurance and a little cashback.

Once you have charged your airfare to your card, most credit card issuers will also require you to activate your free travel insurance five to seven days before your trip.

FAQ: Do Credit Cards Automatically Have Travel Insurance?

Unfortunately, no. As of the time of writing, all OCBC credit cards do not come with complimentary travel insurance coverage. Those that do have complimentary travel insurance will often be highlighted on the credit card product page.

Credit Cards With The Best Complimentary Travel Insurance Coverage

After some extensive research and reading through loads of policy wording documents, I have tracked down one card that stands above the rest in terms of how wide the coverage is.

The HSBC TravelOne is quite an exceptional card with its complimentary travel insurance covering your typical categories such as personal accident, overseas medical expenses, various travel inconveniences and hospitalisation allowance. It even has COVID-19 coverage, making it almost as close as you can get to regular travel insurance!

The runner-ups would be a variety of cards under American Express and Citibank.

For American Express cards, all cover personal accidents. But that’s where the similarities end. Some higher-end cards like the AMEX Platinum Card include baggage delays, missed connections, and even purchase protection when shopping. However, AMEX cards do not include overseas medical expense coverage and COVID-19 coverage.

As for Citibank credit cards, they too suffer from the lack of COVID-19 coverage.

Check out the complimentary travel insurance coverage for your credit card here:

American Express

| Credit Card | Travel Insurance Coverage | Full Policy Wordings |

|---|---|---|

| The American Express® Singapore Airlines KrisFlyer Credit Card Apply Now | Personal Accident: Up to $350,000 Personal Accident (Child): Up to $100,000 Missed Flight Connection: Up to $200 per person / $400 per family Baggage Delay: Up to $200 per person / $400 per family Extended Baggage Delay: Up to $500 per person / $1,000 per family Flight Delay: Up to $200 per person / $400 per family | Link |

| The American Express® Singapore KrisFlyer Ascend Credit Card Apply Now | Personal Accident: Up to $1,000,000 Personal Accident (Child): Up to $100,000 Missed Flight Connection: Up to $200 per person / $400 per family Baggage Delay: Up to $200 per person / $400 per family Extended Baggage Delay: Up to $500 per person / $1,000 per family Flight Delay: Up to $200 per person / $400 per family | Link |

| AMEX Platinum Card Apply Now | Personal Accident: Up to $1,000,000 Personal Accident (Child): Up to $100,000 Legal Assistance: Up to $1,000,000 Missed Departure, Delayed, cancelled or overbooked flight, Missed Connection: Up to $400 per person / $800 per family Baggage Delay: Up to $400 per person / $800 per family Extended Baggage Delay: Up to $400 per person / $800 per family Purchase Protection Benefit: Up to $50,000 Return Guarantee Benefit: Up to $5,000 Extended Warranty Benefit: $50,000 | Link |

| The American Express® Platinum Credit Card Apply Now | Personal Accident: Up to $1,000,000 Personal Accident (Child): Up to $100,000 Purchase Protection Benefit: Up to $25,000 Return Guarantee Benefit: Up to $5,000 | Link |

| AMEX Platinum Reserve Credit Card | Personal Accident: Up to $1,000,000 Personal Accident (Child): Up to $100,000 Missed Flight Connection: Up to $200 per person / $400 per family Luggage Delay: Up to $200 per person / $400 per family Luggage Loss: Up to $500 per person / $1,000 per family Purchase Protection Benefit: Up to $25,000 Return Guarantee Benefit: Up to $5,000 | Link |

| AMEX True Cashback Card Apply Now | Personal Accident: Up to $350,000 Personal Accident (Child): Up to $100,000 Missed Flight Connection: Up to $200 per person / $400 per family Luggage Delay: Up to $200 per person / $400 per family Luggage Loss: Up to $500 per person / $1,000 per family | Link |

| The American Express® Singapore Airlines PPS Club Credit Card | Personal Accident: Up to $1,000,000 Personal Accident (Child): Up to $100,000 Missed Flight Connection: Up to $200 per person / $400 per family Baggage Delay: Up to $200 per person / $400 per family Extended Baggage Delay: Up to $500 per person / $1,000 per family Flight Delay: Up to $200 per person / $400 per family | Link |

| The American Express® Singapore Airlines Solitaire PPS Credit Card | Personal Accident: Up to $1,000,000 Personal Accident (Child): Up to $100,000 Missed Flight Connection: Up to $200 per person / $400 per family Baggage Delay: Up to $200 per person / $400 per family Extended Baggage Delay: Up to $500 per person / $1,000 per family Flight Delay: Up to $200 per person / $400 per family | Link |

