Beginner's Guide to Crypto Staking (2022) And Earning Passive Income With Your Cryptocurrency

●

IF YOU GIVE ME 35 SECONDS OF YOUR TIME, I’ll teach you how to earn passive income.

Before you instinctively click away, I would urge you to read on.

As it turns out, you can actually earn passive income with cryptocurrencies by staking your coins to earn fixed interest or earn farming rewards.

According to leading cryptocurrency data aggregator CoinMarketCap, the total amount of cryptocurrency assets staked on decentralised financed (DeFi) platforms are worth about US$21 to US$23 billion as of January 2021.

If all this sounds like Greek to you…

Check out our beginner’s guide to cryptocurrency staking!

Also, if you are new to the world of cryptocurrencies, check out our Cryptocurrency 101 and guide to buying Bitcoin and other cryptocurrencies in Singapore.

Disclaimer: The information provided by Seedly serves as an educational piece and does not constitute an offer or solicitation to buy or sell any investment product(s). It does not take into account the specific investment objectives, financial situation or particular needs of any person. Readers should always do their own due diligence and consider their financial goals before investing in any investment product(s).

TL;DR: Beginner’s Guide to Crypto Staking (2021)

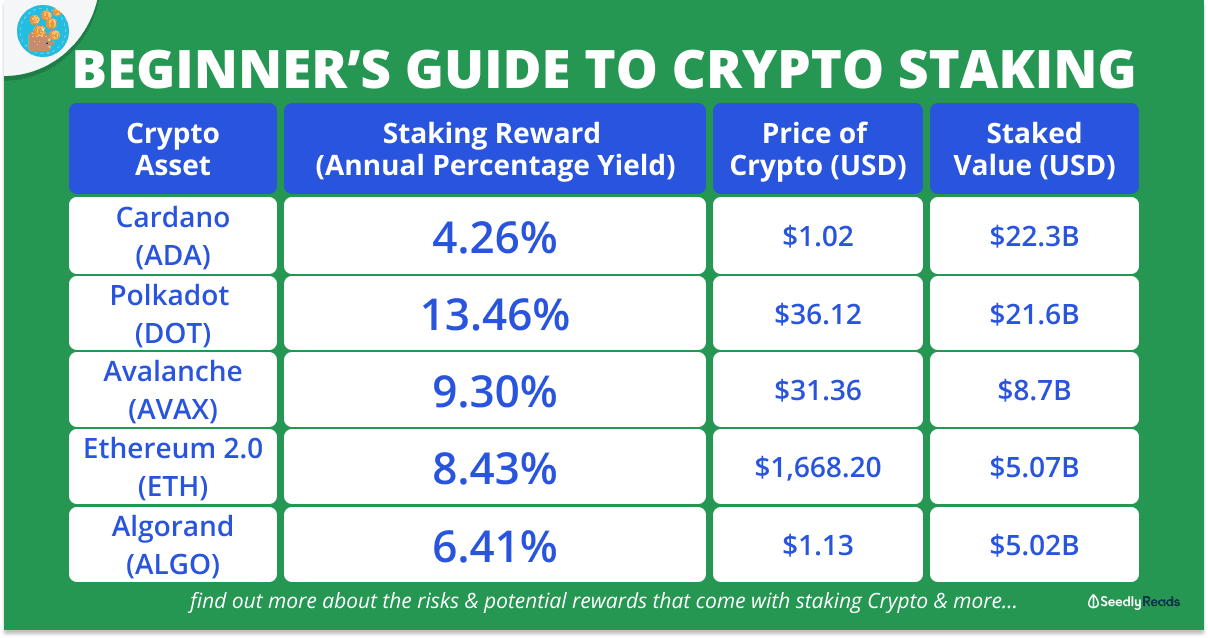

| Cryptocurrency | Staking Reward (Annual Percentage Yield APY) | Price (USD) | Staked Value (USD) |

|---|---|---|---|

| Cardano (ADA) | 4.26% | $1.02 | $22.3B |

| Polkadot (DOT) | 13.46% | $36.12 | $21.6B |

| Avalanche (AVA) | 9.30% | $31.36 | $8.7B |

| Ethereum 2.0 (ETH) | 8.43% | $1,668.20 | $5.07B |

| Algorand (ALGO) | 6.41% | $1.13 | $5.02B |

| Cosmos (ATOM) | 12.52% | $20.72 | $3.6B |

| Tezos (XTZ) | 5.45% | $3.79 | $2.5B |

Source: Staking Rewards | Information accurate as of 24 Feb 2021, 5pm

What is Crypto Staking?