CIMB

| Credit Card | Travel Insurance Coverage | Full Policy Wordings |

|---|---|---|

| CIMB Visa Infinite Apply Now | Personal Accident: Up to $1,000,000 Personal Accident (Child): Up to $100,000 Medical Expense: Up to $25,000 Emergency Medical Evacuation & Repatriation: Up to $100,000 Baggage Loss: Up to $1,000 Baggage Delay: $600 Flight Delay: $500 Trip Misconnection: $200 Trip Cancellation: Up to $1,000 | Link |

| CIMB Visa Signature Apply Now | Personal Accident: Up to $500,000 Baggage Loss: Up to $500 Baggage Delay: $300 Flight Delay: $300 Trip Cancellation: Up to $300 | Link |

Citibank

| Credit Card | Travel Insurance Coverage | Full Policy Wordings |

|---|---|---|

| Citi Prestige Apply Now | Personal Accident: Up to $1,000,000 Overseas Medical Expenses: Up to $50,000 Emergency Medical Evacuation and Repatriation: Up to $100,000 Loss of luggage: Up to $1,000 Luggage delay: Up to $400 Flight delay: Up to $400 | Link |

| Citi PremierMiles Mastercard Apply Now Citi PremierMiles Visa Card Apply Now | Personal Accident: Up to $1,000,000 Medical Expenses: Up to $40,000 Emergency Medical Evacuation and Repatriation: Up to $100,000 Loss of luggage: Up to $1,000 Luggage delay: Up to $600 Flight delay: Up to $500 Trip Cancellation: Up to $500 Trip Interruption: Up to $500 | Link |

| Citi Rewards Credit Card Apply Now Citi Cash Back Card Apply Now Citi Cash Back Plus Card Apply Now Citi Lazada Card Apply Now | Personal Accident: Up to $1,000,000 Personal Accident (Child): Up to $50,000 Medical & Accidental Dental Expenses Incurred In Covered Trip Outside Singapore: Up to $40,000 Medical & Accidental Dental Expenses Incurred In Covered Trip Outside Singapore (Child): Up to $20,000 Emergency Medical Evacuation: Up to $100,000 Emergency Medical Evacuation (child): Up to $100,000 Repatriation: Up to $50,000 Repatriation (child): Up to $50,000 Baggage Loss: Up to $1,000 Baggage Delay: Up to $500 Flight Delay: Up to $500 Trip Cancellation: Up to $500 Trip Interruption: Up to $500 | Link |

HSBC

| Credit Card | Travel Insurance Coverage | Full Policy Wordings |

|---|---|---|

| HSBC TravelOne Apply Now | Personal Accident: Up to $50,000 Overseas Medical Expenses (inclusive of COVID-19 coverage): Up to $100,000 Emergency Medical Evacuation and/or Repatriation (inclusive of COVID-19 coverage): Covered Overseas Hospitalisation Allowance (inclusive of COVID-19 coverage): $100 per day, up to 14 days Trip Cancellation (inclusive of COVID-19 coverage): Up to $1,000 Trip Curtailment (inclusive of COVID-19 coverage): Up to $1,000 Overseas Quarantine Allowance: $100 per day, up to 14 days Travel Delay: Up to $100 Missed Flight Connection: Up to $100 Luggage Delay: Up to $1,000 Loss of Luggage: Up to $1,000 | Link |

Maybank

| Credit Card | Travel Insurance Coverage | Full Policy Wordings |

|---|---|---|

| Mastercard World Mastercard Apply Now Maybank Visa Infinite Maybank Horizon Platinum Visa Card Apply Now Maybank Horizon Visa Signature Card Apply Now Maybank Platinum | Personal Accident: Up to $1,000,000 Missed Flight Connection: Up to $400 Luggage Delay: Up to $400 Luggage Loss: Up to $1,000 | Link |

| Maybank DUO Platinum Mastercard Apply Now Maybank Platinum Visa Card Apply Now Maybank Gold Card Catholic High Alumni Platinum | Personal Accident: Up to $500,000 Missed Flight Connection: Up to $400 Luggage Delay: Up to $400 Luggage Loss: Up to $1,000 |

|

| Maybank FC Barcelona Visa Signature Card Apply Now Maybank Manchester United Platinum Visa Card Apply Now Maybank Classic Card Maybank Family & Friends Card | Personal Accident: Up to $300,000 Missed Flight Connection: Up to $200 Luggage Delay: Up to $200 Luggage Loss: Up to $600 |

Standard Chartered

| Credit Card | Travel Insurance Coverage | Full Policy Wordings |

|---|---|---|

| Standard Chartered Journey Card Apply Now Standard Chartered Rewards+ Credit Card Apply Now Standard Chartered Smart Credit Card Apply Now Standard Chartered Visa Infinite Credit Card | Personal Accident: Up to $500,000 Emergency Medical Assistance, Evacuation and Repatriation: Up to $25,000 | Link |

| Standard Chartered Priority Visa Infinite Credit Card | Medical/Dental Treatment Expenses: Up to $50,000 Emergency Dental Treatment Expenses: Up to $500 Delayed Baggage - Reimbursement of Emergency Purchase of Essential Clothing or Toiletries: Up to $1,000 Pay for Accidental loss or damage to property or goods purchased via Standard Chartered Bank eligible credit card: Up to $10,000 Emergency Medical Assistance, Evacuation and Repatriation: Up to $ 100,000 Repatriation of Mortal Remains: Up to $10,000 Compassionate Visit: Up to $100,000 Hotel Room Accommodation for Compassionate Visit: Up to $1,000 Hotel Room Accommodation for Convalescence: Up to $1,000 Trip Curtailment: Up to $100,000 Other assistance services - Travel Information - Telephone Medical Advice - Emergency Message Transmission - Hospital Admission Deposit Guarantee - Luggage Retrieval - Emergency Rerouting Arrangements - Administration Assistance - Legal Assistance Included – any costs incurred to be borne by Insured Person | Link |

UOB

| Credit Card | Travel Insurance Coverage | Full Policy Wordings |

|---|---|---|

| UOB Lady's Card Apply Now UOB Lady's Solitaire | Medical Expenses (Injury or Sickness): Up to US$100,000 Emergency Medical Evacuation/Return of Mortal Remains: Up to US$100,000 Daily In-Hospital Cash Benefit (minimum 3 days, maximum 15 days): Up to US$100 per Day Overseas COVID-19 Diagnosis Quarantine Allowance (maximum 14 days): US$100 per Day | Link |

| UOB Absolute Cashback American Express Card Apply Now UOB EVOL Card Apply Now UOB One Credit Card Apply Now UOB PRVI Miles Mastercard Apply Now UOB PRVI Miles Visa Card Apply Now UOB PRVI Miles AMEX Apply Now UOB Visa Signature KrisFlyer UOB Credit Card Apply Now KrisFlyer UOB Debit Card | Personal Accident: Up to $500,000 Emergency Medical Assistance, Evacuation & Repatriation : Up to $50,000 per insured person | Link |

Are Complimentary Travel Insurances Enough for Your Travel Needs?

Coverage

Unless you’re a solo traveller or someone who regularly goes on business trips alone, most of these complimentary travel insurances do not provide sufficient coverage.

For solo travellers, every other card but the HSBC TravelOne lacks either COVID-19 coverage, medical expenses or travel inconvenience benefits such as flight delays or loss of baggage.

Just the other day, I came across a TikTok user who was recounting her terrible experience with Scoot and got her flight delayed due to overbooking, to the point that she had to stay in a hotel room to get on the next available flight. I’m sure that many of us have also heard various other horror stories of flight delays, loss of baggage and whatnot.

Around me, two of my colleagues have recently caught COVID-19 again.

So you bet that I’ll be getting travel insurance that covers these situations as they are pretty common despite what my risk-taking personality tells me.

As for families, complimentary travel insurance that covers the above categories AND covers your spouse and dependents is virtually non-existent.

That said, if you are fine with forgoing coverage on certain categories, there are a few credit cards with complimentary travel insurance that cover your dependents and/or spouse.

Amount

Aside from the lack of coverage in most complimentary travel insurances, the amount covered in certain categories is abysmal compared to paid ones. Up to $500 for trip cancellation? That’s barely enough to cover your $3,000 trip!

Don’t be fooled by the big numbers that they love to advertise such as “$1,000,000 coverage” as those are really only for permanent disablement or death. Rather, we should look into things that are way more likely to happen and ensure we have sufficient coverage for that.

Conclusion

All in all, it seems that complimentary travel insurance isn’t really enough and you’d be much better off getting regular travel insurance anyway. It’s better to spend some money on affordable yet comprehensive travel insurance than to have your trip cancelled due to COVID-19 and lose thousands of dollars!

Related articles

- Do I Really Need Travel Insurance?

- How to Keep Your Valuables Safe Overseas: Lost Items, Luggage & Personal Belongings

- Best Travel Insurance in Singapore (2024): Price & Coverage Comparisons Across Insurers

Advertisement