When it comes to cryptocurrencies, the majority of them use blockchain technology: a decentralized ledger/database of all transactions across a peer-to-peer network.

The sets of information about these transactions are recorded together in groups, also known as blocks.

But, these blocks have limited storage capacity. Once one block is filled, any new information is recorded in a new block and chained to the previous block. This creates a chain of data known as the blockchain.

However, these transactions need to be validated and secured.

What is Proof of Work?

At the start, the main way that these transactions were validated was through the Proof of Work (PoW) process that is achieved through mining.

The most well-known example of this is Bitcoin mining.

Put simply, mining will help improve the Bitcoin network’s security by combating fraud and securing cryptocurrency transactions.

I may be simplifying it a bit but, mining is like a contest where computers compete to provide a solution for a complex mathematical problem (i.e. hash challenges). The computer that discovers the solution first will win the chance to write the next block into the ledger.

In exchange for giving up your computing power to Bitcoin’s network for mining, you will be rewarded with newly created Bitcoins.

In other words, the PoW process functions as a consensus mechanism that decides who gets to update the ledger amongst a group of unrelated strangers who have no reason to cooperate with each other.

Although the PoW process is great for managing a decentralised ledger, it is not without its faults.

The mining process takes a toll on the environment as in order to mine cryptocurrency effectively today, you will need purpose-built hardware known as Application Specific Integrated Circuits (ASIC).

On top of requiring vast amounts of electricity to run, these ASICs have to be regularly replaced for better and more efficient models to keep up with the cryptocurrency mining arms race.

The majority of the old ASICs units gets thrown away as ASICs cannot be recycled easily. It is estimated that about 11,500 tonnes of hazardous electronic waste is generated each year from Bitcoin mining.

What is Proof of Stake

Here is where Proof of Stake (PoS) comes in.

Unlike PoW which rewards network participants for their work with a reward, PoS requires that participants ‘stake’ their cryptocurrency by risking or locking it in to guarantee the integrity/security of the blockchain.

The cryptocurrency that is staked and locked in is randomly assigned the right to validate the next block of transactions by the cryptocurrency network.

This chance of your cryptocurrency being selected is generally proportional to the number of coins you stake.

Generally, the more coins you have, the higher your chance of your cryptocurrency getting chosen.

In return, you will be rewarded with more coins for the contribution to the network.

Supporters of PoS argue that this process is better as it is more eco-friendly and bodes well for the scalability and sociability of the blockchain.

This is also one of the main reasons why the creators of the Ethereum network have made the decision to transition from PoW to PoS to scale Ethereum via the Eth2 upgrades.

Rewards For Crypto Staking

Staking is a great way to make your cryptocurrency work for you.

Instead of leaving your cryptocurrency in your cryptocurrency exchange account or wallet, you could stake it and enjoy rewards on top of your holdings appreciating in price.

Also, you can grow your cryptocurrencies further by compounding these potential rewards.

When it comes to Crypto staking, there are a few benefits:

- Getting a percentage of tokens as rewards for staking. The rate of return is measured using annual percentage yield (APY). The rate at which rewards are paid out also varies by cryptocurrency and can range from daily, weekly, monthly etc. You can use this calculator to check the potential returns and rewards payout rate.

- Help secure the cryptocurrency network and your coins as generally, the more wallets staking, the more secure the network becomes.

- Some exchanges also reduce transaction fees if you stake your coins.

Risks of Crypto Staking

As I covered in my How to Buy Bitcoin and Other Cryptocurrencies article,

Lack of MAS Regulation

An important thing to note is that as cryptocurrencies are a relatively new phenomenon, there isn’t as much regulation in Singapore just yet.

The regulation comes in the form of the Payment Services Act 2019. Cryptocurrencies are classified as digital payment tokens (DPT) and the act regulates persons or entities that buy or sell cryptocurrencies or facilitate the exchange of cryptocurrencies.

However, the act is mainly targeted at addressing money laundering and terrorism financing. This means that there is no legislative protection. MAS is not required to safeguard your cryptocurrency or ensure that each crypto transaction is processed in the right way.

You need to be aware of this risk before purchasing any cryptocurrency and staking your coins as cryptocurrencies are largely unregulated by design.

Beware of The Lock-In Period

In addition, when you stake your cryptocurrency, you cannot move or trade the crypto as it is in a locked state. This is true for some cryptocurrencies like Tron and Cosmos.

Alternatively, you have some blockchains that allow you to stake your coin by holding it in your wallet or exchange wallet.

This is somewhat risky as in the event that the cryptocurrency exchange is hacked, there is a chance that you might lose your cryptocurrency.

After all, as they say in the world of crypto: ‘not your key not your coin.’

Validator Commission Fees

To run the PoS process, you will need to go through a validator, who will need specific hardware to run the nodes as well as capital requirements to qualify as a legit validator.

Undoubtedly, the validator will want to take a cut from the crypto staking rewards to cover operational costs and generate profits.

Thus, you will need to be tracking any changes to the rate of commission the validator is taking as they might change it anytime without your consent.

Check Rewards Payout Schedule

When you stake your cryptocurrency, you will need to check your rewards payout schedule as rewards can be credited instantly or take days or weeks depending on your chosen network.

For some networks, validators have almost complete control over the rewards payout schedule.

As such, it is best that you check with the validator or staking provider to ensure that your rewards are paid on time.

As such, it is best that you check with the validator or staking provider to ensure that your rewards are paid on time.

Opportunity Costs of Staking

When you stake your cryptocurrency, it is locked up. As such, you will need to compare and evaluate if you could be earning more by holding other coins.

In addition, the debate between active investing and passive investing applies here as well.

If you are an experienced investor who knows his way around cryptocurrencies, you might be confident that you will earn more by actively trading a coin like ADA instead of staking it (at the time of writing the reward for staking ADA is 4.26% APY)

Volatility Concerns

For the uninitiated, cryptocurrencies are outrageously volatile, with corrections of more than 50% seen quite often.

Also, you might see the network release new coins that can directly impact the token’s price due to the sudden increase in the supply of circulating coins. This may result in price volatility.

Cryptocurrencies are also generally more susceptible to price manipulation as the small market capitalisation and trading volume of some of these coins mean that inflows and outflows of smaller amounts of capital can greatly move the price.

Alternatively, you could look at Stablecoins like TUSD or PAX that are pegged to external assets like the U.S. dollar to reduce volatility.

How to Stake Cryptocurrencies

Although you can technically become a validator to run your own node and stake your own coin, there are high barriers to entry to become a validator.

Thus, the more straightforward way for most would be to use the staking services provided by the crypto exchanges.

Staking Via Crypto Exchanges

Cryptocurrency exchanges like Coinbase, Binance, and Gemini offer up staking services for their customers.

These exchanges allow you to stake your coins via their in house validators for a cut of the rewards.

This will eliminate the trouble of becoming a validator.

But as mentioned above, you are taking a risk as you are ceding control over your coins to the exchange.

However, do note that some crypto exchanges will require a minimum staking amount for you to start. Find more about and compare the different crypto currency exchanges here.

Popular Coins To Stake & the Returns

In addition, here are the top seven cryptocurrencies by staked value according to Staking Rewards (data provider for staking and crypto-growth tools) for you to consider and research more.

| Cryptocurrency | Staking Reward (Annual Percentage Yield APY) | Price (USD) | Staked Value (USD) |

|---|---|---|---|

| Cardano (ADA) | 4.26% | $1.02 | $22.3B |

| Polkadot (DOT) | 13.46% | $36.12 | $21.6B |

| Avalanche (AVA) | 9.30% | $31.36 | $8.7B |

| Ethereum 2.0 (ETH) | 8.43% | $1,668.20 | $5.07B |

| Algorand (ALGO) | 6.41% | $1.13 | $5.02B |

| Cosmos (ATOM) | 12.52% | $20.72 | $3.6B |

| Tezos (XTZ) | 5.45% | $3.79 | $2.5B |

Source: Staking Rewards | Information accurate as of 24 Feb 2021, 5pm

Do note that the APY is updated in real-time based on real-time blockchain data.

Always do Your Own Due Diligence

Now before you go jumping in to buy a coin to stake, I would recommend that you take all the time you need to thoroughly research the cryptocurrency and the project behind it and this also includes the many cryptocurrency scams going about.

It’s best that you find a project that you are convicted by and would expect to have a bright and sustainable future. After all, by staking, you are also playing a part to improve the chances of the project’s success.

A good thing to do will be to tap on the power of the community.

You could always post your investment thesis about why you plan to stake this cryptocurrency and our savvy community members will ask probing questions to help you refine it!

Ask Your Questions About Cryptocurrency Here!

Related Articles

Advertisement